Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Securities Compliance Examiner position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

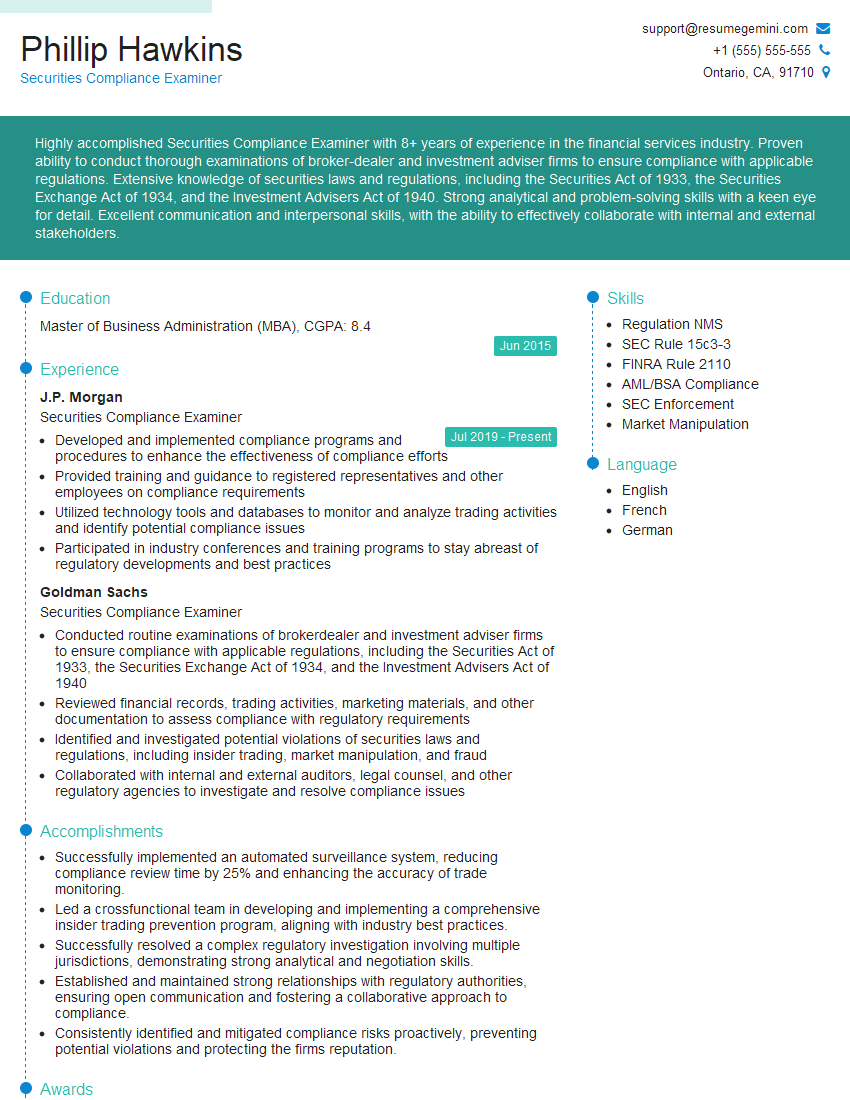

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Securities Compliance Examiner

1. What are the key responsibilities of a Securities Compliance Examiner?

As a Securities Compliance Examiner, I would be responsible for:

- Monitoring and reviewing trading activities to ensure compliance with all applicable laws and regulations.

- Identifying and investigating potential violations of securities laws and regulations.

- Preparing reports and making recommendations on compliance matters.

- Working closely with other departments, such as legal, risk, and operations, to ensure a comprehensive compliance program.

2. What are the FINRA rules that you are familiar with?

FINRA Rule 2010

- This rule requires broker-dealers to establish and maintain a system of supervision and internal controls to ensure that their activities are conducted in accordance with applicable laws and regulations.

FINRA Rule 4511

- This rule requires broker-dealers to establish and maintain a written compliance manual.

- The compliance manual must describe the firm’s compliance policies and procedures, and it must be reviewed and updated regularly.

3. What are some of the common violations of securities laws that you have seen in your experience?

Some of the most common violations of securities laws that I have seen in my experience include:

- Insider trading

- Market manipulation

- Unregistered securities offerings

- Ponzi schemes

- Failure to supervise

4. What are the challenges of being a Securities Compliance Examiner?

The challenges of being a Securities Compliance Examiner include:

- Keeping up with the constantly changing regulatory landscape.

- Identifying and investigating potential violations.

- Maintaining a high level of ethical standards.

- Balancing the need for compliance with the need for business growth.

5. What are the skills and qualifications that are necessary to be a successful Securities Compliance Examiner?

The skills and qualifications that are necessary to be a successful Securities Compliance Examiner include:

- A deep understanding of securities laws and regulations.

- Excellent analytical and investigative skills.

- Strong communication and interpersonal skills.

- A high level of ethical standards.

- The ability to work independently and as part of a team.

6. What are the career opportunities for Securities Compliance Examiners?

The career opportunities for Securities Compliance Examiners are excellent.

- Compliance Examiners can advance to more senior positions within their firms.

- They can also move into other roles within the financial industry, such as risk management or investment banking.

- With additional experience and education, Compliance Examiners can also become certified as Certified Compliance Professionals (CCPs).

7. What are the ethical considerations that Securities Compliance Examiners must be aware of?

Securities Compliance Examiners must be aware of a number of ethical considerations, including:

- The importance of maintaining confidentiality.

- The need to avoid conflicts of interest.

- The obligation to report any potential violations of the law.

- The importance of acting in the best interests of the firm and its clients.

8. What are the best practices for Securities Compliance Examiners?

The best practices for Securities Compliance Examiners include:

- Staying up-to-date on the latest regulatory changes.

- Conducting regular risk assessments.

- Developing and implementing effective compliance policies and procedures.

- Monitoring and reviewing trading activities.

- Investigating any potential violations.

9. What are the emerging trends in the securities compliance landscape?

Some of the emerging trends in the securities compliance landscape include:

- The increasing use of technology.

- The globalization of the financial markets.

- The rise of new types of financial products.

- The increasing focus on cybersecurity.

- The growing importance of corporate social responsibility.

10. What are the key challenges facing Securities Compliance Examiners in the coming years?

Some of the key challenges facing Securities Compliance Examiners in the coming years include:

- The need to keep up with the ever-changing regulatory landscape.

- The increasing complexity of financial products.

- The globalization of the financial markets.

- The rise of new technologies.

- The increasing focus on cybersecurity.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Securities Compliance Examiner.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Securities Compliance Examiner‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Securities Compliance Examiners play a crucial role in ensuring compliance with complex securities regulations and managing risks within financial institutions.

1. Compliance Monitoring and Reporting

Monitor and review activities of individuals and entities to identify potential violations of securities laws and regulations.

- Conducting periodic audits and inspections of broker-dealer activities.

- Analyzing trading patterns and transactions to detect irregularities or suspicious activity.

2. Regulatory Examination Preparation

Assist in preparing for and responding to regulatory examinations conducted by the Financial Industry Regulatory Authority (FINRA), the Securities and Exchange Commission (SEC), and other regulatory bodies.

- Compiling and organizing relevant documents and information.

- Interviewing employees and gathering evidence related to compliance.

3. Policy and Procedure Development

Participate in the development and implementation of compliance policies and procedures to ensure adherence to regulatory requirements.

- Reviewing and updating existing policies and procedures.

- Creating training materials and conducting compliance training sessions.

4. Risk Assessment and Management

Identify, assess, and mitigate potential compliance risks within the organization.

- Conducting risk assessments and developing mitigation plans.

- Monitoring emerging regulatory changes and industry best practices.

Interview Tips

Preparing for an interview for a Securities Compliance Examiner position requires a combination of technical knowledge and effective communication skills.

1. Research the Company and Industry

Demonstrate your understanding of the company’s business and the securities industry by researching their website, annual reports, and industry publications.

- Visit the company’s website to learn about their products, services, and recent news.

- Read industry publications to stay informed about current trends and regulatory changes.

2. Highlight Your Technical Expertise

Emphasize your knowledge of securities laws and regulations, compliance frameworks, and risk management principles.

- Quantify your experience in conducting compliance audits and investigations.

- Provide examples of how you have identified and resolved compliance issues.

3. Showcase Your Problem-Solving Skills

Interviewers will be interested in your ability to analyze complex situations and develop effective solutions.

- Describe a situation where you faced a compliance challenge and how you resolved it.

- Explain how you would prioritize and manage multiple compliance projects.

4. Communicate Clearly and Effectively

As a Securities Compliance Examiner, you will need to be able to communicate complex technical information to a wide range of stakeholders, including senior management and regulators.

- Use clear and concise language to explain compliance concepts and findings.

- Practice your presentation skills by preparing a mock presentation on a recent compliance project.

Next Step:

Now that you’re armed with the knowledge of Securities Compliance Examiner interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Securities Compliance Examiner positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini