Are you gearing up for a career in Income Tax Adjuster? Feeling nervous about the interview questions that might come your way? Don’t worry, you’re in the right place. In this blog post, we’ll dive deep into the most common interview questions for Income Tax Adjuster and provide you with expert-backed answers. We’ll also explore the key responsibilities of this role so you can tailor your responses to showcase your perfect fit.

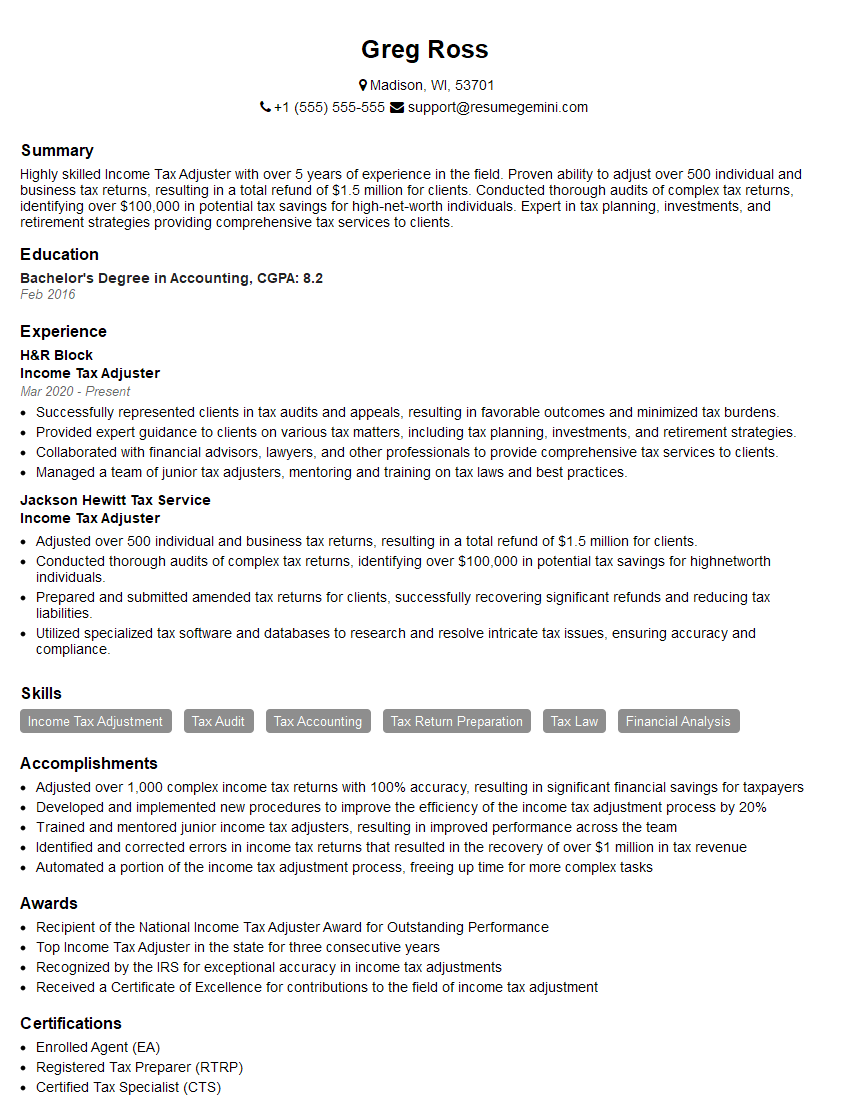

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Income Tax Adjuster

1. What is the difference between a standard and itemized deduction?

- A standard deduction is a specific amount that you can deduct from your taxable income, regardless of your actual expenses. The standard deduction is a flat amount that is set by the IRS each year.

- An itemized deduction is a deduction that you can take for certain expenses that you incur during the year. Some common itemized deductions include mortgage interest, property taxes, charitable donations, and medical expenses.

2. What are the different types of income that are subject to income tax?

Types of income that are subject to income tax include:

- Wages, salaries, tips, and other compensation for personal services

- Net income from self-employment

- Interest income

- Dividend income

- Capital gains

- Rental income

- Royalties

Types of income that are not subject to income tax include:

- Gifts

- Inheritances

- Life insurance proceeds

- Certain scholarships and fellowships

3. How are capital gains taxed?

- Capital gains are taxed at a lower rate than ordinary income.

- The capital gains rate depends on the length of time that you have held the asset.

- Short-term capital gains are taxed at the same rate as ordinary income.

- Long-term capital gains are taxed at a lower rate than short-term capital gains.

4. What are the different types of tax credits?

- Refundable tax credits are tax credits that you can receive even if you do not owe any taxes.

- Non-refundable tax credits are tax credits that can only be used to reduce your tax liability to zero.

- Some common tax credits include the child tax credit, the earned income tax credit, and the American opportunity tax credit.

5. What are the different types of tax deductions?

- Above-the-line deductions are deductions that you can take before you calculate your taxable income.

- Below-the-line deductions are deductions that you can take after you calculate your taxable income.

- Some common above-the-line deductions include the standard deduction, the personal exemption, and student loan interest.

- Some common below-the-line deductions include mortgage interest, property taxes, and charitable donations.

6. What are the different types of tax forms?

- Form 1040 is the most common tax form. It is used to file your individual income tax return.

- Form 1040-EZ is a simplified tax form that can be used by taxpayers who have simple tax returns.

- Form 1040-A is a tax form that is used to file your income tax return if you are claiming the earned income tax credit.

- Form 1040-NR is a tax form that is used to file your income tax return if you are a non-resident alien.

7. What are the different types of tax audits?

- Correspondence audits are the most common type of audit. They are conducted through the mail.

- Office audits are conducted at an IRS office.

- Field audits are conducted at the taxpayer’s home or business.

8. What are the different types of tax liens?

- Federal tax liens are liens that are imposed by the IRS on property owned by taxpayers who owe back taxes.

- State tax liens are liens that are imposed by state tax authorities on property owned by taxpayers who owe back taxes.

- Local tax liens are liens that are imposed by local tax authorities on property owned by taxpayers who owe back taxes.

9. What are the different types of tax levies?

- Wage levies are levies that are imposed on a taxpayer’s wages.

- Bank levies are levies that are imposed on a taxpayer’s bank account.

- Property levies are levies that are imposed on a taxpayer’s property.

10. What are the different types of tax appeals?

- Informal appeals are appeals that are made to the IRS without the need for a formal hearing.

- Formal appeals are appeals that are made to the IRS with the need for a formal hearing.

- Taxpayer Advocate appeals are appeals that are made to the Taxpayer Advocate Service.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Income Tax Adjuster.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Income Tax Adjuster‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

An Income Tax Adjuster is responsible for a range of tasks related to income tax preparation and compliance. Their key duties include:

1. Tax Preparation

Prepare individual, corporate, and other tax returns according to tax laws and regulations.

- Analyze financial documents to determine taxable income and deductions.

- Calculate tax liability using software and manual methods.

2. Tax Audit and Review

Review and audit tax returns to ensure accuracy and compliance.

- Examine financial records and supporting documentation.

- Identify potential errors or discrepancies.

3. Tax Planning and Advice

Provide tax advice and guidance to clients.

- Analyze tax implications of financial decisions.

- Develop strategies to minimize tax liability.

4. Client Communication

Communicate effectively with clients regarding tax matters.

- Explain tax laws and regulations in a clear and concise manner.

- Respond promptly to client inquiries and concerns.

Interview Tips

Preparing thoroughly for an Income Tax Adjuster interview is crucial. Here are some tips to help candidates ace the interview:

1. Research the Company and Position

Familiarize yourself with the company’s history, values, and the specific requirements of the Income Tax Adjuster role.

- Visit the company website and social media pages.

- Read industry news and articles to stay updated on tax laws and regulations.

2. Highlight Relevant Skills and Experience

Emphasize your technical tax knowledge, experience in tax preparation, and analytical abilities.

- Provide specific examples of your work to demonstrate your skills.

- Highlight any certifications or continuing education you have completed.

3. Prepare for Common Interview Questions

Anticipate common interview questions and prepare your answers in advance. Some examples include:

- “Why are you interested in this role?”

- “Tell me about a complex tax issue you resolved.”

- “How do you stay up-to-date on tax laws and regulations?”

4. Be Professional and Confident

Dress appropriately, arrive on time, and maintain a positive and professional demeanor throughout the interview.

- Be enthusiastic and show your passion for tax work.

- Be prepared to ask thoughtful questions at the end of the interview.

5. Consider Mock Interviews

Conduct mock interviews with a friend, family member, or career counselor. This will help you become more confident and improve your communication skills.

- Ask for feedback on your answers and presentation.

- Practice answering questions in a structured and concise manner.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Income Tax Adjuster interview with confidence. Remember, preparation is key. So, start crafting your resume, highlighting your relevant skills and experiences. Don’t be afraid to tailor your application to each specific job posting. With the right approach and a bit of practice, you’ll be well on your way to landing your dream job. Build your resume now from scratch or optimize your existing resume with ResumeGemini. Wish you luck in your career journey!