Are you gearing up for an interview for a Treasury Agent position? Whether you’re a seasoned professional or just stepping into the role, understanding what’s expected can make all the difference. In this blog, we dive deep into the essential interview questions for Treasury Agent and break down the key responsibilities of the role. By exploring these insights, you’ll gain a clearer picture of what employers are looking for and how you can stand out. Read on to equip yourself with the knowledge and confidence needed to ace your next interview and land your dream job!

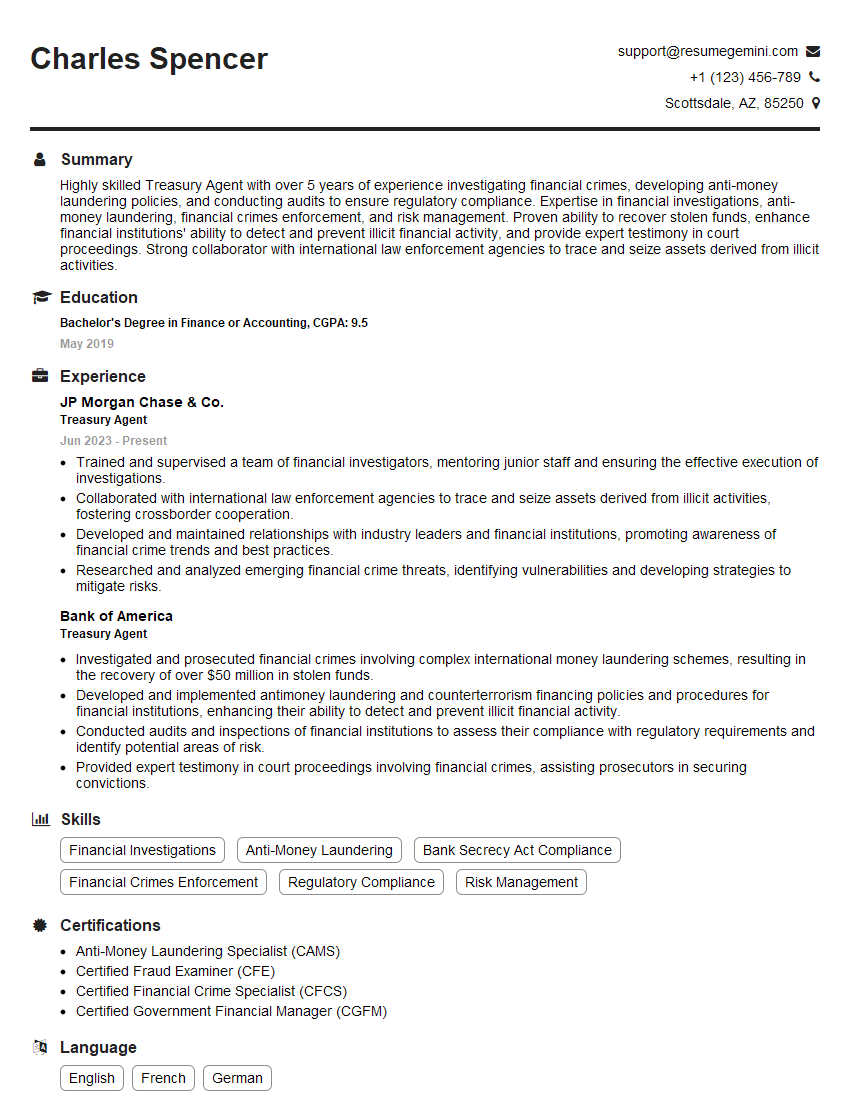

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Treasury Agent

1. What is the Bank Secrecy Act (BSA) and what are the key requirements for financial institutions to comply with the BSA?

- The Bank Secrecy Act (BSA) is a federal law that requires financial institutions to help the government detect and prevent money laundering and other financial crimes.

- Key requirements for financial institutions to comply with the BSA include:

- Establishing a customer identification program

- Maintaining records of transactions

- Reporting suspicious activities

2. Describe the different types of financial investigations conducted by Treasury Agents and the techniques used to conduct these investigations.

Types of financial investigations

- Money laundering investigations

- Terrorist financing investigations

- Bank fraud investigations

- Insurance fraud investigations

Techniques used to conduct financial investigations

- Document analysis

- Interviews

- Surveillance

- Data analysis

3. What are the challenges of conducting financial investigations and how do you overcome them?

- Challenges of conducting financial investigations:

- The complexity of financial transactions

- The lack of cooperation from financial institutions

- The need to protect the privacy of individuals

- Ways to overcome challenges:

- Using specialized software and databases

- Building relationships with financial institutions

- Balancing the need for privacy with the need to investigate financial crimes

4. What is the role of a Treasury Agent in combating money laundering and terrorist financing?

- Investigating suspected money laundering and terrorist financing activities

- Working with law enforcement and intelligence agencies to disrupt money laundering and terrorist financing networks

- Providing training and support to financial institutions to help them comply with BSA requirements

- Developing and implementing policies and procedures to combat money laundering and terrorist financing

5. What are the ethical considerations that Treasury Agents must be aware of when conducting financial investigations?

- Respecting the privacy of individuals

- Protecting the confidentiality of information

- Avoiding conflicts of interest

- Adhering to the letter and spirit of the law

6. What are the career advancement opportunities for Treasury Agents?

- Supervisory Special Agent

- Assistant Special Agent in Charge

- Special Agent in Charge

- Assistant Director

- Director

7. What is your understanding of the role of FinCEN in the fight against money laundering and terrorist financing?

- FinCEN is the Financial Crimes Enforcement Network, a bureau of the U.S. Department of the Treasury

- FinCEN’s mission is to combat money laundering, terrorist financing, and other financial crimes

- FinCEN collects and analyzes financial data from financial institutions and other sources

- FinCEN provides financial intelligence to law enforcement and intelligence agencies

- FinCEN also develops and implements regulations to combat money laundering and terrorist financing

8. What is the importance of international cooperation in the fight against money laundering and terrorist financing?

- Money laundering and terrorist financing are global problems

- No single country can combat these crimes alone

- International cooperation is essential for sharing information, coordinating investigations, and disrupting financial crime networks

9. What are the emerging trends in money laundering and terrorist financing?

- The use of new technologies, such as cryptocurrencies and darknet marketplaces

- The increasing use of shell companies and other opaque entities

- The growing threat of terrorist financing from non-state actors

10. What are your strengths and weaknesses as a Treasury Agent?

- Strong analytical skills

- Excellent communication and interpersonal skills

- Proven ability to conduct complex financial investigations

- I am still relatively new to the field of financial investigations

- I am not yet fluent in all of the relevant software and databases

- I am still developing my leadership skills

Strengths

Weaknesses

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Treasury Agent.

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Treasury Agent‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Treasury Agents, often referred to as Special Agents, play a crucial role in safeguarding the financial system and national security by investigating and combating financial crimes. Their responsibilities encompass a wide range of tasks, including:

1. Financial Crime Investigations

Conducting investigations into financial crimes such as money laundering, bank fraud, and counterfeiting, gathering evidence, and identifying individuals or organizations involved.

- Analyzing financial transactions and records to trace the flow of funds.

- Interviewing witnesses, suspects, and informants to gather information.

2. National Security Investigations

Investigating threats to national security, such as terrorism financing, money laundering related to terrorist activities, and cybercrimes.

- Monitoring financial transactions and identifying suspicious patterns indicative of terrorist activities.

- Collaborating with other law enforcement agencies to gather and analyze intelligence.

3. Financial Intelligence Analysis

Collecting and analyzing financial data to identify emerging trends, patterns, and anomalies in financial transactions that may indicate criminal activity.

- Using specialized software and analytical techniques to detect suspicious transactions.

- Preparing reports and briefings for law enforcement and intelligence agencies.

4. Compliance and Regulatory Enforcement

Ensuring compliance with anti-money laundering and counter-terrorism financing regulations, and investigating violations of these regulations.

- Inspecting financial institutions and businesses to verify their compliance with financial regulations.

- Initiating enforcement actions, including civil and criminal penalties, against non-compliant entities.

Interview Tips

To ace the interview for a Treasury Agent position, candidates should thoroughly prepare and consider the following tips:

1. Research and Understand the Role

Demonstrate a deep understanding of the Treasury Agent’s responsibilities, qualifications, and the mission of the agency. Research the specific agency you are applying to, its priorities, and recent cases they have handled.

- Review the agency’s website, news articles, and social media to gather information.

- Connect with professionals in the field through LinkedIn or industry events.

2. Highlight Relevant Skills and Experience

Tailor your resume and cover letter to emphasize skills and experiences that are directly relevant to the job responsibilities. Quantify your accomplishments whenever possible using specific metrics.

- Demonstrate strong analytical, investigative, and communication skills.

- Showcase experience in financial crime investigations, compliance, or national security.

3. Practice Answering Common Interview Questions

Prepare for common interview questions related to your qualifications, motivations, and understanding of the role. Practice your answers to ensure they are clear, concise, and articulate.

- Prepare examples of your investigative work, analytical skills, and ability to handle pressure.

- Research the agency’s culture and values to align your answers accordingly.

4. Be Professional and Confident

Dress professionally, arrive on time, and maintain a positive and confident demeanor throughout the interview. Show enthusiasm for the role and demonstrate your commitment to serving as a Treasury Agent.

- Maintain eye contact, listen attentively, and ask thoughtful questions.

- Be prepared to discuss your strengths, weaknesses, and how they relate to the job.

Next Step:

Armed with this knowledge, you’re now well-equipped to tackle the Treasury Agent interview with confidence. Remember, a well-crafted resume is your first impression. Take the time to tailor your resume to highlight your relevant skills and experiences. And don’t forget to practice your answers to common interview questions. With a little preparation, you’ll be on your way to landing your dream job. So what are you waiting for? Start building your resume and start applying! Build an amazing resume with ResumeGemini.