Feeling lost in a sea of interview questions? Landed that dream interview for Special Tax Auditor but worried you might not have the answers? You’re not alone! This blog is your guide for interview success. We’ll break down the most common Special Tax Auditor interview questions, providing insightful answers and tips to leave a lasting impression. Plus, we’ll delve into the key responsibilities of this exciting role, so you can walk into your interview feeling confident and prepared.

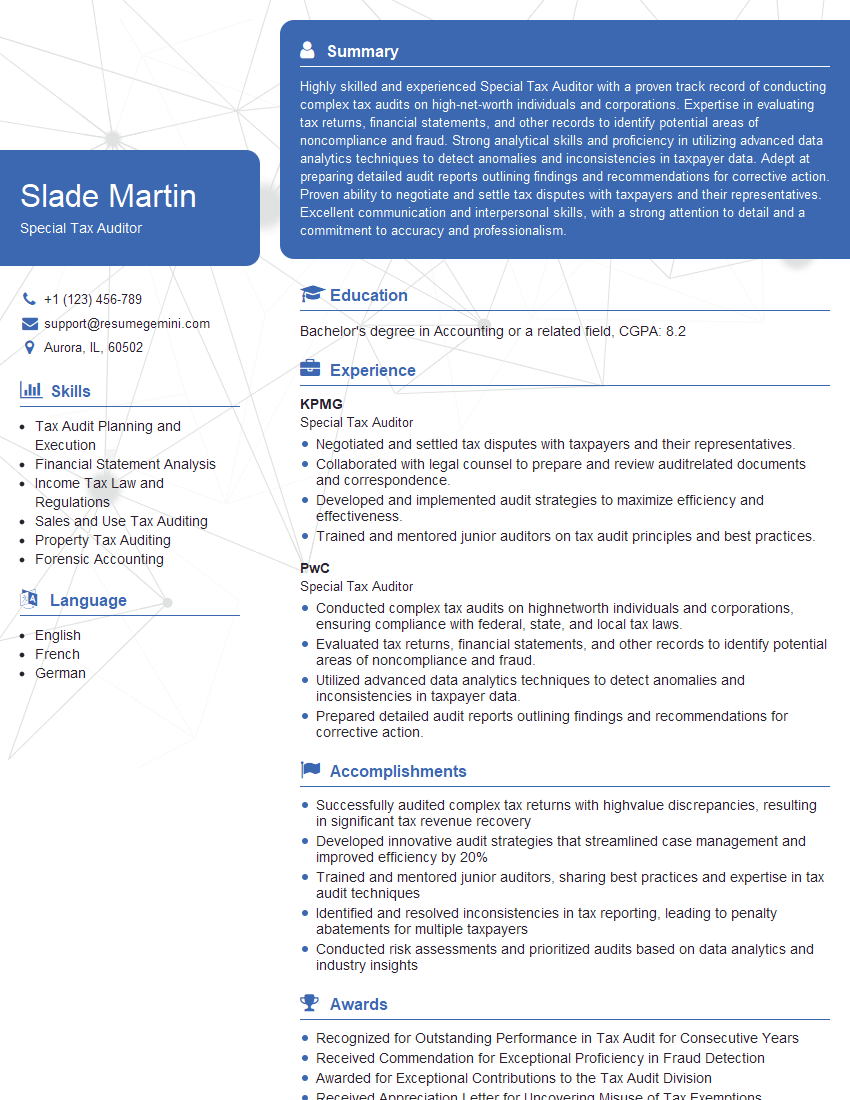

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Special Tax Auditor

1. Can you elaborate on the various audit techniques you employ during a tax audit?

- Analytical procedures: Comparing financial data to industry benchmarks or prior periods to identify anomalies.

- Test of transactions: Examining specific transactions to ensure they are properly recorded and supported by documentation.

- Substantive procedures: Verifying the existence and valuation of assets and liabilities, as well as the accuracy of income and expense reporting.

- Compliance testing: Reviewing compliance with applicable tax laws and regulations, including transfer pricing and international taxation.

- Data analytics: Using specialized software and techniques to analyze large datasets and identify potential areas of risk.

2. Explain the role of a Special Tax Auditor in the context of transfer pricing audits.

- Evaluating the taxpayer’s transfer pricing policies and documentation.

- Performing functional and economic analysis to determine the arm’s length price for intercompany transactions.

- Identifying and quantifying transfer pricing adjustments that may result in additional taxes owed.

- Deep understanding of transfer pricing regulations and best practices.

- Advanced analytical and economic modeling skills.

- Experience in working with multinational corporations and complex intercompany transactions.

3. Describe the international tax laws and regulations that you are familiar with and how you apply them in your audits.

- OECD Transfer Pricing Guidelines:

- Arm’s length principle

- Methods for determining arm’s length prices

- US tax laws related to foreign income and taxation:

- Foreign Tax Credit

- Controlled Foreign Corporations (CFCs)

- Tax treaties and double taxation agreements:

- Preventing double taxation

- Exchanging tax information

4. How do you stay up-to-date on the latest tax laws and regulatory changes that may impact your audits?

- Attending industry conferences and seminars

- Subscribing to professional publications and online resources

- Participating in continuing professional education programs

- Collaborating with other tax professionals and specialists

- Reviewing government and regulatory agency announcements

5. Describe your experience in handling complex tax audits involving multiple jurisdictions and legal entities.

- Coordinated audits with tax authorities in different countries.

- Managed teams of auditors with diverse backgrounds and expertise.

- Negotiated settlements and resolutions with taxpayers and their representatives.

- Prepared and presented audit reports and findings to senior management and regulatory bodies.

- Ensured compliance with ethical guidelines and professional standards.

6. Explain how you utilize data analytics in your tax audits to improve efficiency and effectiveness.

- Identifying potential areas of risk and fraud through data analysis.

- Automating data extraction and analysis tasks to save time and reduce errors.

- Developing data visualization tools to present audit findings in a clear and concise manner.

- Using predictive analytics to anticipate tax compliance issues and trends.

- Collaborating with data scientists and IT professionals to enhance analytical capabilities.

7. Describe your approach to maintaining confidentiality and protecting taxpayer information during audits.

- Adhering to ethical guidelines and regulatory requirements.

- Limiting access to sensitive taxpayer information to authorized personnel only.

- Using secure encryption methods and data storage practices.

- Conducting audits in a professional and respectful manner.

- Reporting any potential breaches or unauthorized access to appropriate authorities.

8. How do you prioritize and manage multiple audit engagements simultaneously while ensuring timely completion and high-quality deliverables?

- Developing a comprehensive audit plan and timeline.

- Delegating tasks and responsibilities to team members effectively.

- Using project management tools and techniques.

- Communicating regularly with stakeholders to manage expectations.

- Seeking support from senior management when necessary.

9. Explain your understanding of the ethical responsibilities and professional conduct expected of a Special Tax Auditor.

- Maintaining independence and objectivity.

- Acting with integrity and honesty.

- Following professional standards and codes of conduct.

- Avoiding conflicts of interest.

- Reporting any unethical or illegal conduct.

10. Describe your approach to resolving disputes and negotiating settlements with taxpayers and their representatives.

- Maintaining a professional and collaborative attitude.

- Objectively evaluating taxpayer submissions and arguments.

- Negotiating fair and reasonable settlements that comply with tax laws and regulations.

- Documenting all agreements and settlements in writing.

- Seeking legal advice when necessary.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Special Tax Auditor.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Special Tax Auditor‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

A Special Tax Auditor is responsible for conducting in-depth audits of tax returns to ensure compliance with tax laws and regulations. They work closely with taxpayers, accountants, and other professionals to ensure that taxes are paid accurately and on time.

1. Audit Tax Returns

Special Tax Auditors examine tax returns to verify the accuracy of reported income, deductions, and credits. They may also review supporting documentation, such as financial statements, invoices, and receipts, to support their findings.

- Analyze tax returns for accuracy and completeness.

- Identify potential areas of non-compliance.

- Conduct interviews with taxpayers and their representatives.

2. Investigate Tax Fraud

Special Tax Auditors investigate cases of suspected tax fraud. They gather evidence, interview witnesses, and prepare reports to support their findings. They may also work with law enforcement officials to prosecute tax fraud cases.

- Examine financial records for evidence of fraud.

- Interview witnesses and gather evidence.

- Prepare reports and present findings to management.

3. Conduct Tax Research

Special Tax Auditors stay up-to-date on the latest tax laws and regulations. They conduct research to answer questions from taxpayers and to identify potential areas of non-compliance.

- Research tax laws and regulations.

- Answer questions from taxpayers and their representatives.

- Identify potential areas of non-compliance.

4. Advise Taxpayers

Special Tax Auditors provide advice to taxpayers on a variety of tax matters. They may help taxpayers understand their tax obligations, prepare their tax returns, and resolve tax disputes.

- Provide advice to taxpayers on tax matters.

- Help taxpayers prepare their tax returns.

- Resolve tax disputes.

Interview Tips

Preparing for an interview for a Special Tax Auditor position can be daunting, but with the right preparation, you can increase your chances of success. Here are a few tips to help you ace the interview:

1. Research the Position

Before you go to the interview, take some time to research the position and the company. This will help you understand the role and the expectations of the hiring manager. You can find information about the position on the company’s website, in job postings, and in industry publications.

- Read the job description carefully.

- Visit the company’s website to learn more about their culture and values.

- Research the industry to understand the current trends and challenges.

2. Practice Your Answers

Once you have a good understanding of the position, take some time to practice your answers to common interview questions. This will help you feel more confident and prepared during the interview.

- Prepare answers to questions about your experience, skills, and qualifications.

- Practice answering questions about your knowledge of tax laws and regulations.

- Be prepared to discuss your experience with auditing tax returns.

3. Dress Professionally

First impressions matter, so make sure you dress professionally for your interview. This means wearing a suit or business casual attire. You should also be well-groomed and have a clean and pressed appearance.

- Wear a suit or business casual attire.

- Be well-groomed and have a clean and pressed appearance.

- Make sure your shoes are polished.

4. Be Enthusiastic and Positive

The hiring manager wants to see that you are enthusiastic about the position and the company. Be positive and upbeat during your interview. This will show the hiring manager that you are excited about the opportunity to work for the company.

- Be enthusiastic and positive during your interview.

- Show the hiring manager that you are excited about the opportunity to work for the company.

- Be confident and assertive, but not arrogant.

Next Step:

Now that you’re armed with interview-winning answers and a deeper understanding of the Special Tax Auditor role, it’s time to take action! Does your resume accurately reflect your skills and experience for this position? If not, head over to ResumeGemini. Here, you’ll find all the tools and tips to craft a resume that gets noticed. Don’t let a weak resume hold you back from landing your dream job. Polish your resume, hit the “Build Your Resume” button, and watch your career take off! Remember, preparation is key, and ResumeGemini is your partner in interview success.