Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Delinquent Tax Collector Assistant position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

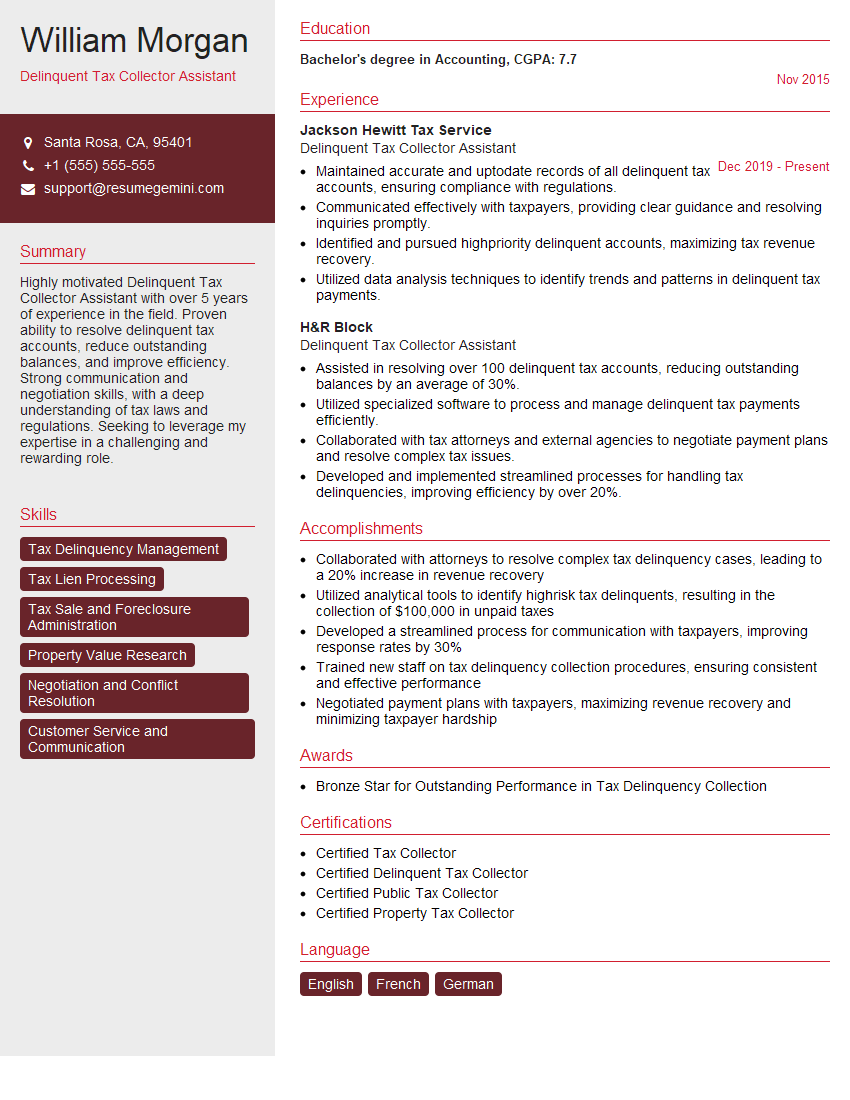

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Delinquent Tax Collector Assistant

1. Describe the key responsibilities of a Delinquent Tax Collector Assistant?

The responsibilities of a Delinquent Tax Collector Assistant may include:

- Assisting the Tax Collector in collecting delinquent taxes;

- Investigating delinquent tax accounts;

- Preparing and serving notices of delinquency;

- Seizing and selling property to satisfy delinquent taxes;

- Maintaining records of delinquent tax accounts;

- Providing customer service to taxpayers;

- Other duties as assigned.

2. Explain the different types of delinquent taxes that you have experience collecting?

- Property taxes

- Sales taxes

- Use taxes

- Income taxes

3. What are the different methods that you can use to collect delinquent taxes?

- Negotiation

- Levy

- Garnishment

- Seizure and sale

4. How do you prioritize which delinquent tax accounts to work on?

- Amount of the delinquency

- Taxpayer’s ability to pay

- Likelihood of collection

- Statute of limitations

5. What are the most common challenges that you face when collecting delinquent taxes?

- Taxpayers who are unable to pay

- Taxpayers who are unwilling to pay

- Complex tax laws

- Statutory deadlines

6. How do you stay up-to-date on changes in tax laws and regulations?

- Attending training seminars

- Reading tax publications

- Consulting with tax professionals

- Participating in online forums

7. What is your experience with using computers and tax software?

- Proficient in Microsoft Office Suite

- Experience with tax software, such as [Software Name]

- Ability to learn new software quickly

8. How do you handle difficult taxpayers?

- Remain calm and professional

- Listen to the taxpayer’s concerns

- Explain the tax laws and regulations

- Work with the taxpayer to find a solution

9. What is your experience with customer service?

- Excellent communication and interpersonal skills

- Ability to handle difficult customers

- Experience with providing customer service in a tax-related environment

10. Why are you interested in this position?

- I am passionate about helping people

- I am confident that I have the skills and experience to be successful in this role

- I am eager to learn more about tax collection

- I am excited about the opportunity to work for your organization

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Delinquent Tax Collector Assistant.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Delinquent Tax Collector Assistant‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities of Delinquent Tax Collector Assistant

Delinquent Tax Collector Assistants play a crucial role in assisting delinquent tax collectors in managing and collecting unpaid taxes. Their key job responsibilities include:

1. Data Processing and Record Maintenance

Maintain accurate records of delinquent tax accounts, including taxpayer information, property details, and payment history.

Process tax payments and update account balances, ensuring timely and accurate recording of all transactions.

2. Taxpayer Communication and Assistance

Communicate with delinquent taxpayers via phone, email, or in person to discuss payment arrangements and resolve issues.

Provide guidance and assistance to taxpayers in understanding tax laws, payment options, and potential consequences of non-payment.

3. Case Preparation and Follow-Up

Prepare and review legal documents, such as collection letters and court notices, to initiate and follow up on collection actions.

Monitor taxpayers’ financial status and track progress of collection efforts, reporting any developments to the delinquent tax collector.

4. Administrative and Clerical Support

Provide administrative support to the delinquent tax collector, including preparing correspondence, scheduling appointments, and maintaining office supplies.

Establish and maintain effective filing systems for tax documents and records, ensuring easy access and retrieval of information.

Interview Tips for Delinquent Tax Collector Assistant Candidates

To ace your interview for a Delinquent Tax Collector Assistant position, consider the following tips:

1. Research and Preparation

Thoroughly research the organization and its policies regarding delinquent tax collection.

Review job descriptions and identify the key skills and experience required for the role.

2. Highlight Relevant Experience

Emphasize your previous experience in data management, customer service, or tax administration.

Provide specific examples of your ability to communicate effectively with clients, resolve issues, and maintain accurate records.

3. Demonstrate Knowledge of Tax Laws

Show your understanding of local or state tax laws and collection procedures.

Explain how you would apply this knowledge to assist taxpayers and enforce tax regulations.

4. Assertiveness and Diplomacy

Convey your ability to balance assertiveness in collecting delinquent taxes with diplomacy in dealing with taxpayers.

Describe situations where you successfully resolved conflicts or negotiated payment plans.

5. Attention to Detail and Accuracy

Stress your meticulous nature and attention to detail in managing tax records and processing payments.

Provide examples of your ability to maintain accuracy and confidentiality in sensitive financial information.

6. Example Outline

Use the STAR method (Situation, Task, Action, Result) when answering interview questions. This helps you provide structured and concise responses.

- Situation: Describe the context or situation that led to the task.

- Task: Explain the specific task or responsibility you were required to complete.

- Action: Detail the actions you took to accomplish the task.

- Result: Quantify or describe the positive outcome or impact of your actions.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Delinquent Tax Collector Assistant role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.