Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Loan Supervisor position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

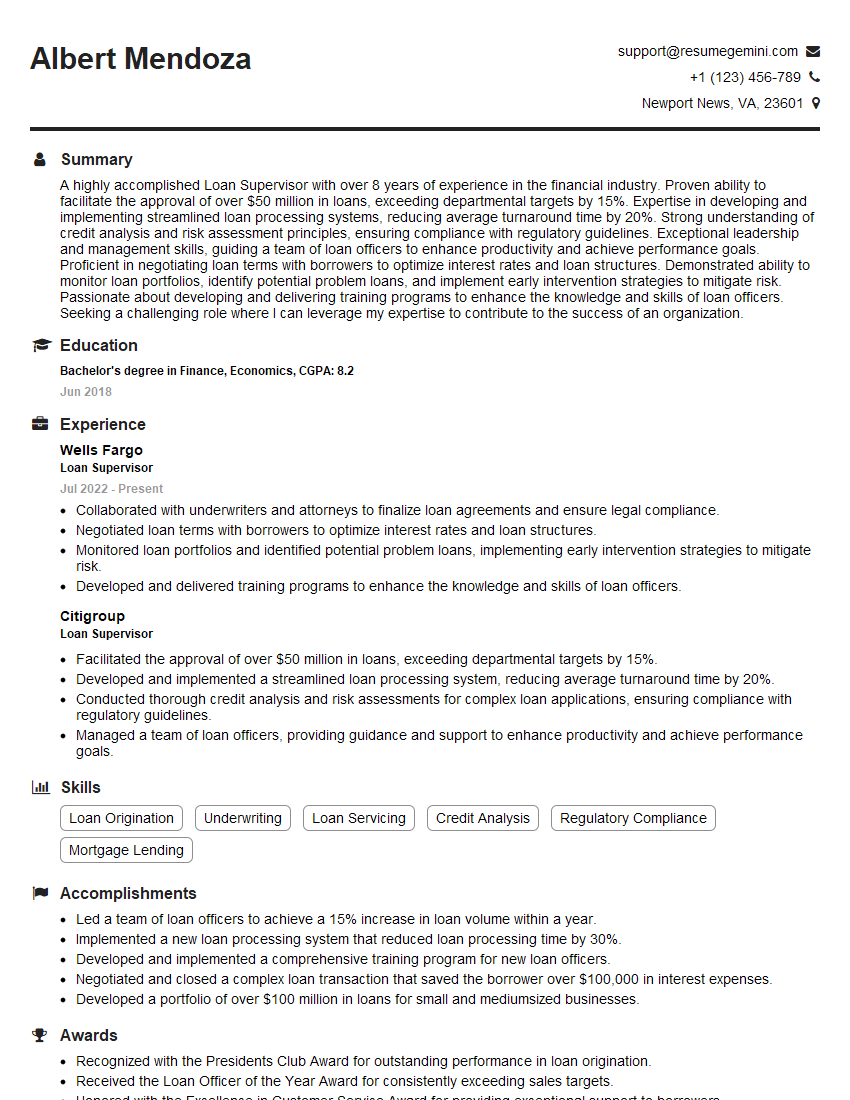

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Loan Supervisor

1. How would you evaluate the creditworthiness of a loan applicant?

To evaluate the creditworthiness of a loan applicant, I would consider the following factors:

- Credit history: Reviewing the applicant’s credit report to assess their past repayment behavior and identify any red flags.

- Debt-to-income ratio: Comparing the applicant’s monthly debt obligations to their income to determine their capacity to repay the loan.

- Employment and income stability: Verifying the applicant’s employment status, income level, and length of time at their current job.

- Collateral: Assessing the value and marketability of any collateral the applicant has offered to secure the loan.

- Character and references: Conducting reference checks and considering the applicant’s character and reputation.

2. What steps would you take to mitigate loan risk?

Loan Underwriting

- Implementing stringent underwriting guidelines to identify and reject high-risk applicants.

- Establishing clear loan approval criteria and adhering to them consistently.

Loan Monitoring

- Establishing regular loan review schedules to monitor repayment patterns and identify potential delinquencies.

- Communicating proactively with borrowers to address any payment concerns early on.

Loan Collection

- Developing and implementing effective collection strategies to maximize recoveries.

- Negotiating repayment plans and exploring loan restructuring options to minimize losses.

3. How do you stay up-to-date on industry regulations and best practices?

- Attending industry conferences and workshops.

- Subscribing to trade publications and industry newsletters.

- Participating in online forums and discussion groups.

- Networking with peers and colleagues.

- Completing continuing education courses and certifications.

4. How would you handle a conflict between a borrower and a loan officer?

- Listen attentively to both sides of the story without interrupting.

- Identify the root cause of the conflict and clearly define the issues involved.

- Explore possible solutions that are fair and equitable to both parties.

- Document the conflict, the actions taken, and the resolution reached.

- Follow up regularly to ensure that the conflict has been effectively resolved.

5. What measures would you implement to improve loan portfolio performance?

- Conducting regular portfolio reviews to identify underperforming loans.

- Developing and implementing loan workout plans to bring delinquent loans current.

- Analyzing portfolio trends and identifying potential risk factors.

- Improving loan origination practices to reduce the risk of future defaults.

- Collaborating with other departments, such as credit analysis and collections, to optimize portfolio performance.

6. How would you evaluate the performance of your loan team?

- Loan origination volume: Measuring the number and value of loans originated by each loan officer.

- Loan delinquency rate: Tracking the percentage of loans that are past due.

- Loan loss rate: Calculating the percentage of loans that have resulted in a loss.

- Customer satisfaction: Surveying borrowers to assess their satisfaction with the loan process and loan servicing.

- Compliance with policies and procedures: Ensuring that all loan officers are adhering to established guidelines.

7. What are the key challenges facing loan supervisors today?

- Regulatory compliance: Navigating the complex and evolving regulatory landscape.

- Credit risk management: Identifying and mitigating risks in a challenging economic environment.

- Loan portfolio performance: Maintaining a healthy loan portfolio amid rising delinquencies and defaults.

- Customer service: Balancing regulatory requirements with the need to provide excellent customer service.

- Technology advancements: Keeping pace with technological advancements in the financial industry.

8. How do you stay motivated and engaged in your work?

- Setting challenging but achievable goals.

- Recognizing and celebrating success.

- Continuous learning and development.

- Collaborating with colleagues.

- Understanding the positive impact my work has on customers and the organization.

9. What are your strengths and weaknesses as a loan supervisor?

Strengths:- Strong understanding of loan underwriting and risk management principles.

- Proven ability to lead and motivate a team.

- Excellent analytical and problem-solving skills.

- Effective communication and interpersonal skills.

- Commitment to compliance and ethical conduct.

- Limited experience in certain types of loans, such as commercial loans.

- Tendency to be detail-oriented, which can sometimes slow down decision-making.

- Working in a fast-paced environment can occasionally lead to stress.

10. What are your career goals for the next 5 years?

- To continue developing my skills and knowledge in loan supervision.

- To assume a leadership role with increased responsibilities.

- To contribute to the success of my team and the organization.

- To stay abreast of industry trends and best practices.

- To make a positive impact on the financial industry and the community.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Loan Supervisor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Loan Supervisor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Loan Supervisor is responsible for overseeing the activities of a team of loan officers, ensuring that they meet performance goals and provide excellent customer service.

1. Manage and Supervise Loan Process

Plan, direct, and coordinate the activities of loan officers and support staff.

- Develop and implement policies and procedures for loan processing and underwriting.

- Hire, train, and evaluate loan officers.

2. Monitor Credit Operations

Review loan applications to determine creditworthiness

- Approve or deny loans based on established credit criteria.

- Monitor loan portfolios to identify potential problems.

3. Maintain Compliance with Laws and Regulations

Stay updated on all applicable laws and regulations.

- Ensure that all loan activities comply with legal requirements.

- Conduct regular audits to ensure compliance.

4. Develop and Implement Policies

Work with senior management to develop and implement policies and procedures for the loan department.

- Monitor industry trends and best practices.

- Develop and implement new loan products and services.

Interview Tips

Preparing for an interview can be daunting, but there are some key tips you can follow to increase your chances of success. Here are some interview preparation tips and hacks for acing your Loan Supervisor interview:

1. Research the Company and the Position

Take some time to learn about the company’s history, culture, and values. This will help you answer questions about why you’re interested in working for the company and how your skills and experience align with the role.

- Visit the company’s website and social media pages.

- Read articles about the company in the news or industry publications.

2. Practice Your Answers to Common Interview Questions

There are some common interview questions that you’re likely to be asked, such as “Tell me about yourself” and “Why are you interested in this position?” It’s helpful to practice your answers to these questions in advance so that you can deliver them confidently and concisely.

- Use the STAR method to answer behavioral questions.

- Tailor your answers to the specific job you’re applying for.

3. Be Prepared to Talk About Your Experience and Skills

The interviewer will want to know about your experience and skills as they relate to the job you’re applying for. Be prepared to talk about your accomplishments, and how they have prepared you for this role.

- Quantify your accomplishments whenever possible.

- Use specific examples to illustrate your skills and abilities.

4. Ask Questions

Asking questions at the end of the interview shows that you’re interested in the job and the company. It also gives you an opportunity to learn more about the role and the company culture.

- Prepare a few questions in advance.

- Avoid asking questions that are easily answered by the job description or the company’s website.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a Loan Supervisor, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for Loan Supervisor positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.