Are you gearing up for an interview for a Personal Banker position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Personal Banker and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

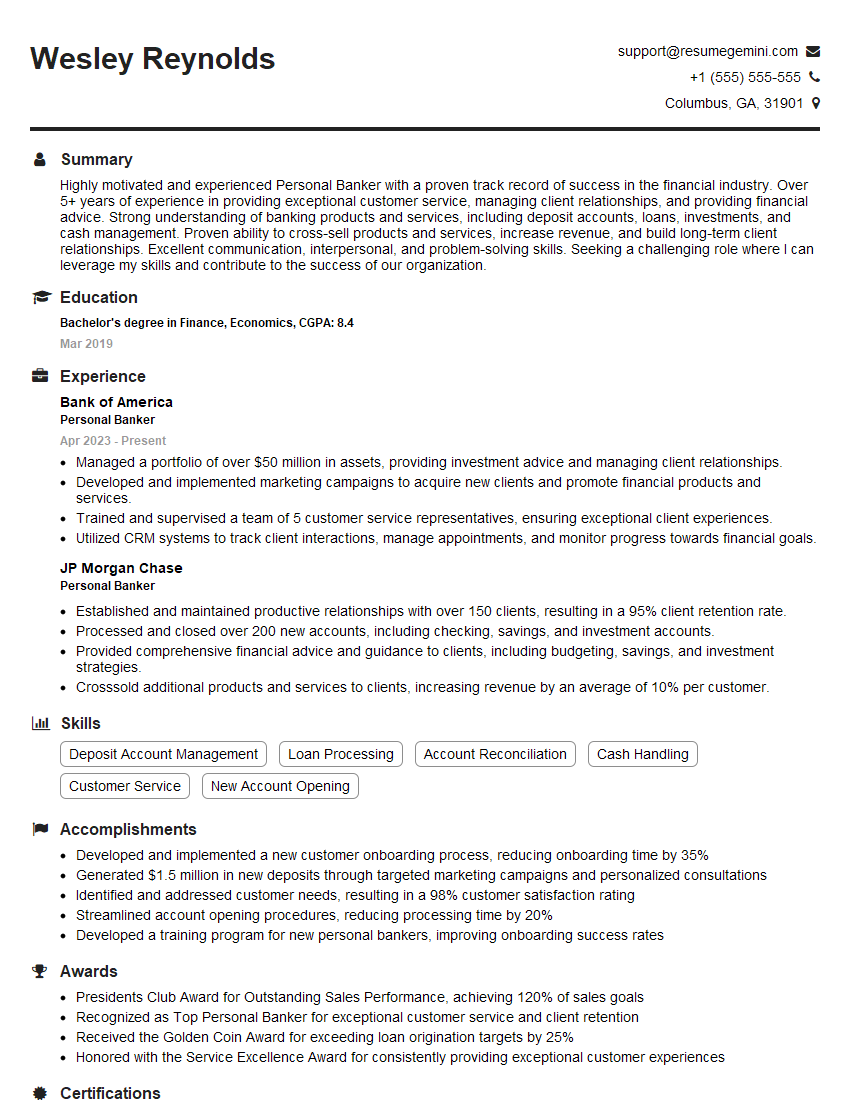

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Personal Banker

1. Describe the key responsibilities of a Personal Banker.

- Providing personalized financial advice and guidance to clients.

- Opening and managing checking, savings, and investment accounts.

- Processing loan applications and advising clients on loan options.

- Identifying and meeting client needs through cross-selling and referrals.

- Building and maintaining relationships with clients.

2. What is your understanding of the current financial market and its impact on personal banking services?

- Provide a brief overview of the current financial market, including key trends and challenges.

- Discuss how these market conditions affect personal banking services and customer needs.

- Explain how you stay up-to-date with financial market developments.

3. How do you assess a client’s financial situation and needs to provide tailored advice?

- Describe the process you use to gather information and analyze a client’s financial situation.

- Explain how you use this information to identify the client’s needs and goals.

- Provide examples of how you have used this approach to successfully advise clients.

4. Describe your experience in managing investment portfolios for clients.

- Explain the investment strategies you have used for clients.

- Discuss how you monitor and evaluate investment performance.

- Provide examples of successful investment portfolios you have managed.

5. How do you build and maintain strong relationships with clients?

- Describe your approach to building rapport and trust with clients.

- Explain how you stay in touch with clients and keep them informed about their financial situation.

- Provide examples of how you have successfully resolved client issues and maintained positive relationships.

6. What is your experience in using financial planning software and tools?

- Describe your proficiency in using specific financial planning software and tools.

- Explain how you use these tools to analyze client data and make recommendations.

- Discuss how you stay updated on the latest financial planning technologies.

7. How do you handle confidential client information?

- Describe the ethical and legal principles you adhere to when handling client information.

- Explain the security measures you take to protect client data.

- Provide examples of how you have successfully maintained client confidentiality.

8. Describe your experience in cross-selling and referral generation.

- Explain how you identify opportunities to cross-sell products and services to clients.

- Discuss your strategies for developing referral networks and generating new leads.

- Provide examples of successful cross-selling and referral generation campaigns you have implemented.

9. What is your understanding of the regulatory environment for personal banking?

- Provide an overview of the key regulatory bodies that govern personal banking.

- Discuss the impact of regulations on personal banking products and services.

- Explain how you ensure that your banking practices comply with regulatory requirements.

10. Describe your approach to meeting the diverse needs of clients from different cultural and socioeconomic backgrounds.

- Explain your understanding of cultural sensitivity and diversity in banking.

- Discuss how you adapt your communication style and financial advice to meet the needs of diverse clients.

- Provide examples of how you have successfully served clients from different backgrounds.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Personal Banker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Personal Banker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Personal Bankers are the face of the bank, providing financial products and services to individuals. Their key responsibilities include:

1. Customer Service and Relationship Management

Greeting and assisting customers with a wide range of banking needs, including account inquiries, withdrawals, deposits, and loan applications.

- Building and maintaining strong relationships with clients.

- Providing personalized financial advice and guidance.

2. Financial Products and Services

Selling and recommending a variety of financial products and services, such as checking and savings accounts, loans, investments, and insurance.

- Explaining product features and benefits to customers.

- Processing and completing financial transactions.

3. Cash Management and Operations

Handling cash transactions, including deposits, withdrawals, and currency exchange.

- Maintaining accuracy and security of cash handling.

- Assisting with bank operations, such as opening and closing accounts.

4. Compliance and Regulations

Adhering to all applicable banking regulations and compliance requirements.

- Preventing fraud and money laundering.

- Providing accurate and timely reports to regulators.

Interview Tips

To ace a Personal Banker interview, candidates should prepare thoroughly and highlight their skills and experience that align with the job requirements. Here are some tips:

1. Research the Bank and Position

Learn about the bank’s history, products, and services. Research the specific Personal Banker position and its responsibilities.

- Visit the bank’s website and social media pages.

- Read online reviews and articles about the bank and industry.

2. Highlight Customer Service and Sales Skills

Emphasize your ability to provide excellent customer service and build relationships. Showcase your sales skills and knowledge of financial products.

- Describe specific examples of how you exceeded customer expectations.

- Explain how you have sold financial products successfully in the past.

3. Demonstrate Banking Knowledge and Experience

Highlight your understanding of banking products, services, and regulations. Share any relevant experience in cash handling, account management, or financial advisory.

- Discuss your knowledge of different types of accounts and investments.

- Describe your experience with compliance and fraud prevention.

4. Prepare for Common Interview Questions

Practice answering common interview questions, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?”

- Use the STAR method (situation, task, action, result) to answer questions.

- Quantify your accomplishments whenever possible.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Personal Banker interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!