Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Financial Advisor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

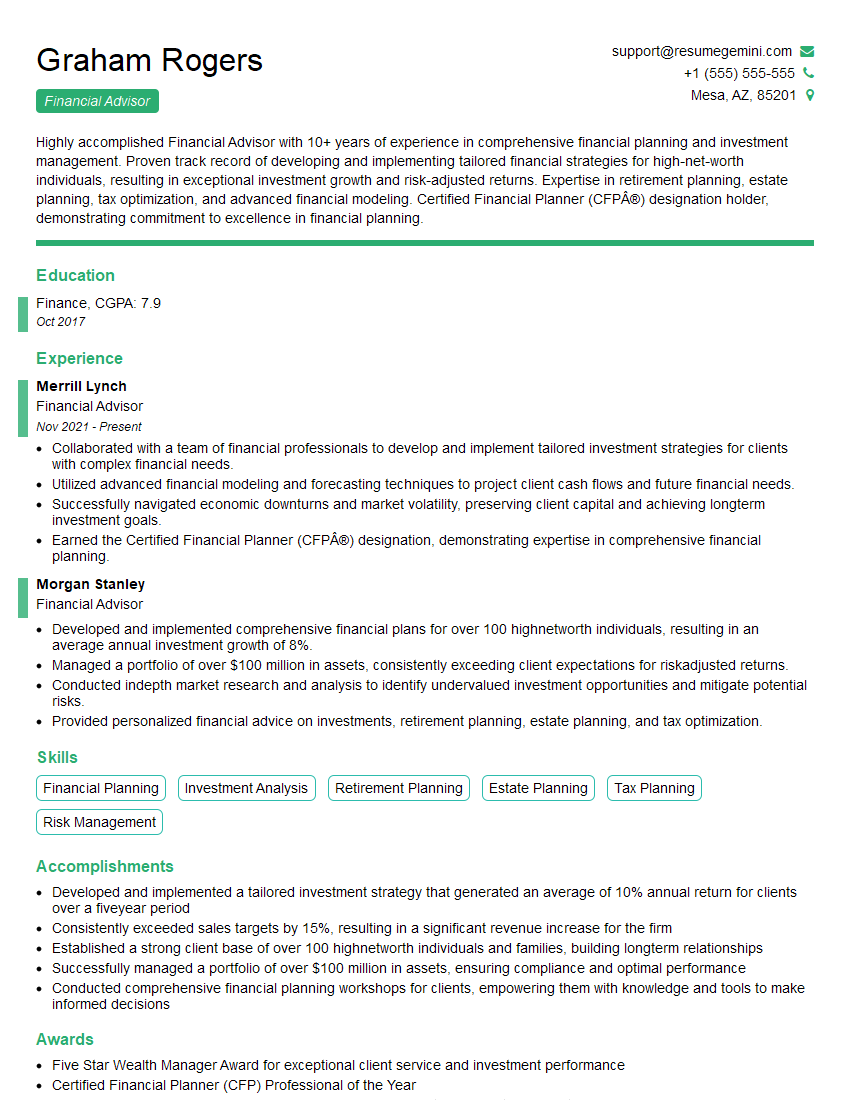

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Financial Advisor

1. Describe the key elements of a comprehensive financial plan?

- Establish financial goals and objectives.

- Analyse current financial situation and risk tolerance.

- Recommend and implement strategies to achieve goals.

- Monitor and adjust plan as needed.

- Review financial performance and make recommendations.

2. How do you determine the appropriate asset allocation for a client?

Investment Time Horizon

- Shorter time horizon: Lower risk tolerance.

- Longer time horizon: Higher risk tolerance.

Risk Tolerance

- Conservative: Lower risk tolerance.

- Aggressive: Higher risk tolerance.

Financial Goals

- Retirement Planning: Higher equity allocation.

- Short-term Savings: Lower equity allocation.

3. What are some of the ethical considerations that financial advisors should be aware of?

- Fiduciary Duty: Act in client’s best interest.

- Conflicts of Interest: Disclose any potential conflicts.

- Suitability: Recommend investments appropriate for clients.

- Privacy: Maintain confidentiality of client information.

- Fair Dealing: Provide clear and accurate information.

4. What are some of the challenges you have faced in your previous role as a financial advisor?

- Managing client expectations during market volatility.

- Staying up-to-date with complex financial regulations and products.

- Balancing clients’ short-term needs with long-term goals.

- Communicating complex financial concepts effectively.

- Building and maintaining strong client relationships.

5. How do you stay up-to-date with the latest investment strategies and financial news?

- Attend industry conferences and webinars.

- Read financial publications and research reports.

- Network with other financial professionals.

- Complete continuing education courses.

- Follow reputable sources online and in print.

6. How do you build strong client relationships?

- Establish clear communication channels.

- Actively listen to clients’ needs and goals.

- Provide personalized advice and recommendations.

- Respond promptly to inquiries and concerns.

- Build trust through transparency and accountability.

7. What are your strengths and how do they make you a good financial advisor?

- Analytical skills to analyze financial data.

- Strong communication skills to explain complex concepts.

- Empathy to understand clients’ financial concerns.

- Problem-solving skills to develop effective strategies.

- Integrity and ethical judgment to act in clients’ best interests.

8. What are your areas of expertise within financial planning?

- Retirement Planning.

- Investment Management.

- Estate Planning.

- Tax Planning.

- Insurance Planning.

9. How do you assess a client’s risk tolerance?

- Use risk tolerance questionnaires.

- Discuss client’s financial situation and goals.

- Analyse client’s investment history and experience.

- Consider client’s age and time horizon.

- Monitor and adjust risk tolerance over time.

10. How do you explain complex financial concepts to clients in a way that they can understand?

- Use clear and concise language.

- Provide real-world examples and analogies.

- Break down complex concepts into smaller parts.

- Use visual aids and diagrams to illustrate concepts.

- Encourage clients to ask questions and provide feedback.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Financial Advisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Financial Advisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Financial Advisors are responsible for providing financial guidance and advice to clients. They help clients make informed decisions about their finances, including investments, retirement planning, and estate planning. To excel in this role, one must possess a deep understanding of financial markets, investment strategies, and tax laws.

1. Client Relationship Management

Financial Advisors are responsible for building and maintaining strong relationships with clients. They must be able to understand the client’s needs, goals, and risk tolerance. They must also be able to communicate complex financial concepts in a clear and concise manner.

- Meet with clients to discuss their financial goals and objectives.

- Develop and implement personalized financial plans for clients.

- Monitor client accounts and make recommendations for changes as needed.

2. Investment Analysis and Management

Financial Advisors must be able to analyze investment options and make recommendations that are in the best interests of their clients. They must be able to assess risk and return, and they must be able to diversify portfolios to minimize risk.

- Research and analyze investment opportunities.

- Make investment recommendations to clients.

- Monitor investment portfolios and make adjustments as needed.

3. Financial Planning

Financial Advisors help clients plan for their financial future. They can provide advice on a variety of topics, including retirement planning, estate planning, and tax planning.

- Develop retirement plans for clients.

- Create estate plans for clients.

- Provide tax planning advice to clients.

4. Insurance and Risk Management

Financial Advisors can also provide advice on insurance and risk management. They can help clients assess their risk tolerance and they can recommend insurance policies to protect against financial losses.

- Analyze client’s insurance needs.

- Recommend insurance policies to clients.

- Help clients manage their risk exposure.

Interview Tips

Preparing for a job interview can be daunting, but by following these tips, you can increase your chances of success.

1. Research the Company and the Position

Before you go to your interview, take some time to research the company and the position you are applying for. This will help you understand the company’s culture and values, and it will also help you prepare for the questions you will be asked during the interview.

- Visit the company’s website to learn about their history, mission, and values.

- Read the job description carefully so that you understand the requirements of the position.

- Talk to people in your network who work at the company or who have interviewed there in the past.

2. Practice Answering Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself,” “Why are you interested in this position?” and “What are your strengths and weaknesses?” Take some time to practice answering these questions so that you can deliver your responses confidently and clearly.

- Use the STAR method to answer behavioral interview questions. This method stands for Situation, Task, Action, Result.

- Be prepared to talk about your skills and experience, and how they relate to the requirements of the position.

- Practice your answers with a friend, family member, or career counselor.

3. Dress Professionally and Arrive on Time

First impressions matter, so it is important to dress professionally for your interview. You should also arrive on time, or even a few minutes early. This will show the interviewer that you are serious about the position and that you respect their time.

- Choose clothing that is clean, pressed, and appropriate for the position you are applying for.

- Make sure your shoes are clean and polished.

- Arrive at the interview location 10-15 minutes early.

4. Be Yourself and Be Enthusiastic

It is important to be yourself during your interview. The interviewer wants to get to know the real you, so don’t try to be someone you’re not. Be enthusiastic about the position and the company, and let the interviewer know why you are the best person for the job.

- Be genuine and authentic in your answers.

- Smile and make eye contact with the interviewer.

- Thank the interviewer for their time at the end of the interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Financial Advisor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!