Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Tax Compliance Agent position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together

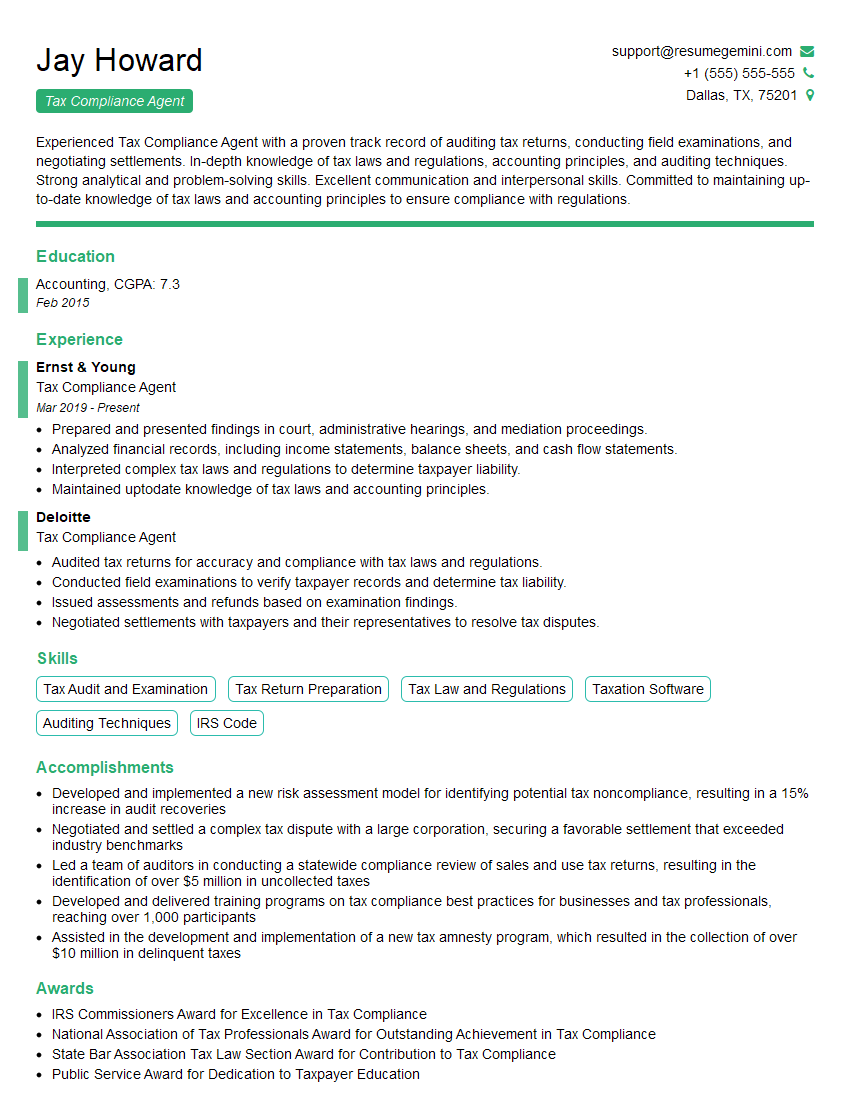

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Tax Compliance Agent

1. Describe your understanding of the role of a Tax Compliance Agent?

A Tax Compliance Agent is responsible for ensuring that individuals and businesses comply with tax laws and regulations. My duties include:

- Investigating tax returns and financial records to identify potential errors or discrepancies.

- Conducting audits and examinations to verify compliance with tax laws.

- Preparing and issuing notices of assessment or refunds.

- Negotiating and settling tax disputes.

2. Explain the key principles of tax compliance?

Taxpayer Responsibilities

- File accurate and timely tax returns.

- Pay taxes due on time.

- Maintain records to support tax claims.

Tax Authority Responsibilities

- Administer tax laws fairly and impartially.

- Provide clear and concise guidance to taxpayers.

- Respect taxpayer rights.

3. What are the common challenges faced by Tax Compliance Agents?

Tax Compliance Agents face a number of challenges, including:

- The increasing complexity of tax laws and regulations.

- The growing use of tax avoidance and evasion schemes.

- The need to balance enforcement with taxpayer service.

- The shortage of qualified tax professionals.

4. Describe the different types of tax audits conducted by Tax Compliance Agents?

Tax Compliance Agents conduct various types of audits, including:

- Field audits: Conducted at the taxpayer’s place of business or residence.

- Office audits: Conducted at the tax authority’s office.

- Correspondence audits: Conducted through correspondence with the taxpayer.

- Special audits: Conducted for specific purposes, such as fraud investigations or industry-specific reviews.

5. Explain the importance of confidentiality in tax compliance?

Confidentiality is essential in tax compliance because it:

- Protects taxpayers’ privacy.

- Maintains trust between taxpayers and the tax authority.

- Ensures the integrity of the tax system.

6. What are the consequences of non-compliance with tax laws?

Non-compliance with tax laws can result in:

- Civil penalties

- Interest on unpaid taxes

- Criminal prosecution

7. How do you stay up-to-date on changes in tax laws and regulations?

I stay up-to-date on changes in tax laws and regulations by:

- Attending training and seminars.

- Reading professional journals and articles.

- Utilizing online resources and databases.

- Networking with other tax professionals.

8. What are your strengths and weaknesses as a Tax Compliance Agent?

My strengths include:

- Strong technical knowledge of tax laws and regulations.

- Excellent analytical and problem-solving skills.

- Effective communication and interpersonal skills.

- Ability to work independently and as part of a team.

My weakness is that I am relatively new to the field of tax compliance and still developing my experience.

9. Why are you interested in working as a Tax Compliance Agent?

I am interested in working as a Tax Compliance Agent because I am passionate about ensuring that everyone pays their fair share of taxes.

I believe that the work of Tax Compliance Agents is essential to maintaining the integrity of the tax system and ensuring that the government has the resources it needs to provide essential services.

10. What are your career goals as a Tax Compliance Agent?

My career goals as a Tax Compliance Agent are to:

- Become a subject matter expert in tax compliance.

- Lead and mentor other Tax Compliance Agents.

- Make a positive contribution to the tax system.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Tax Compliance Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Tax Compliance Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Tax Compliance Agents play a crucial role in ensuring businesses adhere to tax laws and regulations. Their responsibilities encompass a wide range of tasks, including:

1. Tax Audits

Conducting thorough audits to verify the accuracy and completeness of tax returns, financial records, and other relevant documents.

2. Tax Fraud Investigation

Investigating suspected cases of tax fraud, identifying irregularities, and gathering evidence to support legal action.

3. Taxpayer Assistance

Providing guidance and support to taxpayers, answering their queries, and resolving any tax-related issues they may encounter.

4. Policy Analysis and Development

Reviewing and analyzing existing tax policies, identifying areas for improvement, and proposing new measures to enhance compliance.

5. Training and Outreach

Conducting training programs for taxpayers and tax professionals to educate them on tax laws and regulations.

Interview Tips

To ace the interview for a Tax Compliance Agent position, it’s essential to prepare thoroughly. Here are some tips to help you succeed:

1. Research the Company and Role

Familiarize yourself with the company’s mission, values, and specific tax compliance requirements. Research the role to understand its responsibilities and expectations.

2. Highlight Relevant Skills and Experience

Emphasize your technical skills in tax accounting, auditing, and financial analysis. Showcase your experience in conducting tax audits, investigating fraud, and providing taxpayer assistance.

3. Practice Answering Common Interview Questions

Prepare for common questions related to tax compliance, ethics, and communication skills. Consider using the STAR method (Situation, Task, Action, Result) to provide structured and impactful answers.

4. Demonstrate Enthusiasm for Tax Compliance

Express your passion for tax compliance and explain why you’re eager to contribute to the field. Highlight your commitment to ethical practices and your desire to make a positive impact.

5. Prepare Questions for the Interviewer

Asking thoughtful questions shows your interest and engagement. Prepare questions related to the company’s tax compliance strategies, growth plans, or industry trends.

Example Outline

Question: Tell us about your experience in conducting tax audits.

- Describe a specific audit you performed, highlighting your analytical skills, attention to detail, and ability to identify discrepancies.

- Explain how you effectively communicated your findings to taxpayers and resolved any issues.

Question: How would you approach investigating a suspected case of tax fraud?

- Outline your step-by-step process for gathering evidence, analyzing data, and following audit trails.

- Describe the ethical considerations you would prioritize while conducting the investigation.

Next Step:

Now that you’re armed with the knowledge of Tax Compliance Agent interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Tax Compliance Agent positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini