Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Underwriting Service Representative position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

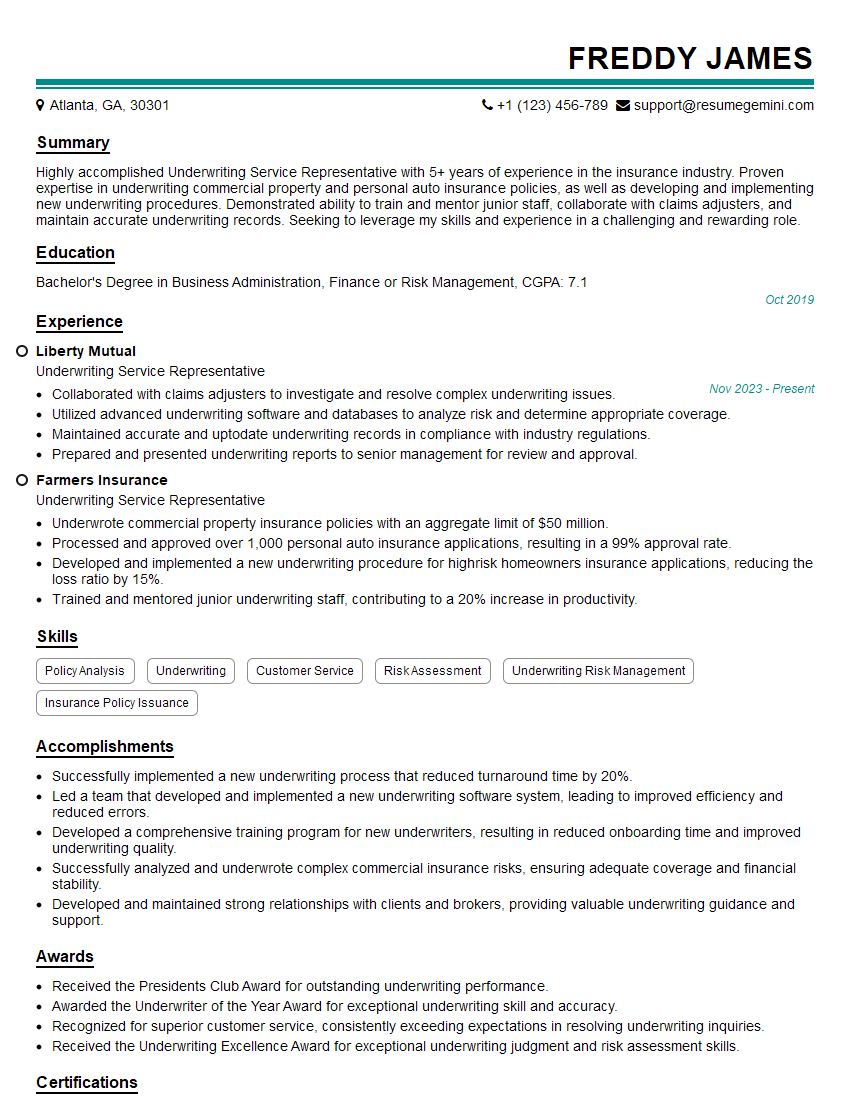

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Underwriting Service Representative

1. Describe the process of underwriting a policy.

- Review and analyze applications for insurance coverage

- Collect and assess data to determine the risk involved

- Calculate premiums based on the assessed risk

- Make recommendations on whether to approve or decline coverage

- Issue policies and riders as necessary

2. What are the different types of insurance policies that you have experience underwriting?

Auto

- Personal auto

- Commercial auto

Property

- Homeowners

- Renters

- Commercial property

Health

- Individual health

- Group health

3. What are some of the key factors that you consider when underwriting a risk?

- Applicant’s age and health history

- Type of insurance being applied for

- Applicant’s driving record or claims history

- Property location and construction

- Financial stability of the applicant

4. How do you use underwriting guidelines to determine the risk associated with an application?

Underwriting guidelines provide a framework for assessing risk and making underwriting decisions. I use these guidelines to:

- Establish minimum requirements for coverage

- Identify and assess risk factors

- Determine appropriate premiums and coverage limits

- Make decisions on whether to approve or decline coverage

5. What is your experience with using insurance software and technology?

- Proficient in using underwriting software platforms such as [Software Name]

- Experienced in using online tools and databases for data retrieval

- Comfortable with using technology to streamline the underwriting process

6. How do you stay up-to-date on changes in the insurance industry and underwriting best practices?

- Attend industry conferences and webinars

- Read industry publications and white papers

- Participate in online forums and discussion groups

7. What is your approach to customer service and building relationships with clients?

- Provide excellent customer service in all interactions

- Build strong relationships by understanding client needs and providing personalized solutions

- Maintain open communication and keep clients informed throughout the underwriting process

8. How do you handle high-risk accounts or applications with complex underwriting requirements?

- Thoroughly analyze the risk factors involved

- Consult with senior underwriters or specialists as needed

- Develop tailored underwriting solutions to meet the specific needs of the client

9. Can you describe a challenging underwriting situation you encountered and how you resolved it?

- Describe the specific situation and the underwriting challenges involved

- Explain the steps taken to analyze the risk and develop a solution

- Highlight the outcome of the situation and any lessons learned

10. What are your goals for your career as an Underwriting Service Representative?

- Continue to develop my underwriting expertise and knowledge

- Build strong relationships with clients and within the industry

- Advance my career and take on additional responsibilities

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Underwriting Service Representative.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Underwriting Service Representative‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Underwriting Service Representatives play a crucial role in the insurance industry, ensuring the smooth functioning of underwriting operations. Their key responsibilities encompass:1. Policy Analysis and Underwriting

Analyzing and evaluating insurance applications to determine the risk profile of applicants.

- Calculating premiums based on risk assessment and industry guidelines.

- Issuing or denying policies based on underwriting decisions.

2. Policy Maintenance and Servicing

Maintaining accurate policy records and ensuring compliance with underwriting guidelines.

- Processing policy changes, endorsements, and cancellations.

- Responding to customer inquiries and resolving policy-related issues.

3. Risk Assessment and Mitigation

Evaluating risk factors and recommending measures to mitigate potential losses.

- Monitoring and identifying emerging risks within the insured portfolios.

- Developing and implementing risk management strategies to minimize financial impact.

4. Customer Service and Relationship Management

Interacting effectively with customers, agents, and brokers to provide exceptional service.

- Building and maintaining strong relationships with key stakeholders.

- Resolving customer complaints and ensuring satisfaction with insurance products.

Interview Tips

To ace the interview for an Underwriting Service Representative position, candidates can follow these essential tips:1. Research the Company and Industry

Thoroughly research the insurance company and the industry to demonstrate your interest and knowledge.

- Familiarize yourself with the company’s products, services, and underwriting practices.

- Stay updated on insurance industry trends and regulations.

2. Prepare for Technical Questions

Expect questions that assess your understanding of underwriting principles and risk assessment techniques.

- Review fundamental underwriting concepts, such as risk factors, risk appetite, and premium calculation.

- Practice analyzing insurance applications and making underwriting decisions.

3. Highlight Your Customer Service Skills

Emphasize your ability to interact effectively with customers and resolve their concerns.

- Describe your experience in providing excellent customer service in previous roles.

- Share examples of how you resolved challenging customer situations.

4. Showcase Your Analytical and Problem-Solving Abilities

Demonstrate your analytical skills and ability to solve complex problems.

- Provide examples of how you analyzed data, identified risks, and developed solutions.

- Explain your approach to problem-solving and decision-making.

5. Prepare Questions for the Interviewer

Asking informed questions during the interview shows your engagement and interest in the role.

- Inquire about the company’s underwriting philosophy and risk management strategies.

- Ask about opportunities for professional development and growth within the organization.

Next Step:

Now that you’re armed with the knowledge of Underwriting Service Representative interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Underwriting Service Representative positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini