Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted City Collector position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

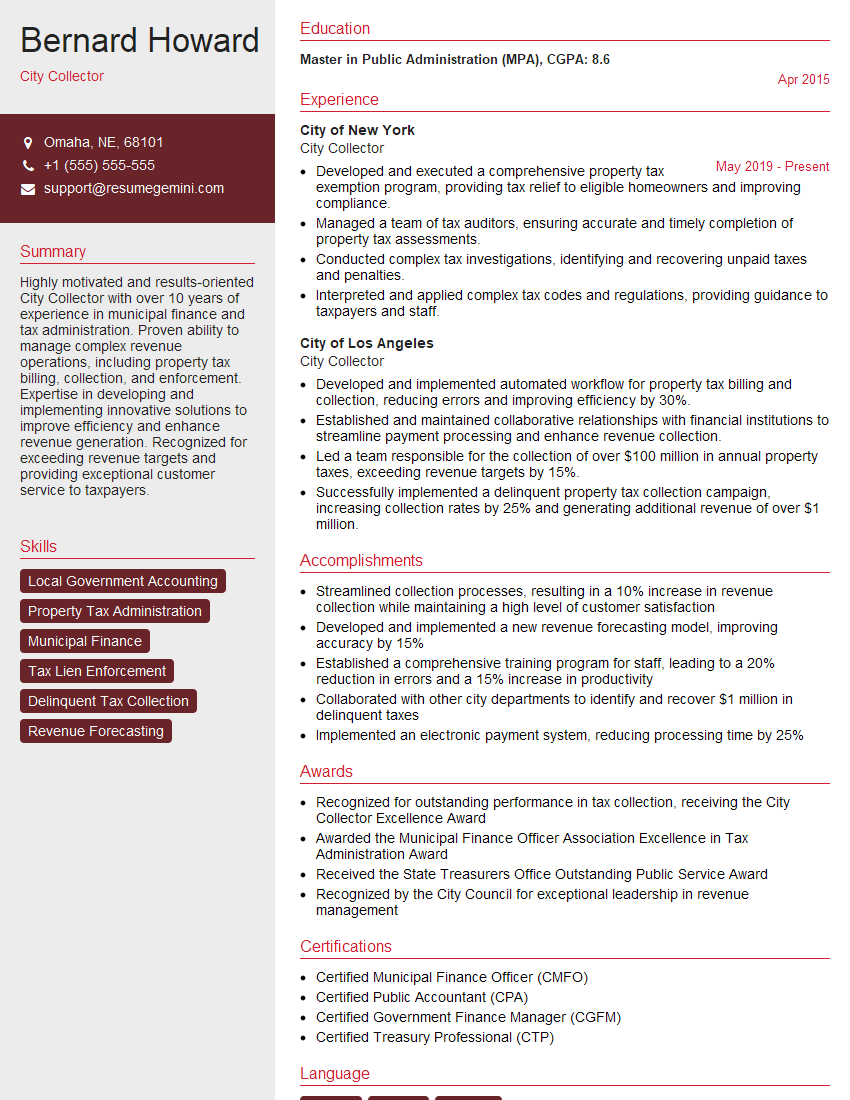

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For City Collector

1. What is the difference between a property tax and a user fee?

- Property taxes are levied on the value of real property, regardless of who owns it or how it is used.

- User fees are charged in exchange for a specific service or benefit, and the amount of the fee is typically based on the cost of providing the service or benefit.

2. What are the different sources of revenue for a city?

- Property taxes

- Sales taxes

- Income taxes

- User fees

- Grants and other intergovernmental revenue

3. What are the different ways to assess property for tax purposes?

- Market value assessment

- Cost of reproduction assessment

- Income capitalization assessment

4. What are the different types of property tax exemptions?

- Homestead exemption

- Senior citizen exemption

- Veteran’s exemption

- Agricultural exemption

5. What are the different types of property tax abatements?

- New construction abatement

- Rehabilitation abatement

- Historic preservation abatement

6. What are the different ways to collect property taxes?

- Annual tax bills

- Installment payments

- Escrow payments

7. What are the different types of property tax delinquencies?

- Unpaid taxes

- Underpaid taxes

- Late payments

8. What are the different ways to enforce property tax delinquencies?

- Tax liens

- Tax sales

- Foreclosure

9. What are the different ways to appeal a property tax assessment?

- Informal appeal

- Formal appeal

- Judicial appeal

10. What are the different types of property tax administration software?

- Commercial software

- Open source software

- Custom software

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for City Collector.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the City Collector‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

City Collectors are responsible for collecting and managing the collection of taxes, fees, and other revenues for a city or municipality. This role plays a crucial part in ensuring the financial stability and smooth operation of the city.

1. Revenue Collection

The primary responsibility of City Collectors is collecting taxes such as property taxes, sales taxes, and utility taxes. They process payments, issue receipts, and maintain accurate records of all transactions conducted.

2. Tax Assessment and Administration

City Collectors are involved in assessing property values for taxation purposes. They analyze market data, conduct property inspections, and determine the fair market value of properties within the city. They also provide guidance to taxpayers on tax laws and regulations.

3. Billing and Enforcement

City Collectors generate and distribute tax bills to property owners and businesses within the city. They are responsible for following up on unpaid taxes and taking enforcement actions, such as liens or property seizures, if necessary.

4. Customer Service and Communication

City Collectors interact with taxpayers and provide assistance on various matters related to taxation. They answer questions, resolve disputes, and offer guidance on payment plans and tax exemptions. They maintain open lines of communication to ensure that taxpayers understand their obligations and have access to necessary information.

5. Cash Management

City Collectors are responsible for managing the city’s cash flow by collecting, depositing, and accounting for all revenues received. They maintain accurate financial records, prepare reports, and provide financial data to the city’s administration and governing body.

Interview Tips for City Collector Position

To ace the interview for a City Collector position, it is important to prepare thoroughly and showcase your relevant skills and experience. Here are some tips to help you make a great impression and increase your chances of success:

1. Research the City and Position

Before the interview, take the time to research the city you are applying to work for and the specific role of City Collector. Understand the city’s financial situation, any recent developments or challenges, and the responsibilities and expectations associated with the position.

2. Practice Your Communication Skills

City Collectors interact with a wide range of individuals, including taxpayers, city officials, and external stakeholders. Strong communication skills are essential in this role. Practice answering questions clearly and concisely, and be prepared to articulate your thoughts and ideas effectively.

3. Highlight Your Experience and Skills

During the interview, emphasize your relevant experience and skills that make you a suitable candidate for the position. If you have experience in tax collection, revenue management, or customer service, be sure to highlight these qualifications and provide specific examples of your accomplishments.

4. Demonstrate Your Knowledge of Taxation

City Collectors must have a thorough understanding of taxation laws and regulations. During the interview, be prepared to answer questions about different types of taxes, tax assessment procedures, and enforcement actions. Show that you are knowledgeable about the subject matter and stay up-to-date on any recent changes or developments in the field.

5. Prepare for Behavioral Questions

Interviewers often ask behavioral questions to assess your problem-solving abilities, teamwork skills, and approach to handling challenging situations. Prepare for questions such as “Tell me about a time you had to resolve a conflict with a taxpayer” or “How would you handle a situation where you suspect tax fraud?”

6. Be Enthusiastic and Professional

Throughout the interview, maintain a positive and enthusiastic attitude. Show that you are genuinely interested in the position and the opportunity to contribute to the city. Dress professionally, arrive on time, and be respectful of the interviewer’s time.

Next Step:

Now that you’re armed with a solid understanding of what it takes to succeed as a City Collector, it’s time to turn that knowledge into action. Take a moment to revisit your resume, ensuring it highlights your relevant skills and experiences. Tailor it to reflect the insights you’ve gained from this blog and make it shine with your unique qualifications. Don’t wait for opportunities to come to you—start applying for City Collector positions today and take the first step towards your next career milestone. Your dream job is within reach, and with a polished resume and targeted applications, you’ll be well on your way to achieving your career goals! Build your resume now with ResumeGemini.