Are you gearing up for an interview for a Personal Financial Planner position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Personal Financial Planner and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

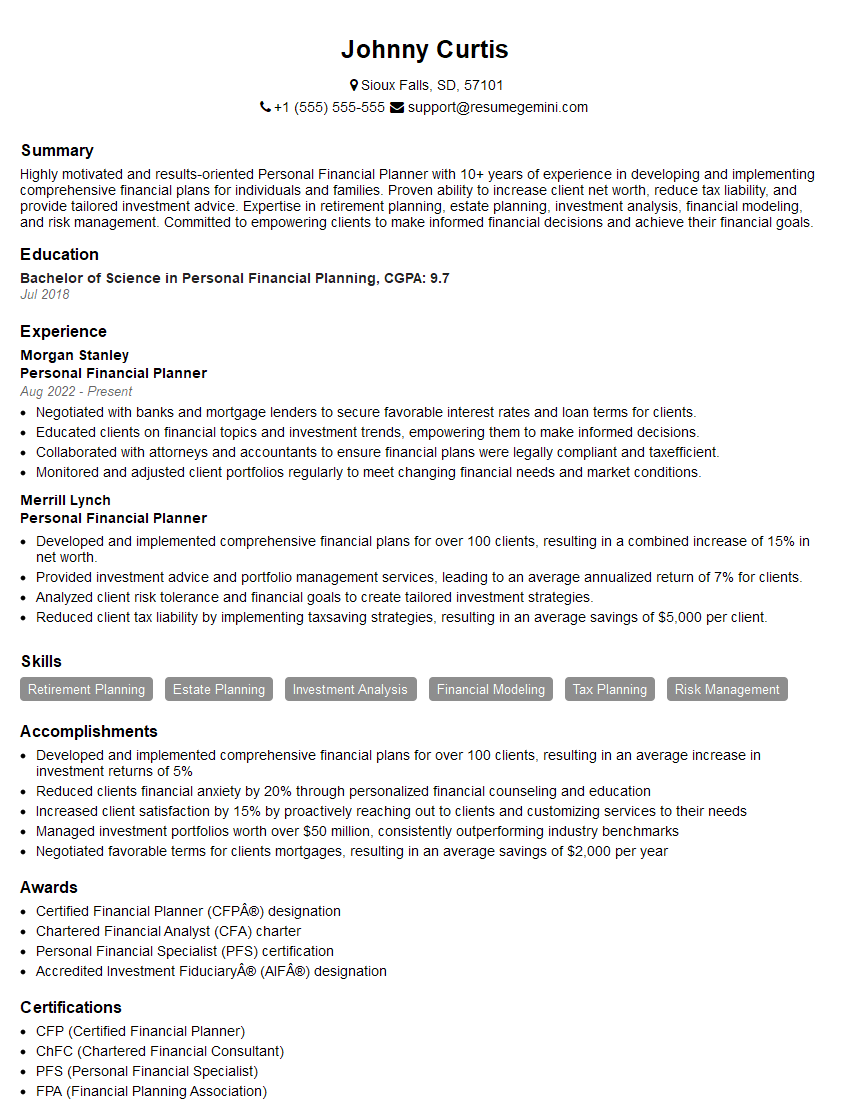

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Personal Financial Planner

1. How would you assess a client’s risk tolerance?

I would assess a client’s risk tolerance using a combination of qualitative and quantitative methods. The qualitative methods would involve asking the client a series of questions about their financial goals, investment experience, and how they react to market volatility. The quantitative methods would involve using a risk tolerance questionnaire or a risk tolerance calculator to assess the client’s risk tolerance based on their answers to a series of questions.

2. What is your process for developing a financial plan for a client?

Goal Setting

- Identify the client’s financial goals and objectives.

- Prioritize the client’s goals based on their importance and feasibility.

Data Gathering

- Collect and analyze the client’s financial information, including their income, expenses, assets, and debts.

- Assess the client’s risk tolerance and time horizon.

Investment Planning

- Develop an investment strategy that aligns with the client’s goals, risk tolerance, and time horizon.

- Monitor the client’s investments and make adjustments as needed.

Retirement Planning

- Estimate the client’s retirement income needs and develop a savings plan to meet those needs.

- Review the client’s retirement accounts and make recommendations for changes as needed.

Education Planning

- Estimate the cost of the client’s children’s education and develop a savings plan to meet those costs.

- Review the client’s education savings accounts and make recommendations for changes as needed.

Estate Planning

- Review the client’s will and other estate planning documents.

- Make recommendations for changes to the client’s estate plan as needed.

Tax Planning

- Review the client’s tax situation and make recommendations for tax-saving strategies.

- Prepare the client’s tax returns and file them on time.

3. What are some of the ethical considerations that you must keep in mind when providing financial advice?

Some of the ethical considerations that I must keep in mind when providing financial advice include:

- Fiduciary Duty: I must act in the best interests of my clients and put their interests ahead of my own.

- Confidentiality: I must keep client information confidential and only disclose it with their consent.

- Competence: I must only provide financial advice in areas where I am qualified and experienced.

- Fair Dealing: I must avoid conflicts of interest and disclose any potential conflicts to my clients.

- Suitability: I must make sure that the financial advice I provide is suitable for my clients’ needs and circumstances.

4. What are some of the challenges that you have faced in your career as a personal financial planner?

Some of the challenges that I have faced in my career as a personal financial planner include:

- Keeping up with the constantly changing financial landscape.

- Communicating complex financial concepts to clients in a way that they can understand.

- Dealing with clients who have unrealistic expectations.

- Managing my own emotions when working with clients who are going through difficult financial times.

5. What are some of the most important qualities that a personal financial planner should have?

Some of the most important qualities that a personal financial planner should have include:

- Strong communication and interpersonal skills.

- Excellent analytical and problem-solving skills.

- A deep understanding of financial planning principles.

- A passion for helping others.

- A commitment to continuing education.

6. What are some of the trends that you are seeing in the personal financial planning industry?

Some of the trends that I am seeing in the personal financial planning industry include:

- The use of technology to provide financial advice.

- The growing demand for personalized financial advice.

- The increasing importance of retirement planning.

- The need for financial planners to be more proactive in helping clients avoid scams.

7. What are some of the most common mistakes that people make when managing their finances?

Some of the most common mistakes that people make when managing their finances include:

- Not having a budget.

- Spending more than they earn.

- Not saving for retirement.

- Taking on too much debt.

- Not investing wisely.

8. What are some of the most important things that people should know about personal finance?

Some of the most important things that people should know about personal finance include:

- The importance of compound interest.

- The dangers of inflation.

- The benefits of diversification.

- The importance of having an emergency fund.

- The need to plan for retirement.

9. What are some of the most valuable lessons that you have learned in your career as a personal financial planner?

Some of the most valuable lessons that I have learned in my career as a personal financial planner include:

- The importance of listening to clients.

- The power of compound interest.

- The importance of diversification.

- The need to be patient and persistent.

- The importance of continuing education.

10. What are your strengths and weaknesses as a personal financial planner?

Strengths

- Strong communication and interpersonal skills.

- Excellent analytical and problem-solving skills.

- A deep understanding of financial planning principles.

- A passion for helping others.

- A commitment to continuing education.

Weaknesses

- I can sometimes be too detail-oriented.

- I can sometimes be too perfectionistic.

- I can sometimes be too hard on myself.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Personal Financial Planner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Personal Financial Planner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Personal Financial Planner is responsible for providing personalized financial guidance and planning services to individuals and families. Key job responsibilities include:

1. Financial Planning

Develop comprehensive financial plans that address clients’ financial goals, risk tolerance, and time horizon.

- Assess clients’ financial needs through interviews and data gathering.

- Analyze clients’ financial situation and identify areas for improvement.

- Develop and implement tailored financial plans that meet clients’ specific objectives.

2. Investment Management

Manage clients’ investment portfolios to meet their financial objectives.

- Research and select investment options that align with clients’ risk tolerance and return expectations.

- Monitor investment performance and make adjustments as necessary.

- Provide investors with ongoing updates and advice on their investment portfolios.

3. Tax and Estate Planning

Assist clients with tax and estate planning to maximize their financial security.

- Collaborate with tax accountants and attorneys to optimize clients’ tax strategies.

- Develop estate plans that ensure the orderly distribution of assets and minimize estate taxes.

- Advise clients on trust and other estate planning tools.

4. Risk Management

Identify and manage risks that may affect clients’ financial well-being.

- Assess clients’ risk tolerance and develop strategies to mitigate potential financial losses.

- Recommend insurance policies and other risk management tools.

- Monitor changes in the economic and regulatory landscape and provide timely advice to clients.

Interview Tips

To ace the interview for a Personal Financial Planner position, it’s essential to prepare effectively. Here are some key tips:

1. Research the Company and Industry

Research the company you’re applying to and the financial planning industry in general. Understand their business model, services offered, and industry trends. Candidates who demonstrate knowledge of the company and industry show genuine interest and enthusiasm.

- Visit the company’s website and social media profiles.

- Read industry news and articles to stay up-to-date on key developments.

2. Practice Your Financial Planning Knowledge

Personal financial planning is a complex field. Ensure you understand fundamental concepts and can articulate them clearly. Practice explaining financial planning principles and strategies to a non-expert audience.

- Review key financial planning concepts such as risk tolerance, asset allocation, and investment diversification.

- Develop scenarios and practice providing financial planning advice based on different client profiles.

3. Prepare for Behavioral Questions

Interviewers often ask behavioral interview questions to assess candidates’ soft skills and problem-solving abilities. Prepare for questions about how you handled specific work situations, such as managing difficult clients or resolving conflicts.

- Use the STAR method to structure your answers: Situation, Task, Action, Result.

- Focus on highlighting your problem-solving skills, communication abilities, and ability to work effectively with clients.

4. Prepare Questions for the Interviewer

Preparing questions for the interviewer demonstrates your engagement and interest in the role. Ask thoughtful questions about the company, the team, and the specific responsibilities of the Personal Financial Planner position.

- Ask about the company’s approach to financial planning.

- Inquire about the team’s dynamics and opportunities for professional development.

- Seek clarification on the specific responsibilities and deliverables of the role.

5. Dress Professionally and Show Confidence

First impressions matter. Dress professionally and arrive on time for the interview. Maintain a confident and positive demeanor throughout the interaction.

- Choose clothing that is appropriate for a business setting.

- Make eye contact, speak clearly, and convey enthusiasm for the role.

- Remember that confidence comes from preparation, so make sure you have thoroughly prepared for the interview.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Personal Financial Planner interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!