Feeling lost in a sea of interview questions? Landed that dream interview for Real Estate Analyst but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Real Estate Analyst interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

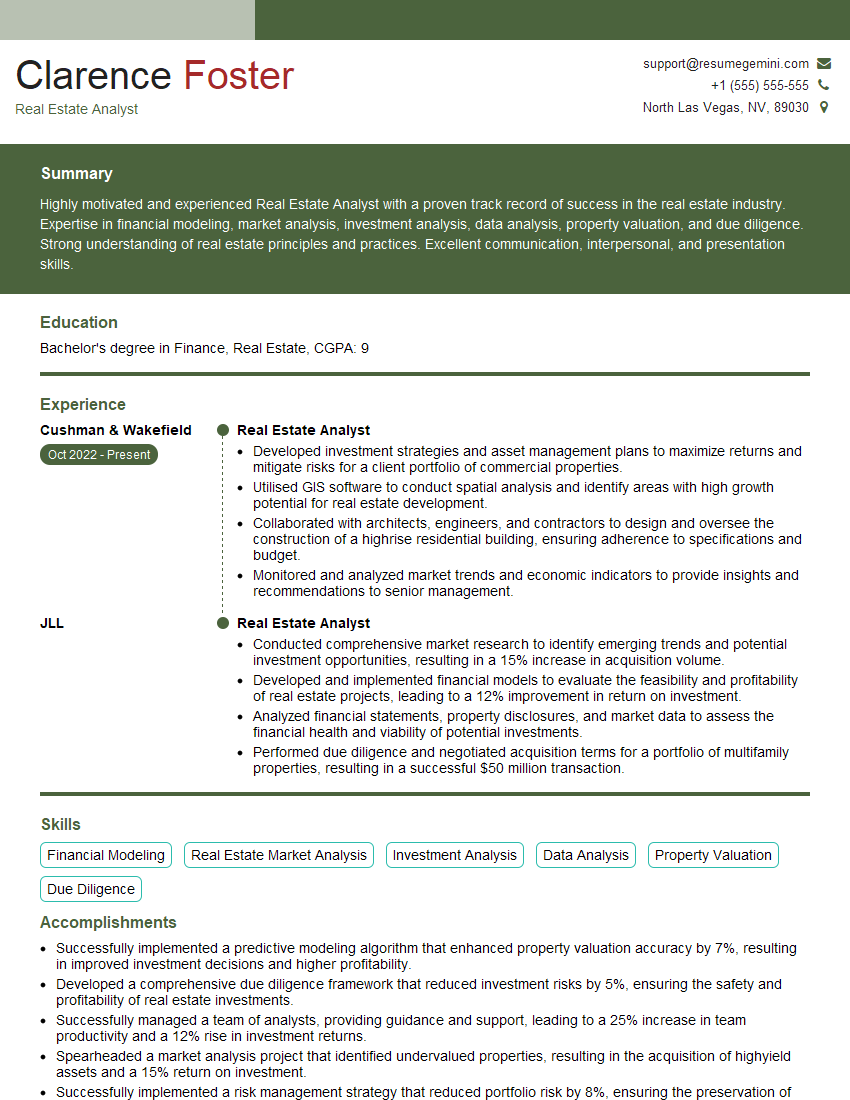

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Real Estate Analyst

1. What are the key drivers of real estate market performance?

- Economic growth and job creation

- Interest rates

- Demographics

- Government policy

- Technological innovation

2. How do you evaluate the potential return on investment (ROI) for a real estate project?

Financial Analysis

- Calculate cash flow

- Determine net operating income (NOI)

- Estimate capital expenditures

Market Analysis

- Research comparable properties

- Analyze market trends

- Project future rental income and appreciation

3. What is your approach to due diligence for a real estate transaction?

- Review property documents (title, surveys, etc.)

- Inspect the property

- Conduct environmental studies

- Analyze financial statements

- Interview key stakeholders

4. How do you stay up-to-date on the latest trends and developments in the real estate industry?

- Attend conferences and webinars

- Read industry publications

- Network with professionals

- Utilize online resources

5. What are the different types of real estate investment trusts (REITs) and their unique characteristics?

- Equity REITs: Invest in real estate directly

- Mortgage REITs: Invest in mortgages and other debt instruments

- Hybrid REITs: Combine equity and mortgage investments

6. How do you assess the risk and return profile of a particular real estate investment?

- Analyze property type and location

- Evaluate market conditions

- Identify potential risks and returns

- Conduct sensitivity analysis

7. What are the key factors to consider when underwriting a commercial real estate loan?

- Property value and location

- Borrower’s creditworthiness

- Loan-to-value ratio

- Debt service coverage ratio

- Loan term and interest rate

8. How do you use financial modeling to analyze real estate investment opportunities?

- Estimate cash flows

- Project property values

- Calculate investment metrics (IRR, NPV, etc.)

- Perform sensitivity analysis

9. What are the different methods for valuing real estate?

- Comparable sales approach

- Income capitalization approach

- Cost approach

- Discounted cash flow analysis

10. What are your ethical responsibilities as a real estate analyst?

- Maintain confidentiality

- Provide unbiased analysis

- Avoid conflicts of interest

- Follow industry regulations

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Real Estate Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Real Estate Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Real Estate Analysts are responsible for conducting comprehensive research and analysis of real estate markets, properties, and trends. Their insights inform investment decisions, property development strategies, and financial planning for various stakeholders in the real estate industry.

1. Market Research and Analysis

Analysts gather and interpret data on real estate markets, including market size, demand and supply dynamics, economic conditions, and competitive landscapes. They identify emerging trends, forecast future market performance, and provide recommendations based on their analysis.

2. Property Valuation and Due Diligence

Analysts assess the value of properties through detailed financial analysis, site inspections, and market research. They perform due diligence to identify potential risks and opportunities associated with real estate transactions.

3. Investment Analysis and Portfolio Management

Analysts analyze investment opportunities, such as property acquisition, development, or financing. They evaluate the financial feasibility, potential returns, and risks associated with different investment strategies. They also assist in managing real estate portfolios, monitoring performance, and recommending adjustments.

4. Financial Modeling and Forecasting

Analysts develop financial models to project future cash flows, returns on investment, and property values. They use statistical techniques and market data to create predictive models that inform decision-making.

5. Data Management and Reporting

Analysts collect, manage, and analyze large datasets related to real estate markets and properties. They present their findings through reports, presentations, and other communication channels.

Interview Tips

Preparing thoroughly for an interview is crucial to showcasing your skills and qualifications as a Real Estate Analyst. Here are some practical tips to help you ace your interview:

1. Research the Company and Industry

Before the interview, research the company you’re applying to, including their business model, investment strategy, and recent projects. Familiarize yourself with industry trends and market dynamics to demonstrate your knowledge and interest.

2. Practice Your Pitch

Prepare a concise pitch that highlights your key skills, experience, and why you’re the ideal candidate for the role. Practice delivering your pitch confidently and within a time limit.

3. Showcase Your Quantitative Skills

Real Estate Analysts have strong quantitative skills. Practice solving analytical problems related to finance, valuation, and modeling. Be ready to discuss your approach and assumptions.

4. Quantify Your Accomplishments

Use numbers to quantify your accomplishments and impact. For example, instead of saying “I conducted market research,” say “I led a market study that resulted in a 15% increase in property sales.”

5. Be Prepared for Behavioral Questions

Interviewers often ask behavioral questions to assess your problem-solving, decision-making, and teamwork abilities. Use the STAR method (Situation, Task, Action, Result) to answer these questions effectively.

6. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview shows your enthusiasm and interest in the role. Prepare insightful questions about the company’s investment strategy, current projects, or industry outlooks.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Real Estate Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!