Feeling lost in a sea of interview questions? Landed that dream interview for Mortgage Underwriter but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Mortgage Underwriter interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

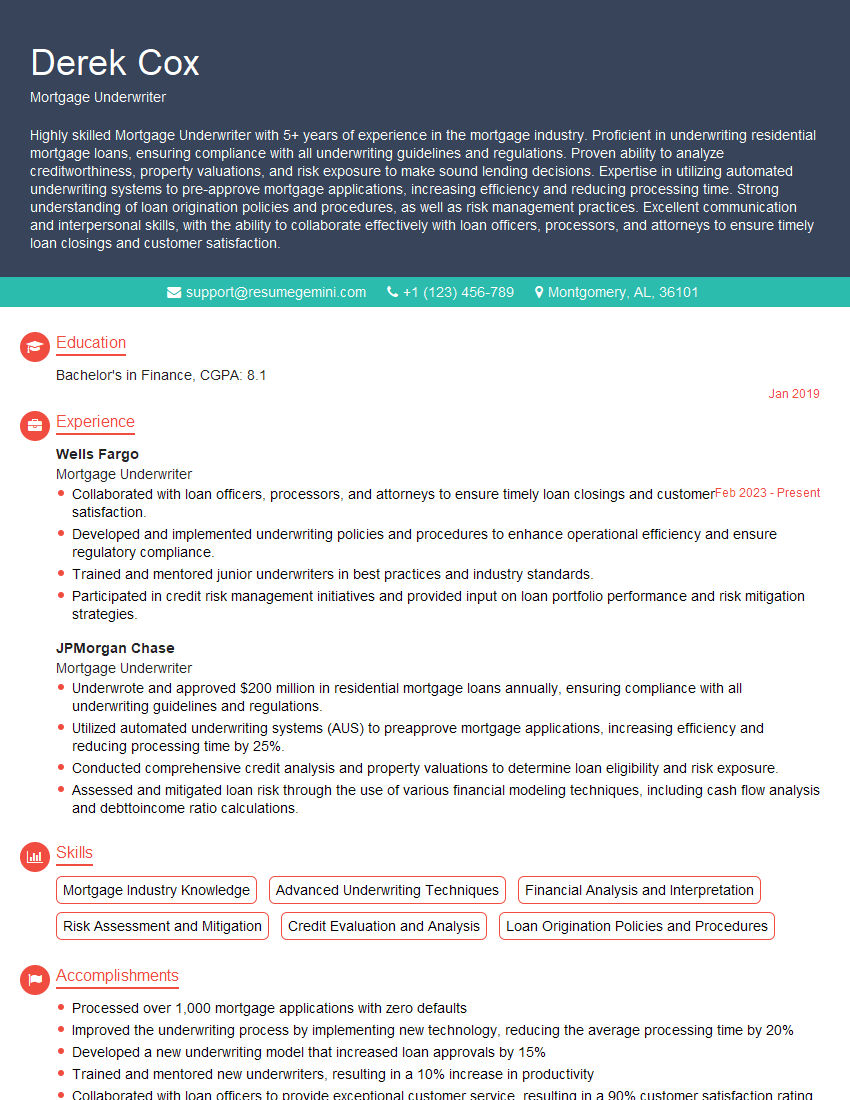

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Mortgage Underwriter

1. Explain the process of mortgage underwriting?

The mortgage underwriting process involves evaluating and assessing the risk of a potential mortgage loan. It includes:

- Verifying the borrower’s income and assets

- Assessing the borrower’s credit history

- Determining the loan-to-value (LTV) ratio

- Reviewing the property appraisal

- Making a final decision on whether to approve or deny the loan

2. What are the key factors you consider when underwriting a mortgage loan?

Credit history

- Reviewing the borrower’s credit score, payment history, and any previous bankruptcies or foreclosures

Income and employment

- Verifying the borrower’s income and employment status, as well as their job history and stability

- Assessing the borrower’s debt-to-income ratio

Property appraisal

- Reviewing the property appraisal to determine the value of the property and ensure it meets the lender’s requirements

Down payment

- Determining the amount of the down payment and ensuring it meets the lender’s minimum requirements

3. What are some of the common red flags that would raise concerns during underwriting?

Some common red flags that could raise concerns during underwriting include:

- Low credit score

- High debt-to-income ratio

- Unstable employment history

- Previous bankruptcies or foreclosures

- Property appraisal that is lower than expected

- Unexplained large deposits or withdrawals in the borrower’s bank accounts

4. How do you handle situations where the borrower’s income or assets are not as strong as you would like?

In situations where the borrower’s income or assets are not as strong as desired, there are several options that can be considered:

- Requesting additional documentation to support the borrower’s financial situation

- Considering alternative loan programs with less stringent requirements

- Working with the borrower to improve their credit score or debt-to-income ratio

- Obtaining a co-signer or guarantor to provide additional support

5. What are some of the challenges you face as a mortgage underwriter?

Some of the challenges faced as a mortgage underwriter include:

- Dealing with complex financial situations

- Making decisions that involve significant financial risk

- Staying up-to-date with changing regulations and guidelines

- Balancing the need for thorough due diligence with the need to process loans efficiently

- Managing a heavy workload and meeting deadlines

6. How do you stay up-to-date with the latest changes in the mortgage industry?

To stay up-to-date with the latest changes in the mortgage industry, I regularly:

- Attend industry conferences and webinars

- Read industry publications and newsletters

- Network with other mortgage professionals

- Participate in continuing education courses

- Review updates from regulatory agencies and government-sponsored enterprises

7. What is your favorite thing about being a mortgage underwriter?

My favorite thing about being a mortgage underwriter is the opportunity to help people achieve their dream of homeownership. I enjoy the challenge of evaluating complex financial situations and making decisions that can have a significant impact on someone’s life.

8. What is your biggest accomplishment as a mortgage underwriter?

My biggest accomplishment as a mortgage underwriter was helping a first-time homebuyer who had been denied a loan by several other lenders. I worked closely with the borrower to improve their credit score and debt-to-income ratio, and ultimately helped them secure a loan that allowed them to purchase their dream home.

9. What are your career goals as a mortgage underwriter?

My career goals as a mortgage underwriter are to continue to develop my skills and knowledge in the industry, and to eventually move into a management role where I can lead a team of underwriters and make a positive impact on the company.

10. How would you describe your underwriting style?

I would describe my underwriting style as thorough, analytical, and risk-averse. I take a conservative approach to underwriting and focus on making decisions that are in the best interests of the lender and the borrower.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Mortgage Underwriter.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Mortgage Underwriter‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Mortgage Underwriters play a crucial role in the financial industry by evaluating loan applications to determine the risk associated with lending money to borrowers. Their key responsibilities include:

1. Loan Application Review

Analyzing loan applications, financial documents, and credit reports to assess the borrower’s creditworthiness, income, assets, and debt.

- Verifying the authenticity of loan documents and ensuring they comply with underwriting guidelines.

- Calculating loan-to-value ratios, debt-to-income ratios, and other financial indicators to determine the borrower’s ability to repay the loan.

2. Risk Assessment

Evaluating the potential risks associated with lending money to a particular borrower, including factors such as:

- Credit history and score

- Employment stability and income

- Debt obligations and financial obligations

- Property value and condition

3. Loan Approval and Denial Recommendations

Making recommendations to loan officers and management on whether to approve or deny loan applications based on the risk assessment. Providing detailed explanations and supporting documentation for their recommendations.

- Developing and implementing underwriting policies and procedures to ensure consistent and accurate risk assessments.

- Staying up-to-date with industry regulations, lending guidelines, and best practices.

4. Post-Approval Follow-Up

Monitoring approved loans to ensure that borrowers meet the terms of their loan agreements and identify any potential issues early on.

- Conducting periodic reviews of loan performance and borrower financial status.

- Working with borrowers and loan servicers to resolve issues and mitigate risks.

Interview Tips

Preparing for a Mortgage Underwriter interview requires a combination of technical knowledge, industry understanding, and effective communication skills. Here are some tips to help you ace the interview:

1. Research the Company and Industry

Demonstrate your interest and knowledge of the company’s lending practices, industry trends, and regulatory environment. Highlight how your skills and experience align with the company’s needs.

- Visit the company website, read industry publications, and attend webinars to stay informed.

- Network with professionals in the mortgage industry to gain insights and learn about potential opportunities.

2. Prepare for Technical Questions

Be prepared to answer questions related to underwriting principles, financial analysis, and industry regulations. Practice working through sample loan scenarios to demonstrate your ability to assess risk and make sound lending decisions.

- Review underwriting guidelines, loan documentation, and relevant case studies.

- Develop examples of complex or challenging loan applications you have handled successfully.

3. Emphasize Communication and Interpersonal Skills

Mortgage Underwriters need to communicate effectively with borrowers, loan officers, and management. Highlight your ability to explain complex financial concepts clearly, build strong relationships, and work as part of a team.

- Showcase examples of how you have effectively communicated underwriting decisions to borrowers and loan officers.

- Discuss your experience in collaborating with other departments and resolving conflicts.

4. Be Confident and Professional

Project a positive and confident attitude throughout the interview. Dress professionally, arrive on time, and maintain eye contact. Demonstrate your commitment to the profession and your desire to contribute to the company’s success.

- Practice your answers to common interview questions and prepare thoughtful questions to ask the interviewer.

- Follow up after the interview to thank the interviewer for their time and express your continued interest in the position.

Next Step:

Now that you’re armed with the knowledge of Mortgage Underwriter interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Mortgage Underwriter positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini