Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Account Underwriter interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Account Underwriter so you can tailor your answers to impress potential employers.

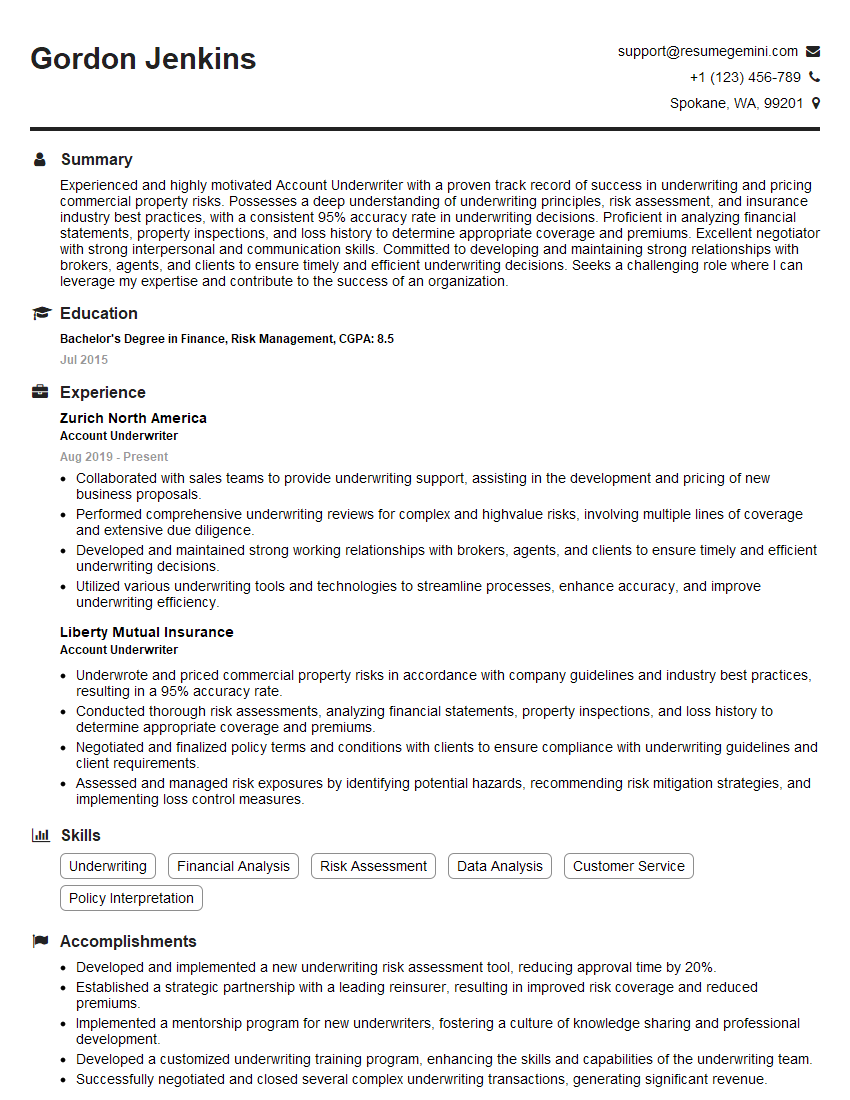

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Account Underwriter

1. Explain the process of underwriting an insurance policy for a commercial property.

- Gather information about the property, including its location, size, construction, and use.

- Assess the risks associated with the property, including the likelihood of fire, theft, or other damage.

- Calculate the premium for the policy, which is based on the risks involved and the coverage provided.

- Review and approve the policy, making sure that it meets the needs of the insured.

2. What are the key factors that you consider when evaluating a risk?

Risk assessment

- The nature of the business

- The location of the business

- The financial stability of the business

- The safety record of the business

Underwriting guidelines

- The company’s underwriting guidelines

- The industry’s best practices

- The laws and regulations governing insurance

3. How do you determine the appropriate premium for an insurance policy?

- The risk involved

- The coverage provided

- The deductible

- The policy limits

- The insured’s claims history

4. What are the different types of coverage that can be included in a commercial property insurance policy?

- Building coverage

- Contents coverage

- Business interruption coverage

- Extra expense coverage

- Liability coverage

5. How do you handle claims under a commercial property insurance policy?

- Receive and review the claim

- Investigate the claim

- Negotiate a settlement with the insured

- Pay the claim

6. What are the ethical considerations that you must be aware of when underwriting insurance policies?

- The duty to act in good faith

- The duty to avoid conflicts of interest

- The duty to disclose material information

- The duty to treat all insureds fairly

7. What are the challenges that you face in your role as an account underwriter?

- The need to balance the need for profitability with the need to provide affordable coverage to insureds

- The need to keep up with changes in the insurance industry

- The need to deal with difficult customers

- The need to make decisions under pressure

8. What are your strengths and weaknesses as an account underwriter?

strengths

- Strong analytical skills

- Excellent communication skills

- Ability to work independently and as part of a team

- Knowledge of the insurance industry

weaknesses

- Lack of experience in underwriting certain types of risks

- Difficulty in dealing with difficult customers

9. Why are you interested in this job?

- I am interested in this job because it offers the opportunity to use my skills and experience to help businesses protect themselves from financial losses.

- I am also interested in the insurance industry and believe that I can make a valuable contribution to your company.

10. What are your salary expectations?

- My salary expectations are commensurate with my experience and qualifications.

- I am open to discussing a compensation package that includes a base salary, bonus, and benefits.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Account Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Account Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Account Underwriter is primarily responsible for assessing and mitigating risk for insurance policies.

1. Risk Assessment and Analysis

In-depth examination of applications, financial statements, and other relevant documents to evaluate the risk associated with potential policyholders.

- Evaluate financial stability and creditworthiness

- Assess operational risks and loss history

2. Premium Determination and Policy Issuance

Calculate and establish appropriate premiums based on the assessed risk and industry benchmarks.

- Determine coverage limits and terms

- Issue policies and manage renewals

3. Underwriting Guidelines and Compliance

Adhere to established underwriting guidelines and industry regulations to ensure the integrity of the insurance process.

- Stay updated on regulatory changes

- Follow internal policies and procedures

4. Client Relationship Management

Maintain positive relationships with insurance brokers and agents to facilitate effective underwriting processes.

- Provide timely responses to inquiries

- Offer guidance and support to agents

Interview Tips

Succeeding in an Account Underwriter interview requires a thorough preparation strategy that showcases your technical skills, industry knowledge, and professionalism.

1. Research the Company and Position

Familiarize yourself with the company’s insurance portfolio, underwriting philosophy, and the specific requirements of the position.

- Visit the company website

- Read industry publications

2. Practice Answering Common Interview Questions

Review common interview questions related to underwriting, risk assessment, and insurance regulations. Prepare clear and concise responses that demonstrate your expertise.

- Explain your approach to assessing financial risk

- Describe your experience with underwriting commercial property policies

3. Highlight Your Technical Proficiency

Emphasize your proficiency in underwriting software, industry-specific databases, and financial analysis tools.

- Provide examples of how you have used technology to improve underwriting efficiency

- Explain your understanding of insurance rating models

4. Showcase Your Analytical and Problem-Solving Abilities

Provide examples of situations where you have successfully analyzed data, identified risks, and made sound underwriting decisions.

- Describe a case where you uncovered a potential fraud scenario

- Explain how you have managed underwriting risks in a challenging economic environment

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Account Underwriter interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!