Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Mortgage or Loan Underwriter position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

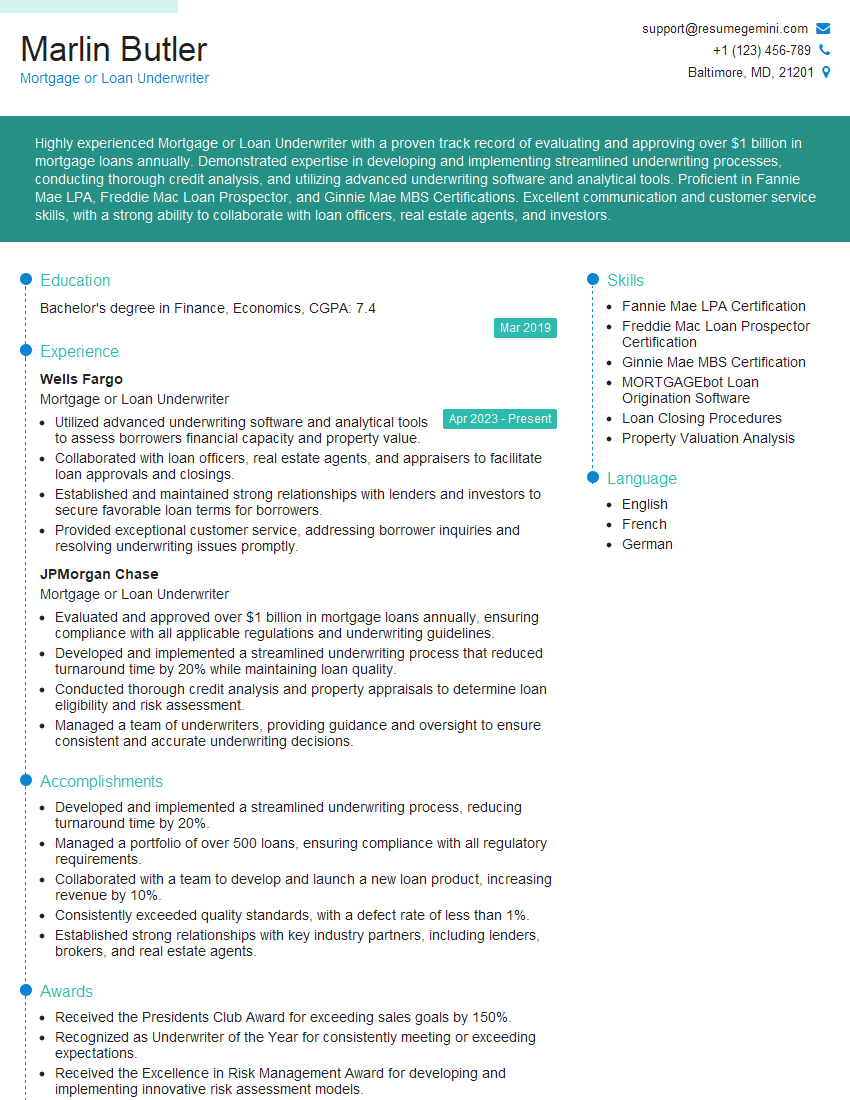

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage or Loan Underwriter

1. Explain the process of underwriting a mortgage loan?

- Reviewing the loan application: This involves verifying the borrower’s income, assets, debts, and credit history.

- Assessing the property: This includes reviewing the appraisal report to ensure that the property is worth the amount of the loan.

- Determining the loan amount and terms: This involves calculating the loan-to-value (LTV) ratio, debt-to-income (DTI) ratio, and other factors to ensure that the borrower can afford the loan.

- Issuing the loan commitment: This is a binding agreement that outlines the terms of the loan.

2. What are the key factors you consider when underwriting a loan?

- Borrower’s credit history: This is a major factor in determining the borrower’s risk of default.

- Debt-to-income ratio: This measures the borrower’s monthly debt payments relative to their monthly income.

- Loan-to-value ratio: This measures the amount of the loan relative to the value of the property.

- Appraisal: This provides an independent assessment of the property’s value.

- Property type: Different types of properties have different risks associated with them.

3. How do you handle a loan application with a low credit score?

- Review the borrower’s credit report carefully: Look for any errors or mitigating circumstances that may explain the low score.

- Consider other factors: Look at the borrower’s income, assets, and debt-to-income ratio to determine if they can still qualify for a loan.

- Request additional documentation: This may include pay stubs, bank statements, or tax returns to verify the borrower’s income and assets.

- Consider a higher down payment: This will reduce the loan-to-value ratio and make the loan less risky.

4. What are the most common reasons for loan denials?

- Insufficient income: The borrower does not earn enough money to qualify for the loan amount.

- Poor credit history: The borrower has a history of late payments or defaults.

- High debt-to-income ratio: The borrower has too much debt relative to their income.

- Property value: The property is not worth enough to support the loan amount.

- Incomplete or inaccurate loan application: The borrower has not provided all of the required information or the information provided is incorrect.

5. What are the different types of mortgage loans available?

- Fixed-rate loans: These loans have an interest rate that remains the same for the life of the loan.

- Adjustable-rate loans: These loans have an interest rate that can change over time.

- Government-backed loans: These loans are insured by the government, which makes them less risky for lenders.

- Conventional loans: These loans are not insured by the government and typically have higher interest rates than government-backed loans.

6. What are the different types of mortgage underwriting?

- Manual underwriting: This type of underwriting is done by a human underwriter who reviews the loan application and makes a decision based on their own judgment.

- Automated underwriting: This type of underwriting is done by a computer program that uses a set of rules to make a decision on the loan application.

- Hybrid underwriting: This type of underwriting combines manual and automated underwriting. The computer program makes an initial decision on the loan application, and then a human underwriter reviews the decision and makes a final decision.

7. What are the key challenges facing mortgage underwriters today?

- The increasing complexity of mortgage products: Lenders are offering a wider variety of mortgage products, which can make it more difficult for underwriters to assess the risks of each loan.

- The growing number of government regulations: The government has implemented a number of regulations in recent years to protect consumers from predatory lending practices. These regulations can add to the complexity of the underwriting process.

- The shortage of qualified underwriters: The demand for mortgage underwriters has increased in recent years, but the supply of qualified underwriters has not kept pace.

8. What are the key trends in mortgage underwriting?

- The use of automated underwriting: Lenders are increasingly using automated underwriting to make decisions on loan applications. This can help to speed up the underwriting process and reduce the cost of underwriting.

- The use of data analytics: Lenders are using data analytics to identify patterns and trends in loan performance. This can help to improve the accuracy of underwriting decisions.

- The development of new mortgage products: Lenders are developing new mortgage products to meet the needs of a changing market. These products can be more complex and difficult to underwrite, but they can also provide borrowers with more options.

9. What are the most important qualities of a successful mortgage underwriter?

- Strong analytical skills: Underwriters need to be able to analyze complex financial information and make sound judgments.

- Excellent communication skills: Underwriters need to be able to communicate their findings and decisions to borrowers, lenders, and other professionals.

- Attention to detail: Underwriters need to be able to review loan applications and other documents carefully to identify any errors or inconsistencies.

- Knowledge of mortgage products and underwriting guidelines: Underwriters need to be familiar with the different types of mortgage products and the underwriting guidelines that apply to each type of product.

10. How do you stay up-to-date on the latest changes in mortgage underwriting?

- Attend industry conferences and webinars: This is a great way to learn about the latest trends and changes in mortgage underwriting.

- Read industry publications: There are a number of industry publications that provide information on mortgage underwriting.

- Network with other underwriters: Talking to other underwriters can help you to stay informed about the latest changes in the industry.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage or Loan Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage or Loan Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mortgage or Loan Underwriters are responsible for evaluating financial information and determining whether to approve or deny loan applications. They play a critical role in the mortgage lending process by assessing the risk associated with each loan and ensuring that the lender is adequately protected. Key job responsibilities of a Mortgage or Loan Underwriter include:

1. Evaluating Loan Applications

Underwriters thoroughly review loan applications, including financial statements, credit reports, and other relevant documents to assess the applicant’s creditworthiness and ability to repay the loan.

- Analyzing financial statements to determine the applicant’s income, expenses, assets, and liabilities.

- Reviewing credit reports to evaluate the applicant’s credit history and identify any potential red flags.

- Verifying employment and income information to ensure the applicant has stable employment and sufficient income to meet loan obligations.

- Assessing the value of the property securing the loan using appraisals or other methods to determine whether it meets the lender’s requirements.

2. Underwriting and Approving Loans

Based on their analysis, underwriters make recommendations on whether to approve or deny loan applications. They consider factors such as the applicant’s financial stability, the risk associated with the loan, and the lender’s lending guidelines.

- Determining the appropriate loan amount, interest rate, and loan terms based on the applicant’s qualifications and the lender’s policies.

- Approving loans that meet the lender’s underwriting criteria and denying loans that pose too high of a risk.

- Issuing loan commitments, which outline the terms of the loan and the conditions that must be met before the loan can be funded.

3. Managing Loan Approvals and Denials

Underwriters are responsible for communicating loan decisions to applicants and managing the approval and denial process.

- Explaining loan decisions to applicants and providing clear and concise reasons for approvals or denials.

- Working with applicants to resolve any issues that may prevent loan approval.

- Denying loans that do not meet the lender’s underwriting criteria or pose an unacceptable risk.

4. Maintaining Compliance with Regulations

Underwriters are required to comply with various federal and state regulations governing the mortgage lending industry.

- Ensuring that loan applications are complete and accurate.

- Following established underwriting guidelines and procedures.

- Documenting all underwriting decisions and maintaining detailed records of all loan-related activities.

Interview Tips

Preparing for an interview for a Mortgage or Loan Underwriter position requires careful research and practice to showcase your skills and knowledge. Here are some interview tips to help you ace the interview:

1. Research the Company and Industry

Before the interview, take the time to learn about the company and the mortgage lending industry. Research the company’s values, products, and services to gain insights into their business and culture. Stay informed about current industry trends and regulations to demonstrate your knowledge and interest in the field.

2. Practice Answering Interview Questions

Make a list of common interview questions you may encounter and prepare your answers in advance. Anticipate questions about your underwriting experience, your understanding of the mortgage lending process, and your ability to assess financial risk. Practice articulating your skills and providing specific examples of your work to illustrate your capabilities.

3. Emphasize Your Technical Skills and Experience

Highlight your proficiency in financial analysis, credit risk assessment, and underwriting techniques. Showcase your ability to interpret financial data, understand credit reports, and evaluate property values. Provide examples of complex loan applications you have underwritten and the factors you considered in making your decisions.

4. Demonstrate Your Soft Skills

In addition to technical skills, underwriters must possess strong soft skills, such as excellent communication, interpersonal skills, and attention to detail. Emphasize your ability to communicate clearly and effectively with borrowers, loan officers, and other stakeholders. Highlight your ability to work independently and as part of a team, and your commitment to maintaining confidentiality.

5. Be Prepared to Discuss Your Career Goals and Objectives

The interviewer will want to know your career aspirations and why you are interested in the position. Be prepared to articulate your long-term goals and how the position aligns with them. Explain how your skills and experience make you a suitable candidate for the role and how you can contribute to the company’s success.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Mortgage or Loan Underwriter interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!