Feeling lost in a sea of interview questions? Landed that dream interview for Revenue Specialist but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Revenue Specialist interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

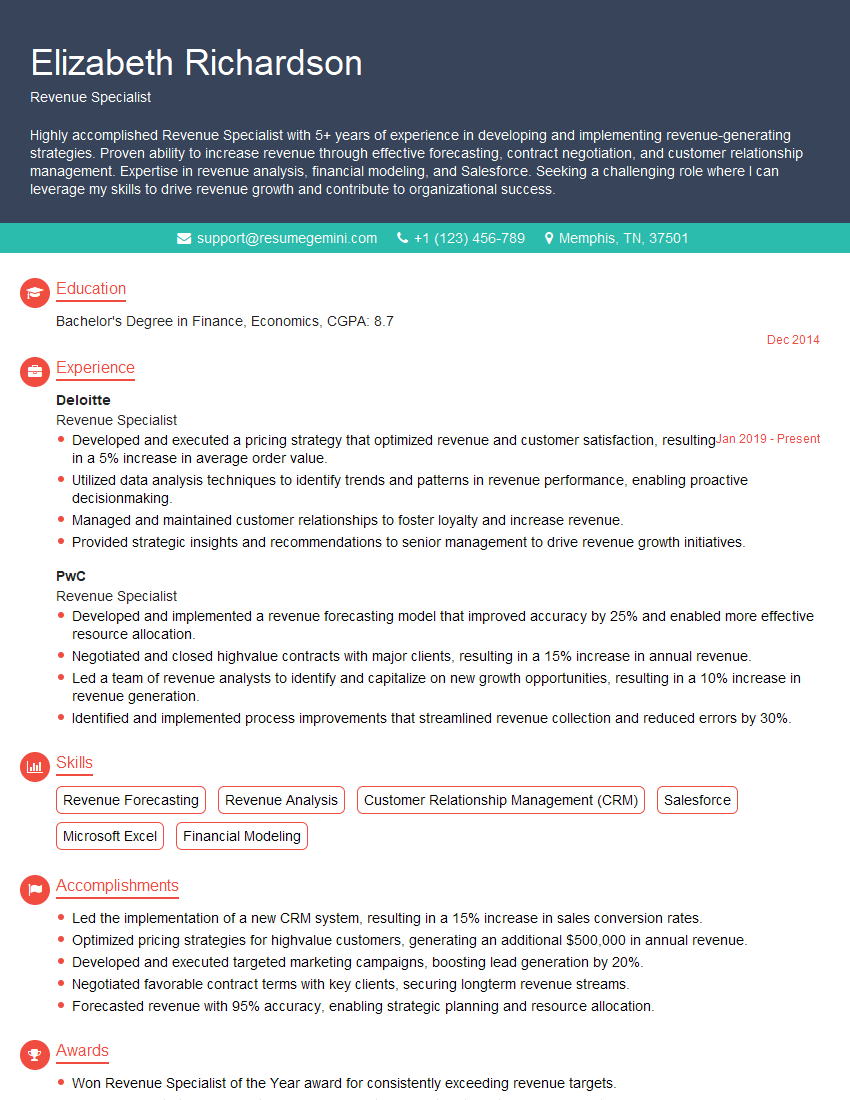

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Revenue Specialist

1. What are your core responsibilities as a Revenue Specialist?

As a Revenue Specialist, my primary responsibilities include:

- Managing and tracking revenue streams to ensure accurate and timely reporting.

- Performing revenue forecasting and analysis to identify trends and opportunities.

- Collaborating with other departments, such as sales and finance, to provide data-driven insights.

- Implementing revenue optimization strategies to maximize revenue generation.

2. How do you ensure revenue accuracy and minimize revenue leakage?

To ensure revenue accuracy and minimize revenue leakage, I employ the following strategies:

Regular Revenue Reconciliation:

- Reconciling revenue data from various sources to identify discrepancies and errors.

- Investigating and resolving any discrepancies promptly to maintain data integrity.

Automated Revenue Monitoring:

- Establishing automated systems to track revenue KPIs and monitor for potential anomalies.

- Using data analytics tools to detect and prevent revenue leakage in real-time.

3. Describe your experience in using revenue forecasting models.

In my previous role, I developed and utilized a range of revenue forecasting models to predict future revenue streams. These models incorporated historical data, market trends, and business strategies to provide accurate and reliable forecasts. I am proficient in using various forecasting techniques, including time series analysis, regression analysis, and Monte Carlo simulations.

4. How do you prioritize and execute revenue optimization initiatives?

To prioritize and execute revenue optimization initiatives, I follow a systematic approach:

- Identify Potential Opportunities: Conduct thorough analysis of revenue data to identify areas for improvement.

- Evaluate and Prioritize Initiatives: Assess the potential impact, feasibility, and resource requirements of each initiative.

- Develop and Implement Solutions: Collaborate with cross-functional teams to develop and implement effective solutions to maximize revenue.

- Monitor and Measure Results: Track progress against established KPIs to measure the success of optimization initiatives.

5. What revenue recognition principles are you familiar with?

I am well-versed in various revenue recognition principles, including:

- ASC 606 (FASB): Recognize revenue when goods or services are transferred to customers in an exchange transaction.

- IFRS 15 (IASB): Focuses on the transfer of control over goods or services, regardless of the timing of payment.

- SAB 101 (GASB): Applicable to government entities, emphasizes the timing of when the obligation to perform services is incurred.

6. How do you stay up-to-date on industry best practices and regulatory changes related to revenue management?

To stay current on industry best practices and regulatory changes, I actively engage in the following activities:

- Attend industry conferences and webinars: Network with professionals and learn about emerging trends and advancements.

- Subscribe to industry publications and blogs: Stay informed about the latest revenue management techniques and insights.

- Participate in professional development courses and certifications: Enhance my knowledge and skills in revenue management.

7. Describe your experience in managing revenue audits.

In my previous role, I was responsible for managing revenue audits conducted by internal and external auditors. My responsibilities included:

- Preparing and reviewing audit documentation: Gathering and organizing relevant financial and operational data.

- Collaborating with auditors: Providing clear and timely responses to audit inquiries and requests for information.

- Addressing audit findings: Working with cross-functional teams to resolve audit findings and implement corrective actions.

8. How do you handle discrepancies between different revenue reporting systems?

When faced with discrepancies between different revenue reporting systems, I follow a systematic approach to ensure accurate and consistent reporting:

- Investigate Data Sources: Analyze the underlying data and identify potential errors or inconsistencies in the source systems.

- Perform Data Reconciliation: Perform thorough reconciliations to identify and correct any discrepancies between the systems.

- Establish Communication Channels: Facilitate communication between stakeholders to ensure transparency and resolve discrepancies efficiently.

9. What experience do you have with using data analytics tools for revenue management?

In my previous role, I utilized data analytics tools extensively for revenue management purposes, including:

- Revenue Forecasting: Leveraging historical data and predictive analytics to develop accurate revenue forecasts.

- Customer Segmentation: Analyzing customer data to identify patterns and trends, enabling targeted revenue optimization strategies.

- Performance Monitoring: Tracking key revenue metrics and identifying areas for improvement.

10. How do you measure the effectiveness of your revenue management strategies?

To assess the effectiveness of my revenue management strategies, I employ the following metrics:

- Revenue Growth: Track the percentage increase in revenue over specific periods.

- Profitability Analysis: Monitor gross and net profit margins to evaluate the profitability of revenue-generating activities.

- Customer Lifetime Value: Analyze customer spending patterns to determine the long-term value of each customer.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Revenue Specialist.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Revenue Specialist‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Revenue Specialists play a pivotal role in driving revenue growth and ensuring financial stability. Their responsibilities encompass a wide range of core functions:

1. Revenue Recognition and Reporting

Accurately record and report revenue in accordance with GAAP and company accounting policies.

- Ensure timely and accurate revenue recognition.

- Prepare and analyze revenue reports to monitor business performance.

2. Revenue Forecasting and Budgeting

Develop and maintain accurate revenue forecasts to support business planning.

- Collaborate with sales and finance teams to gather data and make informed forecasts.

- Monitor forecast accuracy and make adjustments as needed.

3. Contract Management

Manage contracts to optimize revenue streams and ensure compliance.

- Review and analyze contracts for revenue-related provisions.

- Negotiate and amend contracts to maximize revenue potential.

4. Revenue Optimization

Identify and implement strategies to increase revenue and improve profitability.

- Analyze revenue trends and develop recommendations for improvement.

- Collaborate with product and marketing teams to enhance revenue-generating initiatives.

Interview Tips

To ace the interview for a Revenue Specialist role, it is crucial to prepare thoroughly and demonstrate your understanding of the key responsibilities:

1. Research the Company and Role

Familiarize yourself with the company’s business, industry, and financial performance. Thoroughly review the job description to grasp the specific expectations.

- Visit the company’s website and read industry publications to gain insights.

- Identify the key revenue drivers and challenges faced by the organization.

2. Highlight Your Skills and Experience

Emphasize your proficiency in revenue recognition, forecasting, contract management, and revenue optimization. Provide specific examples of your accomplishments.

- Quantify your results whenever possible. Use metrics to demonstrate the impact of your work.

- Share examples of revenue-generating initiatives you implemented or contributed to.

3. Be Prepared for Technical Questions

Anticipate questions related to revenue accounting principles, GAAP compliance, and contract analysis. Be able to articulate your understanding of these concepts.

- Review GAAP guidelines and industry best practices for revenue recognition.

- Prepare to discuss your experience in managing complex contracts and negotiating revenue-related terms.

4. Showcase Your Problem-Solving and Analytical Abilities

Revenue Specialists are often tasked with identifying and solving revenue-related challenges. Highlight your analytical skills and ability to approach problems with a creative mindset.

- Provide examples of revenue analysis projects you have worked on and the conclusions you drew.

- Share your thoughts on potential revenue optimization strategies for the company.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Revenue Specialist interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.