Are you gearing up for an interview for a Customs Appraiser position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Customs Appraiser and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

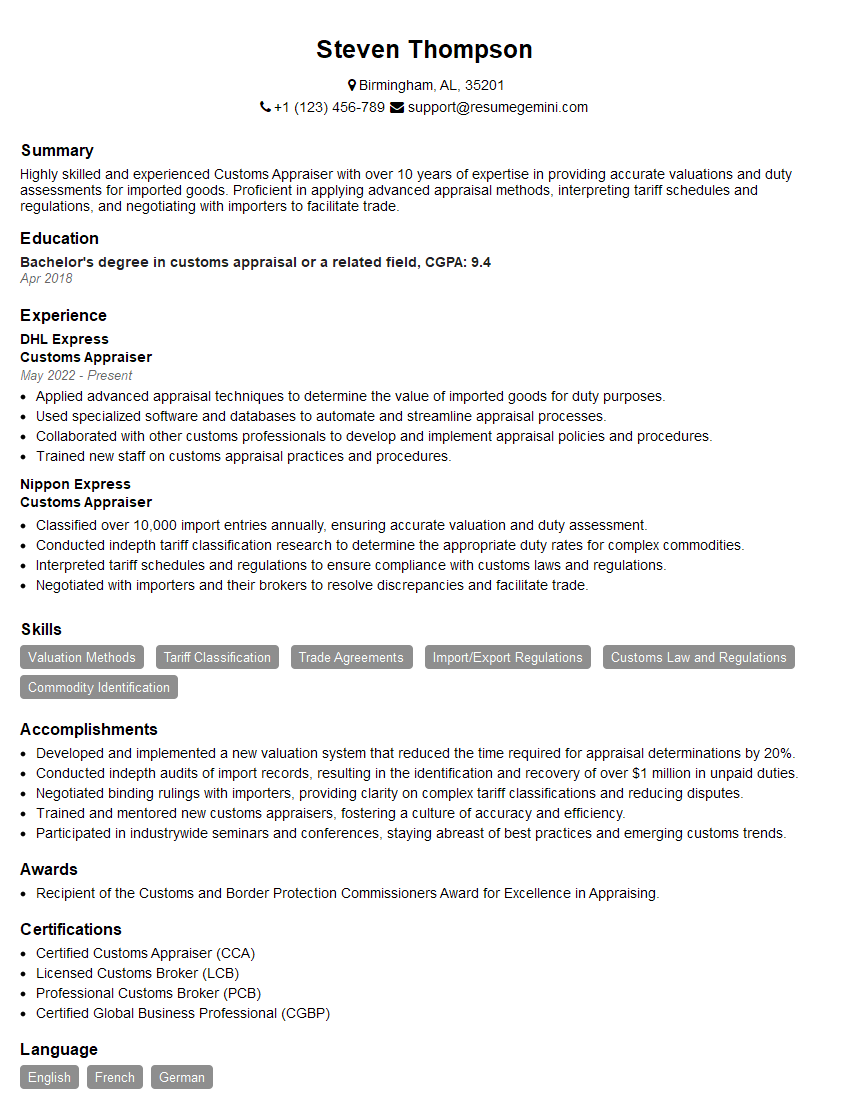

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Customs Appraiser

1. Explain the primary responsibilities of a Customs Appraiser.

- Determine the customs value of imported goods.

- Classify and appraise goods using established principles and regulations.

- Audit and verify import documents and invoices.

2. Describe the WCO’s role in setting customs valuation standards.

World Trade Organization (WTO)

- Establishes general principles and rules for customs valuation.

- Provides guidance and harmonization of customs practices worldwide.

World Customs Organization (WCO)

- Develops and updates technical guidelines and recommendations.

- Promotes uniformity and transparency in customs valuation practices.

3. Explain the difference between transaction value and deductive value.

- Transaction value: The price actually paid or payable for the goods when sold for export.

- Deductive value: The value of the imported goods calculated based on the selling price of identical or similar goods in the country of importation, less certain deductions.

4. Describe the methods used to determine the customs value of goods.

- Transaction value.

- Deductive value.

- Computed value.

- Fallback methods.

5. Explain the importance of precedents and rulings in customs valuation.

- Provide guidance and consistency in decision-making.

- Ensure fair and uniform application of customs laws.

- Facilitate import and export activities.

6. Describe the challenges involved in valuing goods from countries with state-controlled economies.

- Lack of reliable market data.

- Uncertainty about the actual prices paid or payable.

- Potential for government subsidies or intervention.

7. Explain the role of a Customs Appraiser in combating fraud and smuggling.

- Examine and appraise goods to identify potential undervaluation or misclassification.

- Analyze trade data and risk profiles to identify high-risk shipments.

- Coordinate with law enforcement agencies to intercept and investigate illegal activities.

8. Describe the ethical considerations involved in the role of a Customs Appraiser.

- Integrity and impartiality.

- Confidentiality and discretion.

- Objectivity and fairness.

- Professionalism and accountability.

9. Explain how technology is being used to enhance customs valuation practices.

- Digital data exchange and electronic filing.

- Automated valuation systems.

- Risk assessment tools and data analytics.

10. Describe the career path and opportunities for advancement as a Customs Appraiser.

- Promotion to higher levels within the customs organization.

- Specialization in areas such as technical appraisal or compliance.

- Opportunities for international assignments or training.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Customs Appraiser.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Customs Appraiser‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Customs Appraisers are responsible for ensuring that imported goods are properly classified and valued for the purpose of assessing customs duties and taxes. Their duties include:

1. Classification of Goods:

Customs appraisers analyze imported goods to determine their appropriate classification under the Harmonized Tariff Schedule (HTS). Correct classification is crucial for determining the applicable duty rates and other import regulations.

2. Valuation of Goods:

Appraisers use various methods, including transaction value, cost of production, and comparable sales, to determine the value of imported goods. Accurate valuation is essential to calculate the amount of customs duties and taxes owed.

3. Verification of Documentation:

Customs appraisers review accompanying documentation, such as invoices, packing lists, and certificates of origin, to verify the accuracy of the information provided by the importer.

4. Inspection of Goods:

In some cases, appraisers may physically inspect the imported goods to confirm their classification, valuation, or other details.

Interview Preparation Tips

To ace a Customs Appraiser interview, candidates should be well-prepared and demonstrate their knowledge and skills in the field. Here are some tips:

1. Research the Company and Industry:

Learn about the company’s business, industry trends, and the specific role you are applying for.

2. Practice Answering Common Interview Questions:

Prepare for questions about your understanding of customs regulations, valuation methods, and classification processes. Research sample interview questions and rehearse your answers.

3. Showcase Relevant Skills and Experience:

Highlight your knowledge of international trade, customs procedures, and tariff regulations. If you have prior experience as a customs appraiser or in a related field, emphasize your accomplishments.

4. Be Prepared to Discuss Ethical Dilemmas:

Customs appraisers may face ethical challenges. Be prepared to discuss how you would handle situations where there may be conflicts of interest.

5. Stay Updated on Customs Regulations:

Customs regulations are subject to change, so keep abreast of updates and demonstrate your commitment to staying current. Research industry publications and attend relevant seminars or workshops.

6. Dress Professionally and Arrive Punctually:

First impressions matter. Dress appropriately and be on time for your interview. Demonstrate respect for the interviewer and the company.

7. Ask Insightful Questions:

At the end of the interview, show your interest by asking thoughtful questions about the company, the role, or the industry. This indicates your engagement and desire to learn more.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Customs Appraiser interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!