Feeling lost in a sea of interview questions? Landed that dream interview for Personal Loan Specialist but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Personal Loan Specialist interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

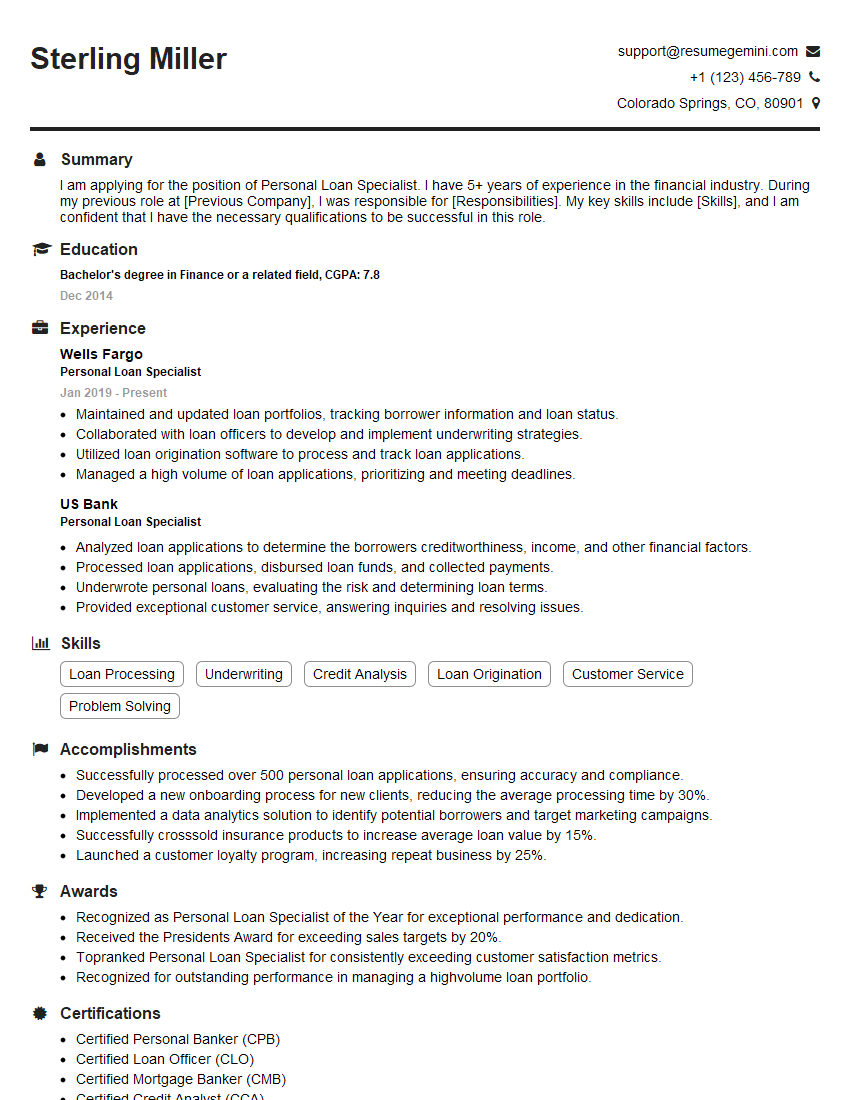

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Personal Loan Specialist

1. Explain the steps involved in processing a personal loan application?

- Receiving and reviewing the loan application.

- Verifying the applicant’s identity and income.

- Checking the applicant’s credit history.

- Determining the applicant’s eligibility for the loan.

- Disbursing the loan proceeds.

2. What factors do you consider when evaluating a personal loan application?

Qualifying factors

- Credit score

- Debt-to-income ratio

- Income

- Employment history

Underwriting Standards

- Loan amount

- Loan term

- Collateral

- Co-signer

3. How do you handle customer objections to loan terms?

- Acknowledge the customer’s concerns.

- Explain the reasons for the loan terms.

- Explore alternative options with the customer.

- Negotiate a mutually acceptable solution.

4. What is your experience with different types of personal loans?

- Secured personal loans

- Unsecured personal loans

- Debt consolidation loans

- Home equity loans

- Personal lines of credit

5. How do you stay up-to-date on the latest changes in the personal loan industry?

- Reading industry publications

- Attending industry events

- Taking continuing education courses

- Networking with other professionals

6. What is the most challenging part of being a Personal Loan Specialist?

- Dealing with customers who are in financial distress.

- Keeping up with the ever-changing regulatory environment.

- Making sound lending decisions in a competitive market.

- Maintaining a high level of customer satisfaction.

7. What is the most rewarding part of being a Personal Loan Specialist?

- Helping customers achieve their financial goals.

- Making a positive impact on people’s lives.

- Building strong relationships with customers.

- Providing excellent customer service.

8. What are your strengths as a Personal Loan Specialist?

- Strong communication and interpersonal skills.

- Excellent analytical and problem-solving skills.

- In-depth knowledge of the personal loan industry.

- Proven ability to build strong relationships with customers.

- Commitment to providing excellent customer service.

9. What are your weaknesses as a Personal Loan Specialist?

- I am sometimes too trusting of customers.

- I can be too eager to close a deal.

- I am not always the best at managing my time.

- I can be too detail-oriented at times.

10. Why are you interested in this position?

- I am passionate about helping people achieve their financial goals.

- I have a strong understanding of the personal loan industry.

- I am confident that I can be a valuable asset to your team.

- I am eager to learn and grow in this role.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Personal Loan Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Personal Loan Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Personal Loan Specialists are responsible for a wide range of duties related to processing and servicing personal loans. These professionals play a crucial role in determining the eligibility of borrowers, managing loan applications, and advising clients on financial matters. Key job responsibilities include:

1. Loan Evaluation and Processing

Assess loan applications, verify financial information, and evaluate creditworthiness of potential borrowers.

- Review credit reports, bank statements, and other financial documents.

- Conduct thorough credit analysis to determine loan eligibility and risk.

- Make recommendations on loan amounts, interest rates, and repayment terms.

2. Client Consultation and Financial Advice

Provide financial advice and guidance to clients throughout the loan process.

- Explain loan terms, interest rates, and repayment options.

- Address client concerns and answer questions related to personal finance.

- Recommend financial products and services tailored to client needs.

3. Loan Documentation and Compliance

Prepare and process loan documents, ensuring compliance with legal and regulatory requirements.

- Draft loan agreements, promissory notes, and other legal documents.

- Obtain necessary signatures and collect required documentation.

- Ensure compliance with all applicable laws and industry regulations.

4. Customer Service and Relationship Management

Provide excellent customer service and build strong relationships with clients.

- Respond promptly to client inquiries and resolve issues efficiently.

- Follow up with clients regularly to monitor loan status and provide ongoing support.

- Maintain a professional and courteous demeanor at all times.

Interview Tips

To ace an interview for a Personal Loan Specialist position, candidates should prepare thoroughly and demonstrate their skills and qualifications. Here are some interview tips to help you succeed:

1. Research the Company and Role

Before the interview, take time to research the company, its mission, values, and the specific role you are applying for. This will help you understand the company culture, the expectations of the role, and how your skills align with the organization’s needs.

2. Practice Your Answers

Anticipate common interview questions and prepare thoughtful, concise answers that highlight your relevant experience and skills. Practice answering questions out loud to improve your delivery and confidence.

- Example Outline for answering “Tell me about a time you provided excellent customer service”:

- Situation: Briefly describe a specific situation where you provided exceptional customer service.

- Task: Explain the task at hand and your role in resolving the issue.

- Action: Describe the specific actions you took to provide a positive experience for the customer.

- Result: Share the positive outcome of your efforts and the impact on the customer’s satisfaction.

3. Emphasize Your Knowledge of Personal Loans

Demonstrate your understanding of personal loan products, including different types of loans, interest rates, and repayment options. Explain how you evaluate loan applications and determine creditworthiness.

4. Showcase Your Communication and Interpersonal Skills

Personal Loan Specialists need to be able to communicate effectively with clients, explain financial concepts clearly, and build strong relationships. Highlight your interpersonal skills, active listening abilities, and empathy.

5. Prepare Questions for the Interviewer

Asking thoughtful questions at the end of the interview shows that you are engaged and interested in the role. Prepare questions that demonstrate your curiosity about the company, the department, and the specific responsibilities of the position.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Personal Loan Specialist role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.