Ever felt underprepared for that crucial job interview? Or perhaps you’ve landed the interview but struggled to articulate your skills and experiences effectively? Fear not! We’ve got you covered. In this blog post, we’re diving deep into the Debt Management Counselor interview questions that you’re most likely to encounter. But that’s not all. We’ll also provide expert insights into the key responsibilities of a Debt Management Counselor so you can tailor your answers to impress potential employers.

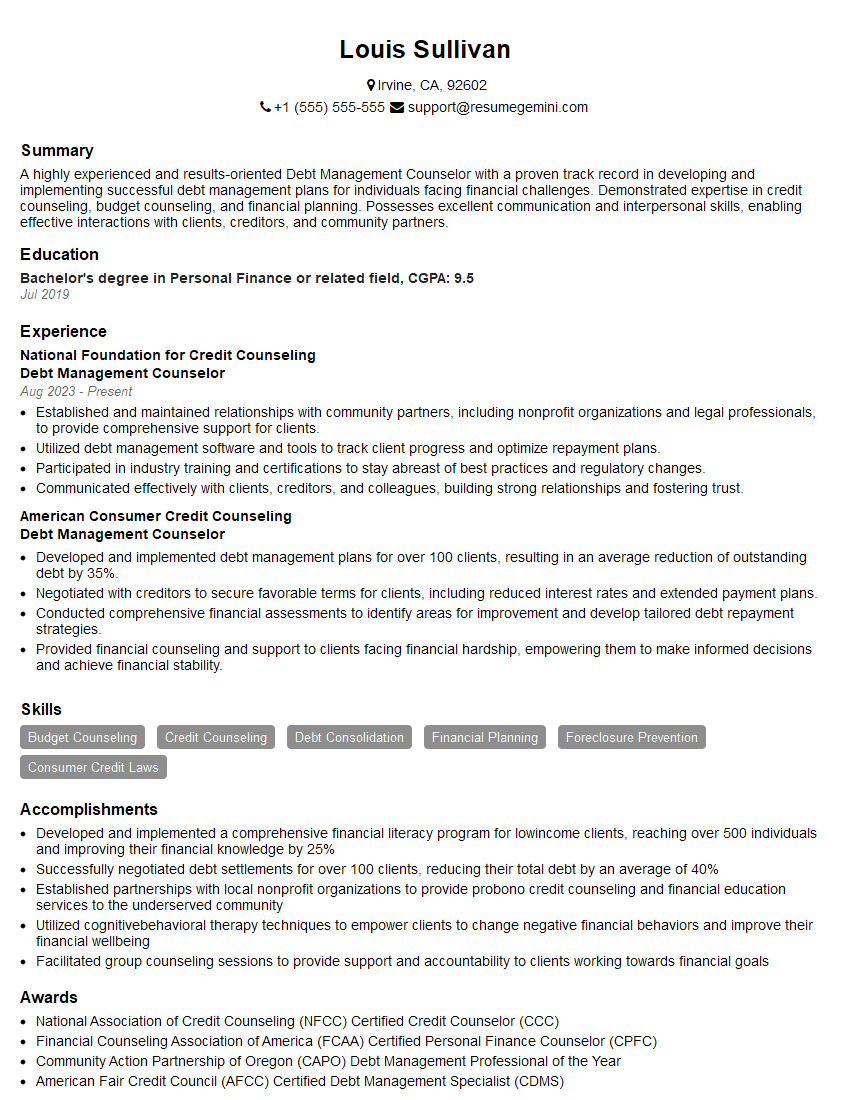

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Debt Management Counselor

1. How do you determine if a client is eligible for debt management services?

In order to qualify for debt management services, clients must meet certain criteria which include but are not limited to:

- Having consumer debts

- Having difficulty repaying their debts

- Having a sufficient income to make monthly payments

- Being willing to work with a credit counselor to develop a debt management plan

2. What are the key steps involved in developing a debt management plan?

Step 1: Assessment

- Review the client’s financial situation

- Assess the client’s needs and goals

- Determine the client’s eligibility for debt management services

Step 2: Plan Development

- Negotiate with creditors to reduce interest rates and monthly payments

- Develop a budget that the client can afford

- Set up a payment schedule

Step 3: Plan Implementation

- Make monthly payments to creditors

- Track progress and make adjustments as needed

- Provide ongoing support and counseling to the client

3. How do you handle clients who are struggling to make their payments?

- Review the client’s budget to identify areas where they can cut expenses

- Negotiate with creditors to reduce monthly payments or extend due dates

- Provide additional financial counseling and support

- Explore alternative debt relief options, such as debt consolidation or bankruptcy

4. How do you stay up-to-date on the latest changes in debt management laws and regulations?

- Attend industry conferences and workshops

- Read trade publications and online resources

- Consult with legal and financial experts

5. What are the ethical considerations that you must take into account when providing debt management services?

- Maintain confidentiality of client information

- Avoid conflicts of interest

- Provide objective and unbiased advice

- Act in the best interests of the client

6. What are the common challenges that you face in your work as a debt management counselor?

- Clients who are resistant to change

- Clients who are struggling to make their payments

- Creditors who are unwilling to negotiate

- Changes in debt management laws and regulations

7. What are the rewards that you find in your work as a debt management counselor?

- Helping people get out of debt and improve their financial situation

- Making a positive impact on the lives of others

- Working in a challenging and rewarding field

8. What is your experience in working with clients from diverse backgrounds?

I have experience working with clients from a wide range of backgrounds, including different cultures, ethnicities, and socioeconomic statuses. I am able to relate to clients from all walks of life and understand their unique financial needs and challenges.

9. How do you build rapport with clients and gain their trust?

I build rapport with clients by being empathetic, understanding, and non-judgmental. I take the time to listen to their concerns and understand their financial situation. I am also honest and transparent with clients about their options and the potential risks and benefits of debt management. I believe that trust is essential in the client-counselor relationship and I work hard to earn the trust of my clients.

10. What are your thoughts on the future of debt management services?

I believe that debt management services will continue to be in high demand in the future. As the cost of living continues to rise and wages stagnate, more and more people are struggling to make ends meet. I also believe that the increasing complexity of the financial system will make it more difficult for people to manage their debt on their own. Debt management counselors can provide valuable guidance and support to people who are struggling with debt and help them achieve their financial goals.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Debt Management Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Debt Management Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Debt Management Counselor provides guidance and support to individuals and families who are struggling with debt. The key job responsibilities include:1. Counseling and Education

Assessing clients’ financial situations and identifying the root causes of their debt.

Developing personalized debt management plans tailored to clients’ needs and goals.

Providing education on financial literacy, budgeting, and credit management.

2. Negotiation and Communication

Negotiating with creditors on behalf of clients to reduce interest rates, fees, and balances.

Communicating regularly with clients to monitor progress and provide updates.

Maintaining strong relationships with creditors and other stakeholders.

3. Case Management

Tracking clients’ progress and ensuring compliance with debt management plans.

Referring clients to other resources and services as needed.

Documenting and maintaining detailed case files.

4. Advocacy

Representing clients’ interests and advocating for their rights.

Challenging unfair or predatory lending practices.

Educating the public about the importance of financial responsibility.

Interview Tips

To ace an interview for a Debt Management Counselor position, consider the following tips:1. Research and Preparation

Thoroughly research the organization and the specific role.

Familiarize yourself with industry trends and best practices in debt management.

Prepare examples of your skills in counseling, negotiation, and case management.

2. Highlight Your Soft Skills

Emphasize your strong interpersonal and communication skills.

Demonstrate your ability to build rapport, establish trust, and motivate clients.

Explain how you handle challenging situations and manage stress effectively.

3. Quantify Your Accomplishments

Provide specific examples of how you have helped clients improve their financial situations.

Quantify your results whenever possible, such as reducing client debt by a certain percentage.

Use metrics to demonstrate the impact of your work.

4. Ask Thoughtful Questions

Prepare insightful questions to ask the interviewer.

This shows your interest in the role and the organization.

Inquire about the organization’s mission, team culture, and opportunities for professional development.

5. Enthusiasm and Passion

Express your genuine interest in helping individuals overcome financial challenges.

Convey your passion for financial literacy and empowering clients.

Share stories or anecdotes that demonstrate your dedication to this field.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Debt Management Counselor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!