Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Property Underwriter position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

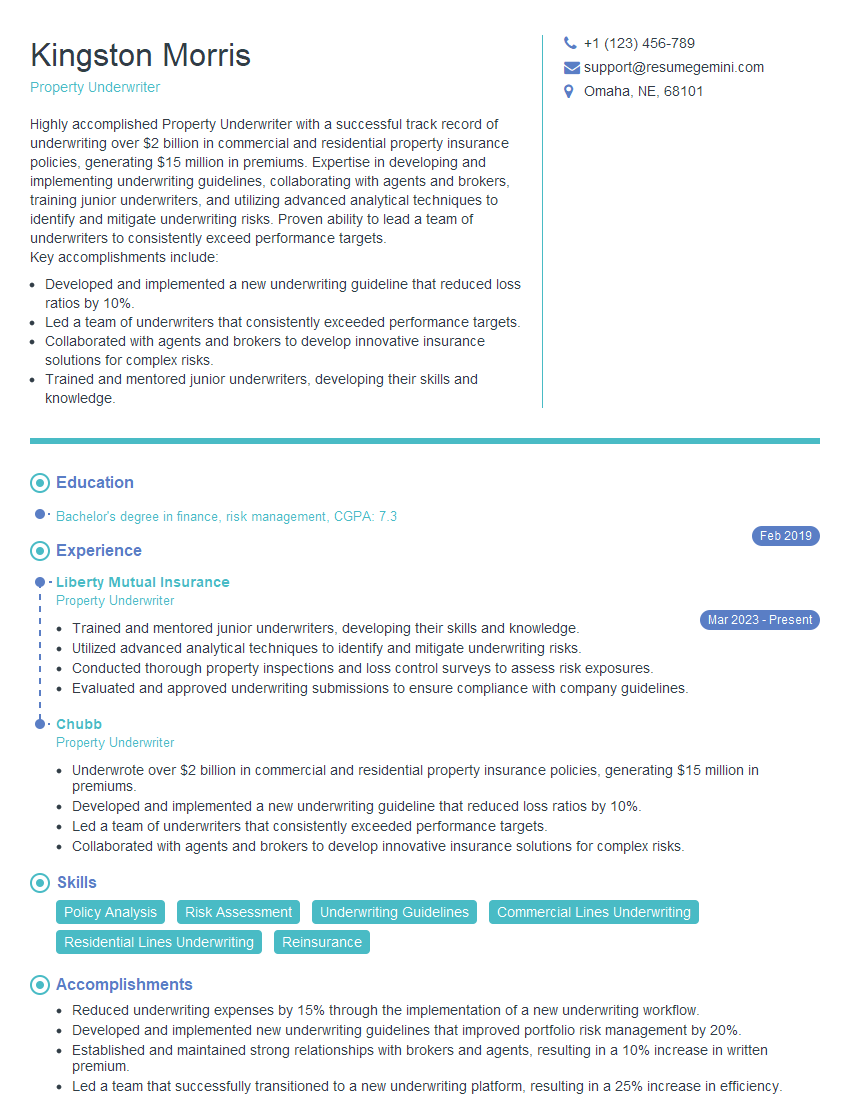

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Property Underwriter

1. Describe the risk factors you consider when underwriting a commercial property insurance policy?

When underwriting a commercial property insurance policy, I consider the following risk factors:

- Property characteristics: age, construction type, location, occupancy, and size of the property.

- Hazards: natural disasters (e.g., earthquakes, floods, hurricanes), fire, theft, and vandalism.

- Management: experience and financial stability of the property owner or manager.

- Loss history: previous claims filed on the property or similar properties in the area.

- Insurance coverage: adequacy of the proposed insurance limits and deductibles.

2. How do you determine the appropriate insurance premium for a commercial property insurance policy?

Factors considered

- Risk factors: As discussed in the previous answer.

- Industry data: Historical loss experience for similar properties within the industry.

- Actuarial analysis: Statistical models to predict the likelihood and severity of losses.

Formula used

- Premium = Base rate * Experience modifier * Schedule rating factors

3. Explain the underwriting process for a large commercial property risk.

- Application review: Gather information about the property, hazards, management, and insurance coverage.

- Inspection: Conduct a physical inspection of the property to verify information and identify potential hazards.

- Risk assessment: Analyze the risk factors and determine the likelihood and severity of potential losses.

- Premium calculation: Use the underwriting factors and data to calculate the appropriate insurance premium.

- Policy issuance: Issue the insurance policy if the risk is acceptable and the premium is paid.

4. What are the key underwriting considerations for a residential property insurance policy?

- Property characteristics: Age, construction type, location, occupancy, and size of the property.

- Hazards: Natural disasters, fire, theft, and vandalism.

- Claims history: Previous claims filed on the property or similar properties in the area.

- Credit history: Financial stability of the homeowner.

- Insurance coverage: Adequacy of the proposed insurance limits and deductibles.

5. Describe the role of reinsurance in commercial property insurance.

- Risk transfer: Reinsurance allows insurance companies to transfer a portion of their risk to other insurance companies, reducing their potential financial exposure.

- Capacity expansion: Reinsurance enables insurance companies to offer higher insurance limits than they could otherwise provide on their own.

- Claims stabilization: Reinsurance helps insurance companies spread the impact of large claims across multiple insurers, reducing volatility in financial results.

6. What are the common challenges faced by property underwriters?

- Data availability: Obtaining accurate and up-to-date information about properties and hazards.

- Model limitations: Actuarial models may not always fully capture the risks associated with certain properties.

- Competition: The competitive nature of the insurance industry can pressure underwriters to accept risks they may not otherwise consider.

- Fraud: Dealing with potential fraudulent insurance claims.

7. How do you stay up-to-date with industry trends and best practices in property underwriting?

- Continuing education: Participating in industry conferences, workshops, and online courses.

- Professional organizations: Engaging with professional organizations like the Insurance Information Institute and the American Institute for CPCU.

- Publications and research: Reading industry publications and conducting research to stay abreast of emerging trends and best practices.

- Networking: Connecting with other property underwriters and insurance professionals.

8. Describe a situation where you had to make a difficult underwriting decision.

I recently faced a challenging decision when reviewing a commercial property insurance application for a manufacturing facility. The property was located in an area prone to earthquakes and had a history of minor claims due to equipment malfunctions. However, the applicant had implemented significant risk mitigation measures and had a strong financial track record. After careful consideration, I decided to offer coverage with a higher deductible than originally requested, as I believed the risk was acceptable with the implemented safeguards.

9. What are your thoughts on the use of technology in property underwriting?

- Data analysis: Technology can help underwriters analyze large amounts of data to identify patterns and trends in risk exposure.

- Remote inspections: Virtual reality and drone technology can enable underwriters to conduct property inspections remotely, improving efficiency and reducing travel costs.

- Automated underwriting: Machine learning algorithms can automate certain aspects of the underwriting process, such as risk assessment and policy issuance.

10. Why are you interested in working as a property underwriter for our company?

I am drawn to your company’s reputation for underwriting excellence and its commitment to providing superior customer service. I believe my skills and experience in property underwriting would align well with your team, and I am eager to contribute to your success. I am confident in my ability to assess risks accurately, make sound underwriting decisions, and build strong relationships with clients and brokers.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Property Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Property Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A property underwriter is accountable for evaluating and assessing the risk of a property before issuing an insurance policy. They review applications, inspect properties, and analyze financial data to determine the likelihood of a claim. Based on their assessment, they determine the appropriate policy terms, limits, and premiums.

1. Risk Assessment

Underwriters must have a deep understanding of the factors that can affect the risk of a property, including its location, construction, and use. They need to be able to identify and assess potential hazards, such as natural disasters, crime, and vandalism.

- Review property applications and inspection reports to assess the risk of a property.

- Conduct site visits to inspect properties and identify potential hazards.

2. Policy Issuance

Once the underwriter has assessed the risk of a property, they will determine the appropriate policy terms, limits, and premiums. They will also work with the policyholder to ensure that they understand the terms of the policy and that it meets their needs.

- Issue insurance policies based on the risk assessment.

- Determine appropriate policy terms, limits, and premiums.

3. Claims Management

In the event of a claim, the underwriter will be responsible for investigating the claim and determining whether it is covered by the policy. They will also work with the policyholder to ensure that they receive the benefits they are entitled to.

- Investigate claims to determine coverage.

- Work with policyholders to settle claims.

4. Loss Prevention

Underwriters can also play a role in loss prevention by providing policyholders with tips and advice on how to reduce the risk of a loss. They can also work with communities to develop and implement safety programs.

- Provide loss prevention tips to policyholders.

- Work with communities to develop safety programs.

Interview Tips

Preparing for an interview for a property underwriter position requires a combination of technical knowledge and communication skills. Here are some tips to help you ace your interview:

1. Research the company and the position

Before you go to your interview, take the time to research the company and the specific position you are applying for. This will help you understand the company’s culture, goals, and needs. It will also help you tailor your answers to the specific requirements of the position.

- Visit the company’s website to learn about their history, mission, and values.

- Read industry publications and news articles to stay up-to-date on the insurance industry.

- Network with people who work in the insurance industry to get insights into the job market.

2. Practice your answers to common interview questions

There are some common interview questions that you are likely to be asked in an interview for a property underwriter position. These questions include:

- “Tell me about your experience in property underwriting.”

- “What are the most important factors you consider when underwriting a property?”

- “How do you stay up-to-date on the latest trends in the insurance industry?”

- “What are your strengths and weaknesses as an underwriter?”

- “Why are you interested in this position?”

Take the time to practice your answers to these questions so that you can deliver them confidently and clearly.

3. Be prepared to talk about your experience

In addition to practicing your answers to common interview questions, you should also be prepared to talk about your experience in property underwriting. This includes your skills, knowledge, and accomplishments. Be sure to highlight your experience in assessing risk, issuing policies, and managing claims.

- Describe a time when you successfully underwrote a complex property risk.

- Explain how you have used your knowledge of the insurance industry to benefit your clients.

- Share an example of a time when you went above and beyond to help a policyholder in need.

4. Be confident and enthusiastic

Confidence and enthusiasm are essential for success in any interview. When you are confident in your abilities and enthusiastic about the position, it shows. Be sure to maintain eye contact, speak clearly and confidently, and smile. Your positive attitude will make you more appealing to potential employers.

- Dress professionally and arrive on time for your interview.

- Make eye contact with the interviewer and speak clearly and confidently.

- Smile and be enthusiastic about the position.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Property Underwriter role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.