Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Estate Planning Counselor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

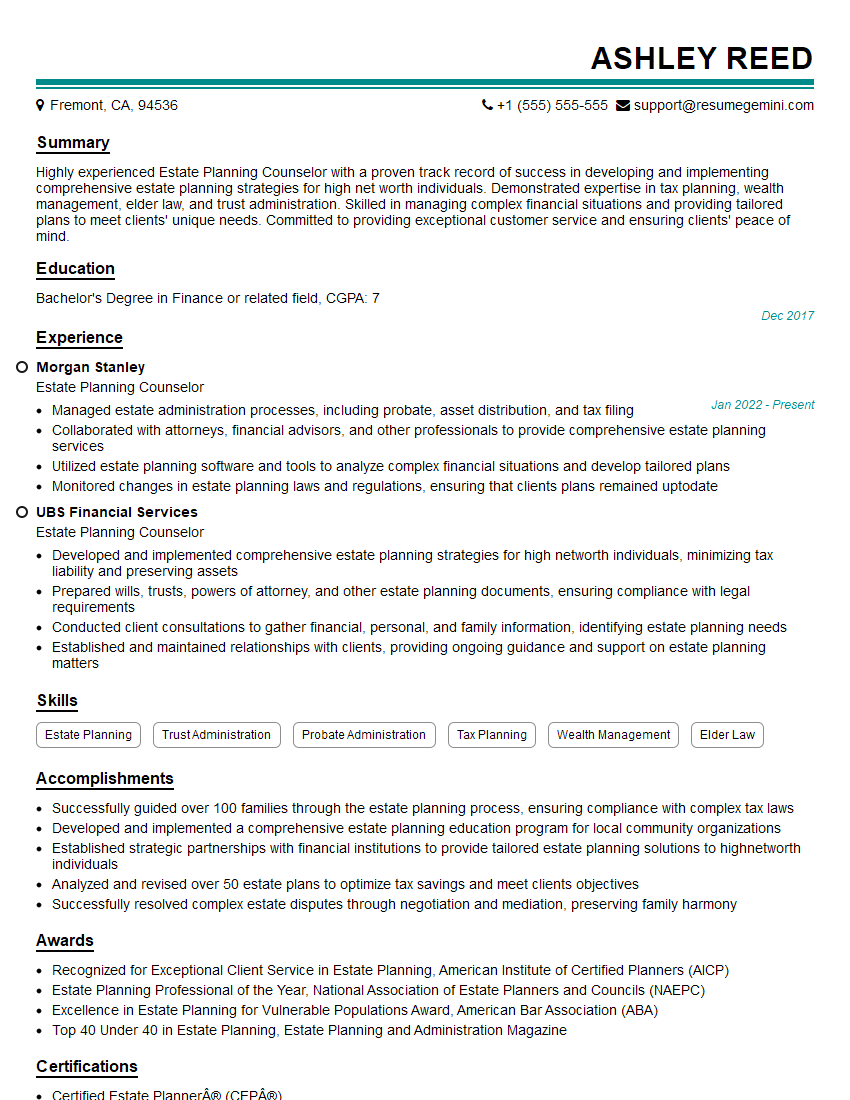

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Estate Planning Counselor

1. Describe the essential elements of a comprehensive estate plan?

A comprehensive estate plan typically includes the following elements:

- Will: A legal document that outlines your wishes for the distribution of your assets after your death.

- Trust: A legal entity that can hold and manage your assets for the benefit of your beneficiaries.

- Power of Attorney: A document that grants someone the legal authority to act on your behalf if you become incapacitated.

- Health Care Proxy: A document that appoints someone to make medical decisions on your behalf if you are unable to do so.

- Advance Directives: Documents that provide instructions on your end-of-life care.

2. What are the key considerations when drafting a will?

Consideration of Beneficiaries:

- Identifying the intended beneficiaries of your estate.

- Determining the specific assets to be distributed to each beneficiary.

Tax Implications:

- Understanding the potential tax consequences of your estate plan.

- Utilizing tax-saving strategies, such as trusts and charitable giving.

Contesting the Will:

- Addressing potential challenges to the validity of your will.

- Minimizing the risk of a will contest by ensuring it is properly executed and witnessed.

3. What are the different types of trusts and how do you determine the appropriate type for a client?

There are various types of trusts, each with its unique purpose and characteristics. The appropriate type of trust for a client depends on their specific needs and objectives. Some common types of trusts include:

- Revocable Living Trust: Allows the grantor to retain control of the assets during their lifetime and make changes as needed.

- Irrevocable Trust: Provides greater asset protection and tax benefits but cannot be modified or revoked after it is created.

- Special Needs Trust: Designed to protect assets for beneficiaries with disabilities and ensure they continue to qualify for government benefits.

- Charitable Trust: Created to benefit a charitable organization and can provide tax advantages for the grantor.

4. How do you handle clients who have complex estate planning needs?

Handling clients with complex estate planning needs requires a comprehensive and tailored approach:

- Collaboration with Other Professionals: Working closely with attorneys, accountants, and financial advisors to ensure a coordinated plan that meets the client’s legal, tax, and financial goals.

- Understanding Family Dynamics: Considering the relationships and dynamics within the client’s family to address potential conflicts and ensure a smooth transition of assets.

- Tax Planning Strategies: Implementing advanced tax planning techniques, such as trusts and gifting strategies, to minimize tax liability and preserve wealth.

5. What ethical considerations are involved in estate planning?

Maintaining ethical standards is crucial in estate planning:

- Client Confidentiality: Protecting the privacy and sensitive information of clients.

- Conflicts of Interest: Avoiding situations where personal interests could compromise the client’s best interests.

- Competency and Capacity: Ensuring that clients have the mental capacity to make informed decisions and understand the implications of their estate plan.

- Duty of Care: Providing competent and diligent services to clients, acting in their best interests.

6. How do you stay up-to-date on changes in estate planning laws and regulations?

To stay current with evolving estate planning laws and regulations:

- Continuing Education: Regularly attending seminars, workshops, and conferences to enhance knowledge and skills.

- Professional Development: Reading industry publications, participating in professional organizations, and networking with other estate planning professionals.

- Legal Updates: Monitoring legal databases and subscribing to legal journals to stay informed about recent court decisions and legislative changes.

7. How do you build rapport with clients and gain their trust?

Building rapport and trust with clients is essential in estate planning:

- Active Listening: Listening attentively to clients’ concerns, needs, and objectives.

- Empathy and Understanding: Demonstrating empathy and understanding towards clients’ personal and financial situations.

- Clear Communication: Communicating complex estate planning concepts in a clear and accessible manner.

- Professionalism and Respect: Maintaining a professional demeanor and treating clients with respect and dignity.

8. What is your approach to advising clients on charitable giving?

When advising clients on charitable giving, I take the following approach:

- Philanthropic Goals: Exploring clients’ philanthropic interests and identifying charities that align with their values.

- Tax Implications: Discussing the potential tax benefits of charitable giving, such as income tax deductions and estate tax savings.

- Types of Charitable Gifts: Presenting various options for charitable giving, including outright gifts, bequests, and charitable trusts.

- Impact and Legacy: Emphasizing the positive impact and legacy that charitable giving can have on the community and the client’s values.

9. How do you handle situations where family members have differing opinions about the estate plan?

In situations where family members have differing opinions about the estate plan:

- Facilitate Communication: Encourage open and respectful communication among family members to understand their perspectives and concerns.

- Mediation and Negotiation: Act as a neutral facilitator to help family members reach a compromise or consensus that meets the needs of all parties.

- Legal Considerations: Explain the legal implications of different estate planning options and ensure that the plan complies with applicable laws and regulations.

- Professional Guidance: If necessary, refer clients to other professionals, such as therapists or financial advisors, to provide additional support and guidance.

10. Describe a challenging estate planning case you have handled and how you resolved it?

One challenging estate planning case I handled involved a client with a large and complex estate. The client had multiple children from previous marriages, blended families, and significant business interests. The challenge was to create an estate plan that equitably distributed the assets, minimized tax liability, and addressed the needs of all beneficiaries.

To resolve this case, I took the following steps:

- Gather Information: I met with the client multiple times to gather detailed information about their assets, family relationships, financial goals, and tax situation.

- Develop Options: I presented the client with several estate planning options, explaining the advantages and disadvantages of each option.

- Facilitate Family Meetings: I facilitated family meetings to discuss the client’s wishes and address the concerns of all beneficiaries.

- Draft and Revise Documents: I drafted an estate plan that incorporated the client’s objectives, addressed tax considerations, and ensured the smooth distribution of assets.

- Execute and Implement: I supervised the execution of the estate planning documents and provided ongoing guidance to the client and their family regarding the implementation of the plan.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Estate Planning Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Estate Planning Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Estate Planning Counselors are responsible for guiding individuals and families through the process of creating and managing estate plans. They help clients understand their financial and legal options and make informed decisions about how to distribute their assets after death. Some key job responsibilities of an Estate Planning Counselor include:

1. Client Consultation and Education

Meeting with clients to discuss their estate planning goals and objectives.

- Explaining the different estate planning tools and strategies available.

- Educating clients on the legal and financial implications of their estate plans.

2. Preparation of Estate Planning Documents

Drafting wills, trusts, and other estate planning documents.

- Ensuring that estate planning documents are legally valid and meet the client’s specific needs.

- Working with clients to make sure their estate plans are updated as their circumstances change.

3. Tax Planning

Advising clients on tax implications of their estate plans.

- Identifying potential tax liabilities and developing strategies to minimize them.

- Working with clients to avoid or minimize probate and estate taxes.

4. Asset Management and Distribution

Assisting clients with the management and distribution of their assets.

- Providing guidance on investment strategies and asset allocation.

- Helping clients manage their assets to meet their financial goals.

- Distributing assets to beneficiaries in accordance with the client’s wishes.

Interview Tips

To ace an interview for an Estate Planning Counselor position, there are several key tips to keep in mind:

1. Research the Firm and Position

Take the time to research the law firm or financial institution where you are interviewing. Learn about their areas of expertise, their approach to estate planning, and the specific role you will be filling. This will demonstrate your interest in the position and help you answer questions intelligently.

2. Practice Answering Common Interview Questions

Prepare for common interview questions by practicing your answers in advance. Some common questions you may encounter include:

- Tell me about your experience in estate planning.

- What are your strengths and weaknesses as an estate planning counselor?

- How do you stay up-to-date on changes in estate planning laws?

- What are your goals for this position?

- Why are you interested in working for our firm?

3. Emphasize Your Communication Skills

Estate Planning Counselors must be able to communicate complex legal and financial concepts to clients in a clear and concise way. Highlight your communication skills in your interview by using specific examples of how you have effectively communicated with clients in the past.

4. Highlight Your Knowledge of Estate Planning Laws

Estate Planning Counselors must have a thorough understanding of estate planning laws and regulations. Demonstrate your knowledge by discussing specific cases or situations you have worked on in the past. You can also mention any continuing education or professional development courses you have taken to stay up-to-date on the latest changes in the law.

5. Be Professional and Enthusiastic

First impressions matter, so be sure to dress professionally and arrive on time for your interview. Throughout the interview, maintain a positive and enthusiastic attitude. This will show the interviewer that you are genuinely interested in the position and that you are confident in your abilities.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Estate Planning Counselor interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.