Are you gearing up for an interview for a Automobile and Property Underwriter position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Automobile and Property Underwriter and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

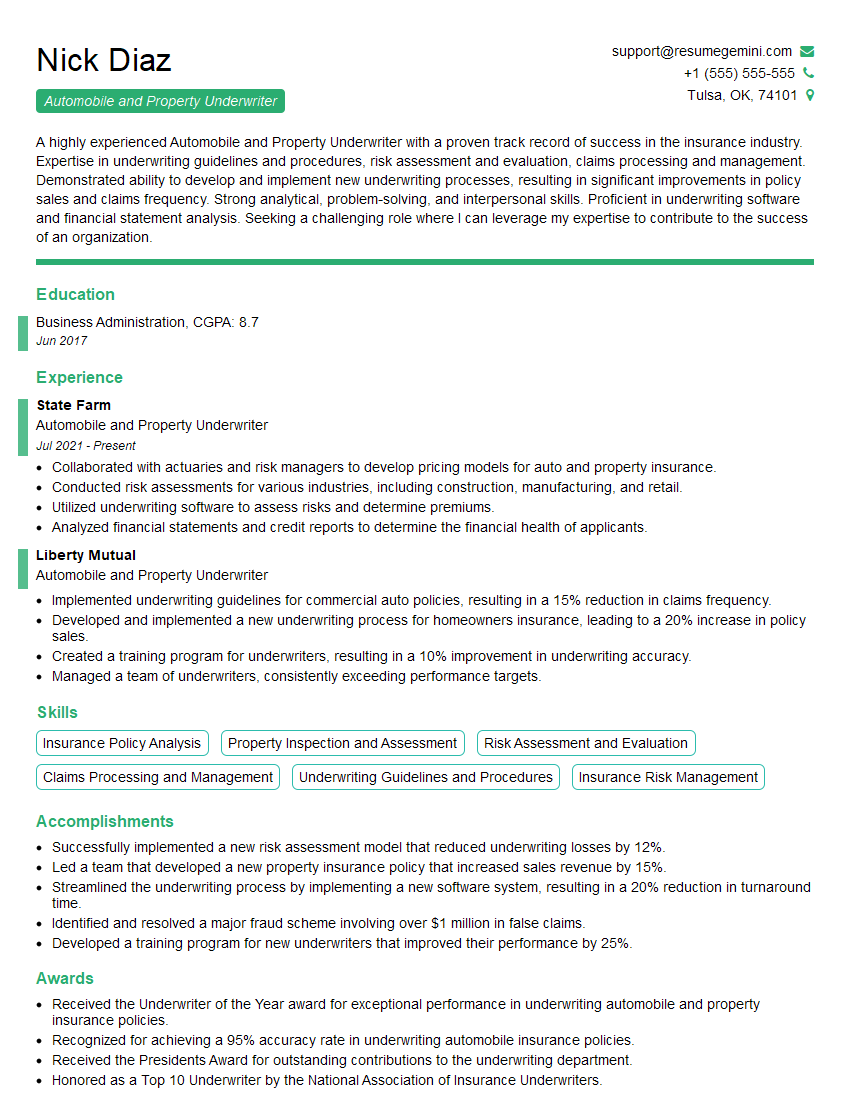

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Automobile and Property Underwriter

1. Explain the key factors you consider when underwriting an automobile policy?

- Driving history and claims experience

- Vehicle make, model, and year

- Usage and mileage

- Age, location, and marital status of the driver

- Coverage limits and deductibles

2. Describe the process of underwriting a property insurance policy.

Risk assessment

- Inspect the property

- Review construction and materials

- Assess potential hazards and risks

Coverage analysis

- Determine appropriate coverage limits

- Identify exclusions and limitations

- Recommend additional coverages

Premium calculation

- Use rating factors and data

- Apply underwriting judgment

- Set a premium that reflects the risk

3. How do you handle high-risk automobile or property underwriting cases?

- Request additional information from the applicant

- Consult with experts or actuaries

- Impose higher premiums or deductibles

- Offer alternative coverage options

- Decline coverage in extreme cases

4. Discuss the importance of reinsurance in automobile and property underwriting.

- Transfers risk to spread exposure

- Provides financial protection against catastrophic losses

- Enhances underwriting capacity

- Helps manage capital requirements

- Allows insurers to offer more competitive rates

5. What are the emerging trends in automobile and property underwriting?

- Telematics and usage-based insurance

- Artificial intelligence and predictive analytics

- Personalized risk assessment and pricing

- Cyber security and data privacy

- Climate change and natural disasters

6. How do you stay updated on changes in underwriting guidelines and regulations?

- Attend industry conferences and seminars

- Read trade publications and insurance journals

- Participate in online forums and discussions

- Work closely with regulatory agencies

- Continuously seek professional development

7. Describe your experience in using underwriting software and technology.

- Proficient in underwriting software (e.g., Verisk ISO, LexisNexis)

- Familiar with data analytics and reporting tools

- Utilize technology to streamline underwriting processes

- Able to interpret and apply complex data

- Open to learning new technologies

8. How do you build strong relationships with agents and brokers?

- Provide clear communication and guidance

- Offer timely and responsive support

- Share knowledge and market insights

- Attend agent and broker events

- Be a trusted resource for their clients

9. What are your strengths and weaknesses as an underwriter?

Strengths

- Strong technical underwriting skills

- Excellent judgment and decision-making

- Detail-oriented and analytical

- Good communication and interpersonal skills

- Ability to handle high-volume workloads

Weaknesses

- Limited experience in certain specialized underwriting areas

- Could improve time management skills in peak periods

10. Why are you interested in this particular underwriting role?

- Excited about the opportunity to contribute to the team

- Impressed by the company’s reputation and values

- Interested in the specific focus on automobile and property underwriting

- Believe my skills and experience align well with the role requirements

- Eager to learn and grow in a supportive environment

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Automobile and Property Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Automobile and Property Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Automobile and Property Underwriter is responsible for assessing the risk associated with issuing insurance policies for vehicles and personal and commercial properties. They determine the premium that is charged and ensure that the policyholder meets the terms and conditions of the policy.

1. Risk Assessment

Evaluate applications for insurance coverage to determine the risk of loss or damage.

- Review insurance applications and supporting documentation.

- Inspect properties and vehicles to assess potential risks.

2. Policy Issuance

Determine the appropriate coverage limits and premiums for insurance policies.

- Calculate insurance premiums based on risk assessment.

- Draft and issue insurance policies.

3. Policy Administration

Maintain and manage insurance policies throughout their term.

- Process policy changes and endorsements.

- Handle policy cancellations and refunds.

4. Claims Investigation

Investigate and assess claims related to insured vehicles and properties.

- Inspect damaged vehicles or properties to determine the extent of loss.

- Determine coverage and liability under insurance policies.

Interview Tips

Preparing for an interview for an Automobile and Property Underwriter position requires careful planning and execution. Here are some tips to help you ace your interview:

1. Research the Company and Position

Familiarize yourself with the company’s website, annual reports, and industry news to gain insights into their business practices and the specific requirements of the position.

- Identify the company’s goals, values, and underwriting criteria.

- Understand the specific responsibilities and expectations of the Automobile and Property Underwriter role.

2. Highlight Your Skills and Experience

Showcase your relevant skills and experience in underwriting, risk assessment, and claims handling.

- Quantify your accomplishments using specific metrics, such as percentage of claims settled within a specific timeframe.

- Provide examples of how you have successfully evaluated risk, priced policies, and resolved complex claims.

3. Demonstrate Your Knowledge of Industry Standards

Expertise in insurance principles and industry regulations is essential for this role. Be prepared to discuss your understanding of underwriting guidelines, actuarial principles, and regulatory compliance.

- Mention any certifications, such as the Associate in Insurance Services (AIS) or Chartered Property Casualty Underwriter (CPCU), that demonstrate your knowledge and commitment to the field.

- Show that you are up-to-date on the latest trends and developments in the insurance industry.

4. Practice Your Communication Skills

Underwriters need to be able to communicate effectively with policyholders, agents, and other stakeholders. Practice your communication skills in advance of the interview.

- Prepare clear and concise answers to common interview questions.

- Demonstrate active listening skills and the ability to ask thoughtful questions.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Automobile and Property Underwriter, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Automobile and Property Underwriter positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.