Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Statistical Financial Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

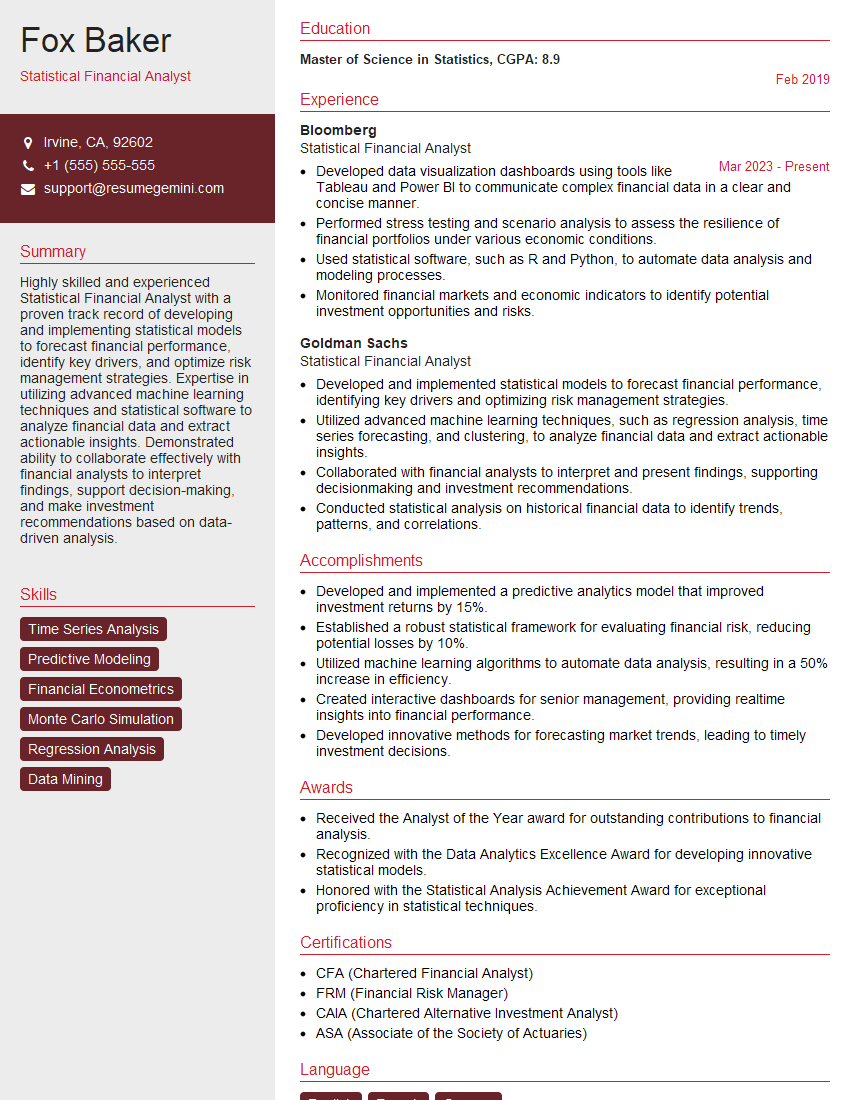

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Statistical Financial Analyst

1. Walk me through your understanding of time series analysis and its applications in financial markets?

- Time series analysis involves analyzing a sequence of data points collected over time to identify patterns and trends

- In financial markets, time series analysis is crucial for forecasting stock prices, predicting market volatility, and analyzing economic indicators

2. How do you approach evaluating the performance of a statistical model in a financial context?

Metric Selection

- Consider relevant metrics such as Mean Absolute Error (MAE), Mean Squared Error (MSE), or Sharpe ratio depending on the specific application

Data Splitting

- Split the data into training and testing sets to avoid overfitting and ensure unbiased evaluation

Cross-Validation

- Use cross-validation techniques such as k-fold cross-validation to assess model robustness and reduce variance

3. Describe the techniques you use for data normalization and transformation in financial data analysis?

- Normalization: Rescaling data to a common range (e.g., Min-Max Normalization)

- Logarithmic Transformation: Compressing the data range when dealing with highly skewed distributions

- Box-Cox Transformation: Power transformation to make data more Gaussian

4. How do you handle missing data in financial datasets, and what techniques do you prioritize?

- Assess the extent and pattern of missingness (e.g., missing at random vs. not at random)

- Imputation: Fill in missing values using statistical methods (e.g., mean, median, multiple imputation)

- Exclusion: Remove data points with a high percentage of missing values

5. Explain your approach to feature selection and variable importance in financial modeling?

- Use statistical techniques such as correlation analysis, information gain, or mutual information to identify relevant features

- Apply machine learning algorithms (e.g., LASSO, Random Forests) with built-in feature selection capabilities

- Interpret variable importance scores to gain insights into the drivers of financial outcomes

6. How do you assess and mitigate the risk of overfitting in statistical financial models?

- Use cross-validation techniques to prevent models from memorizing training data

- Regularization methods (e.g., L1, L2 regularization) to penalize model complexity

- Model averaging techniques to combine predictions from multiple models and reduce variance

7. Describe your experience in Monte Carlo simulations for financial risk analysis?

- Generate random scenarios based on specified probability distributions

- Simulate financial outcomes (e.g., portfolio returns, risk measures) under various market conditions

- Analyze simulation results to assess potential risks and develop risk management strategies

8. How do you stay up-to-date on the latest advancements and best practices in statistical financial analysis?

- Attend industry conferences and workshops

- Read academic journals and research papers

- Follow thought leaders and practitioners on social media and online platforms

9. Discuss the ethical considerations and limitations of statistical modeling in financial decision-making?

- Ensuring transparency and avoiding manipulation of data or models

- Understanding the limitations of models and their potential for bias or inaccuracies

- Considering the impact of model recommendations on stakeholders and financial markets

10. How do you work effectively as part of a team of financial professionals?

- Communicating technical findings clearly to non-technical stakeholders

- Collaborating with finance experts to ensure alignment of models with business objectives

- Proactively seeking feedback and incorporating it into model development

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Statistical Financial Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Statistical Financial Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Statistical Financial Analysts are responsible for providing data-driven insights to support investment decisions, risk management, and financial planning.

1. Data Analysis and Modeling

Analyze financial data using statistical techniques to identify trends, patterns, and relationships.

- Develop and validate statistical models to predict financial outcomes.

- Perform regression analysis, time series analysis, and other advanced statistical methods.

2. Risk Assessment

Assess financial risks associated with investments, portfolios, and financial instruments.

- Develop and implement risk management strategies to mitigate potential losses.

- Analyze market data to identify potential risks and opportunities.

3. Investment Analysis

Identify and evaluate investment opportunities based on financial data and analysis.

- Develop investment recommendations for clients or internal management.

- Conduct due diligence on investments and assess their risk-return potential.

4. Financial Planning and Forecasting

Develop financial plans and forecasts to support business decisions and financial projections.

- Estimate future financial performance and identify potential financial risks.

- Collaborate with other financial professionals to develop and implement financial strategies.

Interview Tips

Preparing for a Statistical Financial Analyst interview requires a combination of technical proficiency and strong interpersonal skills.

1. Highlight Your Technical Skills

Familiarize yourself with the industry-standard statistical software and techniques, such as:

- R, Python, SAS, or Stata

- Regression analysis, time series analysis, and machine learning

2. Quantify Your Results

Provide specific examples of how your statistical analysis has led to actionable insights and improved decision-making.

For instance, you could mention a time when your risk assessment helped a client avoid significant losses or when your investment analysis led to a profitable investment strategy.

3. Showcase Your Business Acumen

Demonstrate your understanding of financial markets, investment principles, and financial planning concepts.

Discuss how your statistical skills contribute to a deeper understanding of financial data and support business decision-making.

4. Emphasize Your Presentation and Communication Skills

Statistical Financial Analysts must be able to effectively communicate complex statistical findings to stakeholders.

Practice presenting your analysis in a clear and concise manner, using both verbal and written communication.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Statistical Financial Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!