Are you gearing up for a career in Individual Pension Adviser? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Individual Pension Adviser and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

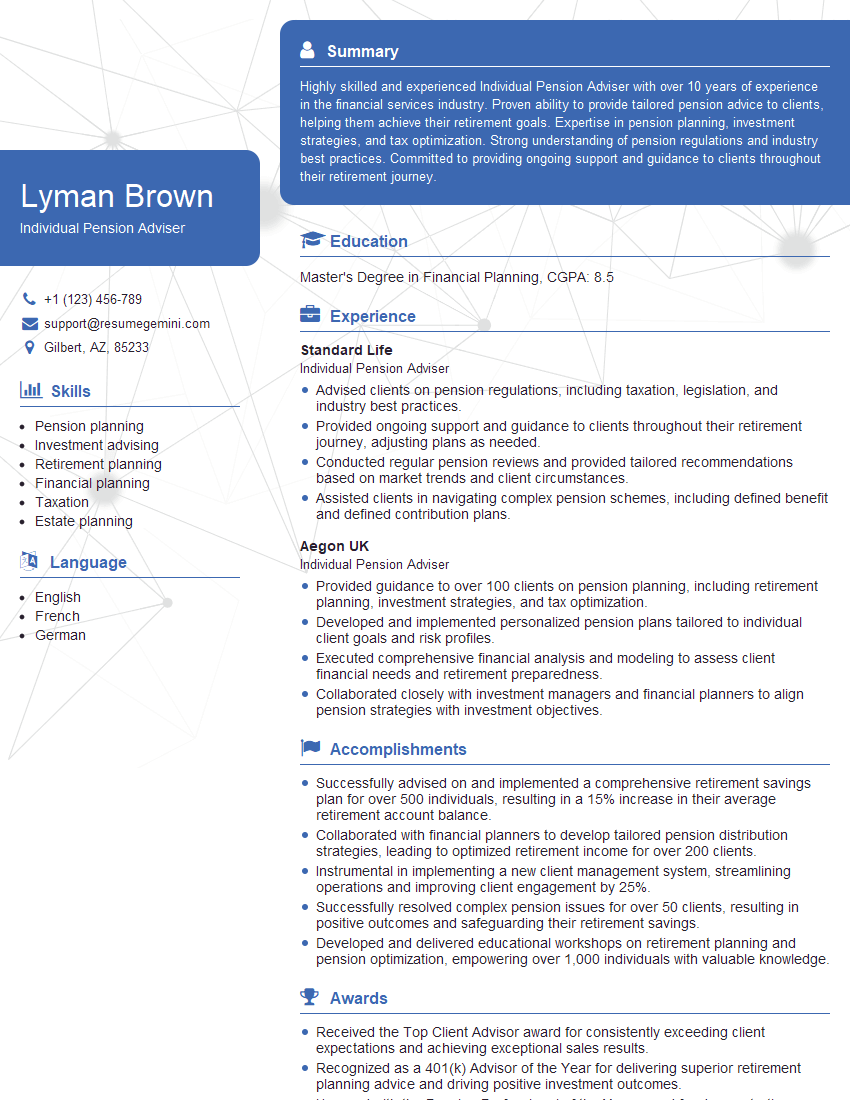

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Individual Pension Adviser

1. Explain the different types of pension plans available to individuals in the UK?

There are several pension plans available in the UK, each with its advantages and disadvantages:

- Defined benefit (DB) pension plans: Defined benefit plans provide a guaranteed income for life based on a formula that considers factors such as salary, years of service, and age. DB plans are less common today than they once were, but they are still offered by some employers.

- Defined contribution (DC) pension plans: Defined contribution plans provide a pot of money that can be used to provide an income in retirement. The amount of money in the pot depends on the contributions made by the individual and their employer, as well as the investment performance of the fund. DC plans are more common than DB plans today.

- Personal pension plans: Personal pensions are individual pension plans that are not linked to an employer. Anyone can open a personal pension, and they offer a range of investment options. Personal pensions are often used by people who are self-employed or who have multiple jobs.

- State pension: The state pension is a basic income provided by the government to people who have reached retirement age. The amount of state pension you receive depends on your National Insurance contributions and your age.

2. What are the key factors to consider when choosing a pension plan?

- Investment objectives: What are your investment goals? Are you looking for a plan that will provide a guaranteed income for life or a plan that has the potential for higher returns?

- Risk tolerance: How much risk are you prepared to take with your pension investments? Some plans offer more conservative investment options, while others offer more aggressive options.

- Tax efficiency: How tax-efficient is the pension plan? Contributions to some plans are tax-deductible, while withdrawals from others are taxed as income.

- Costs: What are the costs associated with the pension plan? These costs can include management fees, investment fees, and withdrawal fees.

- Flexibility: How flexible is the pension plan? Some plans allow you to make withdrawals before retirement, while others do not. Some plans also allow you to transfer your pension to another provider.

3. Discuss the different investment strategies that can be used for pension plans.

- Growth investments: Growth investments are designed to increase the value of your pension pot over time. These investments typically include stocks and shares.

- Income investments: Income investments are designed to provide a regular income stream in retirement. These investments typically include bonds and annuities.

- Balanced investments: Balanced investments are a combination of growth and income investments. These investments offer a mix of potential growth and income.

- Lifestyle investments: Lifestyle investments are designed to provide a smooth transition from working life to retirement. These investments typically start with a higher allocation to growth investments and gradually shift to a higher allocation to income investments as you approach retirement.

4. What are the potential risks and rewards of investing in a pension plan?

Potential risks:- Investment risk: The value of your pension pot can go down as well as up, and you may not get back the same amount of money you put in.

- Inflation risk: Inflation can reduce the value of your pension pot over time.

- Longevity risk: You may live longer than expected, and your pension pot may not provide you with enough income to cover your needs.

- Tax benefits: Contributions to pension plans are often tax-deductible, and withdrawals from some plans are taxed as income.

- Investment growth: The value of your pension pot has the potential to grow over time.

- Guaranteed income: Some pension plans provide a guaranteed income for life.

5. How can I calculate how much I need to save for retirement?

To calculate how much you need to save for retirement, you need to consider several factors, including your desired retirement income, your life expectancy, and your investment returns. There are many online calculators that can help you with this calculation.6. What are the different types of retirement annuities available, and how do they work?

- Immediate annuities: Immediate annuities provide an immediate income stream for life. The amount of income you receive depends on the purchase price of the annuity and the interest rate at the time of purchase.

- Deferred annuities: Deferred annuities allow you to accumulate money in a tax-deferred account until you reach retirement age. At that time, you can annuitize your account and receive an income stream for life.

- Variable annuities: Variable annuities are a type of deferred annuity that invests in a portfolio of stocks and bonds. The value of your annuity will fluctuate depending on the performance of the underlying investments.

7. How can I maximize my pension savings?

- Start saving early: The sooner you start saving for retirement, the more time your money has to grow.

- Contribute the maximum amount: Most pension plans have limits on how much you can contribute each year. Make sure you are contributing the maximum amount that you can afford.

- Take advantage of employer matching: Many employers offer matching contributions to their employees’ pension plans. This is free money that can help you boost your savings.

- Invest wisely: The investment strategy you choose will impact the growth of your pension pot. Make sure you choose a strategy that is appropriate for your risk tolerance and investment goals.

- Review your pension regularly: As you get closer to retirement, you should review your pension plan regularly to make sure that you are on track to meet your retirement goals.

8. What are the different options available for accessing my pension savings?

- Taking a lump sum: When you reach retirement age, you can take a lump sum of up to 25% of your pension pot tax-free. The rest of your pension pot will be taxed as income.

- Buying an annuity: You can use your pension pot to buy an annuity, which will provide you with an income for life.

- Drawing down your pension: You can draw down your pension from the age of 55. However, you will have to pay income tax on any withdrawals you make.

- Leaving your pension invested: You can leave your pension invested until you need the money. However, you may have to pay tax on any investment gains you make.

9. How can I protect my pension savings from fraud?

- Be aware of pension scams: There are a number of pension scams that are designed to trick people into handing over their pension savings. Be aware of these scams and never give your pension details to anyone you don’t trust.

- Keep your pension details safe: Keep your pension details, such as your pension number and password, safe and secure. Do not share these details with anyone you don’t trust.

- Report any suspicious activity: If you are contacted by someone who you believe is trying to scam you, report it to your pension provider and the police.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Individual Pension Adviser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Individual Pension Adviser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Individual Pension Advisers play a vital role in guiding individuals towards financial security in retirement. Their key responsibilities include:

1. Client Relationship Management

Establishing and maintaining strong relationships with clients is crucial. Advisers build rapport, understand clients’ financial situations, retirement goals, and risk tolerance.

- Conducting thorough financial assessments to determine clients’ needs.

- Developing personalized retirement plans tailored to clients’ specific circumstances.

2. Investment Management

Advisers have a deep understanding of financial markets and investment strategies. They provide guidance on:

- Asset allocation based on clients’ risk profiles and time horizons.

- Selection of investment products, including mutual funds, annuities, and stocks.

- Monitoring and reviewing investment performance, making adjustments as needed.

3. Tax Considerations

Advisers stay abreast of tax regulations and their impact on retirement planning. They guide clients on:

- Optimizing tax-advantaged accounts such as 401(k)s and IRAs.

- Minimizing taxes on retirement income and distributions.

4. Estate Planning

Advisers work closely with estate planning attorneys to ensure clients’ assets are distributed according to their wishes. They:

- Review and analyze clients’ estate plans.

- Identify potential tax implications and legal issues.

- Suggest strategies to maximize estate value and minimize taxes.

Interview Tips

Preparing thoroughly for an Individual Pension Adviser interview is essential. Here are some tips to help you ace it:

1. Research the Company

Understanding the company’s culture, values, and approach to retirement planning will demonstrate your interest and alignment with their vision.

- Visit the company’s website and review their annual reports, press releases, and social media presence.

- Connect with current or former employees on LinkedIn to gain insights into the company’s work environment.

2. Practice Your Answers

Identify common interview questions and prepare thoughtful and concise answers that showcase your knowledge and skills. Consider using the STAR (Situation, Task, Action, Result) method to structure your responses.

- Example: When asked about your experience in managing retirement portfolios, you might respond:

- Situation: “In my previous role, I advised high-net-worth individuals and families on their retirement planning strategies.”

- Task: “My responsibilities included asset allocation, investment selection, and performance monitoring.”

- Action: “I employed a rigorous research process to identify suitable investments that aligned with my clients’ risk profiles and return expectations.”

- Result: “Over a five-year period, my clients’ portfolios consistently outperformed industry benchmarks.”

3. Highlight Your Soft Skills

In addition to technical knowledge, hiring managers value soft skills such as communication, empathy, and problem-solving abilities. Showcase these skills through specific examples:

- Example: When asked about your communication skills, you might describe how you effectively explained complex financial concepts to non-financial professionals.

4. Be Enthusiastic and Professional

Throughout the interview, maintain a positive and enthusiastic demeanor. Dress professionally and arrive on time. Demonstrate your passion for helping individuals achieve financial security through your thoughtful questions and genuine interest in the role.

- Example: Ask questions that show your understanding of the industry and your desire to contribute to the company’s success.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Individual Pension Adviser interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!