Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Certified Personal Finance Counselor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

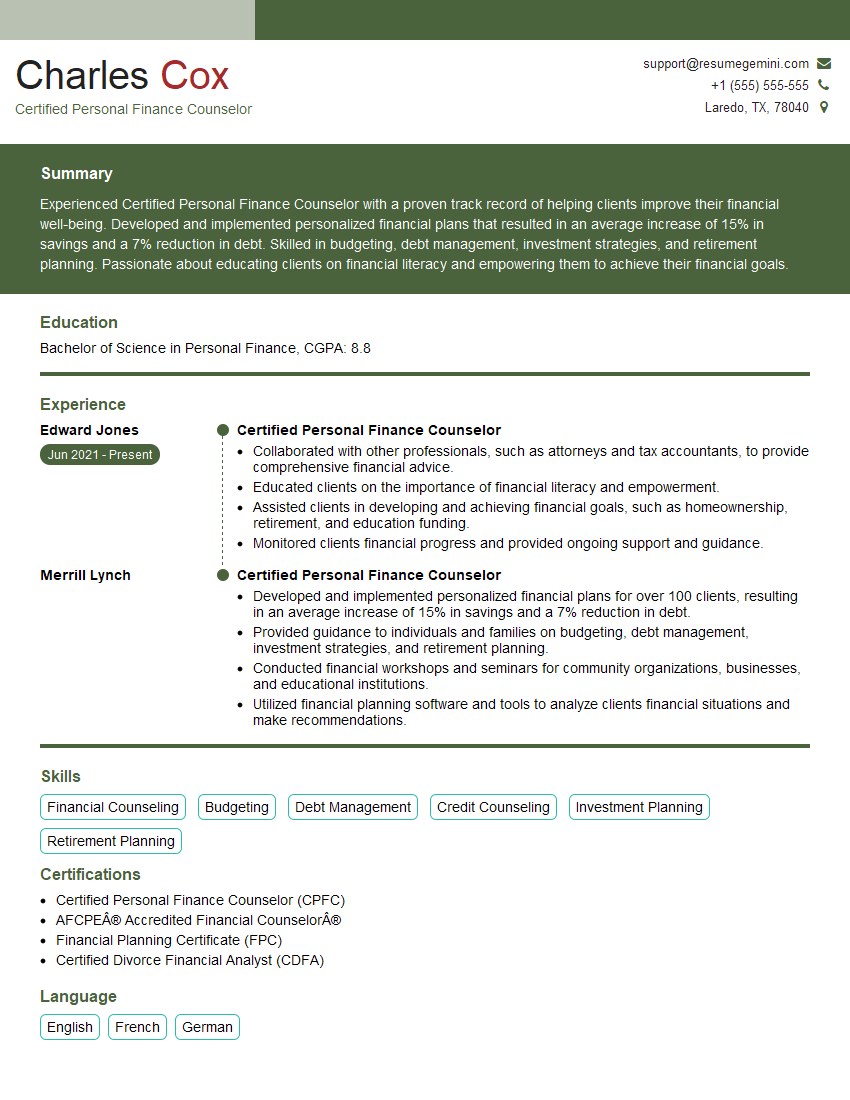

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Certified Personal Finance Counselor

1. How would you prioritize multiple financial goals for a client with limited resources?

To prioritize multiple financial goals for a client with limited resources, I would take the following steps:

- Gather information about the client’s financial situation, including income, expenses, assets, and debts.

- Identify the client’s financial goals and prioritize them based on their importance and urgency.

- Develop a financial plan that outlines how the client can achieve their goals while staying within their budget.

- Monitor the client’s progress and make adjustments to the plan as needed.

2. What is your experience in developing and implementing financial plans?

Methodologies Used:

- Cash flow analysis

- Net worth analysis

- Debt management

- Risk assessment

- Insurance analysis

Implementation:

- Develop a budget

- Create a savings plan

- Consolidate or refinance debt

- Adjust investment portfolio

- Purchase insurance

3. How do you stay up-to-date on changes in tax laws and regulations?

I stay up-to-date on changes in tax laws and regulations by:

- Reading tax publications and attending webinars.

- Consulting with tax professionals.

- Taking continuing education courses.

4. What is your understanding of the ethical principles that govern the practice of personal finance counseling?

The ethical principles that govern the practice of personal finance counseling include:

- Confidentiality

- Competence

- Objectivity

- Integrity

- Fairness

5. How do you build rapport with clients?

I build rapport with clients by:

- Being empathetic and understanding their needs.

- Actively listening to their concerns.

- Providing clear and concise explanations.

- Being patient and supportive.

6. What is your approach to working with clients who are in financial crisis?

My approach to working with clients who are in financial crisis includes:

- Assessing the client’s financial situation and identifying the root causes of the crisis.

- Developing a plan to help the client stabilize their financial situation.

- Providing emotional support and guidance.

- Referring the client to other professionals, such as credit counselors or attorneys, if needed.

7. What are some of the challenges that you have faced in your work as a personal finance counselor?

Some of the challenges that I have faced in my work as a personal finance counselor include:

- Working with clients who are resistant to change.

- Helping clients to overcome emotional barriers to financial success.

- Staying up-to-date on changes in tax laws and regulations.

- Balancing the need to provide sound financial advice with the need to be sensitive to the client’s feelings.

8. What are your strengths and weaknesses as a personal finance counselor?

Strengths:

- Strong analytical and problem-solving skills.

- Excellent communication and interpersonal skills.

- Up-to-date on changes in tax laws and regulations.

- Committed to helping clients achieve their financial goals.

Weaknesses:

- I am still relatively new to the field of personal finance counseling.

- I can sometimes be too detail-oriented.

9. What are your career goals?

My career goal is to become a Certified Financial Planner™ (CFP®) and to open my own personal finance counseling practice.

10. Why are you interested in working for our company?

I am interested in working for your company because I am impressed with your commitment to providing high-quality financial planning services to your clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Certified Personal Finance Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Certified Personal Finance Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Certified Personal Finance Counselors (CPFCs) are finance experts who provide guidance and support to individuals seeking to manage their finances more effectively. Their primary responsibilities include:

1. Financial Planning

CPFCs develop comprehensive financial plans for clients, considering factors such as income, expenses, investments, retirement goals, and estate planning.

- Analyze financial situations.

- Establish financial goals.

2. Budgeting and Debt Management

They assist clients in creating and adhering to budgets, managing debt, and improving cash flow.

- Create personalized budgets.

- Develop strategies for debt repayment.

3. Investment and Retirement Planning

CPFCs provide advice on investment options, asset allocation, and retirement savings strategies.

- Recommend investment portfolios.

- Assist with retirement planning.

4. Insurance and Tax Planning

They assess clients’ insurance needs and make recommendations, while also considering tax implications of financial decisions.

- Review insurance coverage.

- Provide tax planning advice.

5. Financial Education

CPFCs educate clients on various financial topics, empowering them to make informed decisions.

- Conduct financial workshops.

- Provide personalized financial counseling.

Interview Tips

To excel in a CPFC interview, preparation is key. Here are some tips to help you succeed:

1. Research the Company and Industry

Familiarize yourself with the organization’s mission, values, and services. Demonstrate your knowledge of current financial trends and industry best practices.

- Visit the company website and social media pages.

- Read industry publications and attend webinars.

2. Quantify Your Experience and Skills

Use specific examples and data points to highlight your accomplishments. Quantify your results whenever possible to showcase your impact.

- Example: “I developed a financial plan that resulted in a 15% increase in a client’s savings over a two-year period.”

- Example: “I managed a portfolio of $5 million in assets, achieving an average annual return of 10%.”

3. Demonstrate Your Ethics and Compliance

CPFCs are bound by ethical guidelines and must adhere to regulatory compliance. Emphasize your commitment to integrity and professionalism.

- Example: “I maintain an up-to-date knowledge of the Code of Ethics for Personal Financial Planners.”

- Example: “I have successfully completed multiple continuing education courses in financial planning and compliance.”

4. Practice Your Responses

Prepare for common interview questions by practicing your responses. This will build your confidence and help you articulate your thoughts clearly.

- Example: “Tell me about your experience in financial planning.”

- Example: “What are your strengths and weaknesses as a financial advisor?”

5. Ask Thoughtful Questions

Asking insightful questions at the end of the interview demonstrates your interest and engagement. It also provides an opportunity to learn more about the role and organization.

- Example: “What are the key performance indicators for this position?”

- Example: “Can you describe the company’s culture and how it supports financial advisors?”

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Certified Personal Finance Counselor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!