Are you gearing up for a career in Mortgage Loan Counselor? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Mortgage Loan Counselor and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

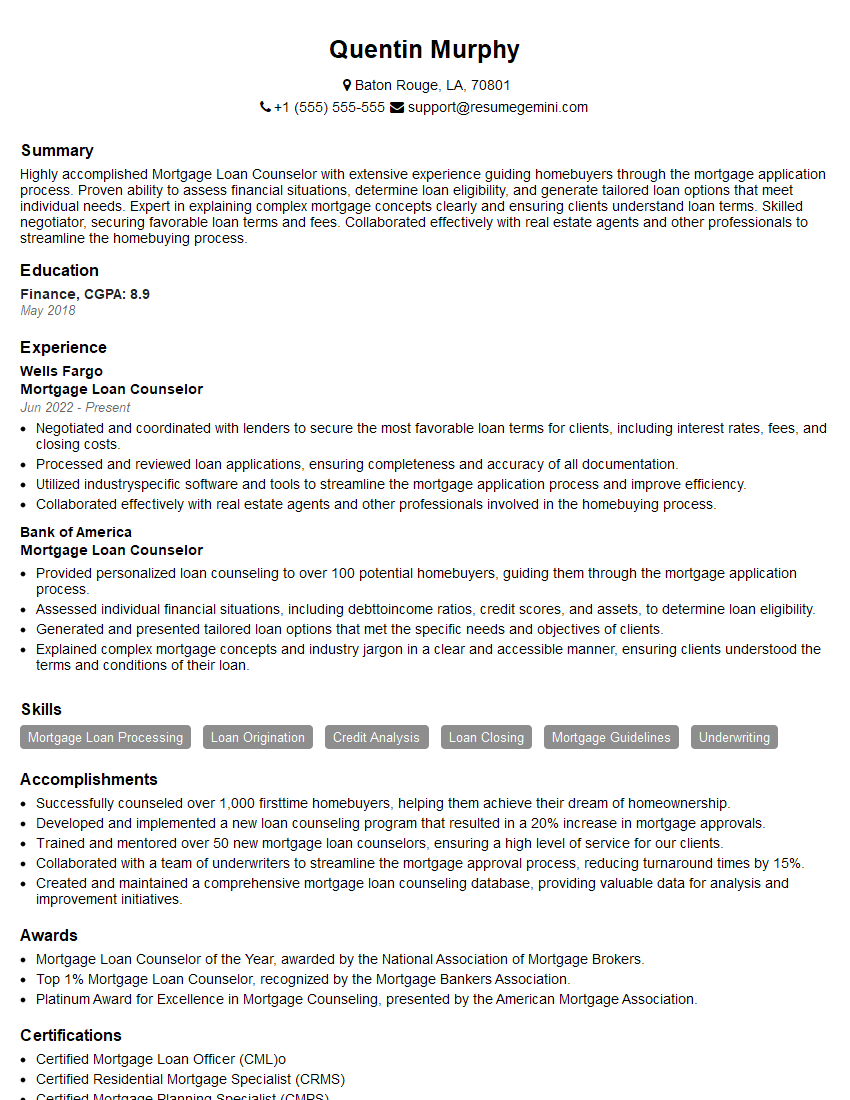

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Loan Counselor

1. Describe the process of pre-qualifying a borrower for a mortgage?

- Gather the borrower’s financial information, including income, assets, debts, and credit history.

- Calculate the borrower’s debt-to-income ratio (DTI) and determine if they meet the lender’s DTI requirements.

- Review the borrower’s credit history to assess their creditworthiness and identify any potential red flags.

- Issue a pre-qualification letter that states the maximum loan amount the borrower is likely to qualify for.

2. What are the different types of mortgage loans available?

Types of Mortgage Loans

- Conventional loans: These loans are not backed by the government and typically require a higher credit score and down payment.

- FHA loans: These loans are backed by the Federal Housing Administration and have lower credit score and down payment requirements.

- VA loans: These loans are backed by the Department of Veterans Affairs and are available to eligible veterans and active-duty military members.

- USDA loans: These loans are backed by the US Department of Agriculture and are available to borrowers in rural areas.

Factors Affecting Loan Type

- Borrower’s credit score

- Down payment amount

- Property location

- Borrower’s income and debt obligations

3. How do you determine the interest rate on a mortgage loan?

- The borrower’s credit score

- The loan amount

- The loan term

- The type of mortgage loan

- The current market interest rates

4. What are the closing costs associated with a mortgage loan?

- Loan origination fee

- Appraisal fee

- Credit report fee

- Title search fee

- Recording fee

- Attorney fee

- Homeowners insurance premium

- Property taxes

5. What are the different ways to pay off a mortgage loan early?

- Make extra payments towards the principal each month

- Round up your monthly payments to the nearest hundred dollars

- Make a lump sum payment towards the principal when you have extra money

- Refinance your mortgage into a shorter-term loan

6. What are the most common reasons for a mortgage loan to be denied?

- Insufficient income

- Poor credit history

- Too much debt

- Unstable employment

- Property value issues

7. What are the ethical responsibilities of a mortgage loan counselor?

- Providing accurate and unbiased information

- Treating all borrowers fairly and respectfully

- Protecting borrowers’ privacy

- Avoiding conflicts of interest

- Complying with all applicable laws and regulations

8. What are the challenges facing mortgage loan counselors in today’s market?

- Increasing interest rates

- Rising home prices

- Tighter lending standards

- Increased competition

- Regulatory changes

9. How do you stay up-to-date on the latest changes in the mortgage industry?

- Attending industry conferences and webinars

- Reading trade publications and articles

- Networking with other professionals

- Taking continuing education courses

10. What is your favorite part about being a mortgage loan counselor?

- Helping people achieve their dream of homeownership

- Providing financial guidance and education

- Building relationships with clients

- Making a difference in the lives of others

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Loan Counselor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Loan Counselor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Mortgage Loan Counselor plays a crucial role in guiding individuals through the complex process of obtaining a mortgage. Key responsibilities include:1. Client Consultation

Meet with potential borrowers to assess their financial situation, determine their mortgage needs, and provide personalized loan recommendations.

- Gather financial information, including income, expenses, assets, and debts.

- Analyze credit history, calculate debt-to-income ratios, and determine loan eligibility.

2. Loan Processing

Assist with the loan application process by gathering necessary documentation, verifying information, and coordinating with underwriters.

- Review and prepare loan applications, ensuring accuracy and completeness.

- Obtain and verify documentation, such as pay stubs, bank statements, and tax returns.

3. Loan Education

Provide clear and comprehensive information about mortgage products, loan terms, interest rates, and closing costs.

- Explain different mortgage types, such as FHA, VA, and conventional loans.

- Discuss loan features, including fixed and adjustable rates, loan terms, and down payment requirements.

4. Customer Service

Establish and maintain positive relationships with clients throughout the mortgage process, addressing their questions and concerns.

- Respond promptly to inquiries, providing clear and accurate information.

- Resolve any issues or concerns that may arise during the loan process.

Interview Preparation Tips

To ace an interview for a Mortgage Loan Counselor position, it is crucial to:1. Research the Company and Position

Thoroughly research the company’s history, mission, values, and current mortgage offerings. Familiarize yourself with the specific job description and key responsibilities.

- Visit the company’s website, read industry news, and connect with employees on LinkedIn.

- Identify the specific skills and qualifications required for the position.

2. Prepare for Technical Questions

Expect questions related to mortgage products, loan processing, and financial analysis. Practice answering questions about different mortgage types, loan terms, and the impact of credit score on loan eligibility.

- Review common mortgage lending scenarios and be prepared to provide detailed explanations.

- Stay updated on industry trends and regulations.

3. Highlight Customer Service Skills

Emphasize your strong communication, interpersonal, and customer service skills. Share examples of how you have effectively interacted with clients and resolved their concerns.

- Use the STAR method (Situation, Task, Action, Result) to describe specific instances where you provided excellent customer service.

- Demonstrate your ability to build rapport, listen attentively, and address concerns professionally.

4. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview shows your genuine interest in the position and the company. Prepare questions related to the company’s culture, growth opportunities, and training programs.

- Avoid generic questions. Ask for specific details about the company’s values, onboarding process, and commitment to professional development.

- Questions could include: “What sets your company apart in the mortgage industry?” or “What opportunities are available for professional growth and advancement?”

5. Be Enthusiastic and Confident

Approach the interview with a positive and enthusiastic attitude. Demonstrate your passion for helping clients achieve their homeownership dreams.

- Maintain eye contact, speak clearly, and project a professional demeanor.

- Share your personal experiences or motivations for pursuing a career in mortgage lending.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mortgage Loan Counselor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!