Are you gearing up for an interview for a Certified Credit Counselor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Certified Credit Counselor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

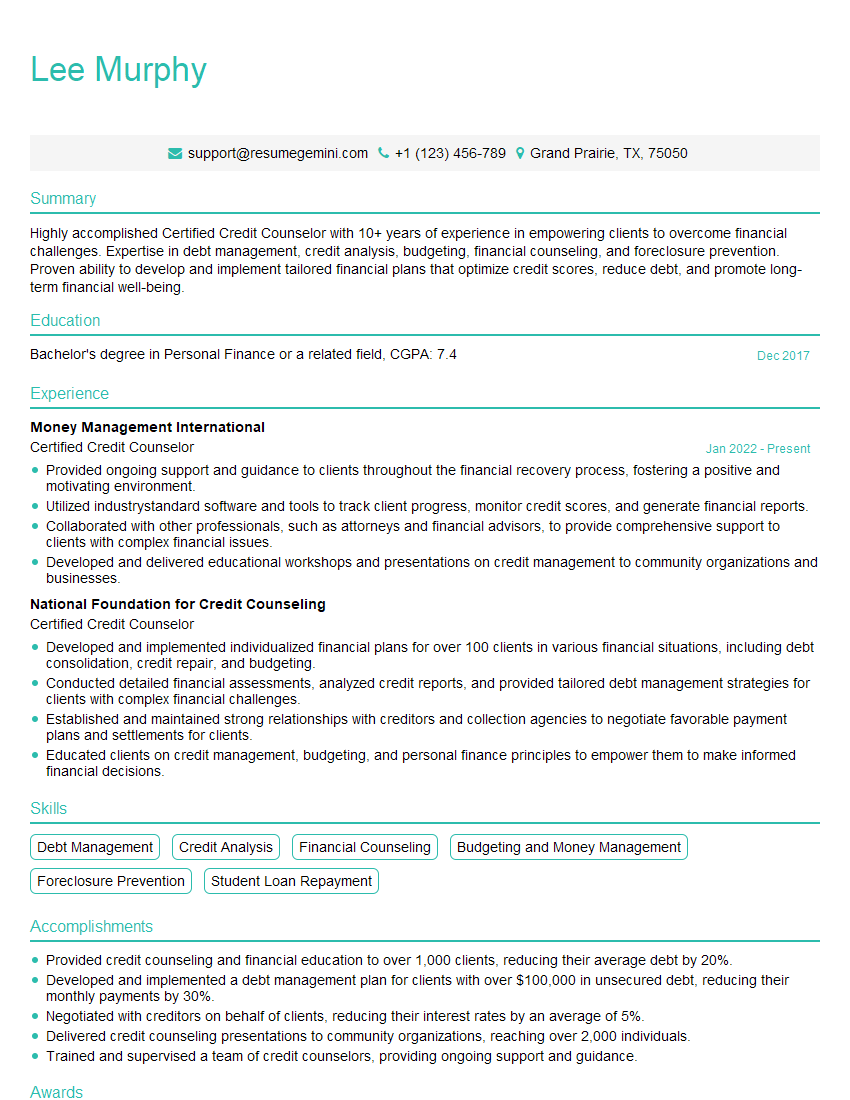

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Certified Credit Counselor

1. What are the key responsibilities of a Certified Credit Counselor (CCC)?

- Providing confidential financial counseling to individuals and families

- Assessing clients’ financial situations and identifying areas of concern

- Developing personalized debt management plans, including budgeting and credit counseling

- Negotiating with creditors to reduce interest rates and lower monthly payments

- Educating clients on financial management principles and practices

- Refer clients to additional resources, such as housing assistance or legal aid

2. What are the different types of debt management plans a CCC can help clients create?

Debt Consolidation Plan

- Combining multiple debts into a single loan with a lower interest rate

- Simplifies monthly payments and makes it easier to track debt progress

Debt Settlement Plan

- Negotiating with creditors to pay less than the full amount owed

- Can result in significant savings, but may impact credit scores

Consumer Credit Counseling Plan

- Creating a structured plan to pay off debt within a specific timeframe

- Involves making regular payments to a non-profit credit counseling agency

3. How do you approach working with clients who are facing financial hardship?

- Build trust and rapport by actively listening and showing empathy

- Assess their financial situation thoroughly and identify underlying causes of debt

- Explain all options and potential consequences clearly and honestly

- Collaborate with clients to develop a realistic and achievable debt management plan

- Provide ongoing support and encouragement throughout the process

4. What are the ethical considerations involved in providing credit counseling services?

- Maintaining client confidentiality

- Avoiding conflicts of interest

- Providing unbiased and accurate information

- Adhering to professional standards and regulations

- Treating clients with respect and dignity

5. How do you stay up-to-date on the latest changes in the credit industry and financial regulations?

- Attending industry conferences and workshops

- Subscribing to trade publications and newsletters

- Participating in online forums and discussion groups

- Consulting with other professionals in the field

- Maintaining certification and continuing education requirements

6. What are the common challenges faced by Certified Credit Counselors?

- Working with clients who are resistant to change

- Negotiating with uncooperative creditors

- Dealing with clients who have complex financial situations

- Managing a high caseload

- Maintaining emotional objectivity while working with clients facing financial distress

7. How do you measure the effectiveness of your counseling services?

- Tracking client satisfaction

- Measuring improvement in clients’ financial management skills

- Assessing the reduction in client debt

- Evaluating client feedback and testimonials

- Comparing outcomes to industry benchmarks

8. What are your strengths and weaknesses as a Certified Credit Counselor?

- Strengths:

- Strong communication and interpersonal skills

- Excellent problem-solving and analytical abilities

- Extensive knowledge of financial management and credit counseling

- Compassionate and understanding

- Ability to motivate and empower clients

- Weaknesses:

- Limited experience in dealing with high-net-worth individuals

- Can be emotionally affected by clients’ financial struggles

- May need to improve time management skills

9. How do you stay motivated and engaged in your work as a Certified Credit Counselor?

- Focusing on the positive impact my work has on clients’ lives

- Continuously learning and expanding my knowledge

- Collaborating with other professionals in the field

- Setting personal and professional goals

- Taking breaks and practicing self-care

10. What are your future career goals as a Certified Credit Counselor?

- Becoming a leader in the field of credit counseling

- Expanding my services to include financial education and coaching

- Advocating for changes in policies that impact financial literacy

- Mentoring and training new Certified Credit Counselors

- Establishing a non-profit organization to provide free financial counseling to underserved communities

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Certified Credit Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Certified Credit Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Certified Credit Counselors (CCCs) provide essential financial guidance to individuals and families seeking to manage and improve their credit. Their responsibilities include:

1. Credit Counseling and Education

Identify and analyze clients’ financial situations, including income, expenses, and debt.

- Develop personalized credit management plans to address specific financial challenges.

- Educate clients on financial literacy, budgeting, and credit optimization strategies.

2. Debt Management and Consolidation

Negotiate with creditors on behalf of clients to reduce interest rates, fees, and balances.

- Assist clients in consolidating multiple debts into a single, more manageable loan.

- Monitor client progress and adjust plans as needed to ensure debt repayment success.

3. Bankruptcy Prevention and Alternatives

Explore alternative solutions to bankruptcy, such as debt settlement, credit counseling, and financial hardship programs.

- Educate clients on the implications and consequences of bankruptcy.

- Provide referrals to legal professionals or other resources if bankruptcy is deemed necessary.

4. Budget Counseling and Financial Planning

Help clients create realistic budgets, prioritize expenses, and manage cash flow effectively.

- Provide guidance on savings, investments, and other long-term financial planning strategies.

- Empower clients to make informed financial decisions and achieve their financial goals.

Interview Tips

Preparing thoroughly for a Certified Credit Counselor interview can significantly increase your chances of success. Here are some tips to help you ace the interview:

1. Research the Organization and Position

Take the time to learn about the organization’s mission, values, and services. Understand the specific responsibilities of the Certified Credit Counselor role.

- Visit the organization’s website and review their materials.

- Read industry publications and articles to stay up-to-date on current trends.

2. Highlight Your Expertise and Experience

Emphasize your relevant skills and experience in credit counseling and financial management.

- Quantify your accomplishments whenever possible, using specific metrics and data points.

- Prepare examples that demonstrate your ability to provide comprehensive credit counseling services.

3. Demonstrate Empathy and Communication Skills

Certified Credit Counselors work with clients who are facing financial challenges. It is essential to display empathy, understanding, and effective communication skills.

- Share examples of how you have supported clients through difficult financial situations.

- Practice active listening and demonstrate your ability to build rapport with clients.

4. Be Prepared to Discuss Financial Regulations

Certified Credit Counselors must adhere to various financial regulations and industry standards.

- Familiarize yourself with relevant laws and regulations, such as the Fair Debt Collection Practices Act.

- Be prepared to discuss your understanding of ethical practices and client confidentiality.

Additional Tips

- Dress professionally and arrive on time for your interview.

- Be confident and enthusiastic, and demonstrate your passion for helping others manage their finances.

- Prepare questions to ask the interviewer, indicating your interest in the organization and the role.

- Follow up after the interview with a thank-you note, reiterating your interest and highlighting your key qualifications.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Certified Credit Counselor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Certified Credit Counselor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.