Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Bank Compliance Officer interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Bank Compliance Officer so you can tailor your answers to impress potential employers.

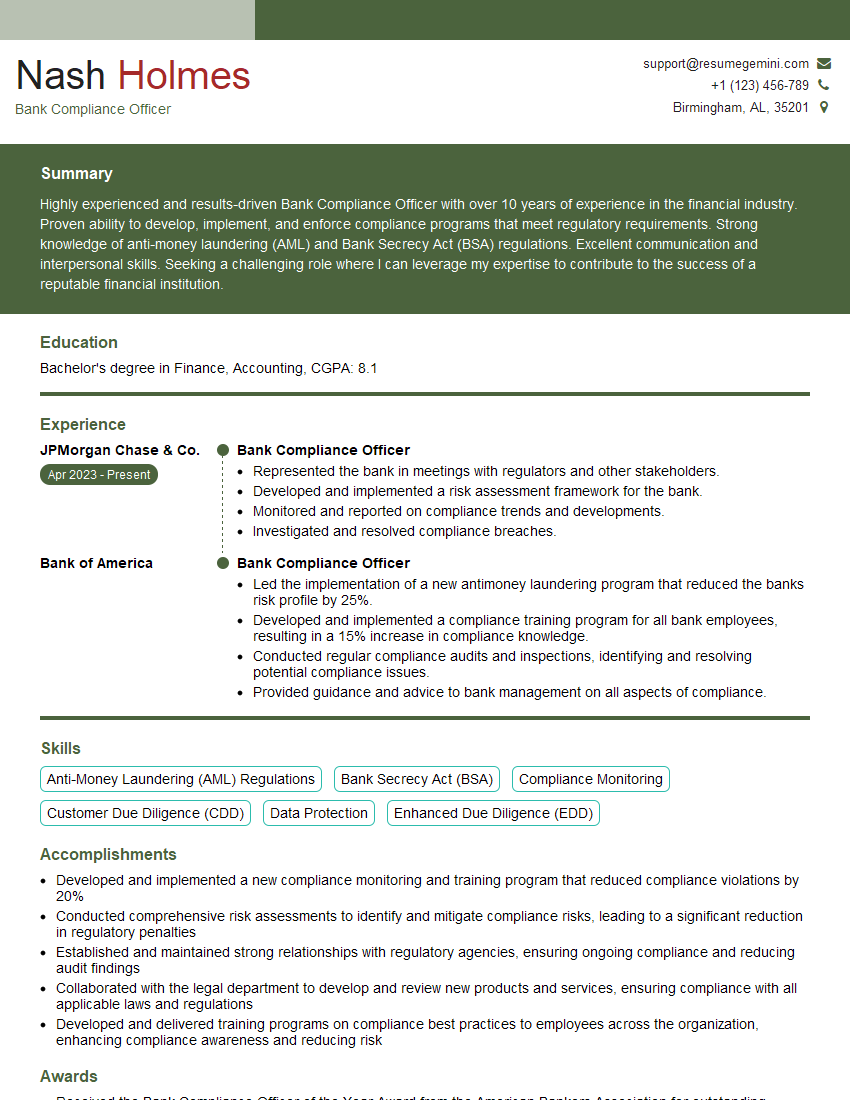

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Bank Compliance Officer

1. What are the key responsibilities of a Bank Compliance Officer?

As a highly qualified Bank Compliance Officer, my responsibilities would encompass a wide range of tasks, including:

- Developing and implementing compliance programs that adhere to regulatory requirements and industry best practices

- Monitoring and assessing compliance risks across the organization

- Conducting investigations into compliance breaches and recommending appropriate actions

- Providing training and guidance to employees on compliance-related matters

- Working closely with external regulators and auditors to ensure compliance

2. Can you elaborate on your experience in conducting compliance risk assessments?

Understanding Risk Factors

- Identifying potential compliance risks based on industry regulations, internal policies, and external factors

- Analyzing historical data, industry trends, and best practices to assess risk likelihood and impact

Assessment Methodology

- Developing and implementing risk assessment methodologies that align with regulatory expectations

- Utilizing a combination of qualitative and quantitative techniques to assess risk

Reporting and Communication

- Documenting risk assessment findings and recommendations in comprehensive reports

- Communicating risk assessments to management and other stakeholders

3. How do you handle situations where employees violate compliance policies or regulations?

When confronted with employee violations of compliance policies or regulations, I would approach the situation in a manner that prioritizes the following steps:

- Investigation: Conduct a thorough investigation to gather facts and understand the circumstances surrounding the violation

- Assessment: Analyze the severity of the violation, its potential impact, and any mitigating factors

- Action: Recommend appropriate disciplinary actions based on the findings of the investigation and assessment

- Communication: Communicate the findings and actions taken to the employee, management, and any other relevant parties

- Follow-Up: Monitor the situation and provide ongoing support to the employee to prevent future violations

4. What frameworks and regulations are you familiar with in the context of bank compliance?

I am well-versed in various frameworks and regulations that govern bank compliance, including:

- Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF): Bank Secrecy Act, Patriot Act, FinCEN regulations

- Consumer Protection: Dodd-Frank Wall Street Reform and Consumer Protection Act, Truth in Lending Act, Fair Credit Reporting Act

- Operational Risk Management: Basel Accords, Sarbanes-Oxley Act, Federal Reserve and FDIC regulations

- Securities Regulation: Securities Act of 1933, Securities Exchange Act of 1934, Investment Company Act of 1940

- Data Privacy: Gramm-Leach-Bliley Act, California Consumer Privacy Act, General Data Protection Regulation (GDPR)

5. How do you stay up-to-date with evolving compliance requirements?

To stay abreast of evolving compliance requirements, I employ a multifaceted approach:

- Regulatory Monitoring: Regularly reviewing and analyzing updates to regulations and guidance from regulatory agencies

- Industry Publications: Subscribing to industry publications and journals to stay informed about best practices and emerging trends

- Professional Development: Attending conferences, webinars, and seminars to enhance my knowledge and skills

- Networking: Engaging with other compliance professionals to share insights and learn about industry developments

- Continuing Education: Pursuing continuing education courses and certifications to maintain my expertise

6. Can you describe a time when you successfully implemented a compliance program?

Assessment and Planning

- Conducting a thorough risk assessment to identify compliance gaps

- Developing a comprehensive compliance program that addressed identified risks

Implementation and Monitoring

- Implementing the compliance program through policy updates, training, and communication

- Establishing monitoring mechanisms to track compliance and identify any deviations

Evaluation and Improvement

- Regularly evaluating the effectiveness of the compliance program

- Making necessary adjustments to enhance its efficiency and effectiveness

7. How do you prioritize compliance activities in a rapidly changing regulatory landscape?

To prioritize compliance activities effectively, I would:

- Risk Assessment: Regularly assess compliance risks to identify areas of highest concern

- Regulatory Monitoring: Monitor regulatory changes and identify their potential impact on the organization

- Resource Allocation: Allocate resources strategically to address the most critical risks

- Stakeholder Engagement: Collaborate with business units to understand their compliance needs and tailor activities accordingly

- Technology Utilization: Leverage technology to automate compliance processes and enhance efficiency

8. What are some of the challenges you foresee in the future of bank compliance?

I anticipate several challenges in the future of bank compliance, including:

- Evolving Regulatory Environment: The regulatory landscape is constantly evolving, requiring compliance professionals to stay adaptable

- Cybersecurity Threats: The increasing sophistication of cyberattacks poses significant risks to financial institutions

- Data Privacy Concerns: Banks handle vast amounts of sensitive customer data, making data privacy a critical compliance concern

- Technology Disruptions: The rapid adoption of new technologies can outpace existing compliance frameworks

- Globalization and Cross-Border Compliance: Compliance professionals must navigate the complexities of cross-border regulations

9. How do you contribute to a positive and ethical work environment?

To foster a positive and ethical work environment, I would:

- Lead by Example: Demonstrate ethical behavior and compliance with all applicable regulations

- Promote Open Communication: Encourage employees to raise concerns and report any compliance issues

- Provide Training and Resources: Ensure employees have access to compliance training and resources

- Collaborate with Management: Work closely with management to create a culture of compliance and ethics

- Stay Informed: Keep abreast of ethical and compliance best practices to guide decision-making

10. How do you measure the effectiveness of a compliance program?

To measure the effectiveness of a compliance program, I would employ the following metrics:

- Compliance Audits: Conduct regular compliance audits to assess adherence to policies and regulations

- Regulatory Compliance: Track compliance with all applicable regulatory requirements

- Employee Training and Awareness: Evaluate the effectiveness of compliance training and employee understanding

- Incident Reporting: Monitor the number and nature of compliance incidents reported

- Customer Feedback: Gather feedback from customers to assess their satisfaction with compliance practices

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Bank Compliance Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Bank Compliance Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Bank Compliance Officer plays a vital role in ensuring that financial institutions adhere to regulatory guidelines and internal policies. Their key responsibilities include:

1. Regulatory Compliance

Monitoring and ensuring compliance with all applicable laws, regulations, and industry standards, including anti-money laundering (AML), know your customer (KYC), and anti-terrorist financing (ATF) regulations.

- Developing and implementing compliance programs

- Conducting risk assessments and due diligence

2. Internal Policies and Procedures

Enforcing adherence to internal policies and procedures designed to prevent and detect financial crime, fraud, and other misconduct.

- Reviewing and updating policies and procedures

- Providing training and guidance to employees

3. Risk Management

Identifying, assessing, and mitigating compliance risks, including operational, legal, and reputational risks.

- Developing and implementing risk management strategies

- Monitoring and reporting on compliance incidents

4. Auditing and Investigations

Conducting periodic audits and investigations to ensure compliance and identify potential areas of concern.

- Investigating compliance violations and recommending appropriate action

- Working with external auditors and regulators

Interview Tips

Preparing thoroughly for a Bank Compliance Officer interview is crucial to showcase your expertise and land the job. Here are some tips:

1. Research the Company and Position

Thoroughly research the financial institution and the specific role. Understand their business model, compliance challenges, and the scope of responsibilities.

- Visit the company’s website and social media pages

- Read industry news and articles about their recent compliance initiatives

2. Highlight Your Compliance Expertise

Emphasize your knowledge and experience in relevant compliance areas such as AML, KYC, and ATF. Provide specific examples of your contributions to compliance programs.

- Quantify your accomplishments using metrics, such as reduced compliance violations or improved risk assessment processes

- Demonstrate your understanding of industry best practices and regulatory trends

3. Strong Communication and Interpersonal Skills

Compliance Officers need excellent communication skills to effectively convey complex regulatory requirements and policies to colleagues, management, and external stakeholders.

- Emphasize your ability to effectively communicate and collaborate with diverse teams

- Highlight your ability to build strong relationships with regulators and auditors

4. Ethical Standards and Integrity

Integrity is paramount for Bank Compliance Officers. They must maintain the highest ethical standards and be committed to upholding the law and preventing financial crime.

- Discuss your personal values and commitment to ethical behavior

- Provide examples of how you have maintained integrity in challenging situations

5. Continuous Learning and Development

Compliance regulations and industry best practices are constantly evolving. Show the interviewer your commitment to continuous learning and professional development.

- Discuss your plans for ongoing compliance education and training

- Highlight your involvement in industry organizations or conferences

Next Step:

Now that you’re armed with the knowledge of Bank Compliance Officer interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Bank Compliance Officer positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini