Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Bond Underwriter position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

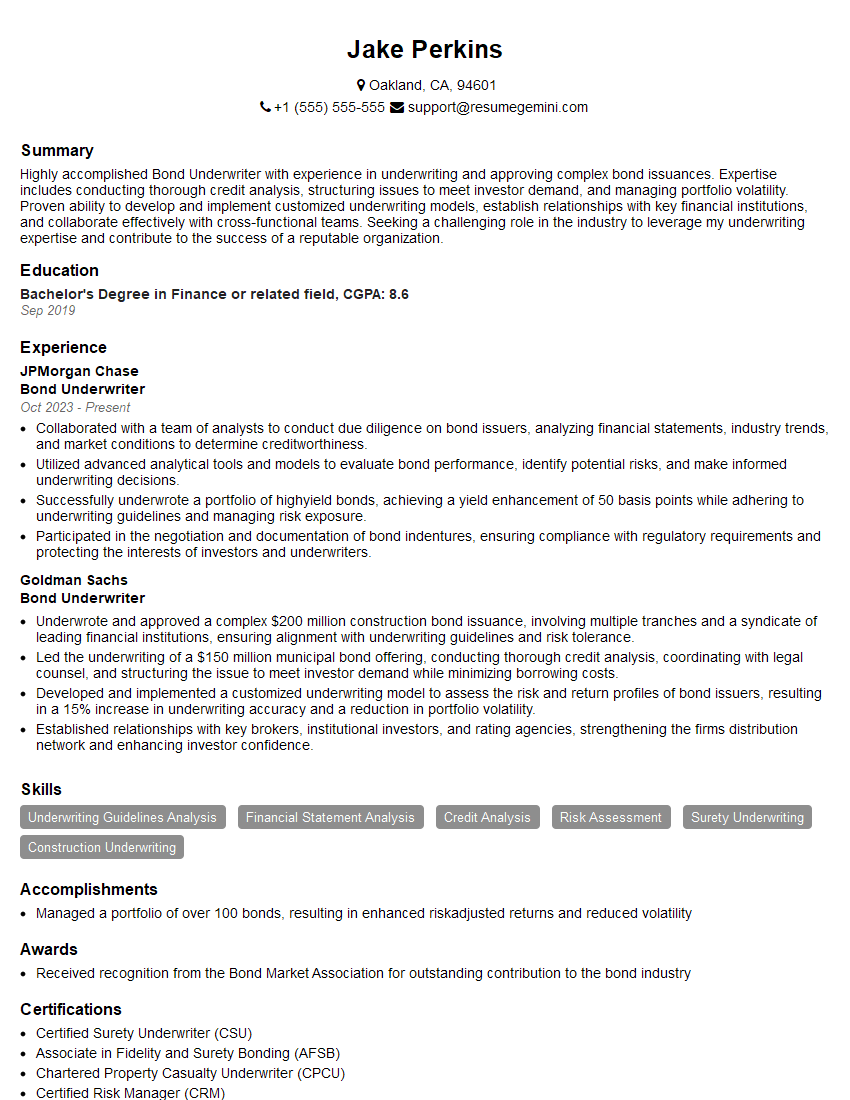

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bond Underwriter

1. Describe the process of bond underwriting from start to finish.

- Review the prospectus and other offering documents.

- Conduct due diligence on the issuer, including financial analysis, legal review, and site visits.

- Negotiate the terms of the bond issue, including the interest rate, maturity date, and other features.

- Structure the bond issue to meet the needs of the issuer and investors.

- Sell the bonds to investors.

- Monitor the bond issue after it is sold to ensure that the issuer is meeting its obligations.

2. What are the key factors that you consider when evaluating a bond issue?

Financial factors

- Issuer’s creditworthiness

- Issuer’s financial performance

- Issuer’s debt-to-equity ratio

- Issuer’s interest coverage ratio

- Issuer’s cash flow

Legal factors

- Bond indenture

- Trust agreement

- Offering document

- Applicable laws and regulations

3. What are the different types of bond issues?

- Investment-grade bonds

- High-yield bonds

- Municipal bonds

- Corporate bonds

- Government bonds

- Convertible bonds

- Zero-coupon bonds

4. What are the risks associated with bond underwriting?

- Default risk

- Interest rate risk

- Refinancing risk

- Liquidity risk

- Regulatory risk

5. What are the ethical considerations that bond underwriters must be aware of?

- Conflicts of interest

- Insider trading

- Market manipulation

- Unauthorized disclosure of information

- Bribery and corruption

6. What are the trends that you are seeing in the bond market?

- Increasing demand for fixed income

- Declining issuance of new bonds

- Rising interest rates

- Growing popularity of ESG bonds

- Increasing use of technology in bond underwriting

7. What are the challenges that bond underwriters face?

- Regulatory compliance

- Volatility in the bond market

- Competition from other underwriters

- Finding qualified staff

- Developing new products and services

8. What are your strengths and weaknesses as a bond underwriter?

Strengths

- Strong knowledge of the bond market

- Excellent analytical skills

- Strong negotiation skills

- Ability to work independently and as part of a team

- Commitment to ethical behavior

Weaknesses

- Limited experience in some areas of bond underwriting

- Sometimes I can be too detail-oriented

- I am still learning how to manage my time effectively

9. Why are you interested in this position?

I am interested in this position because I am passionate about the bond market and I believe that I have the skills and experience to be a successful bond underwriter. I am eager to learn more about the bond underwriting process and to contribute to the success of your firm.10. What are your salary expectations?

My salary expectations are in line with the market rate for bond underwriters with my level of experience. I am open to discussing a compensation package that includes base salary, bonus, and benefits.Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bond Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bond Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Bond underwriters play a pivotal role in the financial markets, acting as intermediaries between bond issuers and investors. They perform crucial tasks that contribute to the successful execution of bond offerings.

1. Evaluate Creditworthiness

Underwriters meticulously assess the financial health and creditworthiness of potential bond issuers. This involves analyzing financial statements, historical performance, and industry trends to determine the issuer’s ability to repay the principal and interest.

- Conduct in-depth financial analysis

- Assess collateral and security arrangements

2. Structure Bond Offerings

Underwriters work closely with issuers to design bond offerings that meet the specific requirements of both the issuer and investors. They determine the terms of the bond, including maturity date, interest rate, and security features, to ensure that the offering is attractive to potential investors.

- Set interest rates and redemption schedules

- Determine the offering price and quantity

3. Market and Sell Bonds

Underwriters are responsible for marketing and selling the bond offerings to institutional investors and individual buyers. They promote the bonds’ features and benefits to potential investors through presentations, conferences, and roadshows.

- Manage investor relations

- Negotiate with lead managers and syndicates

4. Manage Risk

Underwriters play a crucial role in managing risks associated with bond offerings. They conduct stress tests and scenario analyses to assess potential losses and develop mitigation strategies. They also evaluate the potential impact of market volatility and macroeconomic events on the bonds’ performance.

- Monitor market conditions and industry developments

- Develop hedging strategies to mitigate risks

Interview Tips

Preparing for a bond underwriter interview requires a combination of technical expertise, industry knowledge, and effective communication skills. Here are some tips to help you ace the interview:

1. Technical Proficiency

Ensure a solid understanding of bond underwriting principles, including financial analysis, credit rating methodologies, and bond structuring. Familiarize yourself with industry terminology and current trends.

- Study key financial ratios and their implications

- Understand different bond types and their characteristics

2. Industry Knowledge

Stay updated with the latest news and developments in the financial markets and bond industry. Follow industry publications and attend conferences to demonstrate your knowledge and enthusiasm.

- Follow bond market indices and ratings

- Stay informed about regulatory changes and economic events

3. Communication and Presentation Skills

Bond underwriters must effectively communicate with issuers, investors, and other stakeholders. Practice delivering clear and concise presentations. Be prepared to discuss complex financial concepts in a manner that is easily understandable.

- Prepare a mock presentation on a recent bond offering

- Practice answering interview questions confidently and professionally

4. Behavioral Interview Questions

Interviewers often use behavioral interview questions to assess your problem-solving skills, teamwork abilities, and work ethic. Prepare thoughtful examples that demonstrate your competence in these areas.

- Highlight your experience in financial modeling and analysis

- Provide examples of successful teamwork on previous projects

5. Research the Firm

Thoroughly research the financial institution you are applying to. Understand their business model, recent transactions, and industry reputation. This demonstrates your interest in the company and its values.

- Visit the company’s website and read their annual reports

- Check LinkedIn to connect with employees and learn about the company culture

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Bond Underwriter, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Bond Underwriter positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.