Are you gearing up for an interview for a Income Tax Administrator position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Income Tax Administrator and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

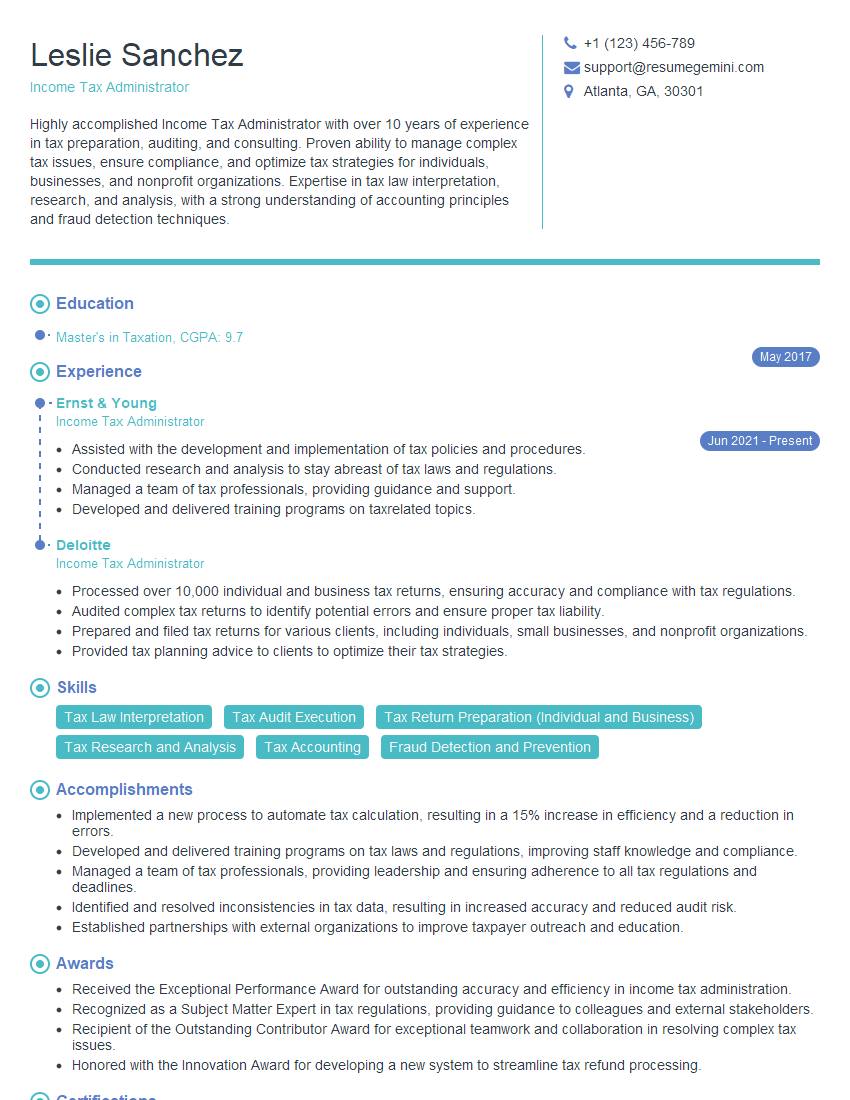

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Income Tax Administrator

1. How do you determine the tax liability of an individual?

- Begin by analyzing the individual’s income from various sources, such as salaries, investments, and businesses.

- Identify allowable deductions and exemptions to reduce the taxable income.

- Calculate taxable income based on applicable tax rates.

- Determine tax liability by applying the appropriate progressive tax brackets.

- Consider any tax credits or refunds that may reduce the final tax amount.

2. Explain the concept of tax avoidance and tax evasion. How do you handle taxpayers who engage in such practices?

Tax Avoidance

- Recognize that tax avoidance involves legal strategies to minimize tax liability.

- Analyze the taxpayer’s actions to ensure they comply with tax laws and regulations.

- Provide guidance on legitimate tax avoidance methods to support taxpayer compliance.

Tax Evasion

- Understand that tax evasion constitutes illegal activities to deliberately avoid paying taxes.

- Investigate and gather evidence to identify taxpayers engaging in evasion.

- Impose appropriate penalties and pursue legal action against individuals who evade taxes.

3. How do you handle disputes and objections raised by taxpayers?

- Receive and review objections or appeals filed by taxpayers.

- Analyze supporting documentation and conduct thorough investigations.

- Schedule meetings with taxpayers to discuss their concerns and gather additional information.

- Provide clear explanations of tax laws and regulations to justify assessments.

- Negotiate settlements or recommend adjustments based on available evidence.

4. Describe the ethical responsibilities and confidentiality standards that you adhere to as an Income Tax Administrator.

- Maintain the highest level of integrity and impartiality in all interactions.

- Protect taxpayer information and ensure confidentiality as required by law.

- Avoid conflicts of interest that may compromise professional judgment.

- Comply with ethical guidelines and code of conduct for tax professionals.

- Uphold the public trust by providing fair and equitable tax administration.

5. How do you stay updated on the latest tax laws and regulations?

- Participate in continuing professional education programs and attend industry conferences.

- Review and analyze new tax legislation, amendments, and case laws.

- Subscribe to tax journals and publications to stay informed about current developments.

- Seek guidance from tax authorities and consult with experts as needed.

- Utilize online resources and databases to access up-to-date information.

6. Explain the process of tax auditing and the various techniques used in conducting an audit.

- Plan and prepare for the audit, including gathering relevant documents.

- Conduct an initial review to assess the taxpayer’s compliance.

- Apply appropriate auditing techniques, such as risk assessment, sampling, and analytical procedures.

- Examine financial records and supporting documentation to verify accuracy and completeness.

- Interview taxpayers, third parties, and other relevant individuals to gather additional information.

7. How do you prioritize cases and allocate resources effectively within your workload?

- Analyze the complexity and potential impact of each case.

- Identify cases that require immediate attention based on deadlines, taxpayer circumstances, or legal implications.

- Assign cases to team members based on their expertise and workload capacity.

- Monitor progress and adjust resource allocation as needed to ensure timely completion.

- Utilize technology and process automation to streamline workload management.

8. Describe your experience in dealing with complex tax issues and the strategies you have employed to resolve them.

- Provide specific examples of complex tax cases you have handled, highlighting your problem-solving abilities.

- Explain the research and analysis you conducted to identify relevant laws and regulations.

- Discuss the strategies you developed to resolve the issues, including negotiations, settlements, or litigation.

- Quantify the results achieved, such as tax savings, penalties avoided, or disputes resolved.

9. How do you maintain a positive and professional demeanor when dealing with taxpayers who may be hostile or confrontational?

- Remain calm and composed, even in challenging situations.

- Listen actively to taxpayer concerns and acknowledge their perspective.

- Use clear and respectful language, avoiding technical jargon.

- Focus on providing factual information and explaining tax laws objectively.

- Seek support from supervisors or colleagues when necessary to diffuse tension or resolve conflicts.

10. What are your strengths and weaknesses as an Income Tax Administrator?

Strengths

- Exceptional knowledge and understanding of tax laws and regulations.

- Strong analytical and problem-solving skills.

- Proven ability to handle complex tax issues and disputes effectively.

- Excellent communication and interpersonal skills.

- Commitment to maintaining the highest ethical standards.

Weaknesses

- Can be overly detail-oriented at times, which may slow down the review process.

- Have not had extensive experience in international taxation.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Income Tax Administrator.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Income Tax Administrator‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Income Tax Administrators are responsible for a wide range of duties related to income tax administration. They may work for the government or for private accounting firms. The key job responsibilities of an Income Tax Administrator can be grouped into four main categories:

1. Tax Preparation and Filing

Income Tax Administrators assist individuals and businesses with preparing and filing their tax returns. They review the taxpayer’s financial information, identify deductions and credits, and calculate the amount of tax owed.

- Prepare and file individual and business tax returns

- Review taxpayer’s financial information

- Identify deductions and credits

- Calculate the amount of tax owed

2. Tax Audits

Income Tax Administrators may conduct tax audits to ensure that taxpayers are complying with tax laws. They examine the taxpayer’s financial records to verify that the information reported on their tax return is accurate.

- Conduct tax audits

- Verify accuracy of tax returns

- Identify and resolve tax issues

- Enforce tax laws

3. Tax Policy and Regulations

Income Tax Administrators may be involved in developing and implementing tax policy and regulations. They research and analyze tax laws and regulations to ensure that they are fair and equitable.

- Research and analyze tax laws and regulations

- Develop and implement tax policy

- Interpret tax laws and regulations

- Provide guidance to taxpayers

4. Taxpayer Education

Income Tax Administrators may provide taxpayer education to help taxpayers understand their rights and obligations under the tax laws. They may conduct workshops, seminars, and prepare educational materials.

- Provide taxpayer education

- Conduct workshops and seminars

- Prepare educational materials

- Answer taxpayer questions

Interview Tips

Preparing for an interview for an Income Tax Administrator position can be daunting, but by following these tips you can increase your chances of success.

1. Research the Company and Position

Before the interview, take some time to research the company and the specific position you are applying for. This will help you understand the company’s culture and values, as well as the specific requirements of the job.

- Visit the company website

- Read the job description

- Talk to people who work at the company

2. Practice Your Answers to Common Interview Questions

There are a number of common interview questions that you are likely to be asked, such as “Tell me about yourself” or “Why are you interested in this position?” By preparing your answers to these questions ahead of time, you can ensure that you are able to articulate your skills and experience in a clear and concise way.

- “Tell me about yourself”

- “Why are you interested in this position?”

- “What are your strengths and weaknesses?”

- “What is your experience with income tax administration?”

- “How do you stay up-to-date on tax laws and regulations?”

3. Be Prepared to Discuss Your Experience

The interviewer will want to know about your experience in income tax administration. Be prepared to discuss your specific skills and knowledge, as well as your experience with tax audits, tax policy, and taxpayer education.

- Quantify your accomplishments whenever possible.

- Use specific examples to illustrate your skills and experience.

- Be prepared to discuss your experience with different types of taxpayers.

4. Be Enthusiastic and Professional

First impressions matter, so make sure to be enthusiastic and professional during your interview. Dress appropriately, arrive on time, and be prepared to answer questions in a clear and concise way.

- Dress appropriately

- Arrive on time

- Be polite and respectful

- Maintain eye contact

- Speak clearly and confidently

Next Step:

Now that you’re armed with the knowledge of Income Tax Administrator interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Income Tax Administrator positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini