Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Credit Union Field Examiner position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

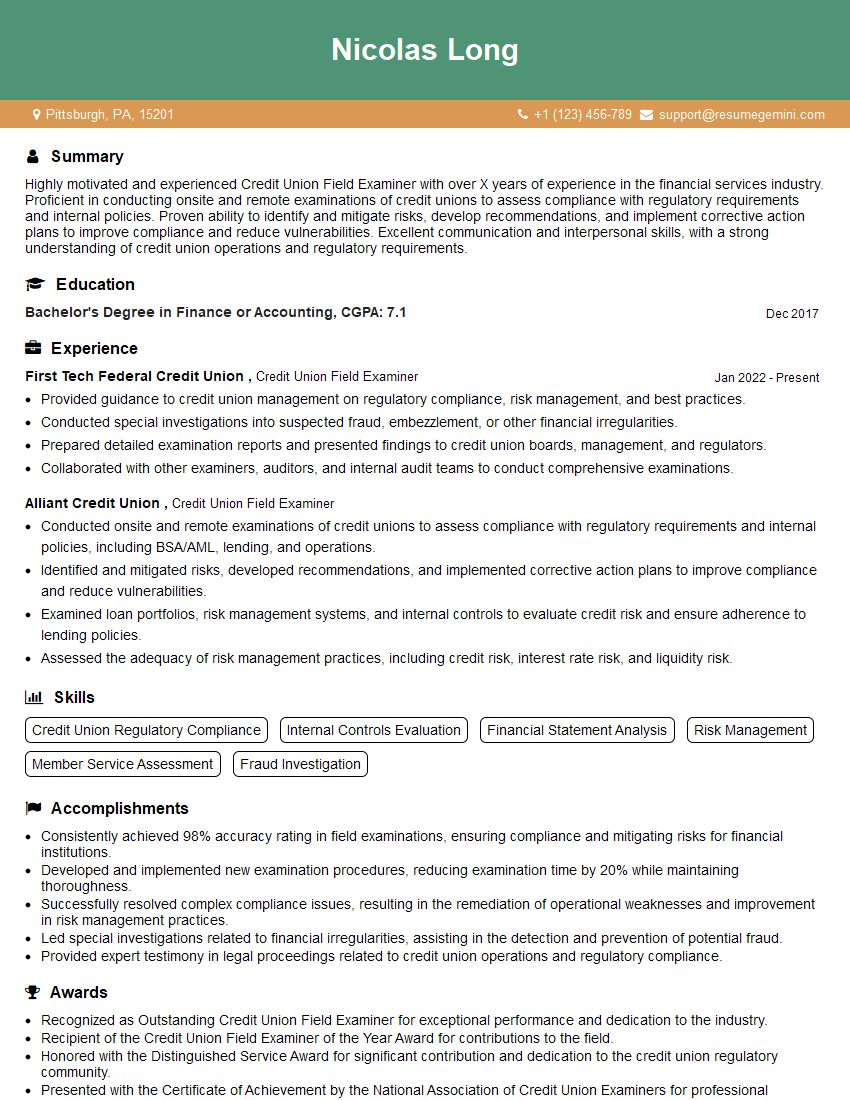

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Credit Union Field Examiner

1. Describe the key responsibilities of a Credit Union Field Examiner?

As a Credit Union Field Examiner, my primary responsibilities would include:

- Conducting financial examinations of credit unions to assess their financial health, compliance with regulations, and risk management practices

- Evaluating credit union operations, including loan portfolios, risk management systems, and internal controls

- Identifying and reporting on areas of concern, recommending corrective actions, and monitoring progress towards improvement

- Working closely with credit union management to provide guidance and support on regulatory compliance and best practices

- Staying abreast of industry trends, regulatory changes, and emerging risks to ensure effective examinations

2. What are the essential technical skills required for this role?

Financial Analysis and Examination Techniques

- Advanced knowledge of accounting, auditing, and financial analysis principles

- Expertise in examining financial statements, loan portfolios, and other financial data

- Proficiency in using audit software and data analytics tools

Regulatory Compliance Expertise

- In-depth understanding of federal and state regulations governing credit unions

- Familiarity with the NCUA’s CAMELS rating system and other regulatory frameworks

- Ability to identify and assess compliance risks and develop mitigation strategies

3. How do you ensure the confidentiality of the information you obtain during examinations?

Maintaining confidentiality is paramount in my role. I adhere to strict protocols and ethical guidelines to safeguard sensitive information:

- All data and documents are secured and stored in accordance with regulatory requirements

- Communication of examination findings is limited to authorized individuals on a need-to-know basis

- I am bound by a confidentiality agreement and have undergone background checks to ensure integrity

- Any potential conflicts of interest are disclosed and managed appropriately

4. Describe your experience in assessing the adequacy of a credit union’s internal controls.

In assessing internal controls, I follow a systematic approach:

- Reviewing policies and procedures to identify control points

- Testing controls through walkthroughs, interviews, and document reviews

- Evaluating the effectiveness of controls in mitigating identified risks

- Making recommendations for improvements or corrective actions when necessary

- Documenting findings and communicating them to credit union management

5. What are the common challenges you anticipate in this role and how do you plan to address them?

Common challenges I anticipate and my strategies for addressing them:

- Evolving Regulatory Landscape: Staying informed through industry publications, attending conferences, and maintaining connections with regulatory bodies

- Limited Resources: Prioritizing examinations based on risk assessments, leveraging technology for efficiency, and collaborating with other examiners

- Resistance to Change: Communicating findings and recommendations effectively, providing data and evidence to support recommendations, and fostering a positive working relationship with credit unions

- Conflicting Priorities: Balancing examination schedules with regulatory deadlines and credit union needs through effective communication and planning

6. How do you stay updated on changes in regulations and industry best practices?

To stay up-to-date, I employ various strategies:

- Subscribing to industry publications and newsletters

- Attending conferences and webinars hosted by regulatory agencies and industry organizations

- Participating in continuing education programs and workshops

- Networking with other examiners and industry professionals through professional organizations

7. What is your approach to providing feedback and guidance to credit unions?

My approach to providing feedback and guidance is:

- Collaborative: Engaging with credit union management to identify areas for improvement and develop solutions

- Evidence-Based: Supporting recommendations with data and analysis from the examination

- Constructive: Focusing on actionable steps and providing specific examples of best practices

- Timely and Transparent: Communicating findings promptly and providing clear explanations

- Supportive: Offering assistance and guidance throughout the implementation process

8. How do you handle situations where you identify potential non-compliance issues during an examination?

When identifying potential non-compliance issues, I follow a diligent process:

- Document Observations: Thoroughly document the findings and supporting evidence

- Communicate Findings: Discuss the findings with credit union management and provide a clear explanation

- Assess Impact: Evaluate the severity and potential impact of the non-compliance

- Recommend Corrective Actions: Work with credit union management to develop a plan for addressing the issues

- Follow-Up: Monitor progress towards implementing corrective actions and provide ongoing support

9. Describe your experience in conducting financial ratio analysis and its importance in credit union examinations.

Financial ratio analysis is a crucial aspect of my examinations:

- Identifying Trends: Ratios allow me to identify trends and compare the credit union’s performance to industry benchmarks

- Assessing Financial Health: Ratios provide insights into a credit union’s liquidity, solvency, profitability, and efficiency

- Identifying Risks: Unusual ratios can indicate potential financial risks or areas requiring further investigation

10. What are your strengths and weaknesses as a Credit Union Field Examiner?

My strengths as a Credit Union Field Examiner:

- Technical Expertise: Advanced knowledge of financial analysis, regulatory compliance, and examination techniques

- Analytical Skills: Ability to interpret complex financial data and identify areas of concern

- Communication Skills: Effectively communicate findings and recommendations to credit union management and other stakeholders

- Strong Work Ethic: Committed to delivering high-quality examinations and meeting deadlines

As for areas where I am working to improve:

- Expanding Industry Knowledge: Continuing to stay abreast of emerging trends and best practices in the credit union industry

- Refining Report Writing: Enhancing my ability to convey complex findings and recommendations in a clear and concise manner

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Credit Union Field Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Credit Union Field Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Credit Union Field Examiner is responsible for evaluating the operations and financial health of credit unions. Their duties include:

1. Conducting on-site examinations

Field examiners will visit credit unions and review their records, policies, and procedures. They will assess the credit union’s compliance with regulations and identify any areas of risk.

- Prepare for and conduct on-site examinations of credit unions.

- Review financial statements, loan portfolios, and other relevant documents.

2. Preparing examination reports

Field examiners will write reports summarizing their findings and make recommendations for improvement. These reports are used by credit unions to identify and address any weaknesses in their operations.

- Draft examination reports that summarize findings and make recommendations for improvement.

- Present examination reports to credit union management and boards of directors.

3. Providing training and guidance

Field examiners may also provide training and guidance to credit union staff on topics such as compliance, risk management, and internal controls.

- Provide training and guidance to credit union staff on regulatory compliance, risk management, and internal controls.

- Participate in industry conferences and workshops to stay up-to-date on best practices.

4. Participating in regulatory development

Field examiners may also participate in the development of regulations and policies that affect credit unions.

- Participate in regulatory development by providing input to regulatory agencies.

- Stay up-to-date on industry trends and best practices.

Interview Tips

To ace your interview for a Credit Union Field Examiner position, follow these tips:

1. Research the credit union and the industry

Before your interview, take some time to learn about the credit union you’re applying to and the credit union industry as a whole. This will show the interviewer that you’re interested in the position and that you’ve taken the time to prepare.

- Visit the credit union’s website and read its annual report.

- Read industry publications and news articles.

2. Practice your answers to common interview questions

There are a number of common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?”. Practice answering these questions in advance so that you can deliver your responses confidently and concisely.

- Use the STAR method to answer behavioral questions (Situation, Task, Action, Result).

- Prepare examples of your experience that demonstrate your skills and qualifications.

3. Be prepared to talk about your experience and skills

The interviewer will want to know about your experience and skills as they relate to the job of a Credit Union Field Examiner. Be prepared to talk about your experience in financial auditing, risk management, and compliance.

- Highlight your experience in conducting financial audits and examinations.

- Describe your knowledge of credit union regulations and policies.

4. Be professional and enthusiastic

First impressions matter, so dress professionally and arrive on time for your interview. Be polite and respectful to everyone you meet, and be enthusiastic about the position and the credit union.

- Make eye contact and smile when greeting the interviewer.

- Speak clearly and confidently, and be prepared to answer questions.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Credit Union Field Examiner role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.