Are you gearing up for a career in Mortgage Broker? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Mortgage Broker and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

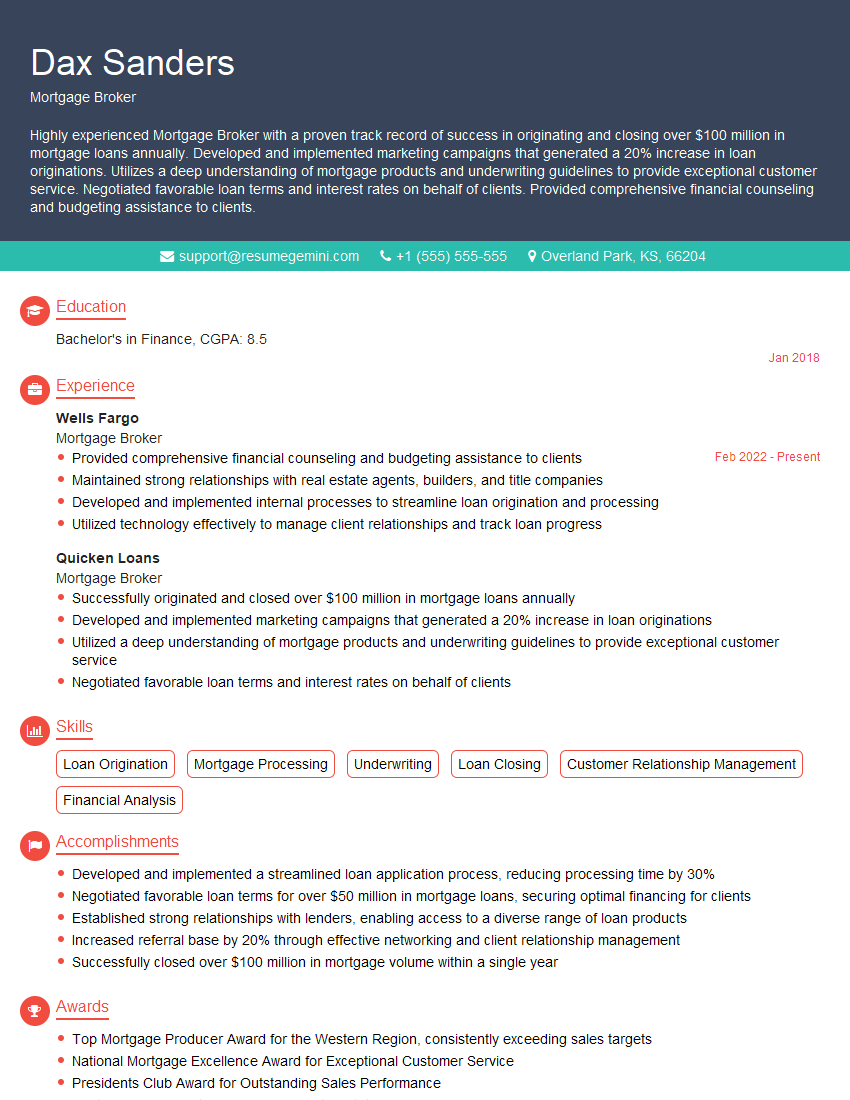

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Broker

1. What are the key factors that influence mortgage interest rates?

- Economic conditions, such as inflation and unemployment

- Government policies, such as monetary policy

- The supply and demand for mortgages

- The creditworthiness of borrowers

- The type of mortgage

2. What are the different types of mortgage products available, and what are the pros and cons of each?

Fixed-rate mortgages

- Pros: Interest rates are fixed for the life of the loan, so you know exactly what your monthly payments will be. This can provide peace of mind and help you budget more effectively.

- Cons: If interest rates fall, you will not be able to take advantage of the lower rates.

Adjustable-rate mortgages (ARMs)

- Pros: ARMs typically have lower interest rates than fixed-rate mortgages, at least initially. This can save you money on your monthly payments.

- Cons: The interest rate on an ARM can change periodically, which can make it difficult to budget. If interest rates rise, your monthly payments could increase significantly.

3. How do you assess a borrower’s creditworthiness?

- Credit score

- Debt-to-income ratio

- Credit history

- Employment history

- Assets and liabilities

4. What are the different types of government-backed loans, and what are the eligibility requirements for each?

- FHA loans: These loans are insured by the Federal Housing Administration (FHA) and are available to borrowers with lower credit scores and down payments.

- VA loans: These loans are guaranteed by the Department of Veterans Affairs (VA) and are available to eligible veterans and active-duty military members.

- USDA loans: These loans are guaranteed by the United States Department of Agriculture (USDA) and are available to borrowers in rural areas.

5. What are the legal and ethical responsibilities of a mortgage broker?

- To act in the best interests of their clients

- To provide accurate and timely information about mortgage products and services

- To avoid conflicts of interest

- To comply with all applicable laws and regulations

6. What are the most common challenges that mortgage brokers face, and how do you overcome them?

- Finding qualified borrowers: This can be a challenge in a competitive market, but it can be overcome by developing a strong marketing strategy and networking with real estate agents and other professionals.

- Getting loans approved: Lenders have become more stringent in their lending criteria in recent years, so it can be difficult to get loans approved, especially for borrowers with less-than-perfect credit.

- Staying up-to-date on the latest mortgage products and regulations: The mortgage industry is constantly changing, so it is important to stay up-to-date on the latest products and regulations in order to provide the best possible service to clients.

7. What are the key trends that you see in the mortgage industry?

- The rise of online lending: More and more borrowers are applying for mortgages online, which is making it more convenient for them to shop for the best rates and terms.

- The increasing popularity of ARMs: ARMs are becoming more popular as borrowers look for ways to save money on their monthly payments.

- The growing demand for jumbo loans: Jumbo loans are loans that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. The demand for jumbo loans is growing as more and more people are buying expensive homes.

8. What are your strengths and weaknesses as a mortgage broker?

Strengths

- Excellent communication and interpersonal skills

- Strong knowledge of the mortgage industry

- Ability to build rapport with clients and earn their trust

- Proven track record of success in the mortgage industry

Weaknesses

- Limited experience with certain types of mortgage products, such as jumbo loans

- Need to improve time management skills

9. Why are you interested in this position?

- I am passionate about helping people achieve their homeownership goals.

- I am confident that I have the skills and experience necessary to be successful in this role.

- I am eager to learn more about the mortgage industry and to contribute to the success of your company.

10. What are your salary expectations?

- My salary expectations are commensurate with my experience and qualifications.

- I am open to negotiating a salary that is fair and equitable for both parties.

- I am more interested in finding a position that is a good fit for my skills and interests than I am in maximizing my salary.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Broker.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Broker‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mortgage Brokers play a crucial role in the real estate industry, assisting individuals in securing the best mortgage loans based on their unique needs and financial situations.

1. Business Development

Proactively generate leads and build relationships with potential clients through networking, referrals, and marketing initiatives.

- Develop and implement effective lead generation strategies.

- Attend industry events and build connections with real estate agents, builders, and financial professionals.

2. Loan Origination

Guide clients through the mortgage application process, evaluating their financial situation, and recommending suitable loan options.

- Pre-approve clients for mortgages and provide estimates.

- Collect and review financial documentation such as tax returns, pay stubs, and credit reports.

3. Loan Analysis and Approval

Analyze loan applications, assess creditworthiness, and determine loan eligibility based on established underwriting guidelines.

- Collaborate with lenders to evaluate loan applications and negotiate terms.

- Explain loan terms and conditions clearly to clients and answer their questions.

4. Customer Service and Relationship Management

Provide personalized service throughout the loan process, building strong relationships with clients and addressing their concerns promptly.

- Maintain regular communication with clients, keeping them informed of the loan status.

- Resolve customer issues and provide support after loan closing.

Interview Tips

Preparing thoroughly for a Mortgage Broker interview can significantly increase your chances of success. Here are some valuable tips to help you ace the interview:

1. Research the Company and Industry

Take the time to learn about the company, its values, and its reputation in the mortgage industry. Stay updated on industry trends and regulations.

- Visit the company’s website and read about their mission, services, and team.

- Stay informed about current mortgage rates, market conditions, and government regulations.

2. Highlight Your Experience and Skills

Tailor your resume and cover letter to the specific requirements of the job. Emphasize your relevant experience in loan origination, analysis, and customer service.

- Quantify your accomplishments using specific numbers and metrics.

- Demonstrate your knowledge of mortgage products, underwriting guidelines, and industry best practices.

3. Prepare for Common Interview Questions

Practice answering common interview questions related to your experience, skills, and motivation. Anticipate questions about your understanding of the mortgage process, your approach to customer service, and your handling of challenging situations.

- Review your resume and identify key skills and experiences that align with the job requirements.

- Consider potential questions and prepare concise and thoughtful answers that highlight your strengths.

4. Be Confident and Enthusiastic

Convey confidence in your abilities and a genuine enthusiasm for the mortgage industry. Show the interviewer that you are passionate about helping clients achieve their financial goals.

- Maintain eye contact, speak clearly, and project a positive demeanor.

- Share examples of your dedication to customer satisfaction and your commitment to ethical practices.

Next Step:

Now that you’re armed with the knowledge of Mortgage Broker interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Mortgage Broker positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini