Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Loan Auditor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

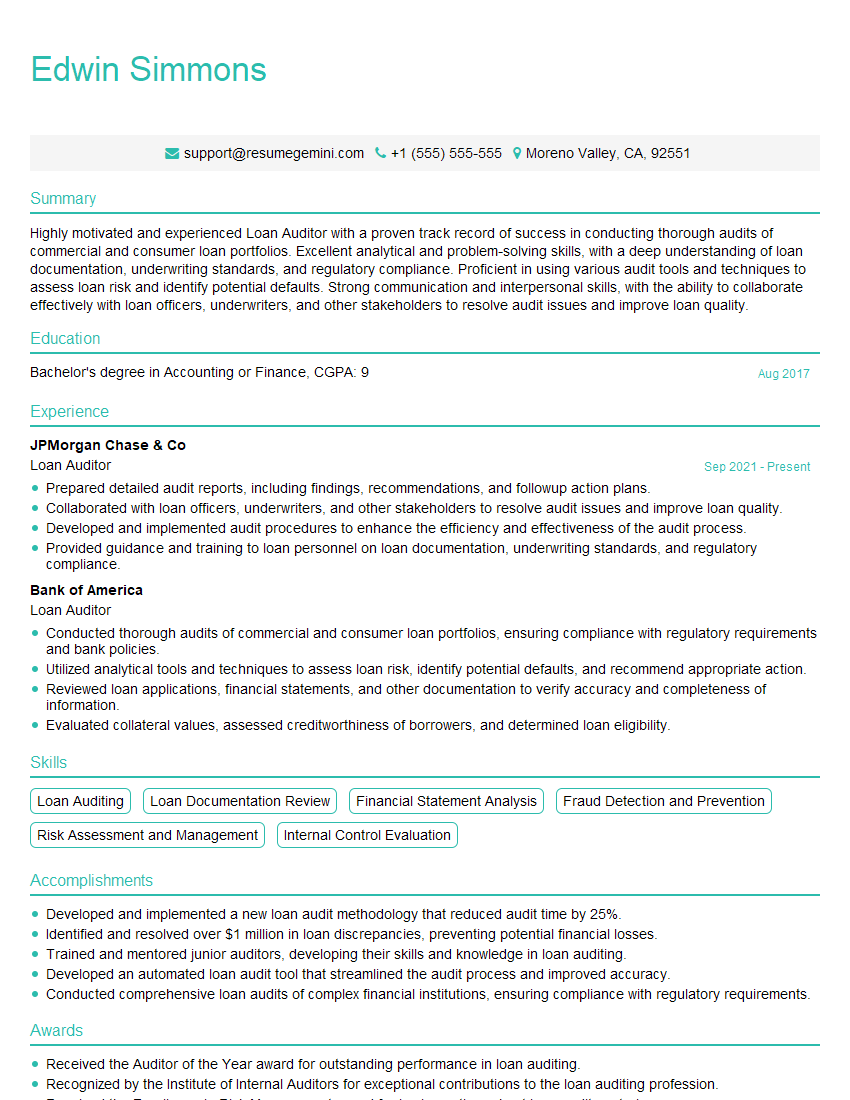

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Auditor

1. Explain the purpose and scope of a loan audit.

The purpose of a loan audit is to provide assurance that the financial statements are fairly presented and that the loans are in compliance with the applicable regulations. The scope of a loan audit includes the review of the loan documentation, the assessment of the credit risk, and the verification of the loan balance.

2. Describe the key risk areas in loan auditing.

Credit Risk

- The borrower’s ability to repay the loan.

- The value of the collateral securing the loan.

Compliance Risk

- The loan complies with all applicable laws and regulations.

- The loan is properly documented and executed.

Operational Risk

- The loan is processed and serviced in a timely and efficient manner.

- The loan is properly recorded and reported in the financial statements.

3. What are the key steps involved in a loan audit?

- Planning the audit

- Examining the loan documentation

- Assessing the credit risk

- Verifying the loan balance

- Reporting the audit findings

4. What are the key audit procedures used in a loan audit?

- Review loan applications, credit reports, and other loan documentation

- Inspect collateral

- Interview loan officers and other bank personnel

- Analyze loan performance data

- Test loan loss reserves

5. What are the key differences between a loan audit and a financial statement audit?

- Scope: A loan audit focuses on the specific risks associated with loans, while a financial statement audit covers all aspects of the financial statements.

- Procedures: A loan audit involves more detailed testing of loan documentation and credit risk, while a financial statement audit involves more testing of accounting records and financial reporting.

- Reporting: A loan audit report typically includes a detailed description of the loan portfolio, the key risks identified, and the audit findings. A financial statement audit report provides an opinion on the fairness of the financial statements.

6. What are the key challenges in loan auditing?

- The complexity of loan transactions

- The need to assess credit risk

- The large volume of loan data

- The frequent changes in loan regulations

7. What are the key trends in loan auditing?

- The use of data analytics to improve audit efficiency

- The focus on emerging risks, such as cyber risk

- The increasing use of artificial intelligence to automate audit tasks

8. What are the key skills and qualities of a successful loan auditor?

- Strong accounting and auditing knowledge

- Excellent analytical and communication skills

- Expertise in loan products and risk assessment

- Ability to work independently and as part of a team

- Attention to detail and accuracy

9. How do you stay up-to-date on the latest developments in loan auditing?

- Attending industry conferences and webinars

- Reading professional publications and journals

- Participating in online discussion forums

- Networking with other loan auditors

10. What is your favorite aspect of loan auditing?

I enjoy the challenge of assessing credit risk and the opportunity to make a difference in the financial stability of my clients.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Auditors are responsible for ensuring the accuracy and compliance of loan applications, and reporting any discrepancies or suspected fraud. They also make sure that the bank’s lending policies and procedures are being followed properly. Key responsibilities include:

1. Loan Application Review

Reviewing loan applications for completeness and accuracy, and verifying the information provided by the borrower.

- Checking the applicant’s credit history and financial statements

- Verifying the applicant’s income and employment status

2. Loan Documentation Review

Reviewing loan documents such as promissory notes, mortgages, and security agreements to ensure that they are complete and compliant with the bank’s policies and procedures.

- Verifying the signatures of all parties

- Checking for any missing or incomplete information

3. Loan Disbursement Review

Reviewing loan disbursements to ensure that the funds are being used for the intended purpose and that the borrower is meeting the terms of the loan agreement.

- Verifying the amount of the disbursement

- Checking for any unauthorized withdrawals or payments

4. Loan Repayment Review

Reviewing loan repayments to ensure that the borrower is making timely payments and that the loan is being repaid according to the terms of the loan agreement.

- Calculating the amount of interest and principal due

- Identifying any late payments or defaults

Interview Tips

Preparing for a job interview can be a daunting task, but with the right tips and practice, you can increase your chances of success. Here are some tips to help you ace your interview for a Loan Auditor position:

1. Research the Company and Position

Take the time to learn about the company and the specific Loan Auditor position you are applying for. This will help you understand the company’s culture and the role you would be playing within the organization.

- Visit the company’s website

- Read industry news and articles

- Connect with employees on LinkedIn

2. Practice Common Interview Questions

There are some common interview questions that you are likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” Practice answering these questions in a clear and concise way.

- Use the STAR method to answer behavioral questions

- Be specific and provide examples

- Tailor your answers to the job description

3. Highlight Your Skills and Experience

Make sure to highlight your skills and experience that are relevant to the Loan Auditor position. This includes your experience in loan processing, underwriting, or auditing. You should also emphasize your strong analytical and problem-solving skills.

- Quantify your accomplishments whenever possible

- Use action verbs to describe your experience

- Be prepared to discuss your knowledge of loan accounting and regulations

4. Be Enthusiastic and Professional

First impressions matter, so it is important to be enthusiastic and professional during your interview. Dress appropriately, arrive on time, and be prepared to answer questions about your experience and qualifications.

- Make eye contact and smile

- Be polite and respectful

- Ask thoughtful questions about the company and position

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Loan Auditor interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!