Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tax Agent position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

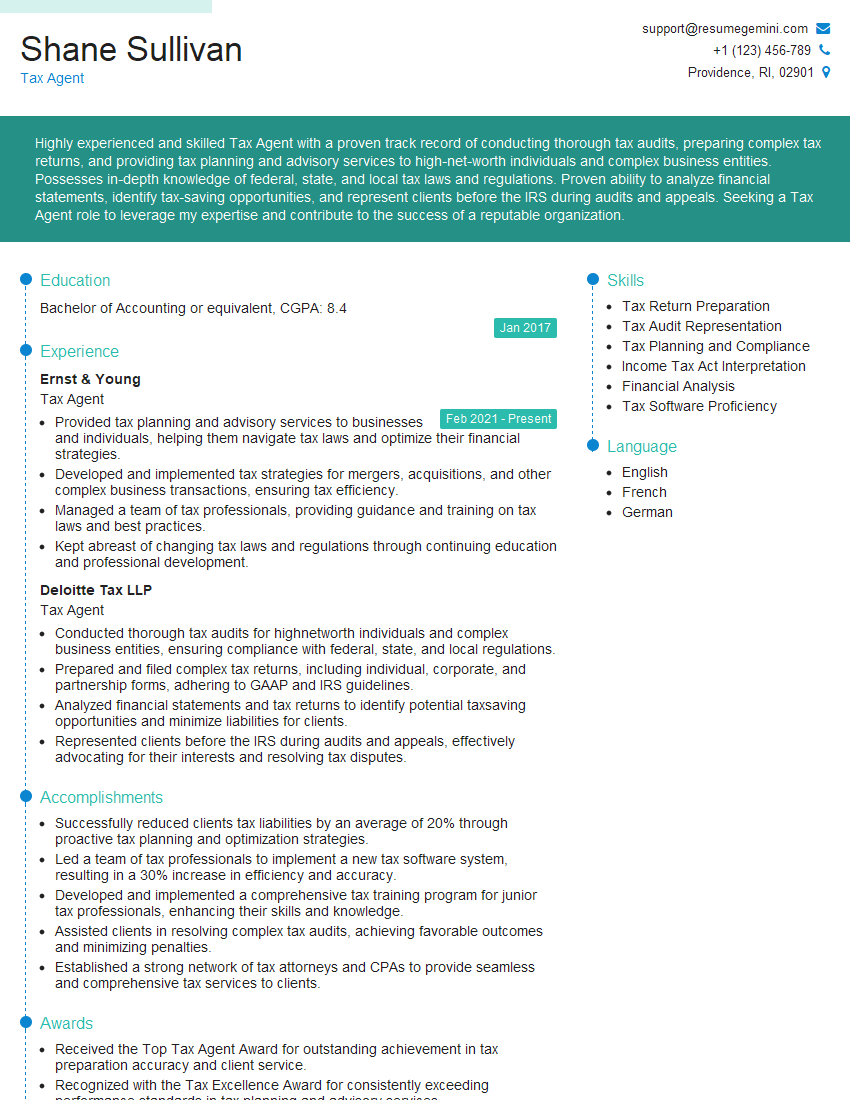

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Agent

1. Can you explain the concept of deemed income and exempt income?

- Deemed income refers to income that is considered taxable by law, even if it has not been physically received. It is created when certain events occur, such as living in a rent-free property.

- Exempt income, on the other hand, refers to income that is not subject to taxation. It is typically specified under the tax law of a particular jurisdiction.

2. What is the difference between the income tax rate and the marginal tax rate?

- The income tax rate is a flat percentage of taxable income. It remains the same regardless of how much income is earned.

- The marginal tax rate is the rate applied to the last dollar of taxable income. It increases as taxable income increases. This is because the tax system is progressive, meaning that higher earners pay a higher proportion of their income in taxes.

3. Can you explain the concept of capital gains tax?

- Capital gains tax is a tax on the profit made from the sale of an asset, such as a stock or property. It is calculated by subtracting the purchase price of the asset from the sale price.

- Capital gains can be either short-term or long-term. Short-term capital gains are taxed at the ordinary income tax rate, while long-term capital gains are taxed at a lower rate.

4. How do you determine the tax residency of an individual?

- Tax residency is determined based on a number of factors, including the individual’s physical presence, intention to stay, and domicile.

- In most jurisdictions, an individual is considered a tax resident if they spend a certain number of days in the country during a tax year.

5. Can you explain the difference between a tax audit and a tax investigation?

- A tax audit is a review of a taxpayer’s tax return to ensure that it is accurate and complete.

- A tax investigation is a more in-depth examination of a taxpayer’s tax affairs. It is typically initiated when there is a suspicion of fraud or other wrongdoing.

6. What is the role of the Australian Taxation Office (ATO)?

- The ATO is the Australian government agency responsible for administering the tax system.

- Its role includes collecting taxes, providing tax advice, and conducting tax audits and investigations.

7. What are the key tax deductions for individuals?

- Key tax deductions for individuals include work-related expenses, education expenses, and charitable contributions.

- Taxpayers can claim these deductions on their tax return to reduce their taxable income.

8. How do you stay up-to-date with the latest tax laws and regulations?

- To stay up-to-date with the latest tax laws and regulations, I regularly read tax publications, attend seminars, and consult with tax professionals.

- I also subscribe to online tax services that provide updates on changes to the tax law.

9. How do you handle complex tax issues?

- When faced with complex tax issues, I first research the relevant laws and regulations.

- I also consult with tax professionals and other experts to gain their insights.

- Once I have a thorough understanding of the issue, I develop a plan to resolve it.

10. What is your approach to providing tax advice?

- My approach to providing tax advice is to first understand the client’s specific situation.

- I then research the relevant laws and regulations to determine the best course of action.

- I explain my findings to the client in a clear and concise manner.

- I am also available to answer any questions the client may have.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Agents are responsible for a wide range of duties related to tax preparation and compliance. Some of the key job responsibilities for a Tax Agent include:

1. Tax Preparation

Tax Agents are responsible for preparing individual and business tax returns for their clients. This involves gathering and analyzing financial information, calculating taxes owed, and completing all necessary tax forms.

2. Tax Planning

Tax Agents help their clients plan for future tax obligations. This involves identifying potential tax deductions and credits, developing tax-saving strategies, and advising clients on how to minimize their tax liability.

3. Tax Representation

Tax Agents represent their clients before the Internal Revenue Service (IRS) in the event of an audit or other tax dispute. This involves negotiating with the IRS on behalf of their clients and advocating for their best interests.

4. Tax Consulting

Tax Agents provide tax consulting services to businesses and individuals. This involves advising clients on complex tax issues, developing tax compliance strategies, and helping clients understand their tax obligations.

Interview Tips

To ace an interview for a Tax Agent position, it is important to prepare thoroughly and be well-versed in the key responsibilities of the role. Here are some tips to help you prepare:

1. Research the Company and the Position

Before the interview, take some time to research the company you are applying to and the specific Tax Agent position. This will help you understand the company’s culture, values, and expectations for the role.

2. Prepare for Common Interview Questions

There are several common interview questions that you are likely to encounter during an interview for a Tax Agent position. Some of the most common questions include:

- Tell me about yourself and your experience in the tax field.

- Why are you interested in this position?

- What are your strengths and weaknesses as a Tax Agent?

- How do you stay up-to-date on tax laws and regulations?

To prepare for these questions, take some time to think about your experiences and skills, and practice answering the questions in a clear and concise manner.

3. Highlight Your Skills and Experience

During the interview, be sure to highlight your skills and experience that are relevant to the Tax Agent position. This includes your knowledge of tax laws and regulations, your experience in preparing tax returns, and your ability to represent clients before the IRS.

4. Be Enthusiastic and Professional

It is important to be enthusiastic and professional during the interview. This will show the interviewer that you are interested in the position and that you are confident in your abilities. Dress appropriately, arrive on time for the interview, and be respectful of the interviewer’s time.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Tax Agent role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.