Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Insurance Writer position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

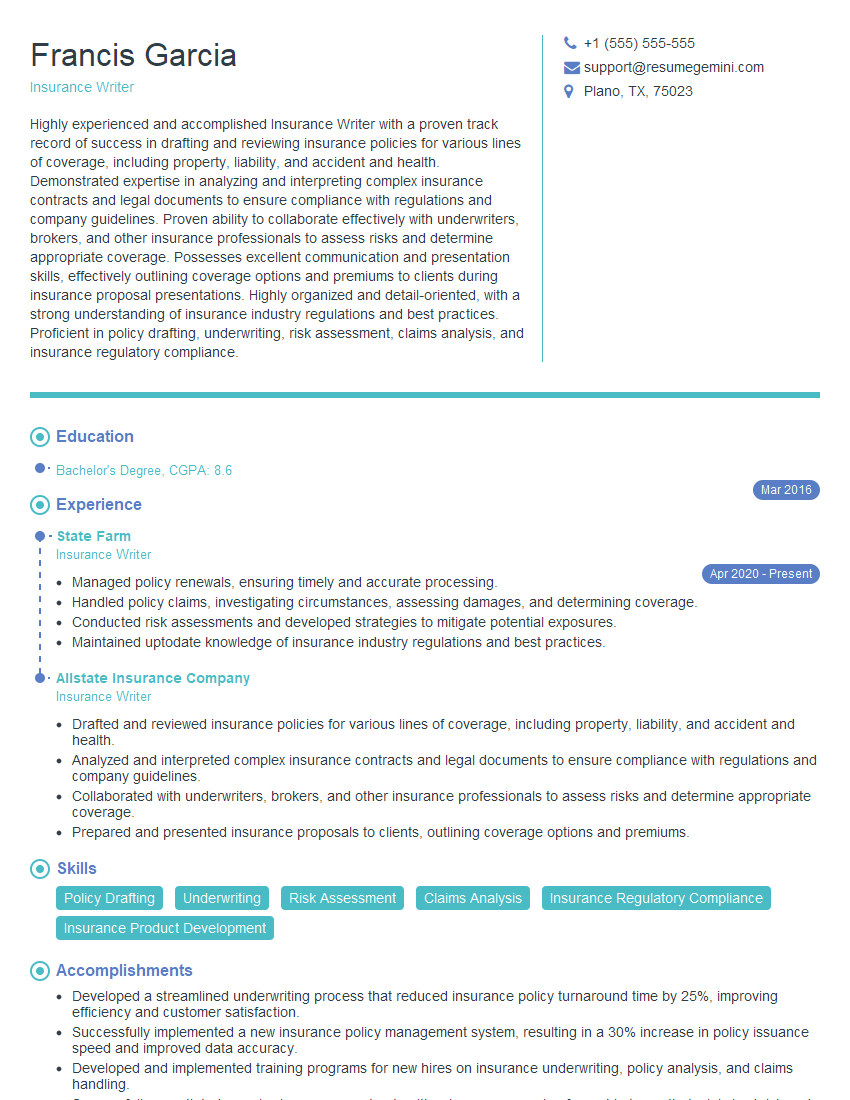

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Insurance Writer

1. What are the key elements of an insurance policy?

- Policyholder

- Insured person/property

- Coverage

- Policy period

- Premium

2. Explain the difference between a deductible and a co-payment.

Deductible

- A fixed amount that the policyholder must pay before the insurance coverage begins

- Usually applies to major medical expenses

Co-payment

- A fixed amount that the policyholder must pay for each covered service

- Usually applies to smaller medical expenses such as doctor’s visits or prescriptions

3. What are the different types of insurance coverage?

- Health insurance

- Life insurance

- Property insurance

- Liability insurance

- Auto insurance

4. What are the key factors that affect the cost of insurance?

- Age

- Gender

- Health history

- Occupation

- Location

- Type of coverage

5. What are the different underwriting processes used by insurance companies?

- Medical underwriting

- Financial underwriting

- Risk underwriting

6. What are the different types of insurance fraud?

- Policyholder fraud

- Insurer fraud

- Agent fraud

7. What are the different methods used to prevent insurance fraud?

- Educating policyholders

- Performing background checks on agents

- Using data analytics to identify suspicious claims

8. What are the different types of insurance claim investigations?

- First-party claims

- Third-party claims

- Subrogation claims

9. What are the different methods used to settle insurance claims?

- Negotiation

- Arbitration

- Litigation

10. What are the different types of insurance regulation?

- State regulation

- Federal regulation

- International regulation

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Insurance Writer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Insurance Writer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Insurance Writers play a crucial role in the insurance industry, responsible for developing and drafting insurance policies, contracts, and other legal documents. To succeed in this role, a strong understanding of insurance principles, laws, and regulations is essential. Additionally, proficiency in writing clear, concise, and legally binding documents is paramount.

Here are some of the key job responsibilities:

1. Policy Drafting and Revision

Insurance Writers are responsible for drafting new insurance policies and revising existing ones. This involves understanding the specific risks and coverage requirements of different types of insurance, such as property, liability, and life insurance.

- Collaborate with underwriters, actuaries, and legal counsel to determine the terms and conditions of policies.

- Draft policy language that is clear, concise, and legally compliant.

- Review and revise existing policies to ensure they are up-to-date with regulatory changes and industry best practices.

2. Policy Analysis and Interpretation

Insurance Writers analyze and interpret insurance policies to determine their coverage, exclusions, and limitations. They also provide guidance to policyholders and other stakeholders on the meaning and application of policy language.

- Review claims and other documentation to determine coverage under a policy.

- Provide written or verbal explanations of policy coverage to policyholders and other interested parties.

- Identify and resolve ambiguities or inconsistencies in policy language.

3. Regulatory Compliance

Insurance Writers must ensure that insurance policies and other documents comply with applicable laws and regulations. They stay abreast of regulatory changes and update policies accordingly.

- Monitor changes in insurance laws and regulations.

- Ensure that insurance policies comply with regulatory requirements.

- Work with legal counsel to address regulatory compliance issues.

4. Communication and Collaboration

Insurance Writers work closely with underwriters, actuaries, legal counsel, and other stakeholders to develop and implement insurance policies. They also communicate with policyholders and other interested parties to provide guidance and support.

- Communicate effectively with a variety of stakeholders, including policyholders, underwriters, and legal counsel.

- Provide written and verbal presentations on insurance policies and related matters.

- Participate in industry committees and working groups.

Interview Tips

Preparing for an Insurance Writer interview requires a thorough understanding of the role and the industry. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Research the insurance company you are applying to, as well as the insurance industry in general. This will give you a good understanding of the company’s products, services, and culture, as well as the industry trends and challenges.

- Visit the company’s website and social media pages.

- Read industry publications and articles.

- Attend industry events and webinars.

2. Practice Your Writing Skills

As an Insurance Writer, writing is your primary tool. Practice writing clear, concise, and legally binding documents. This could involve drafting sample policy language or analyzing existing policies.

- Take a writing course or workshop.

- Join a writing group or critique circle.

- Volunteer to write for a non-profit organization or industry publication.

3. Highlight Your Relevant Experience

In your resume and interview, be sure to highlight your relevant experience and skills. This could include experience in drafting legal documents, working in the insurance industry, or any other experience that demonstrates your writing and analytical abilities.

- Quantify your accomplishments whenever possible.

- Use specific examples to illustrate your skills and experience.

- Tailor your resume and cover letter to the specific job you are applying for.

4. Be Prepared to Discuss Your Knowledge of Insurance

Interviewers will want to know that you have a solid understanding of insurance principles and practices. Be prepared to discuss your knowledge of different types of insurance, insurance law, and regulatory compliance.

- Study the basics of insurance law and regulations.

- Read articles and books on insurance topics.

- Take an insurance course or certification program.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Insurance Writer, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Insurance Writer positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.