Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Certified Financial Planner (CFP) interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Certified Financial Planner (CFP) so you can tailor your answers to impress potential employers.

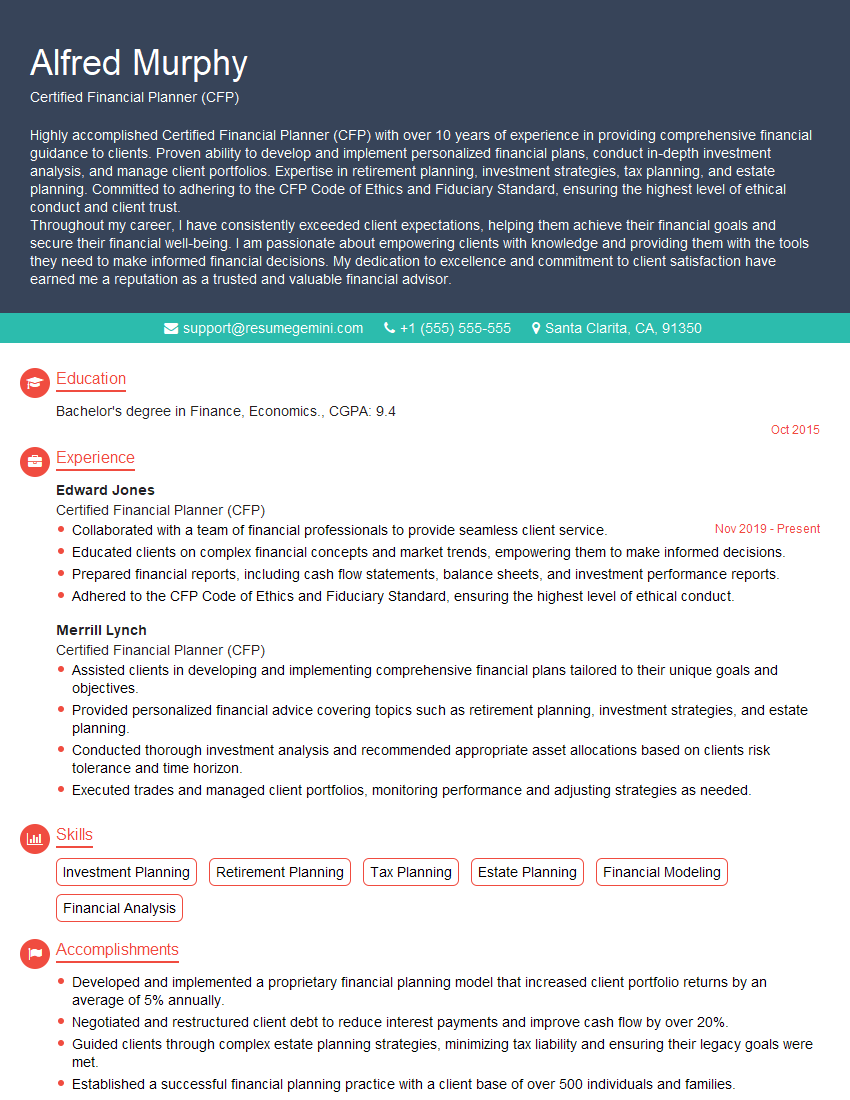

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Certified Financial Planner (CFP)

1. Describe the fundamental principles of financial planning that you adhere to in your practice.

The fundamental principles of financial planning that I adhere to in my practice include:

- Client-centered approach: I put my clients’ needs first and tailor my recommendations to their unique circumstances and goals.

- Holistic planning: I consider all aspects of my clients’ financial lives to develop comprehensive solutions that address their short-term and long-term goals.

- Risk management: I help clients identify, assess, and mitigate financial risks to protect their assets and achieve their goals.

- Tax optimization: I work with clients to minimize their tax liability and maximize their after-tax returns.

- Estate planning: I help clients plan for the distribution of their assets upon death or incapacity, minimizing estate taxes and ensuring their wishes are fulfilled.

2. How do you structure your financial planning process for clients?

Initial Assessment

- Gather client information through interviews and questionnaires.

- Assess client’s financial situation, goals, and risk tolerance.

Planning

- Develop financial plan outlining strategies and recommendations.

- Consider all aspects of client’s financial life, including investments, retirement, insurance, estate planning, etc.

Implementation

- Work with clients to implement the plan’s recommendations.

- Monitor and adjust the plan as needed.

3. How do you stay up-to-date with the latest developments in financial planning and tax regulations?

- Attend industry conferences and workshops.

- Read journals, books, and articles.

- Participate in continuing education courses.

- Stay connected with professional organizations, such as the CFP Board.

- Monitor government websites and publications for updates on tax regulations.

4. How do you handle conflicts of interest that may arise in your role as a financial planner?

- Disclosure: I disclose any potential conflicts of interest to my clients in writing.

- Avoidance: I avoid situations where my personal interests could compromise my clients’ best interests.

- Recusal: If a conflict of interest arises, I may recuse myself from the matter.

- Seek guidance: I may consult with an independent third party or seek guidance from the CFP Board’s Ethics Committee.

5. Can you describe a particularly challenging financial planning situation you encountered and how you resolved it?

In one instance, I worked with a client who had complex financial needs, including managing a large retirement portfolio, planning for future healthcare expenses, and ensuring their estate was distributed according to their wishes. I used a holistic planning approach to develop a comprehensive strategy that addressed all of their concerns. This involved coordinating with a tax accountant to optimize their retirement withdrawals and utilizing trusts to minimize estate taxes. The client was very satisfied with the plan and felt reassured that their financial future was secure.

6. How do you measure the success of your financial planning services?

- Client satisfaction: I regularly survey my clients to assess their satisfaction with my services.

- Goal achievement: I track my clients’ progress towards their financial goals.

- Financial performance: I monitor the performance of my clients’ investments and other financial assets to ensure they are meeting their expectations and objectives.

- Industry recognition: I have received industry awards and recognition for my financial planning services.

7. What makes you passionate about financial planning?

- I enjoy helping people achieve their financial goals and secure their financial futures.

- I am fascinated by the complexities of financial planning and the challenges it presents.

- I believe that everyone deserves access to sound financial advice and guidance.

- I am proud to be part of a profession that makes a positive impact on people’s lives.

8. How do you differentiate yourself from other financial planners in the market?

- Client-centric approach: I put my clients’ best interests first and tailor my services to their unique needs.

- Holistic perspective: I consider all aspects of my clients’ financial lives to develop comprehensive solutions for a holistic financial plan.

- Expertise and experience: I have extensive experience in financial planning and have completed advanced training. I am a Certified Financial Planner™ professional, and I hold various other industry certifications.

- Strong ethical standards: I adhere to the highest ethical standards and am committed to putting my clients’ interests first.

9. How do you approach working with clients who have a limited understanding of financial planning?

- Clear communication: I use clear and simple language to explain complex financial concepts.

- Personalized education: I provide tailored financial education to help clients understand their options and make informed decisions.

- Active listening: I listen attentively to my clients’ concerns and questions to ensure I fully understand their needs.

- Patience and empathy: I am patient and understanding, recognizing that clients may have different levels of financial literacy.

10. What are your thoughts on the future of financial planning?

- Technology: Technology will continue to play a significant role in financial planning, with tools that enhance efficiency, personalization, and accessibility.

- Personalization: Financial planning will become increasingly personalized, with a focus on tailoring plans to each client’s unique circumstances and goals.

- Financial literacy: There will be a growing emphasis on financial literacy, as individuals become more aware of the importance of managing their finances effectively.

- Collaboration: Financial planners will increasingly collaborate with other professionals, such as accountants, attorneys, and insurance agents, to provide comprehensive financial services.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Certified Financial Planner (CFP).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Certified Financial Planner (CFP)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of a Certified Financial Planner (CFP)

A Certified Financial Planner (CFP) is a highly qualified financial professional who provides comprehensive financial planning services to individuals and families. Their primary responsibilities include:

1. Financial Planning and Analysis

CFPs assess clients’ financial situations, create personalized financial plans, and provide guidance on investment, retirement planning, tax optimization, and estate planning.

- Assess clients’ financial goals, risk tolerance, and time horizon.

- Develop comprehensive financial plans that outline strategies for achieving clients’ goals.

2. Investment Management

CFPs recommend and manage investment portfolios for clients, ensuring alignment with their risk tolerance and financial objectives.

- Research and select investment options that meet clients’ risk-return profiles.

- Monitor and adjust investment portfolios as needed.

3. Retirement Planning

CFPs assist clients in preparing for retirement by maximizing savings, investing for growth, and planning for income needs in retirement.

- Create retirement income projections and recommend strategies for meeting retirement expenses.

- Review and manage retirement accounts, such as 401(k) and IRAs.

4. Tax Planning

CFPs provide guidance on tax laws and strategies to help clients minimize taxes and optimize their financial positions.

- Analyze tax implications of financial decisions and recommend strategies for tax savings.

- Prepare tax returns or work with tax professionals to ensure compliance.

5. Estate Planning

CFPs help clients preserve and transfer their wealth to future generations through estate planning.

- Draft wills, trusts, and other estate planning documents.

- Plan for the distribution of assets upon death or incapacity.

Interview Preparation Tips for a CFP Interview

To ace your CFP interview, it’s essential to prepare thoroughly. Here are some tips to help you succeed:

1. Research the Company and Position

Familiarize yourself with the company’s values, financial services, and specific requirements for the CFP position. Understanding their business and culture will demonstrate your interest and preparedness.

2. Highlight Your Credentials and Experience

Emphasize your CFP certification and any relevant financial planning experience. Quantify your accomplishments and provide specific examples of how you have helped clients achieve their financial goals.

3. Prepare for Behavioral and Technical Questions

Interviewers will likely ask STAR (Situation, Task, Action, Result) questions to assess your problem-solving skills and financial acumen. Practice answering these questions succinctly and providing detailed examples.

- Example: “Walk me through a time you helped a client with complex retirement planning.”

- Example: “Explain how you would manage an investment portfolio for a client with a moderate risk tolerance and a 10-year time horizon.”

4. Practice Your Communication Skills

CFPs need to be able to communicate complex financial concepts clearly and effectively. During the interview, practice active listening, ask clarifying questions, and present your ideas in a concise and organized manner.

5. Be Professional and Enthusiastic

Dress professionally, arrive on time, and maintain a positive and engaged demeanor throughout the interview. Express your interest in the position and the company, and show your enthusiasm for helping clients achieve their financial goals.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Certified Financial Planner (CFP) interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!