Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Insurance Analyst position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

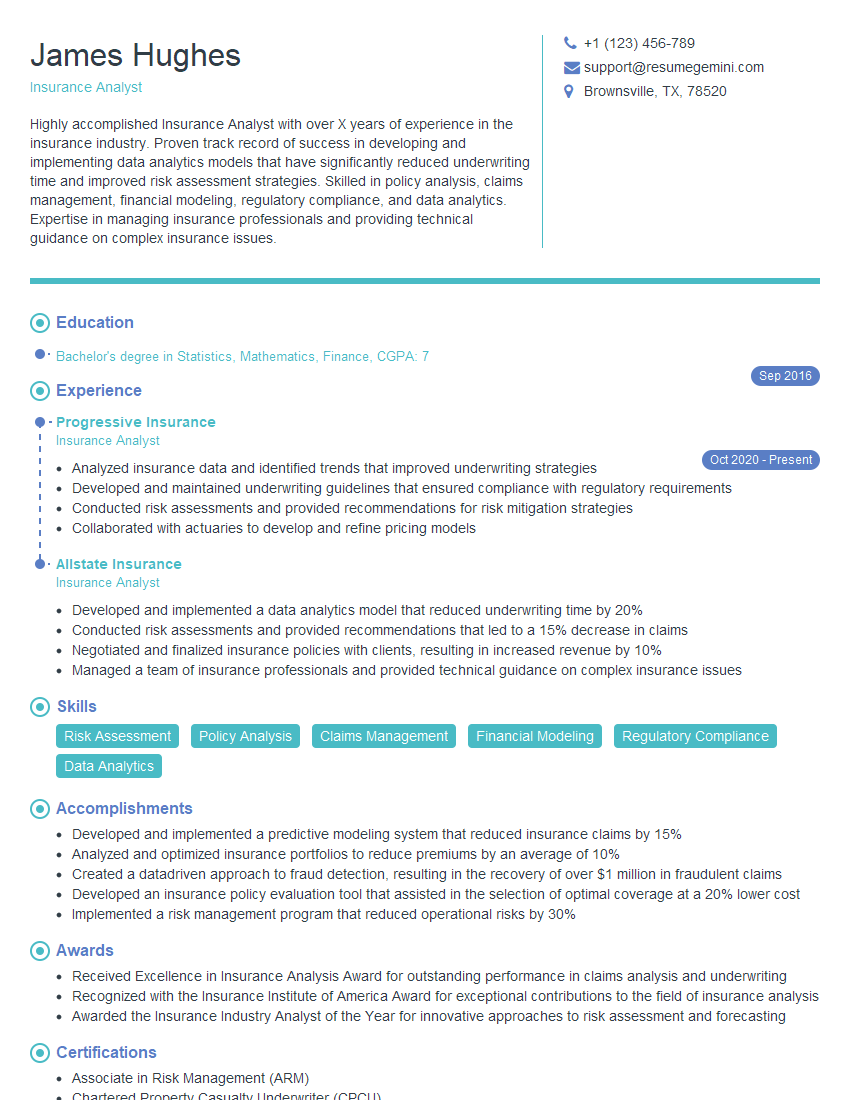

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Analyst

1. What are the key financial ratios used to evaluate the performance of an insurance company?

To evaluate an insurance company’s performance, key financial ratios must be considered. Some of the most commonly used ones are:

- Underwriting ratio:

- Combined ratio:

- Return on equity (ROE):

- Solvency ratio:

- Loss ratio:

2. What are the different types of insurance products that an insurance company can offer?

Life Insurance Products:

- Term life insurance

- Whole life insurance

- Universal life insurance

- Variable life insurance

Health Insurance Products:

- Health maintenance organizations (HMOs)

- Preferred provider organizations (PPOs)

- Point-of-service (POS) plans

- Fee-for-service plans

3. What are the different factors that can affect the insurance premium?

Multiple factors can influence the determination of insurance premiums, including:

- Age of the insured

- Health of the insured

- Occupation of the insured

- Amount of coverage

- Type of insurance

4. What are the different types of insurance claims that can be filed?

Insurance claims can be categorized into several types:

- First-party claims:

- Third-party claims:

- Subrogation claims:

- Salvage claims:

- Contribution claims:

5. What are the different steps involved in the insurance claims process?

The insurance claims process generally involves the following steps:

- Reporting the claim to the insurance company

- Providing documentation to support the claim

- Insurance company investigation

- Settlement of the claim

6. What are the different types of insurance fraud?

Insurance fraud can manifest in various forms:

- Applicant fraud

- Policyholder fraud

- Claim fraud

- Agent fraud

- Organized fraud

7. What are the different methods used to detect and prevent insurance fraud?

Insurance companies employ a range of techniques to identify and deter fraudulent activities, including:

- Data analytics

- Predictive modeling

- Special investigation units

- Fraud hotlines

8. What are the different types of insurance regulations?

The insurance industry is subject to various regulations, including:

- State insurance regulations

- Federal insurance regulations

- International insurance regulations

9. What are the different types of insurance markets?

Insurance markets can be categorized into several types:

- Primary insurance market

- Reinsurance market

- Surplus lines market

- Lloyd’s of London market

10. What are the different types of insurance careers?

The insurance industry offers a diverse range of career opportunities, including:

- Insurance underwriters

- Insurance agents and brokers

- Insurance claims adjusters

- Insurance actuaries

- Insurance lawyers

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Analyst.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Analyst‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of an Insurance Analyst

An Insurance Analyst plays a crucial role in evaluating insurance risks, underwriting policies, and assisting in claims management. Their responsibilities encompass a wide range of tasks that contribute to the overall success and profitability of insurance companies.

1. Risk Assessment and Evaluation

Thoroughly reviewing applications and assessing the risk associated with potential insurance policyholders.

- Analyzing financial statements, credit reports, and other relevant documents to determine the financial stability and risk profile of applicants.

- Inspecting properties, reviewing medical records, and consulting with experts to assess potential risks and hazards.

2. Underwriting Policies

Determining the terms, conditions, and coverage limits of insurance policies based on risk assessments.

- Setting premiums, deductibles, and policy limits that appropriately balance risk and profitability.

- Drafting policy language that clearly outlines the coverage and exclusions of the policy.

3. Claims Management Assistance

Providing support to claims adjusters in evaluating and settling insurance claims.

- Reviewing claim documentation, investigating incidents, and assessing the validity of claims.

- Negotiating settlements and recommending coverage decisions based on policy terms and applicable laws.

4. Data Analysis and Reporting

Analyzing insurance data to identify trends, evaluate performance, and develop strategies.

- Using statistical models and data mining techniques to identify patterns and correlations in insurance risks and claims.

- Preparing reports and presentations that communicate insights and recommendations to stakeholders.

5. Regulatory Compliance

Ensuring that insurance operations are in compliance with all applicable laws and regulations.

- Staying abreast of changes in insurance regulations and industry best practices.

- Developing and implementing compliance programs to mitigate legal and reputational risks.

Interview Preparation Tips for Insurance Analyst Interviews

To excel in an Insurance Analyst interview, it’s essential to demonstrate your analytical skills, industry knowledge, and commitment to delivering quality results.

1. Research the Company and Position

Thoroughly study the insurance company and the specific role you’re applying for.

- Visit the company’s website to learn about their products, services, and financial performance.

- Review the job description carefully to identify the key responsibilities and qualifications required.

2. Quantify Your Accomplishments

When describing your experiences, use specific numbers and metrics to quantify your accomplishments.

- For example, instead of saying “I analyzed insurance risks,” say “I analyzed over 1,000 insurance applications, resulting in a 15% reduction in underwriting losses.”

- Highlight the impact of your work on the company’s performance and profitability.

3. Practice Your Analytical Skills

Interviewers may ask you to solve analytical problems or interpret data during the interview.

- Practice solving hypothetical insurance risk assessment scenarios.

- Demonstrate your ability to analyze data and draw insights using statistical tools or data visualization techniques.

4. Prepare Questions for the Interviewer

Asking thoughtful questions shows that you’re engaged and interested in the role.

- Ask about the company’s growth plans and innovation initiatives.

- Inquire about the team structure and opportunities for professional development.

5. Dress Professionally and Arrive on Time

First impressions matter. Make sure to dress appropriately for the interview and arrive on time.

- Choose conservative business attire in neutral colors.

- Plan your route in advance to avoid any delays.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Insurance Analyst interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!