Are you gearing up for an interview for a Banking Analyst position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Banking Analyst and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

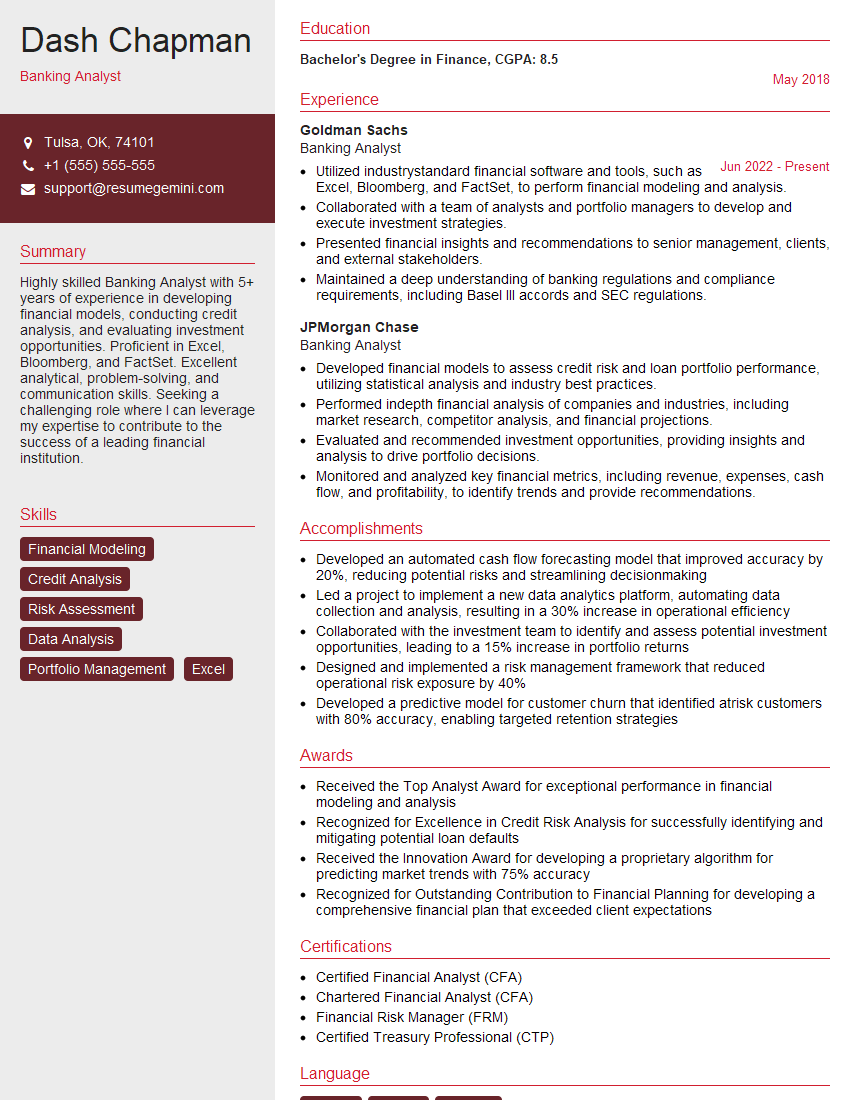

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Banking Analyst

1. What are the key financial ratios used to assess the financial health of a bank?

Key financial ratios used to assess the financial health of a bank include:

- Return on assets (ROA)

- Return on equity (ROE)

- Net interest margin (NIM)

- Capital adequacy ratio (CAR)

- Loan-to-deposit ratio (LDR)

- Non-performing loan ratio (NPL)

2. How do you evaluate the creditworthiness of a corporate borrower?

Assessing Financial Performance

- Analyze financial statements (income statement, balance sheet, cash flow statement)

- Examine key financial ratios (e.g., profitability, solvency, liquidity)

- Review cash flow generation and forecasting

Assessing Business Risk

- Evaluate industry and market factors

- Assess management team’s experience and track record

- Review corporate governance and internal controls

Assessing Collateral and Guarantees

- Identify and value collateral (e.g., real estate, equipment)

- Assess the strength of any guarantees or surety bonds

- Consider the potential for recovery in case of default

3. Walk me through the process of developing a financial model for a commercial real estate project.

The process of developing a financial model for a commercial real estate project typically involves the following steps:

- Identify the project’s assumptions and inputs (e.g., purchase price, operating expenses, lease terms)

- Estimate future cash flows from operations (e.g., rent, utilities, maintenance)

- Analyze the project’s financial performance (e.g., net operating income, debt service coverage ratio)

- Forecast the project’s value over time (e.g., internal rate of return, equity multiple)

- Conduct sensitivity analysis to assess the impact of changes in key assumptions

4. What are the different types of securitization structures used in the banking industry?

Different types of securitization structures used in the banking industry include:

- Pass-through securities: Investors receive a proportionate share of the underlying assets’ cash flows.

- Collateralized debt obligations (CDOs): Pools of different types of debt (e.g., mortgages, corporate bonds) are assembled and divided into tranches with different risk and return profiles.

- Mortgage-backed securities (MBSs): Bonds backed by a pool of mortgages, which are often used by banks to reduce their credit risk.

- Asset-backed securities (ABSs): Bonds backed by a pool of non-mortgage assets (e.g., auto loans, credit card receivables).

5. How would you approach the valuation of a privately held company?

Approaches to valuing a privately held company include:

- Discounted cash flow (DCF) analysis: Forecasts future cash flows and discounts them back to present value.

- Comparable company analysis: Compares the company to similar publicly traded companies to determine a valuation multiple.

- Asset-based valuation: Values the company based on its tangible and intangible assets.

- Market multiple approach: Multiplies company revenue or earnings by industry-specific multiples.

- Precedent transactions analysis: Reviews recent transactions involving similar companies to establish a valuation range.

6. What are the key factors to consider when structuring a loan agreement?

Key factors to consider when structuring a loan agreement include:

- Loan amount and term

- Interest rate and payment schedule

- Collateral and security

- Covenants and restrictions

- Default and enforcement provisions

- Applicable laws and regulations

7. How do you manage the risk of a loan portfolio?

Risk management of a loan portfolio involves:

- Identifying and assessing potential risks (e.g., credit risk, market risk, operational risk)

- Developing mitigation strategies (e.g., diversification, credit analysis, hedging)

- Monitoring and controlling risks (e.g., regular reporting, stress testing)

- Establishing risk limits and policies

8. What are the regulatory and compliance requirements that apply to banking analysts?

Banking analysts are subject to various regulatory and compliance requirements, including:

- Bank Secrecy Act (BSA)

- Anti-Money Laundering (AML) regulations

- Know Your Customer (KYC) guidelines

- Financial Industry Regulatory Authority (FINRA) rules

9. How do you stay up-to-date on industry trends and best practices?

I stay up-to-date on industry trends and best practices through a combination of methods, including:

- Attending industry conferences and workshops

- Reading industry publications and research reports

- Networking with other professionals in the field

- Pursuing continuing education and professional development opportunities

10. Please describe a challenging financial analysis project you worked on and how you overcame the challenges.

In one project, I was tasked with developing a financial model for a client’s proposed acquisition of a target company. The challenge lay in the limited availability of historical financial data for the target company. To overcome this, I utilized industry benchmarks and comparable company data to supplement my analysis. I also conducted thorough due diligence to gain a deep understanding of the target company’s business operations and financial position.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Banking Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Banking Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Banking Analysts play a critical role in the financial industry, providing invaluable insights and support to investment bankers, portfolio managers, and other stakeholders. Their responsibilities are multifaceted and encompass various aspects of financial analysis and modeling.

1. Financial Modeling and Analysis

Banking Analysts are responsible for developing and maintaining complex financial models to evaluate the performance and value of companies, investments, and transactions. They analyze financial data, such as income statements, balance sheets, and cash flow statements, to create projections and forecasts. This involves using sophisticated analytical techniques and software to assess various scenarios and identify potential risks and opportunities.

2. Industry and Company Research

Banking Analysts conduct thorough research on specific industries and companies to gain a deep understanding of their operations, market dynamics, and competitive landscapes. They monitor industry trends, macroeconomic factors, and regulatory changes that may impact the performance of companies and investments. This research forms the basis for their financial models and recommendations.

3. Pitch Book Preparation and Presentation

Banking Analysts play a key role in preparing pitch books, which are marketing materials used to present investment opportunities to potential investors. They work closely with investment bankers to create compelling presentations that highlight key financial metrics, investment theses, and risk-reward profiles. Analysts may also be involved in presenting these pitch books to investors during roadshows and other marketing events.

4. Client Communication and Relationship Management

Banking Analysts interact regularly with clients, both internal and external, to provide financial insights, answer queries, and maintain strong relationships. They develop strong communication skills to convey complex financial information in a clear and concise manner. Analysts also keep abreast of client needs and market developments to tailor their analysis and recommendations accordingly.

Interview Tips

Preparing thoroughly for a Banking Analyst interview is crucial to showcase your skills and knowledge. Here are some tips to help you ace the interview:

1. Research the Bank and Industry

Familiarize yourself with the bank you’re applying to, its industry focus, and recent deals it has worked on. Research the banking industry as a whole to demonstrate your understanding of the market and key trends.

2. Practice Financial Modeling

Banking Analysts are expected to be proficient in financial modeling. Practice building models using Excel or other financial software. Be prepared to discuss your modeling experience and techniques during the interview. You can also prepare case studies to demonstrate your problem-solving abilities.

3. Prepare for Behavioral Questions

Behavioral interview questions are common in Banking Analyst interviews. These questions aim to assess your teamwork skills, attention to detail, and ability to handle pressure. Prepare STAR (Situation, Task, Action, Result) answers to highlight your experiences and skills.

4. Stay Up-to-Date on Financial News

Keep up with the latest financial news and market trends. This demonstrates your interest in the industry and ability to stay informed about relevant events. You may be asked about your views on recent financial headlines or industry developments.

5. Be Confident and Enthusiastic

Confidence and enthusiasm are essential for success in Banking Analyst interviews. Believe in your abilities and demonstrate your passion for the role and industry. Enthusiasm for finance will shine through in your responses and make a positive impression on the interviewers.

6. Prepare Questions for the Interviewers

Preparing thoughtful questions for the interviewers shows that you’re engaged and interested in the role. Ask questions about the team, culture, and career opportunities within the bank. This also gives you the opportunity to learn more about the position and the organization.

7. Dress Professionally and Be Punctual

First impressions matter in Banking Analyst interviews. Dress professionally and arrive on time for your interview. This shows respect for the interviewers and the organization.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Banking Analyst interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.