Feeling lost in a sea of interview questions? Landed that dream interview for Business Banking Officer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Business Banking Officer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

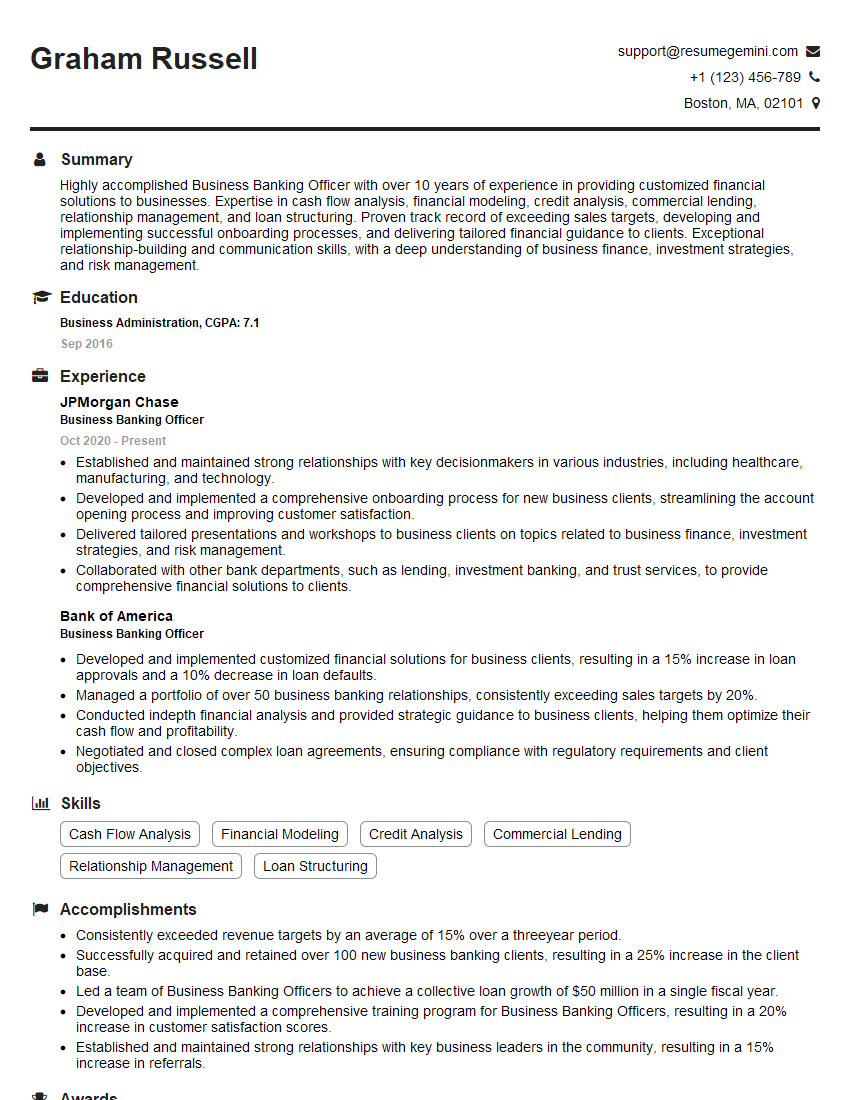

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Business Banking Officer

1. What is the role of a Business Banking Officer?

As a Business Banking Officer, I will be responsible for:

- Developing and maintaining relationships with business clients, understanding their financial needs, and providing tailored solutions

- Analyzing and structuring commercial loans, lines of credit, and other financial products

- Managing a portfolio of clients, ensuring their satisfaction and business growth

- Providing financial advice and guidance to business clients on various matters, such as cash flow management, budgeting, and investment strategies

- Staying up-to-date on industry trends and best practices in business banking

2. What are the key skills and qualifications required for this role?

The key skills and qualifications required for a Business Banking Officer include:

Technical Skills:

- Strong understanding of commercial banking principles and practices

- Proficiency in financial analysis, credit underwriting, and loan structuring

- Excellent communication and interpersonal skills

- Ability to build and maintain strong relationships with clients

- Knowledge of industry best practices and regulatory compliance

Qualifications:

- Bachelor’s degree in Finance, Economics, Business, or a related field

- Previous experience in business banking or a related role

- Certifications such as the Certified Business Banker (CBB) or Certified Treasury Professional (CTP) are preferred

3. How do you assess a business’s financial health and creditworthiness?

To assess a business’s financial health and creditworthiness, I follow a comprehensive approach that involves:

- Reviewing financial statements (balance sheet, income statement, cash flow statement)

- Analyzing key financial ratios and metrics

- Assessing the business’s industry, market position, and competitive landscape

- Evaluating the management team’s experience and track record

- Conducting due diligence on the business’s operations and financial history

- Consulting with industry experts and credit bureaus as needed

4. What is your process for structuring and negotiating commercial loans?

My process for structuring and negotiating commercial loans involves:

- Meeting with the client to understand their business and financial needs

- Analyzing the client’s financial health and creditworthiness

- Developing a loan proposal that outlines the loan terms, including the amount, interest rate, repayment schedule, and collateral

- Negotiating the loan terms with the client and obtaining their approval

- Preparing and executing the loan documentation

5. How do you manage a portfolio of business clients?

I manage a portfolio of business clients by:

- Maintaining regular communication with clients to understand their changing needs and provide ongoing support

- Monitoring clients’ financial performance and providing early warning of any potential issues

- Proactively identifying opportunities for additional business or cross-selling products and services

- Conducting regular portfolio reviews to assess performance and identify areas for improvement

6. What is your understanding of industry regulations and compliance?

As a Business Banking Officer, I am responsible for adhering to various industry regulations and compliance requirements, including:

- The Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) laws

- The Truth in Lending Act (TILA)

- The Equal Credit Opportunity Act (ECOA)

- The Fair Credit Reporting Act (FCRA)

- The Dodd-Frank Wall Street Reform and Consumer Protection Act

7. How do you stay up-to-date on industry trends and best practices?

To stay up-to-date on industry trends and best practices, I:

- Attend industry conferences and webinars

- Read trade publications and research reports

- Network with other professionals in the field

- Pursue professional development opportunities, such as certifications and training programs

8. What is your experience with using technology in business banking?

I am proficient in using various technologies in business banking, including:

- Customer Relationship Management (CRM) systems

- Loan origination and underwriting software

- Financial analysis tools

- Online banking platforms

- Data visualization and reporting tools

9. What is your sales and marketing approach?

My sales and marketing approach in business banking involves:

- Identifying and targeting potential clients

- Developing and implementing marketing campaigns

- Networking and attending industry events

- Providing value-added content and thought leadership

- Building strong relationships with key decision-makers

- Tracking and measuring marketing and sales results

10. What is your understanding of the current economic climate and its impact on business banking?

The current economic climate is characterized by:

- Rising interest rates

- Inflation

- Supply chain disruptions

- Labor shortages

- Global economic uncertainty

These factors can impact business banking in several ways, including:

- Increased demand for loans and lines of credit

- Greater emphasis on risk management and credit quality

- Need for tailored financial solutions to address specific challenges

- Importance of providing advisory services and guidance to clients

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Business Banking Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Business Banking Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Business Banking Officers are responsible for managing and developing relationships with business clients, providing financial advice and services, and generating new business.

1. Client Relationship Management

Building and maintaining relationships with business clients by providing personalized service and support.

- Meeting with clients to discuss their financial needs and goals.

- Developing and implementing financial solutions that meet client objectives.

2. Financial Analysis and Advisory Services

Providing financial analysis and advice to clients on a range of topics, including:

- Cash flow management.

- Debt financing.

- Investment strategies.

3. Business Development

Generating new business leads and developing opportunities to expand the bank’s client base.

- Attending industry events and networking with potential clients.

- Cold calling and emailing prospective clients.

- Developing and implementing marketing campaigns to attract new clients.

4. Collaboration

Working with other departments within the bank, such as credit analysts and portfolio managers, to ensure that clients receive the best possible service and support.

- Coordinating with credit analysts to review loan applications and make recommendations on loan approvals.

- Working with portfolio managers to develop investment strategies for clients.

Interview Tips

Preparing thoroughly for a Business Banking Officer interview is crucial to demonstrate your skills and impress the hiring manager. Here are a few tips to help you ace the interview:

1. Research the Bank and the Position

Before the interview, take the time to research the bank’s website to learn about their products, services, and culture. This will help you understand the bank’s business and how your skills and experience align with their needs.

- Visit the bank’s website to learn about their products, services, and culture.

- Check out the bank’s LinkedIn page to see what their employees are saying about the company.

- Read industry news and articles to stay up-to-date on the latest trends in business banking.

2. Practice Your Answers to Common Interview Questions

There are a few common interview questions that you can expect to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It is helpful to prepare your answers to these questions ahead of time so that you can deliver them confidently and concisely.

- Use the STAR method to answer interview questions. STAR stands for Situation, Task, Action, Result. When answering a question using the STAR method, start by describing the situation you were in, then the task you had to complete, the actions you took, and the results you achieved.

- For example, if you are asked “Tell me about a time you had to overcome a challenge,” you could use the STAR method to answer as follows:

- Situation: “When I was working as a Business Banking Officer at my previous bank, one of my clients was experiencing financial difficulties. The client had a large loan balance and was struggling to make their payments.

- Task: “My task was to work with the client to develop a plan to help them get back on track and avoid defaulting on their loan.

- Action: “I met with the client multiple times to discuss their financial situation and develop a plan. The plan included reducing the client’s interest rate, extending the loan term, and providing them with additional resources to help them manage their finances.

- Result: “As a result of my efforts, the client was able to get back on track and avoid defaulting on their loan. The client was also very grateful for the help and support that I provided them.

3. Be Enthusiastic and Professional

Throughout the interview, be enthusiastic and professional. Dress appropriately, arrive on time, and maintain eye contact when you are speaking. Be sure to thank the interviewer for their time at the end of the interview.

- Make sure to dress professionally for the interview. This means wearing a suit or business casual attire. You should also make sure that your clothes are clean and wrinkle-free.

- Arrive on time for the interview. This shows that you are respectful of the interviewer’s time.

- Maintain eye contact when you are speaking. This shows that you are engaged in the conversation and that you are confident in what you are saying.

- Be sure to thank the interviewer for their time at the end of the interview. This shows that you are appreciative of their time and that you are interested in the position.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Business Banking Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!