Are you gearing up for a career in Home Lending Officer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Home Lending Officer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

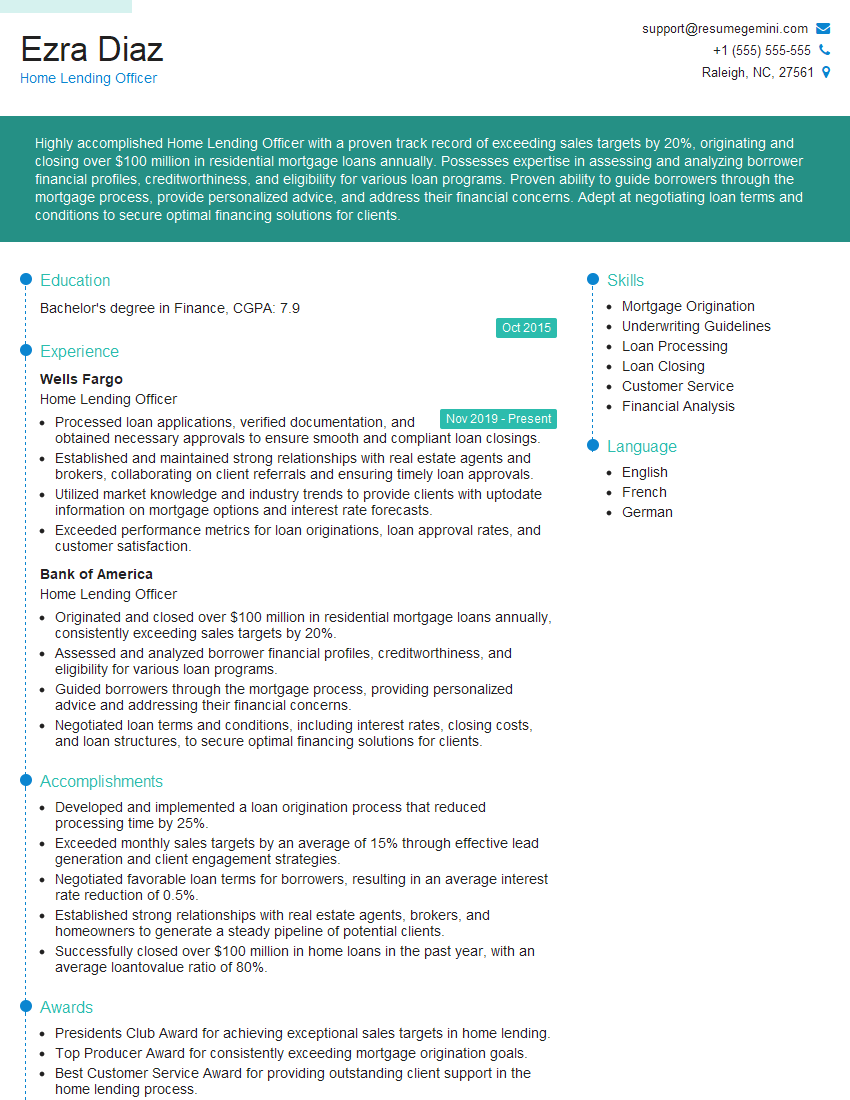

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Home Lending Officer

1. Explain the process of underwriting a mortgage loan application.

Sample Answer

- Begin by reviewing the applicant’s credit report, income, and assets to assess their financial standing and risk profile.

- Analyze the property’s value and marketability through an appraisal or broker price opinion (BPO).

- Evaluate the loan-to-value (LTV) ratio, debt-to-income (DTI) ratio, and other key metrics to determine the applicant’s ability to repay the loan.

- Verify the applicant’s income and employment status, typically through pay stubs and W-2 forms.

- Review the title search to ensure that the property has a clear title and is free from liens or encumbrances.

- Make a final decision on whether to approve or deny the loan based on the underwriting guidelines and policies set by the lender.

2. Describe the different types of mortgage loans and their key features.

Conventional Loans

- Backed by Fannie Mae or Freddie Mac

- Typically require higher credit scores and down payments

FHA Loans

- Backed by the Federal Housing Administration (FHA)

- Allow for lower credit scores and down payments

- Require mortgage insurance premiums (MIPs)

VA Loans

- Backed by the Department of Veterans Affairs (VA)

- Available to eligible veterans and active-duty military members

- Do not require down payments or mortgage insurance

USDA Loans

- Backed by the U.S. Department of Agriculture (USDA)

- Designed for low- to moderate-income borrowers in rural areas

- Typically have no down payment requirement and flexible underwriting criteria

3. What are the key factors that influence a borrower’s eligibility for a mortgage?

- Credit score

- Debt-to-income ratio

- Loan-to-value ratio

- Employment history and income

- Property type and location

- Loan program requirements

4. Explain the process of closing a mortgage loan.

Sample Answer

- Review the final loan documents with the borrower and ensure they understand the terms and conditions.

- Receive the signed loan documents from the borrower and submit them to the lender for final approval.

- Coordinate with the title company to ensure that the property title is clear and that the necessary closing costs are paid.

- Attend the closing meeting with the borrower, where they will sign the final loan documents and receive the keys to the property.

- Submit the signed loan documents to the lender and receive the loan proceeds.

- Follow up with the borrower after closing to ensure that they are satisfied and to answer any questions.

5. What are the ethical and legal responsibilities of a Home Lending Officer?

- Maintain confidentiality of borrower information

- Provide accurate and transparent loan information

- Avoid conflicts of interest

- Comply with all applicable laws and regulations

- Act in the best interests of the borrower

- Uphold industry standards and best practices

6. Describe your experience in working with different types of borrowers.

Sample Answer

- Assisted first-time homebuyers with navigating the mortgage process and identifying loan options that met their needs.

- Worked with experienced investors to secure financing for multiple properties and portfolio loans.

- Provided guidance to self-employed borrowers and helped them demonstrate their income and financial stability.

- Collaborated with real estate agents and builders to provide mortgage solutions for their clients.

7. What is your approach to providing customer service to borrowers?

Sample Answer

- Establish clear communication channels and respond promptly to inquiries.

- Provide personalized and tailored mortgage solutions that meet each borrower’s unique needs.

- Educate borrowers about the mortgage process and empower them to make informed decisions.

- Foster long-term relationships with borrowers and provide ongoing support throughout their homeownership journey.

8. How do you stay up-to-date with industry trends and regulatory changes?

- Attend industry conferences and webinars

- Subscribe to industry publications and newsletters

- Network with other professionals in the mortgage industry

- Take continuing education courses

- Monitor government websites and regulatory agencies for updates

9. What is your experience with using technology and software in the mortgage process?

Sample Answer

- Proficient in using loan origination software (LOS) to process mortgage applications and track loan progress.

- Familiar with electronic document signing platforms and other digital tools to streamline the closing process.

- Utilized credit analysis software to assess borrower creditworthiness and identify risk factors.

- Integrated social media and online marketing strategies to generate leads and connect with potential borrowers.

10. What are your strengths and weaknesses as a Home Lending Officer?

- Strong understanding of mortgage products and loan programs

- Excellent communication and interpersonal skills

- Ability to build rapport with clients and gain their trust

- Detail-oriented and analytical with a proven track record of accuracy

- Limited experience with high-end luxury mortgages

- Working towards developing expertise in commercial lending

- Occasional difficulty prioritizing tasks during peak workload periods

Strengths:

Weaknesses:

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Home Lending Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Home Lending Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Home Lending Officers are responsible for a range of tasks related to providing mortgage loans to homebuyers. Their key responsibilities include:

1. Qualifying Borrowers

Assessing the financial situation of potential borrowers to determine their eligibility for a loan.

- Verifying income, assets, and credit history.

- Calculating debt-to-income ratios and credit scores.

2. Loan Origination

Preparing and submitting loan applications to lenders.

- Gathering and reviewing necessary documentation.

- Explaining loan terms and conditions to borrowers.

3. Loan Processing

Coordinating the underwriting and closing process.

- Communicating with underwriters and loan processors.

- Resolving any issues that arise during the loan approval process.

4. Loan Closing

Preparing and facilitating the closing of the loan.

- Reviewing and explaining closing documents.

- Collecting signatures and funds from borrowers.

Interview Tips

Preparing for a Home Lending Officer interview can improve your chances of success. Here are some tips to help you ace the interview:

1. Research the Company and Role

Take the time to learn about the company’s culture, values, and specific loan products and services.

- Visit the company’s website and social media pages.

- Review the job description carefully and identify key responsibilities.

2. Highlight Your Relevant Skills and Experience

In your resume and during the interview, emphasize skills that are essential for Home Lending Officers, such as:

- Financial analysis and underwriting.

- Loan processing and origination.

- Sales and customer service.

3. Prepare for Common Interview Questions

Anticipate common interview questions and prepare thoughtful responses that showcase your knowledge and experience. Some common questions include:

- “Tell me about your experience in qualifying borrowers and underwriting loans.”

- “Describe a challenging loan application you have processed and how you resolved it.”

- “How do you stay up-to-date with the latest mortgage regulations and industry trends?”

4. Ask Informed Questions

Asking informed questions at the end of the interview demonstrates your interest in the position and the company.

- Inquire about the company’s training and development programs for Home Lending Officers.

- Ask about the team you will be working with.

- Express your enthusiasm for the opportunity and how you can contribute to the company’s success.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Home Lending Officer interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!