Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Underwriting Consultant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

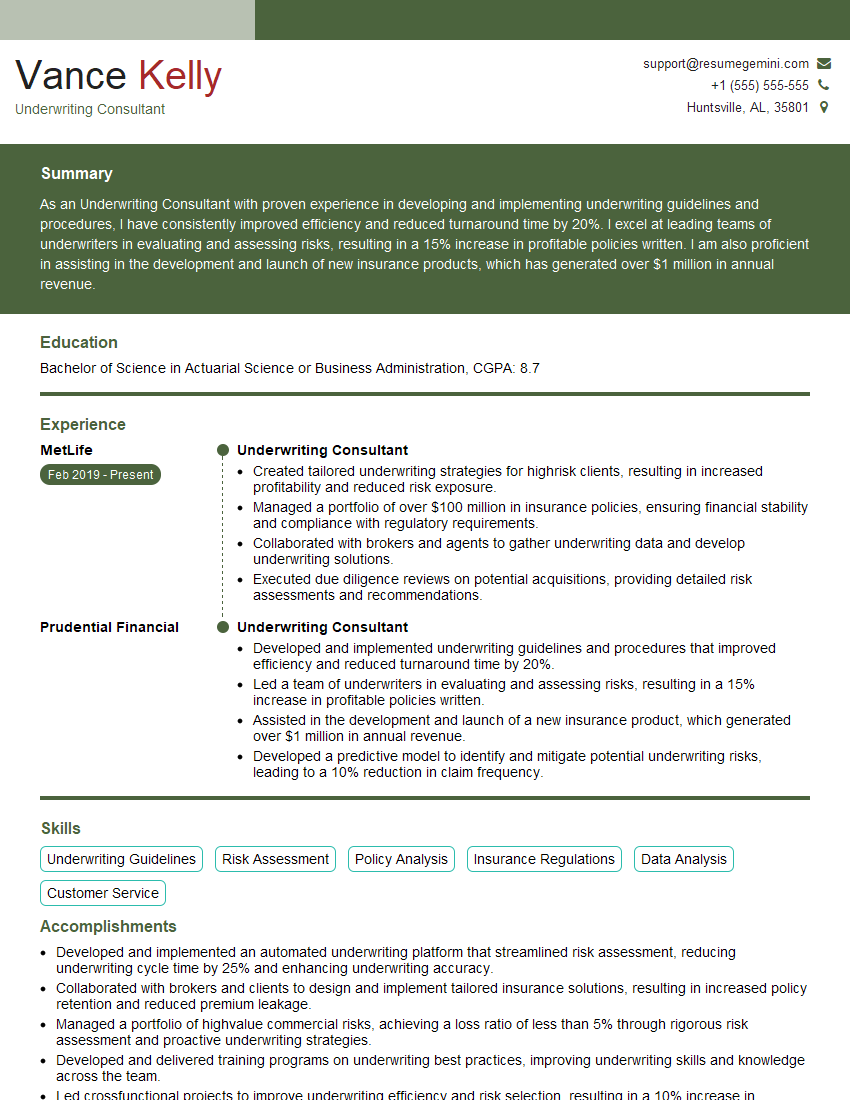

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Underwriting Consultant

1. Explain the underwriting process for a commercial property insurance policy?

- Gathering information about the property, including its location, construction, and use.

- Assessing the risks associated with the property, such as fire, theft, and vandalism.

- Determining the appropriate insurance coverage and premium.

- Issuing the insurance policy.

2. What are the key factors that you consider when underwriting a commercial property insurance policy?

- The property’s location

- The property’s construction

- The property’s use

- The property’s claims history

- The applicant’s financial stability

3. What are the different types of commercial property insurance coverage?

- Building coverage

- Business interruption coverage

- Equipment coverage

- Inventory coverage

- Money and securities coverage

4. What are the most common exclusions to commercial property insurance policies?

- Flood damage

- Earthquake damage

- War damage

- Nuclear damage

- Intentional damage

5. What are the different underwriting guidelines that you use?

- Company underwriting guidelines

- Industry underwriting guidelines

- State underwriting guidelines

- Federal underwriting guidelines

6. How do you stay up-to-date on the latest underwriting trends?

- Reading industry publications

- Attending industry conferences

- Taking continuing education courses

- Networking with other underwriters

7. What are the challenges of underwriting commercial property insurance in today’s market?

- The increasing frequency and severity of natural disasters

- The rising cost of construction

- The increasing complexity of businesses

- The evolving regulatory landscape

8. What are the opportunities for underwriting commercial property insurance in today’s market?

- The growing demand for insurance

- The development of new products and services

- The use of technology to improve underwriting

- The increasing focus on risk management

9. How do you measure the success of your underwriting?

- Loss ratio

- Combined ratio

- Return on equity

- Customer satisfaction

10. What are your career goals?

- To become a senior underwriter

- To manage a team of underwriters

- To develop new products and services

- To lead the industry in underwriting innovation

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Underwriting Consultant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Underwriting Consultant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Underwriting Consultants play a crucial role in the insurance industry, evaluating and assessing risks associated with underwriting policies. Their key responsibilities include:

1. Risk Assessment and Evaluation

Conduct thorough risk assessments by analyzing financial statements, business plans, and other relevant data to determine the level of risk associated with underwriting a policy.

- Assess the financial condition and stability of the company or individual seeking insurance.

- Evaluate the nature and scope of the business operations to identify potential risks.

2. Underwriting Policy Development

Develop and implement underwriting policies and guidelines to ensure consistent and accurate assessment of risks.

- Establish risk appetite and tolerance levels for various types of policies.

- Define the criteria and factors considered in evaluating and approving insurance applications.

3. Client Consultation and Risk Management

Provide expert advice and guidance to clients on risk management strategies.

- Consult with clients to understand their business objectives and risk tolerance.

- Recommend appropriate coverage and risk mitigation measures.

4. Market Analysis and Industry Knowledge

Monitor and analyze industry trends and regulations to stay abreast of changes in the insurance landscape.

- Track emerging risks and develop strategies to address them.

- Stay updated on regulatory changes and their impact on underwriting practices.

Interview Tips

To ace an interview for an Underwriting Consultant position, consider the following tips:

1. Research and Industry Knowledge

Thoroughly research the company and the insurance industry. Familiarize yourself with their underwriting policies, market share, and recent developments.

- Review industry publications and reports to gain insights into current trends and best practices.

- Attend industry conferences and webinars to expand your knowledge and network with professionals.

2. Highlight Your Analytical and Risk Assessment Skills

Emphasize your strong analytical abilities and experience in risk assessment. Provide examples of complex risks you have evaluated and the solutions you recommended.

- Quantify your accomplishments whenever possible, using metrics and data to demonstrate your impact.

- Discuss your understanding of insurance regulations and how you ensure compliance.

3. Demonstrate Client-Centric Approach

Showcase your ability to build strong relationships with clients and provide them with tailored advice. Highlight instances where you have successfully addressed client concerns and exceeded their expectations.

- Emphasize your communication skills and ability to explain complex concepts in a clear and concise manner.

- Provide examples of how you have used your understanding of client needs to develop innovative underwriting solutions.

4. Prepare for Behavioral Questions

Many interviewers use behavioral questions to assess your problem-solving, decision-making, and teamwork abilities. Practice answering these questions using the STAR method:

- Situation: Describe the specific situation or challenge you faced.

- Task: Explain the task or responsibility you had in that situation.

- Action: Describe the specific actions you took to address the situation.

- Result: State the outcome or impact of your actions.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Underwriting Consultant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.