Are you gearing up for a career in Alternative Financing Specialist? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Alternative Financing Specialist and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

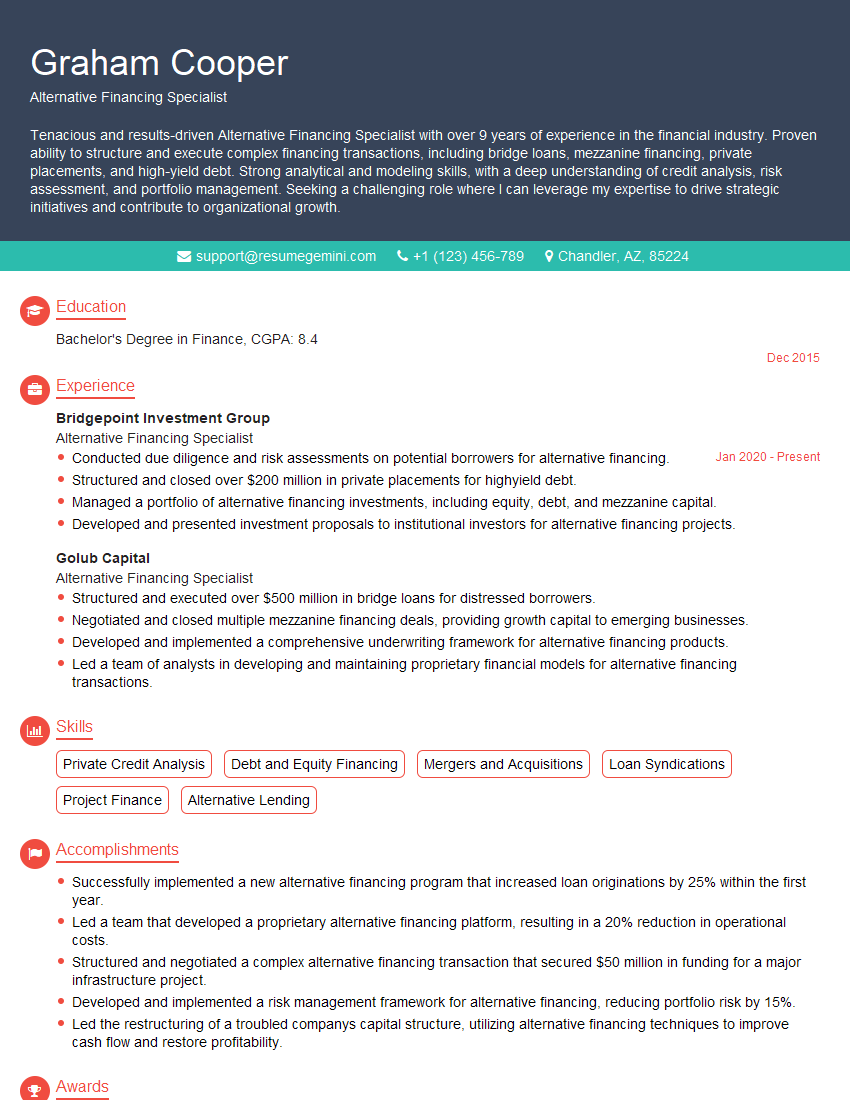

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Alternative Financing Specialist

1. Describe the key types of alternative financing options available to businesses?

- Invoice factoring and discounting

- Asset-based lending

- Crowdfunding

- Venture capital and private equity

- Merchant cash advances

2. What factors do you consider when evaluating an alternative financing proposal?

Risk Assessment

- Creditworthiness of the business

- Collateral offered

- Industry and market conditions

Financial Analysis

- Cash flow projections

- Profitability and loss statements

- Debt-to-equity ratio

3. How do you structure alternative financing deals to mitigate risk?

- Negotiating flexible repayment terms

- Requiring collateral or personal guarantees

- Conducting thorough due diligence on the business

- Monitoring the business’s performance regularly

4. What are the advantages and disadvantages of using alternative financing compared to traditional bank loans?

Advantages

- Faster approval process

- Less stringent credit requirements

- Tailored to specific business needs

Disadvantages

- Higher interest rates

- Shorter repayment terms

- Potentially more restrictive covenants

5. How do you stay updated on the latest trends in alternative financing?

- Attending industry conferences and webinars

- Reading trade publications and research reports

- Networking with other professionals in the field

6. What is your experience in underwriting and pricing alternative financing deals?

Describe relevant work experience, including specific examples of deals you have structured and underwritten.

7. How do you build relationships with potential clients and intermediaries?

- Networking at industry events

- Cold calling and email campaigns

- Referrals from existing clients

8. What is your understanding of the regulatory environment surrounding alternative financing?

- Knowledgeable about Dodd-Frank Act and other relevant regulations

- Up-to-date on industry best practices and ethical guidelines

9. How do you handle conflicts of interest that may arise in your role?

- Adherence to ethical guidelines and professional conduct

- Disclosure of any potential conflicts to clients

10. Why are you interested in working as an Alternative Financing Specialist?

Express interest in the industry, passion for supporting businesses, and drive to find innovative financing solutions.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Alternative Financing Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Alternative Financing Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Alternative Financing Specialists are responsible for identifying and securing alternative financing solutions for their clients. This may include exploring various financing options, such as venture capital, private equity, and crowdfunding, to meet the specific needs of each client.

1. Client Development and Relationship Management

Alternative Financing Specialists play a critical role in developing and maintaining strong relationships with clients. They must fully understand their clients’ business models and financial situations, identify their financing needs, and provide tailored solutions that meet those needs.

2. Alternative Financing Options Evaluation

Alternative Financing Specialists are responsible for thoroughly evaluating and comparing various alternative financing options. This involves assessing the pros and cons of each option, including the cost of financing, repayment terms, and potential risks.

3. Financial Analysis

Alternative Financing Specialists must have a strong understanding of financial analysis techniques. They need to evaluate a client’s financial statements, perform credit checks, and assess the viability of the client’s business plan to determine the appropriate financing solution.

4. Preparation of Financial Documents

Alternative Financing Specialists assist clients in preparing financial documents, such as business plans, financial projections, and loan proposals. These documents provide essential information to potential investors and lenders.

5. Deal Negotiation and Closure

Alternative Financing Specialists engage in negotiations with investors or lenders, on behalf of their clients, to secure the best possible financing terms. They must have strong negotiation skills and be able to advocate effectively for their clients’ interests.

Interview Tips

To ace an interview for an Alternative Financing Specialist position, it’s essential to be well-prepared. Here are some tips:

1. Research the Company and Role

Take the time to thoroughly research the company you’re applying to, including its industry, size, financial performance, and company culture. Understanding the specific role you’re applying for and its responsibilities is also crucial.

2. Showcase Your Skills and Experience

Highlight your relevant skills and experience in alternative financing. Discuss specific projects or deals you’ve worked on, emphasizing your understanding of the industry and your ability to deliver results.

3. Quantify Your Accomplishments

When describing your experience, use specific metrics and data to quantify your accomplishments. This demonstrates your ability to drive tangible outcomes through your work.

4. Prepare for Behavioral Interview Questions

Behavioral interview questions focus on your past experiences and how you handled specific situations. Practice answering these questions by following the STAR method (Situation, Task, Action, Result).

5. Practice Your Presentation Skills

Be prepared to present your understanding of the alternative financing industry and your approach to helping clients. You may also be asked to present a case study or business plan.

6. Ask Thoughtful Questions

Asking thoughtful questions during the interview shows engagement and interest in the opportunity. Prepare questions about the company, the role, and the industry.

7. Dress Professionally and Be Punctual

First impressions matter. Dress professionally and arrive on time for your interview. Maintain a positive and confident demeanor throughout the interview.

Next Step:

Now that you’re armed with the knowledge of Alternative Financing Specialist interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Alternative Financing Specialist positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini