Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Delinquent Tax Collection Assistant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

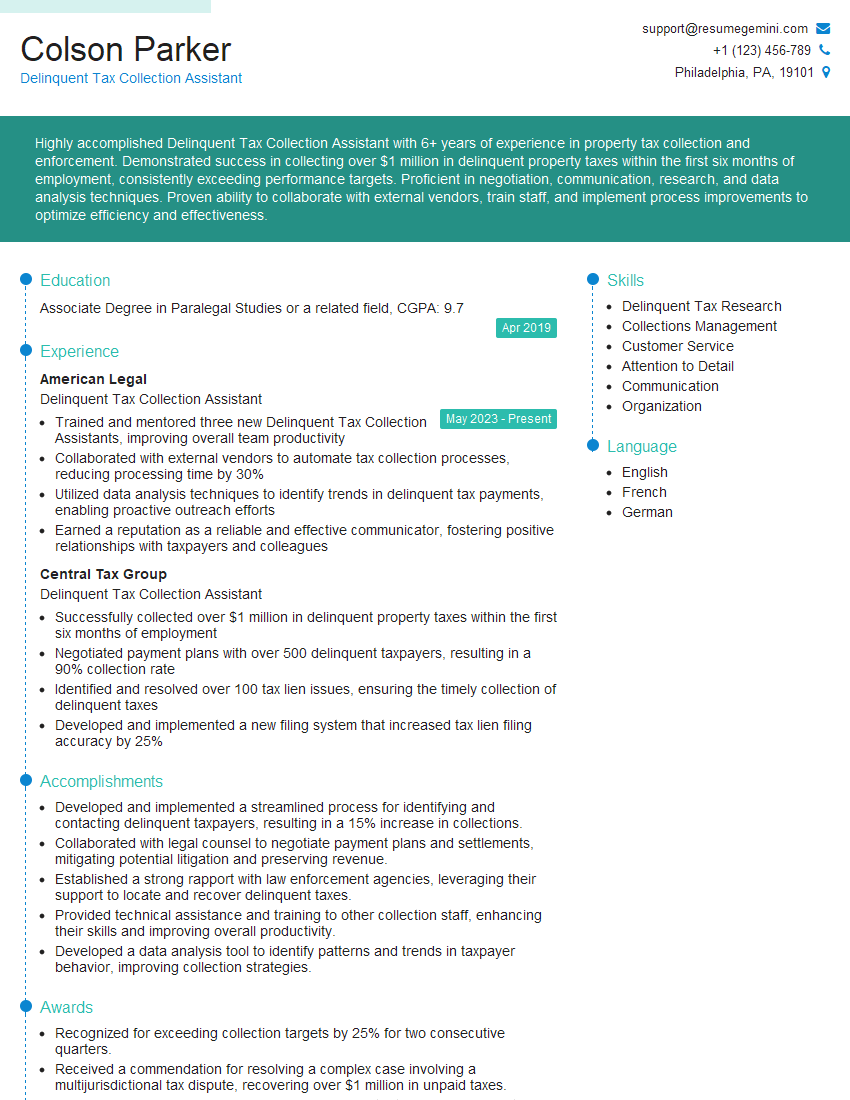

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Delinquent Tax Collection Assistant

1. Explain the process of delinquent tax collection.

- Identify and prioritize delinquent taxpayers

- Contact taxpayers and notify them of delinquency

- Negotiate payment plans and enforce collection

- Pursue legal action if necessary

2. How do you prioritize delinquent taxpayers?

Severity of Delinquency

- Overdue balance

- Length of delinquency

Taxpayer Financial Situation

- Income and assets

- Ability to pay

Likelihood of Payment

- Past payment history

- Communication with the department

3. What methods do you use to contact delinquent taxpayers?

- Phone calls

- Mail (letters, notices)

- In-person visits

4. How do you negotiate payment plans with taxpayers?

- Assess taxpayer’s financial situation

- Discuss payment options (installments, lump sum)

- Establish clear payment schedule and deadlines

- Document the agreement

5. What is your strategy for pursuing legal action against delinquent taxpayers?

- Weigh the costs and benefits of legal action

- Consult with legal counsel

- Prepare and file appropriate documents

- Represent the department in court

6. How do you maintain confidentiality when dealing with taxpayer information?

- Adhere to all department policies and procedures

- Limit access to taxpayer information to authorized personnel

- Handle taxpayer information securely and discreetly

7. What is your experience with using collection software?

- Describe the software you have experience with

- Explain how you use the software to manage tax collections

8. What are the ethical considerations in delinquent tax collection?

- Treating taxpayers fairly and respectfully

- Balancing the need for revenue collection with taxpayer hardship

- Avoiding conflicts of interest

9. What is your motivation for working as a Delinquent Tax Collection Assistant?

- Interest in public service

- Desire to help taxpayers comply with their tax obligations

- Enthusiasm for working with numbers and data

10. What are your strengths and weaknesses as they relate to this role?

Strengths

- Strong communication and negotiation skills

- Attention to detail and accuracy

- Ability to manage multiple priorities and deadlines

Weaknesses

- Limited experience with collection software

- Can sometimes be impatient with non-responsive taxpayers

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Delinquent Tax Collection Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Delinquent Tax Collection Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

The Delinquent Tax Collection Assistant is responsible for collecting delinquent taxes, resolving disputes, and maintaining accurate records.

1. Collection of Delinquent Taxes

The primary responsibility of a Delinquent Tax Collection Assistant is to collect delinquent taxes from individuals and businesses. This involves:

- Contacting taxpayers via phone, email, or mail to discuss their delinquent balance.

- Negotiating payment plans and making arrangements for timely payments.

- Responding to taxpayer inquiries and providing information about tax laws and regulations.

2. Dispute Resolution

The assistant may also be responsible for resolving disputes and resolving collection issues. This may involve:

- Investigating taxpayer claims and determining the validity of disputes.

- Negotiating settlements and resolving disputes to the satisfaction of both parties.

- Referring unresolved disputes to appropriate authorities or external agencies.

3. Record Keeping

The assistant is also responsible for maintaining accurate records of all tax collection activities. This includes:

- Tracking delinquent tax balances, payment history, and correspondence with taxpayers.

- Preparing reports and summaries of collection activities for management and auditors.

- Ensuring compliance with all applicable laws, regulations, and policies.

4. Other Responsibilities

In addition to the above, the assistant may also be responsible for:

- Assisting with tax audits and investigations.

- Participating in training and professional development programs.

- Providing customer service and support to taxpayers.

Interview Tips

To ace the interview for a Delinquent Tax Collection Assistant position, you should:

1. Research the Position and Company

Before the interview, research the specific position and the company to gain a thorough understanding of their collection practices and procedures. This will demonstrate your interest and show that you have taken the time to learn about the organization.

2. Practice Your Communication Skills

As a Delinquent Tax Collection Assistant, you will be communicating with taxpayers regularly. Practice your communication skills, including your ability to listen attentively, clearly explain tax laws and regulations, and negotiate effectively.

3. Highlight Your Relevant Experience

If you have prior experience in tax collection or customer service, be sure to emphasize this in your interview. Highlight your skills in resolving disputes, negotiating payment plans, and maintaining accurate records.

4. Prepare for Common Interview Questions

Research common interview questions for Delinquent Tax Collection Assistant positions. Prepare your answers to questions about your experience, skills, and motivations for pursuing this role.

5. Ask Thoughtful Questions

At the end of the interview, take the opportunity to ask thoughtful questions about the position, the company, and the company’s commitment to taxpayer rights. This shows your engagement and interest in the organization.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Delinquent Tax Collection Assistant interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.