Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Chief Bank Examiner position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

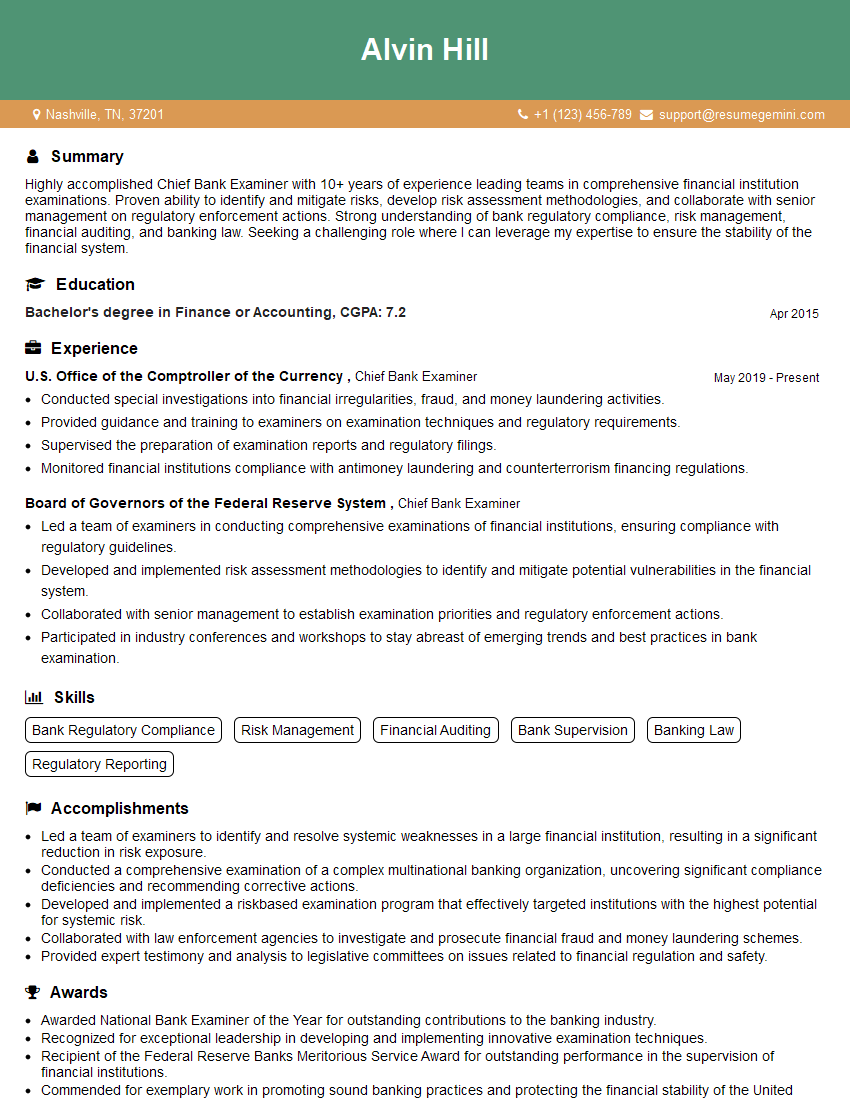

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Chief Bank Examiner

1. Explain the primary responsibilities of a Chief Bank Examiner.

As a Chief Bank Examiner, my primary responsibilities include:

- Leading and managing a team of bank examiners to ensure the safety and soundness of financial institutions.

- Developing and implementing examination plans and procedures.

- Conducting on-site and off-site examinations of banks to assess their financial condition, risk management practices, and compliance with regulations.

2. Describe your approach to risk assessment and management in bank examinations.

Understanding the Bank’s Business

- Reviewing the bank’s business plan, financial statements, and other relevant documents.

- Conducting interviews with bank management and staff.

Assessing the Bank’s Risk Profile

- Identifying and analyzing potential risks to the bank, such as credit risk, market risk, operational risk, and compliance risk.

- Assessing the bank’s risk management framework and its effectiveness in mitigating these risks.

Evaluating the Bank’s Risk Management Practices

- Reviewing the bank’s risk management policies, procedures, and controls.

- Assessing the effectiveness of the bank’s risk management practices in mitigating identified risks.

3. How do you ensure the accuracy and reliability of examination findings?

To ensure the accuracy and reliability of examination findings, I adhere to the following principles:

- Proper Planning: Thoroughly planning examinations and conducting risk assessments to identify potential areas of concern.

- Independent Verification: Obtaining evidence from multiple sources and independently verifying information to minimize bias and error.

- Objectivity and Professionalism: Maintaining impartiality and objectivity throughout the examination process to ensure fairness and accuracy.

- Quality Control: Implementing quality control procedures to review and validate examination findings before they are finalized.

4. What are your key considerations when determining the scope and intensity of a bank examination?

When determining the scope and intensity of a bank examination, I consider the following key factors:

- Risk Profile: The bank’s risk profile, including its size, complexity, and exposure to various risk factors.

- Compliance History: The bank’s compliance history and any previous regulatory concerns or enforcement actions.

- Industry Trends: Current industry trends, economic conditions, and regulatory developments that may impact the bank’s operations.

- Internal Controls: The strength and effectiveness of the bank’s internal controls and risk management framework.

- External Factors: External factors that may affect the bank’s financial condition, such as economic conditions, industry competition, and regulatory changes.

5. How do you communicate examination findings to bank management and regulatory authorities?

To communicate examination findings effectively, I follow these steps:

- Clear and Concise Reporting: Preparing a comprehensive and well-written examination report that clearly outlines the findings and recommendations.

- Exit Interviews: Conducting exit interviews with bank management to discuss the findings and provide an opportunity for clarification.

- Follow-up Communication: Maintaining regular communication with the bank to monitor progress on corrective actions and address any ongoing concerns.

- Regulatory Reporting: Submitting examination reports to regulatory authorities as required to ensure transparency and accountability.

6. How do you stay up-to-date on regulatory changes and emerging risks in the banking industry?

To stay up-to-date on regulatory changes and emerging risks, I engage in the following practices:

- Regulatory Monitoring: Regularly reviewing regulatory guidance, circulars, and updates from regulatory authorities.

- Industry Publications: Subscribing to industry publications and attending conferences to gain insights into emerging trends and best practices.

- Networking: Building relationships with professionals in the banking industry and participating in industry forums to exchange knowledge and information.

- Continuous Education: Pursuing continuing education courses and certifications to enhance my understanding of regulatory requirements and emerging risks.

7. How do you manage a team of bank examiners and ensure their professional development?

As a leader, I prioritize the following strategies for managing and developing my team:

- Clear Communication: Establishing clear expectations, providing regular feedback, and fostering open communication channels.

- Mentoring and Coaching: Providing guidance, support, and opportunities for professional growth to help team members enhance their skills.

- Training and Development: Identifying training needs and providing access to training programs to enhance the team’s knowledge and expertise.

- Performance Management: Setting performance goals, providing regular performance reviews, and recognizing achievements to motivate and develop team members.

8. Describe a situation where you successfully identified and addressed a significant risk in a bank examination.

In a recent examination, I identified a significant operational risk related to the bank’s IT systems. The bank had recently implemented a new core banking system without adequate testing and validation. I conducted a thorough review of the system’s implementation, identified potential vulnerabilities, and recommended corrective actions. The bank promptly addressed the findings, implemented enhanced security measures, and conducted additional testing to mitigate the risk.

9. How do you handle disagreements or conflicts with bank management during an examination?

When disagreements or conflicts arise with bank management during an examination, I approach the situation with the following principles:

- Objectivity and Professionalism: Maintaining objectivity and focusing on the facts and evidence to support my findings.

- Open Communication: Engaging in open and respectful communication, actively listening to the bank’s perspective, and presenting my findings clearly and concisely.

- Collaboration: Seeking common ground and working collaboratively with bank management to develop mutually acceptable solutions.

- Escalation: If necessary, escalating the matter to higher management levels within the bank or regulatory authorities to facilitate resolution.

10. What are your thoughts on the future of bank regulation and the role of Chief Bank Examiners?

The future of bank regulation is likely to be characterized by increased complexity and the need for a more proactive approach to risk management. Chief Bank Examiners will need to:

- Embrace Technology: Utilize advanced technologies and data analytics to enhance examination processes and identify emerging risks.

- Focus on Systemic Risks: Pay greater attention to systemic risks that could impact the entire financial system.

- Promote Innovation: Encourage innovation while maintaining a sound regulatory framework that protects depositors and promotes financial stability.

- Adapt to Changing Regulatory Landscape: Continuously adapt to evolving regulatory requirements and international standards.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Chief Bank Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Chief Bank Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Chief Bank Examiner plays a critical role in ensuring the safety and soundness of financial institutions. Their primary responsibilities include:

1. Supervising and Managing Bank Examinations

Leading teams of examiners in conducting comprehensive examinations of financial institutions to assess their financial condition, compliance with regulations, and overall risk profile.

- Planning and coordinating examination schedules

- Directing teams in examining bank operations, financial statements, and risk management practices

2. Developing and Implementing Examination Policies and Procedures

Establishing and enforcing examination policies and procedures to ensure consistency and effectiveness of examinations. This includes staying abreast of regulatory changes and industry best practices.

- Developing examination manuals and checklists

- Ensuring examiners adhere to established standards

3. Collaborating with Regulatory Agencies and Other Stakeholders

Maintaining regular communication with federal and state regulatory agencies, as well as industry associations and external auditors. This ensures coordination and information sharing.

- Participating in regulatory working groups and committees

- Providing input on policy development and regulatory initiatives

4. Training and Developing Examination Staff

Providing comprehensive training and professional development opportunities to examiners to enhance their knowledge, skills, and professional certifications.

- Developing and conducting training programs

- Monitoring examiner performance and providing feedback

Interview Tips

1. Research the Organization and Industry

Thoroughly research the financial institution you are applying to, its industry, and current regulatory landscape. This demonstrates your understanding of the organization and its challenges.

- Review the institution’s website, annual reports, and regulatory filings

- Stay up-to-date on industry news and regulatory changes

2. Prepare Examples of Your Experience

Be prepared to provide specific examples from your past experience that demonstrate your skills and abilities in the following areas:

- Examination planning and execution

- Policy development and implementation

- Regulatory collaboration

- Staff training and development

3. Highlight Your Leadership and Management Skills

Emphasize your leadership qualities and ability to effectively manage a team of examiners. Describe situations where you successfully motivated, guided, and developed your team members.

4. Communicate Your Passion for the Industry

Convey your enthusiasm for the financial industry and your commitment to promoting its stability and safety. Explain your motivations for pursuing a career in bank examination.

5. Be Professional and Enthusiastic

Throughout the interview, maintain a professional demeanor and positive attitude. Be enthusiastic about the opportunity and show that you are genuinely interested in the position.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Chief Bank Examiner, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Chief Bank Examiner positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.