Are you gearing up for a career in Loan Service Officer? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Loan Service Officer and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

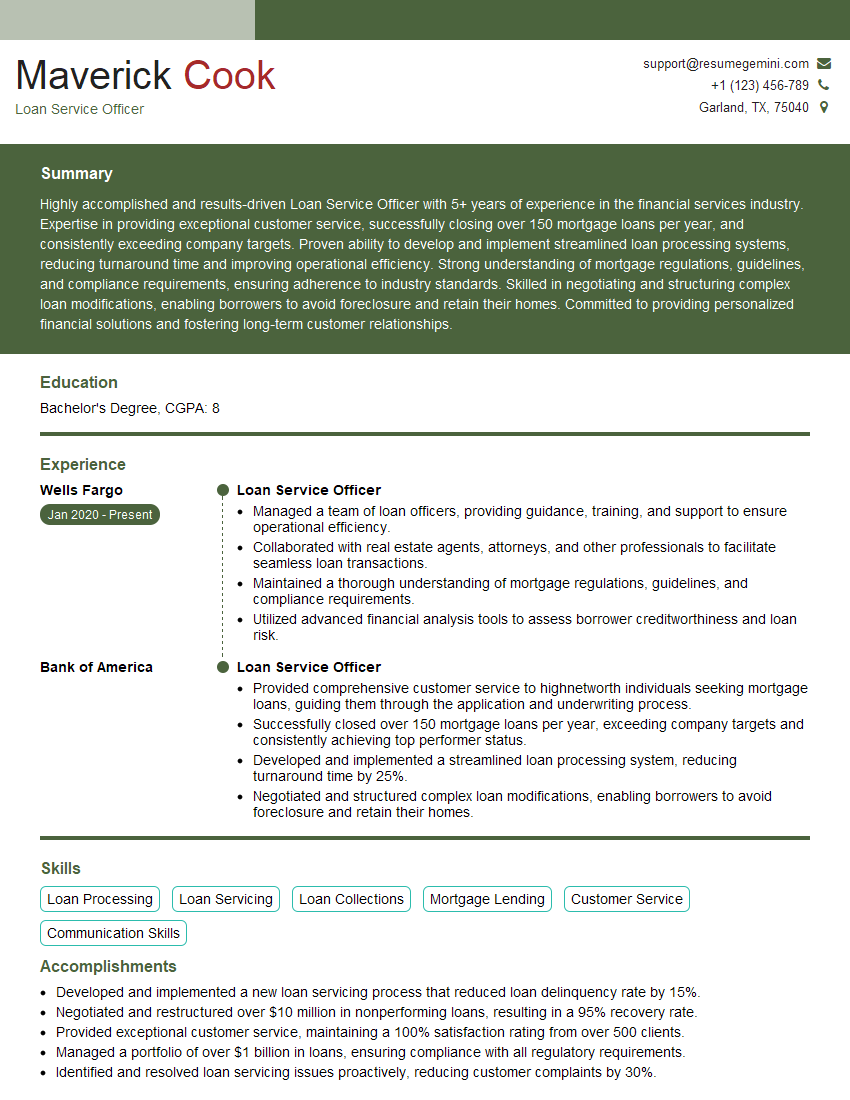

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Service Officer

1. What are the key responsibilities of a Loan Service Officer?

As a Loan Service Officer with proficiency in mortgages, I am held responsible for a wide array of tasks, which include:

- Providing the necessary guidance to borrowers throughout the entire loan process, from application to closing.

- Assessing loan applications, evaluating creditworthiness, and analyzing financial documents to determine loan eligibility.

- Working closely with loan processors, underwriters, and other team members to ensure smooth and timely loan processing.

2. What are the different types of loan products you are familiar with?

Throughout my career, I have gained extensive experience working with a diverse range of loan products, including:

Mortgages:

- Conventional loans

- FHA loans

- VA loans

- USDA loans

Refinancing Loans:

- Rate-and-term refinances

- Cash-out refinances

3. How do you handle challenging customers?

Interacting with customers exhibiting challenging behavior requires patience, empathy, and effective communication skills. In such situations, I adopt the following strategies:

- Actively listening to their concerns and acknowledging their frustrations.

- Maintaining a calm and professional demeanor, even under pressure.

- Providing clear and concise explanations, addressing their specific queries or issues.

- Seeking support from supervisors or senior colleagues when needed.

4. What are the key performance indicators (KPIs) for a Loan Service Officer?

As a Loan Service Officer, my performance is typically evaluated based on the following KPIs:

- Loan volume processed and closed within specified timeframes.

- Customer satisfaction ratings and feedback.

- Compliance with regulatory guidelines and industry best practices.

- Accuracy and efficiency in loan documentation and processing.

5. How do you stay up-to-date with the latest mortgage industry regulations and best practices?

To ensure I remain knowledgeable and compliant, I actively engage in the following practices:

- Attending industry conferences, webinars, and training programs.

- Reading industry publications, articles, and whitepapers.

- Participating in professional development courses and certifications.

- Networking with other professionals in the mortgage industry.

6. What are the common challenges faced by Loan Service Officers?

In my experience as a Loan Service Officer, I have encountered various challenges that include:

- Handling a high volume of loan applications and tight deadlines.

- Dealing with complex loan scenarios and underwriting guidelines.

- Navigating regulatory changes and compliance requirements.

- Managing customer expectations and addressing their concerns effectively.

7. How do you handle loan defaults and delinquencies?

When faced with loan defaults and delinquencies, I prioritize the following steps:

- Contacting borrowers promptly to understand the reasons for non-payment.

- Exploring options for loan modification or repayment plans.

- Working closely with legal counsel when necessary.

- Adhering to all applicable laws and regulations.

8. What is your approach to building and maintaining strong relationships with clients?

Building and maintaining strong client relationships is crucial to my success as a Loan Service Officer. I achieve this by:

- Providing personalized service and tailored loan solutions.

- Communicating regularly and proactively with clients.

- Being responsive to their inquiries and addressing their concerns promptly.

- Going above and beyond to ensure client satisfaction.

9. How do you utilize technology to enhance your productivity and efficiency?

I leverage technology to streamline my workflow and enhance efficiency in various ways:

- Using loan origination software to automate the loan application process.

- Implementing customer relationship management (CRM) tools to manage client interactions.

- Utilizing electronic signature platforms to expedite loan documentation.

- Exploring artificial intelligence (AI) and machine learning to improve loan processing accuracy.

10. What are your career goals and aspirations?

My long-term career goal is to assume a leadership role within the mortgage industry. I am eager to leverage my expertise and experience to make a significant contribution to the company’s success and the mortgage industry as a whole. I believe my passion for helping clients achieve their homeownership dreams, combined with my commitment to continuous learning and professional development, will enable me to excel in a leadership capacity.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Service Officer.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Service Officer‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Loan Service Officers are responsible for managing loan accounts and providing customer service to borrowers. Their primary focus is to ensure that loans are processed, serviced, and collected efficiently and in compliance with regulatory requirements. Let’s delve into the key responsibilities involved in this role:

1. Loan Processing

Loan Service Officers are typically involved in the loan processing stage, where they:

- Review and analyze loan applications to assess the borrower’s creditworthiness and risk profile.

- Verify income and asset information to ensure the borrower’s financial stability.

2. Loan Servicing

Once a loan is approved, Loan Service Officers handle the following tasks:

- Collecting loan payments and managing escrow accounts for taxes and insurance.

- Monitoring loan performance, identifying potential issues, and taking appropriate action to mitigate risks.

3. Customer Service

Loan Service Officers serve as the primary point of contact for borrowers throughout the loan lifecycle. They:

- Respond to inquiries, provide account information, and address concerns.

- Resolve disputes, negotiate payment arrangements, and work to maintain positive customer relationships.

4. Compliance and Regulatory Reporting

Loan Service Officers must adhere to various regulations and compliance guidelines. They are responsible for:

- Maintaining accurate loan records and ensuring compliance with federal and state regulations.

- Reporting loan performance and other data to regulatory agencies as required by law.

Interview Tips

To ace your interview for a Loan Service Officer position, consider the following preparation tips:

1. Research the Company and Position

Demonstrate your interest and knowledge by researching the financial institution and the specific loan service officer role. Familiarize yourself with their products, services, and any relevant industry news.

- Point 1

- Point 2

2. Prepare for Common Interview Questions

Prepare thoughtful answers to common interview questions such as:

- Tell us about your experience in loan servicing or a related field.

- How do you handle challenging customers or difficult situations?

- What are your strengths and weaknesses as a loan service officer?

3. Showcase Your Skills

Highlight your relevant skills and experience throughout the interview. Emphasize your analytical abilities, attention to detail, and customer service orientation.

- Point 1

- Point 2

4. Ask Informed Questions

At the end of the interview, prepare insightful questions to show your engagement and interest in the position. This could include asking about the company’s growth plans or the specific challenges faced by the loan servicing department.

- Point 1

- Point 2

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Loan Service Officer interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.