Are you gearing up for an interview for a Securities Research Analyst position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Securities Research Analyst and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

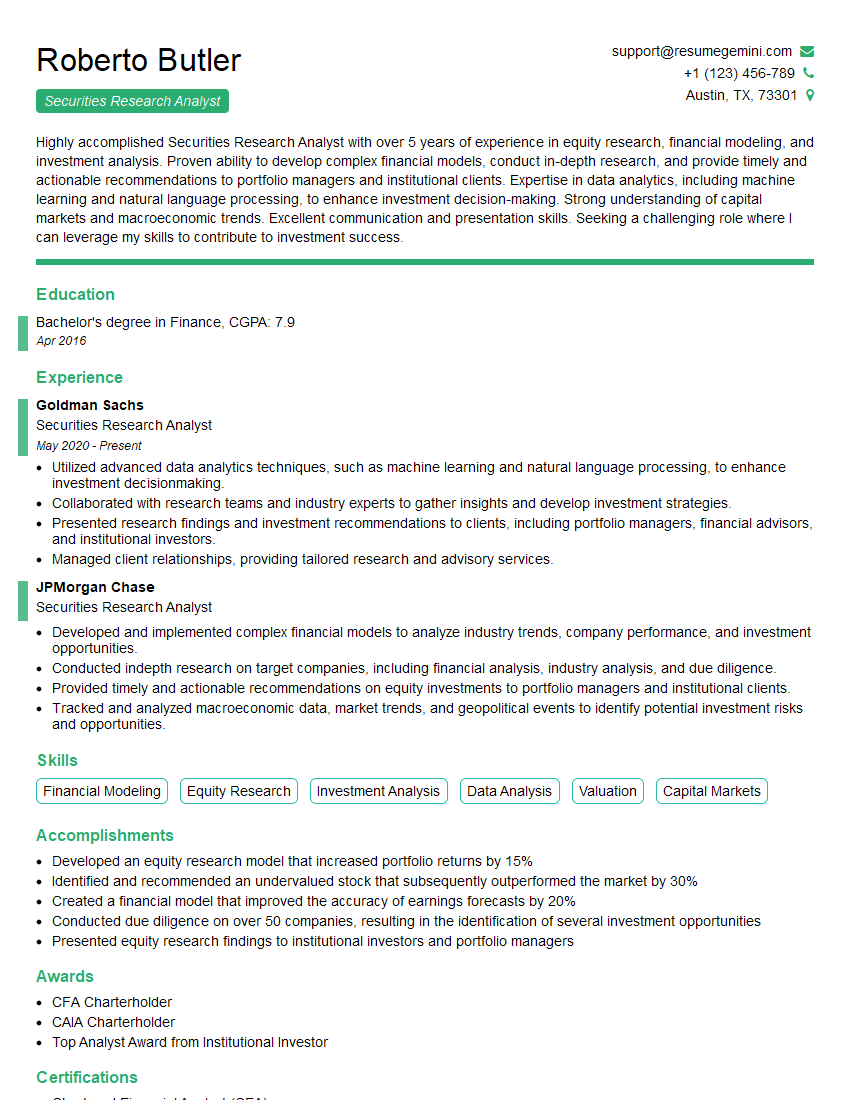

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Securities Research Analyst

1. Walk me through your process for developing a financial model for a company.

- Begin by gathering financial data from the company’s financial statements, SEC filings, and other sources.

- Create a base case using historical financials, management guidance, and industry research to forecast future financial performance.

- Develop scenarios to adjust the base case to account for different assumptions about the company’s future performance.

- Test the sensitivity of the model to changes in key assumptions to assess the impact of different scenarios on the company’s financial performance.

- Review the results of the model with management and other stakeholders to provide insights and recommendations.

2. How do you evaluate the quality of a company’s management?

Assessing the CEO

- Track record of success in previous roles.

- Vision and strategic planning skills.

- Ability to communicate effectively with stakeholders.

Evaluating the Management Team

- Experience and expertise of the team.

- Alignment of interests with shareholders.

- History of managing the company through challenging times.

Other Factors

- Corporate governance practices.

- Board of directors’ independence and expertise.

3. Describe your approach to analyzing a company’s competitive landscape.

- Identify the company’s key competitors.

- Assess the competitors’ strengths and weaknesses.

- Analyze the competitive dynamics of the industry.

- Identify potential threats and opportunities.

- Use Porter’s Five Forces Framework to understand industry dynamics.

4. How do you incorporate ESG factors into your investment analysis?

- Review the company’s ESG disclosures.

- Assess the company’s ESG performance relative to peers.

- Consider the potential impact of ESG factors on the company’s future financial performance.

- Engage with the company’s management on ESG issues.

- Use ESG ratings and data providers to inform analysis.

5. What are some of the most important financial ratios you use in your analysis?

- Gross margin.

- Operating margin.

- Net profit margin.

- Return on equity (ROE).

- Return on assets (ROA).

- Debt-to-equity ratio.

- Current ratio.

- Quick ratio.

6. How do you stay up-to-date on the latest financial news and research?

- Read financial news websites and publications.

- Attend industry conferences and webinars.

- Network with other analysts and investors.

- Use social media to follow industry experts and news sources.

- Subscribe to research reports from reputable firms.

7. Describe your experience with using financial modeling software.

- Proficient in using Excel for financial modeling.

- Experienced in using specialized financial modeling software, such as FactSet or Bloomberg.

- Able to develop and maintain complex financial models.

- Comfortable using macros and VBA to automate tasks.

8. How do you handle disagreements with colleagues or clients?

- Listen actively to the other person’s perspective.

- State my own views clearly and respectfully.

- Work to find common ground and reach a consensus.

- If necessary, agree to disagree and move forward.

- Maintain a professional and respectful demeanor throughout the discussion.

9. What are your career goals?

- To become a leading Securities Research Analyst.

- To develop my expertise in financial modeling and analysis.

- To provide valuable insights and recommendations to clients.

- To contribute to the success of my firm.

- To make a positive impact on the investment community.

10. Why are you interested in this position?

- I am passionate about financial markets and research.

- I am eager to apply my skills and experience to help clients make informed investment decisions.

- I am impressed by your firm’s reputation and commitment to excellence.

- I believe that I can make a significant contribution to your team.

- I am excited about the opportunity to learn and grow with your firm.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Securities Research Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Securities Research Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Securities Research Analysts are responsible for providing in-depth research and analysis of securities, which includes stocks, bonds, and other financial instruments. Their insights help guide investment decisions made by portfolio managers, financial advisors, and individual investors.

1. Research and Analysis of Securities

Conduct thorough research on companies, industries, and economic trends to evaluate the potential performance of securities.

- Analyze financial statements, industry reports, and other relevant data

- Forecast financial performance and make investment recommendations

2. Industry and Company Analysis

Develop a deep understanding of specific industries and the companies operating within them

- Identify industry trends, competitive dynamics, and growth opportunities

- Evaluate company management, strategy, and competitive advantages

3. Economic and Market Analysis

Monitor economic and market conditions to assess their impact on securities

- Track interest rates, inflation, and other macroeconomic factors

- Analyze market trends, sector performance, and geopolitical events

4. Communication and Reporting

Effectively communicate research findings and recommendations to clients

- Write research reports, presentations, and other materials

- Attend industry conferences and briefings to share insights

Interview Tips

Preparing thoroughly for an interview can increase your chances of success. Here are some tips to help you ace the interview for a Securities Research Analyst position:

1. Research the Company and Role

Before the interview, take time to research the company, its investment philosophy, and the specific role you are applying for. This will show the interviewer that you are genuinely interested in the opportunity and have taken the initiative to learn about the firm.

2. Practice Your Technical Skills

Securities Research Analysts need to have strong analytical and modeling skills. Be prepared to discuss your experience in financial modeling, valuation techniques, and industry analysis. You may also be asked to provide examples of your research work or case studies.

3. Demonstrate Your Industry Knowledge

The interviewer will be interested in assessing your knowledge of the financial industry and your understanding of current market trends. Stay up-to-date on the latest economic and market news, and be prepared to discuss your insights and opinions.

4. Highlight Your Communication and Interpersonal Skills

Securities Research Analysts need to be able to communicate their findings effectively to a variety of audiences. In the interview, emphasize your written and verbal communication skills, as well as your ability to build relationships with clients.

5. Prepare Thoughtful Questions

Asking well-thought-out questions at the end of the interview shows that you are interested in the role and the company. Prepare questions that demonstrate your understanding of the industry and the current market environment, and that are tailored to the specific company and position you are applying for.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Securities Research Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!