Are you gearing up for an interview for a Certified Consumer Credit and Housing Counselor position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Certified Consumer Credit and Housing Counselor and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

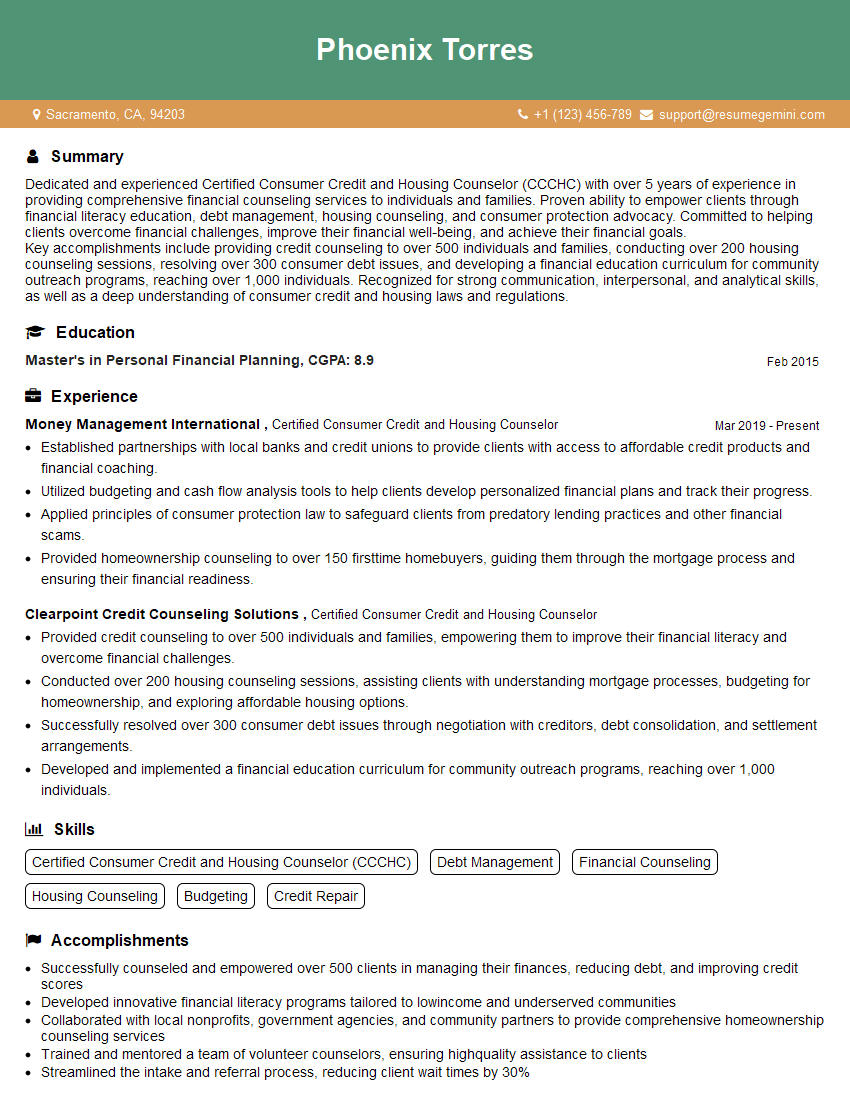

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Certified Consumer Credit and Housing Counselor

1. What are the key responsibilities of a Certified Consumer Credit and Housing Counselor?

As a Certified Consumer Credit and Housing Counselor, I would be responsible for providing confidential and impartial counseling to individuals and families facing financial challenges or seeking to improve their financial well-being. My core responsibilities would include:

- Conducting financial assessments to evaluate clients’ income, expenses, assets, and debts

- Developing and implementing personalized financial management plans to help clients achieve their goals

- Providing education on budgeting, debt management, credit repair, and other financial topics

- Negotiating with creditors on behalf of clients to reduce interest rates, lower monthly payments, or consolidate debts

- Assisting clients in developing and maintaining realistic repayment plans

2. What are the ethical guidelines that you follow as a Certified Consumer Credit and Housing Counselor?

Confidentiality

- Maintaining the privacy of clients’ financial information

- Only sharing information with authorized parties with the client’s consent

Objectivity

- Providing unbiased and objective advice

- Avoiding conflicts of interest

Competence

- Staying up-to-date on industry best practices and regulations

- Continuously developing professional skills and knowledge

3. What are the common challenges that clients face when seeking credit and housing counseling?

Clients facing financial challenges often experience a range of difficulties, including:

- High levels of debt and difficulty managing monthly payments

- Poor credit scores and limited access to affordable credit

- Lack of financial literacy and budgeting skills

- Housing affordability issues and the risk of eviction or foreclosure

- Stress, anxiety, and depression related to financial problems

4. How do you approach working with clients who are facing significant financial difficulties and emotional distress?

When working with clients experiencing financial difficulties and emotional distress, I prioritize the following approaches:

- Establishing a safe and compassionate space for open communication

- Actively listening to clients’ concerns and acknowledging their feelings

- Providing empathy and support while maintaining a professional demeanor

- Collaborating with clients to identify and address underlying causes of financial distress

- Referring clients to appropriate resources for mental health support or other assistance as needed

5. What are the key strategies you use to help clients improve their credit scores?

To help clients improve their credit scores, I employ a range of strategies:

- Reviewing credit reports for errors and disputing any inaccuracies

- Establishing a regular payment schedule and avoiding late payments

- Reducing credit utilization by paying down existing debts and avoiding new debt

- Building positive credit history by opening secured credit cards or obtaining small loans and making on-time payments

- Monitoring credit scores regularly and making adjustments to financial habits as needed

6. How do you assist clients in developing realistic budgeting plans that they can stick to?

When assisting clients in creating realistic budgeting plans, I follow these steps:

- Thoroughly assessing clients’ income and expenses to identify areas for improvement

- Collaborating with clients to set financial goals and priorities

- Developing customized budgets that are tailored to each client’s unique circumstances

- Providing education on budgeting principles and techniques

- Offering ongoing support and monitoring to ensure clients stay on track

7. What are the key factors to consider when evaluating a client’s eligibility for different types of housing assistance programs?

When evaluating a client’s eligibility for housing assistance programs, I consider the following factors:

- Income and financial resources

- Household size and composition

- Location and housing market conditions

- Occupancy history and rental references

- Program eligibility criteria and requirements

8. How do you stay up-to-date on the latest changes and regulations affecting consumer credit and housing counseling?

To stay abreast of industry advancements and regulatory changes, I engage in the following practices:

- Attending industry conferences and workshops

- Reading professional publications and online resources

- Participating in professional development courses

- Consulting with colleagues and mentors

- Monitoring government agencies and industry associations for updates

9. How do you handle situations where clients are resistant to your advice or recommendations?

When faced with client resistance, I approach the situation with sensitivity and professionalism:

- Actively listening to the client’s concerns and reasons for resistance

- Emphasizing the benefits and potential positive outcomes of following the recommendations

- Exploring alternative solutions or modifications that may be more acceptable

- Providing additional information and resources to support my recommendations

- Respecting the client’s decision-making process, even if I do not agree with their choices

10. How do you measure the effectiveness of your counseling services?

I evaluate the effectiveness of my counseling services through the following metrics:

- Client satisfaction surveys

- Improvements in clients’ financial behaviors and outcomes

- Feedback from referral sources and community partners

- Tracking clients’ progress in meeting their financial goals

- Continuous self-assessment and reflection on my counseling practices

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Certified Consumer Credit and Housing Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Certified Consumer Credit and Housing Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Certified Consumer Credit and Housing Counselors provide assistance to individuals and families with financial counseling and budgeting. They help clients understand and manage their personal finances, and provide guidance on a variety of financial topics including credit management, debt reduction, and homeownership.

1. Provide Financial Counseling and Education

Counselors assess clients’ financial situations, analyze their spending habits, and develop personalized strategies to help them manage their finances. They also provide education on topics such as budgeting, credit repair, debt management, and saving for retirement.

- Conduct financial counseling sessions with individuals and families.

- Develop and implement financial management plans.

2. Assist with Credit Management

Counselors help clients improve their credit scores and manage their credit effectively. They provide guidance on how to obtain and use credit, and negotiate with creditors to reduce debts and improve credit terms.

- Review and analyze clients’ credit reports.

- Develop and implement strategies to improve credit scores.

3. Provide Housing Counseling

Counselors assist clients with a variety of housing issues, including renting, buying, and foreclosure prevention. They provide information on affordable housing programs and help clients navigate the mortgage process.

- Provide guidance on renting, buying, and refinancing homes.

- Assist clients with foreclosure prevention and loss mitigation.

4. Conduct Community Outreach and Education

Counselors engage in community outreach and education initiatives to promote financial literacy and homeownership. They provide workshops, presentations, and materials on financial management and housing issues.

- Develop and conduct financial education workshops and presentations.

- Create and distribute educational materials on financial management and housing issues.

Interview Tips

Preparing for an interview can be a daunting task, but following these tips will increase your chances of success.

1. Research the Organization

Before your interview, take some time to research the organization you’re applying to. This will help you understand their mission, values, and the specific role you’re interviewing for.

- Visit the organization’s website and social media pages.

- Read news articles and blog posts about the organization.

2. Practice Your Answers

Come prepared to answer common interview questions. Practice your answers out loud so that you can deliver them confidently and concisely. Some common questions include:

- Tell me about yourself.

- Why are you interested in this position?

- What are your strengths and weaknesses?

- Why should we hire you?

3. Dress Professionally

First impressions matter, so make sure to dress professionally for your interview. This means wearing clean, pressed clothing that is appropriate for the office environment.

- Wear a suit or business casual attire.

- Make sure your clothes fit well and that you’re comfortable wearing them.

4. Be Punctual

Punctuality shows that you respect the interviewer’s time. Plan to arrive at the interview location 10-15 minutes early so that you have time to check in and prepare yourself.

- Factor in travel time and potential delays.

- If you’re running late, call or email the interviewer to let them know.

5. Follow Up

After your interview, send a thank-you note to the interviewer. This is a great way to express your appreciation for their time and reiterate your interest in the position.

- Send a thank-you note within 24 hours of the interview.

- Proofread your note before sending it.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Certified Consumer Credit and Housing Counselor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!