Feeling lost in a sea of interview questions? Landed that dream interview for Commercial Loan Officer but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Commercial Loan Officer interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

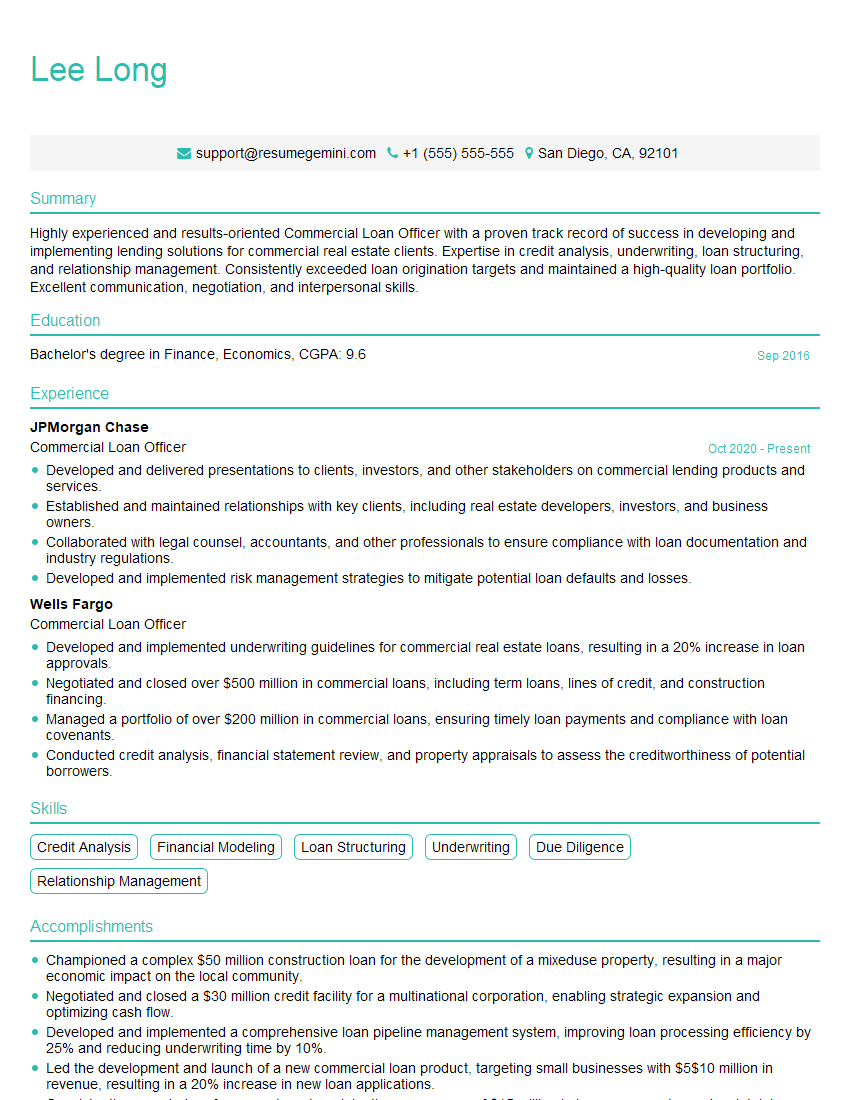

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Commercial Loan Officer

1. What are the key financial ratios you analyze when underwriting a commercial loan?

- Debt-to-income ratio: This measures the borrower’s ability to repay the loan based on their income and existing debt obligations.

- Debt-to-equity ratio: This measures the borrower’s leverage, or the amount of debt they have relative to their equity in the business.

- Interest coverage ratio: This measures the borrower’s ability to generate enough cash flow to cover their interest payments.

- Current ratio: This measures the borrower’s ability to meet their short-term obligations.

- Quick ratio: This measures the borrower’s ability to meet their short-term obligations with their most liquid assets.

2. How do you assess the creditworthiness of a potential borrower?

Factors Considered

- Financial history: This includes the borrower’s credit score, payment history, and any bankruptcies or foreclosures.

- Business experience: This includes the borrower’s experience in the industry, their management team, and their track record of success.

- Collateral: This includes the assets that the borrower is offering as security for the loan.

- Personal guarantee: This is a guarantee from the borrower’s personal assets, which can increase the lender’s confidence in the loan.

Methods Used

- Credit analysis: This involves reviewing the borrower’s financial statements and other financial information.

- Site visit: This involves visiting the borrower’s business to assess their operations and meet with their management team.

- Reference checks: This involves contacting the borrower’s references to get their feedback on the borrower’s character and creditworthiness.

3. What are the different types of commercial loans available?

- Term loans: These loans are typically used to finance the purchase of equipment, real estate, or other assets.

- Lines of credit: These loans allow borrowers to access a pool of money up to a certain limit.

- Commercial mortgages: These loans are used to finance the purchase or construction of commercial real estate.

- Equipment loans: These loans are used to finance the purchase of equipment.

- Invoice financing: These loans are used to finance the accounts receivable of a business.

4. What are the key factors that affect the interest rate on a commercial loan?

- The borrower’s creditworthiness: Borrowers with good credit scores and a history of timely payments will typically qualify for lower interest rates.

- The loan amount: Larger loans typically have lower interest rates than smaller loans.

- The loan term: Longer loan terms typically have higher interest rates than shorter loan terms.

- The collateral: Loans that are secured by collateral typically have lower interest rates than unsecured loans.

- The current interest rate environment: Interest rates fluctuate over time, and the current interest rate environment will affect the interest rate on a commercial loan.

5. What are the ethical considerations that you must keep in mind when working as a commercial loan officer?

- Confidentiality: Commercial loan officers must maintain the confidentiality of their clients’ financial information.

- Fair lending: Commercial loan officers must treat all borrowers fairly and equally, regardless of their race, gender, religion, or other protected characteristics.

- Conflicts of interest: Commercial loan officers must avoid conflicts of interest, such as lending money to friends or family members.

- Transparency: Commercial loan officers must be transparent with their clients about the terms of their loans.

- Professionalism: Commercial loan officers must conduct themselves in a professional and ethical manner at all times.

6. What are the challenges that you face in your role as a commercial loan officer?

- The ever-changing regulatory environment: Commercial loan officers must stay up-to-date on the latest regulations affecting their industry.

- The competitive lending landscape: Commercial loan officers must compete with other lenders for borrowers’ business.

- The need to balance risk and reward: Commercial loan officers must carefully balance the risk of lending money to borrowers with the potential reward of earning interest income.

- The pressure to meet sales targets: Commercial loan officers may be under pressure to meet sales targets, which can lead to them making poor lending decisions.

- The long hours and demanding workload: Commercial loan officers often work long hours and have a demanding workload.

7. What are the rewards that you find in your role as a commercial loan officer?

- The opportunity to help businesses grow and succeed: Commercial loan officers can help businesses grow and succeed by providing them with the financing they need to expand their operations, purchase equipment, or hire new employees.

- The challenge of working in a complex and ever-changing industry: Commercial loan officers are constantly challenged to stay up-to-date on the latest regulations and trends affecting their industry.

- The opportunity to build strong relationships with clients and colleagues: Commercial loan officers work closely with their clients and colleagues, and they have the opportunity to build strong relationships with them.

- The potential for a high income: Commercial loan officers can earn a high income, especially if they are successful in generating new business.

- The job security that comes with working in a regulated industry: Commercial loan officers work in a regulated industry, which provides them with a degree of job security.

8. What are your goals for your career as a commercial loan officer?

- To become a top producer in my field:

- To develop a reputation for excellence in customer service:

- To build a strong network of clients and colleagues:

- To stay up-to-date on the latest regulations and trends affecting my industry:

- To eventually move into a leadership role in my company:

9. Why are you interested in working for our company?

- Your company is a leader in the commercial lending industry

- Your company has a reputation for providing excellent customer service

- Your company offers a competitive compensation and benefits package

- Your company is located in a convenient location

- Your company has a positive work culture

10. Do you have any questions for me?

- What is the average loan size that your commercial loan officers originate?

- What is the typical approval time for a commercial loan application?

- What are the most common reasons for commercial loan applications to be denied?

- What are the opportunities for professional development within your company?

- What is the company culture like?

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Commercial Loan Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Commercial Loan Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of Commercial Loan Officer

Commercial Loan Officers play a pivotal role in assessing, structuring, and managing commercial loan portfolios. Key job responsibilities include:

1. Loan Origination

- Prospect and secure potential borrowers for commercial loans

- Collect and analyze financial data to assess creditworthiness and risk

- Determine loan terms (amount, rate, maturity, covenants)

2. Loan Structuring

- Design loan products that meet the specific needs of borrowers

- Negotiate loan terms and covenants with borrowers

- Ensure compliance with bank policies and regulations

3. Loan Portfolio Management

- Monitor loan performance and identify potential risks

- Manage loan documentation and ensure compliance

- Communicate with borrowers on ongoing loan status and progress

4. Risk Management

- Assess and mitigate credit risks associated with commercial loans

- Conduct due diligence and review loan collateral

- Implement strategies to manage loan concentrations

Interview Tips for Commercial Loan Officer

To ace the interview for a Commercial Loan Officer position, candidates should focus on demonstrating their technical expertise, analytical skills, and relationship-building abilities.

1. Research the Company and Industry

- Study the bank’s website, financial reports, and news articles.

- Understand the industry trends and competitive landscape.

2. Highlight Relevant Experience

- Quantify your accomplishments in loan origination, structuring, and management.

- Provide specific examples of complex loans or risk assessment strategies you’ve handled.

3. Demonstrate Credit Analysis Skills

- Explain your approach to credit analysis and risk assessment.

- Discuss your experience in evaluating financial statements, cash flow projections, and other financial data.

4. Emphasize Customer Service and Relationship Management

- Highlight your ability to build and maintain strong relationships with borrowers and other stakeholders.

- Share examples of how you communicate effectively and resolve client concerns.

5. Discuss Industry Knowledge and Trends

- Show your understanding of current industry trends and regulatory changes.

- Discuss how you stay up-to-date with industry best practices.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Commercial Loan Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!