Are you gearing up for a career shift or aiming to ace your next interview? Look no further! We’ve curated a comprehensive guide to help you crack the interview for the coveted Certified Income Tax Preparer (CTP) position. From understanding the key responsibilities to mastering the most commonly asked questions, this blog has you covered. So, buckle up and let’s embark on this journey together.

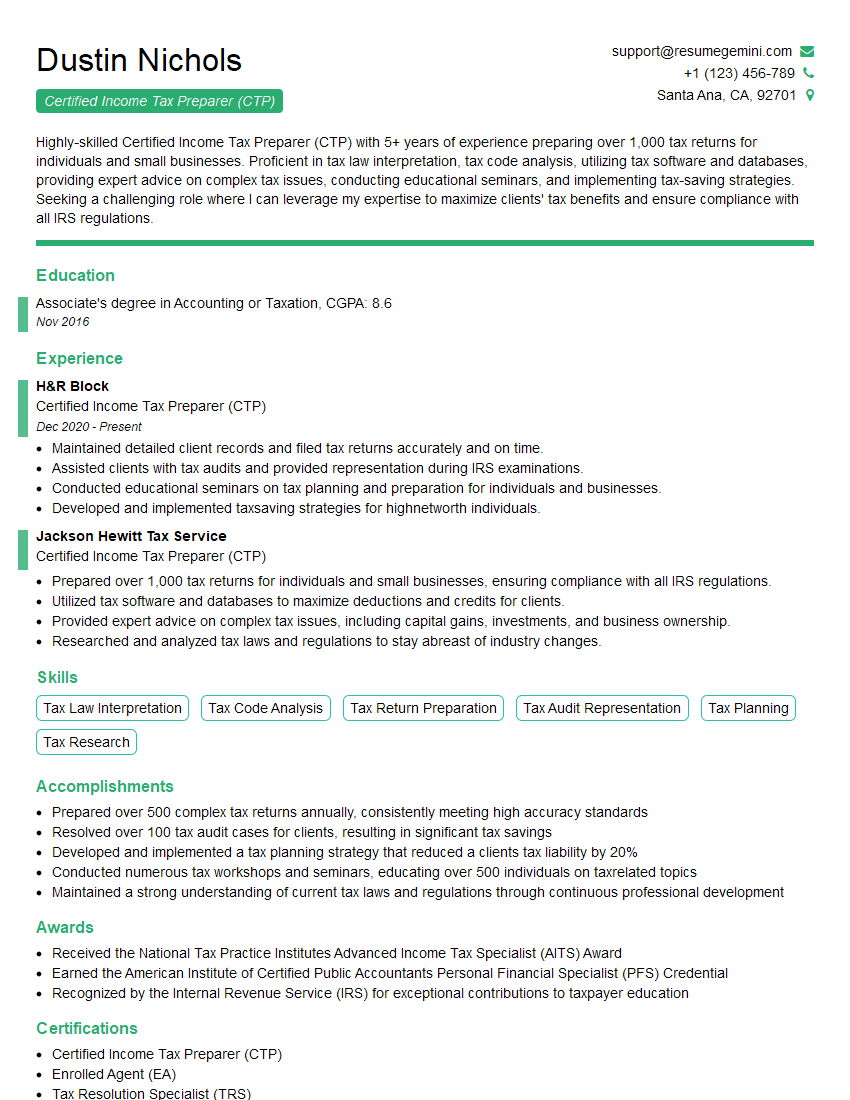

Acing the interview is crucial, but landing one requires a compelling resume that gets you noticed. Crafting a professional document that highlights your skills and experience is the first step toward interview success. ResumeGemini can help you build a standout resume that gets you called in for that dream job.

Essential Interview Questions For Certified Income Tax Preparer (CTP)

1. What are the key responsibilities of a Certified Income Tax Preparer (CTP)?

As a CTP, my main responsibilities include:

- Preparing accurate and timely individual and business tax returns in accordance with federal and state tax laws.

- Interviewing clients to gather necessary financial information, including income, expenses, and deductions.

- Applying tax laws and regulations to determine clients’ tax liability and potential refund or balance due.

- Calculating and filing tax returns electronically or by mail, ensuring accuracy and compliance with filing deadlines.

- Staying up-to-date on tax laws and regulations through continuing education to provide clients with the most current tax advice.

2. Explain the differences between the Schedule C and Schedule SE forms?

Schedule C

- Used to report self-employment income and expenses from a sole proprietorship.

- Provides details on business income, expenses, and profit or loss.

- Attaches to Form 1040, the individual income tax return.

Schedule SE

- Used to calculate and pay self-employment taxes (Social Security and Medicare).

- Based on the net income reported on Schedule C.

- Attaches to Form 1040 and is used to determine the amount of self-employment taxes due.

3. What are the most common deductions and credits that taxpayers can claim on their income tax returns?

The most common deductions and credits include:

- Standard Deduction: A flat amount that reduces taxable income.

- Itemized Deductions: Specific expenses that can be deducted from income, such as mortgage interest, charitable contributions, and medical expenses.

- Child Tax Credit: A credit for each qualifying child under the age of 17.

- Earned Income Tax Credit: A credit for low- to moderate-income working individuals and families.

- Child and Dependent Care Credit: A credit for expenses paid for the care of qualifying children and dependents.

4. How do you handle a situation where a client provides incomplete or inaccurate financial information?

When faced with incomplete or inaccurate financial information, I take the following steps:

- Contact the client immediately to request the missing or corrected information.

- Explain the importance of providing accurate information for proper tax preparation.

- If the client is unable to provide the necessary information, I may request supporting documentation or consult with tax authorities for guidance.

- Document all communication and actions taken to ensure transparency and accountability.

5. What are the ethical responsibilities of a CTP?

As a CTP, I am committed to the following ethical responsibilities:

- Confidentiality: Maintaining the privacy and confidentiality of client information.

- Integrity: Preparing tax returns with honesty, accuracy, and professionalism.

- Objectivity: Avoiding conflicts of interest and providing unbiased tax advice.

- Competence: Staying up-to-date on tax laws and regulations to provide competent and reliable services.

- Compliance: Adhering to all applicable laws and regulations governing tax preparation.

6. What software do you typically use for tax preparation?

I am proficient in the following tax preparation software:

- TaxSlayer Pro

- Intuit ProConnect Tax Online

- Drake Software

- CCH ProSystem fx Tax

- ATX

I am also familiar with various other software programs and can quickly adapt to new systems as needed.

7. How do you stay updated on changes in tax laws and regulations?

To stay updated on changes in tax laws and regulations, I engage in the following activities:

- Attend industry conferences and seminars.

- Subscribe to tax-related publications and newsletters.

- Participate in continuing education courses and workshops.

- Monitor the IRS website and other official sources for tax updates.

- Network with other tax professionals to share knowledge and insights.

8. What are the potential consequences of filing an inaccurate tax return?

Filing an inaccurate tax return can have various consequences, including:

- Penalties: Financial penalties imposed by the IRS for underpayment of taxes.

- Interest: Interest charges on unpaid taxes.

- Civil Fraud: In cases of intentional tax fraud, taxpayers may face civil penalties and fines.

- Criminal Prosecution: In extreme cases, individuals involved in tax fraud may be subject to criminal prosecution.

- Damage to Reputation: Filing inaccurate returns can damage a taxpayer’s reputation and credibility with the IRS and other entities.

9. What sets you apart from other CTPs in the industry?

I believe I stand out as a CTP because of the following attributes:

- Experience: Extensive experience in preparing tax returns for individuals and businesses of various complexities.

- Expertise: Deep understanding of tax laws and regulations, with a proven track record of accuracy and compliance.

- Ethics: Unwavering commitment to ethical practices, including confidentiality, integrity, and objectivity.

- Client Service: Dedication to providing excellent customer service, ensuring clear communication and timely responses.

- Continuous Learning: Passion for staying up-to-date on tax changes and developments.

10. Why are you interested in working for our company?

I am eager to join your company for the following reasons:

- Reputation: Your company’s reputation for excellence in tax preparation and client satisfaction.

- Growth Opportunities: The potential for professional growth and development within your organization.

- Team Environment: The opportunity to collaborate with a team of skilled professionals and contribute to your company’s success.

- Commitment to Quality: Your company’s emphasis on accuracy, compliance, and ethical practices aligns with my own values.

- Contribution: My desire to make a meaningful contribution to your team and assist your clients in meeting their tax obligations.

Interviewers often ask about specific skills and experiences. With ResumeGemini‘s customizable templates, you can tailor your resume to showcase the skills most relevant to the position, making a powerful first impression. Also check out Resume Template specially tailored for Certified Income Tax Preparer (CTP).

Career Expert Tips:

- Ace those interviews! Prepare effectively by reviewing the Top 50 Most Common Interview Questions on ResumeGemini.

- Navigate your job search with confidence! Explore a wide range of Career Tips on ResumeGemini. Learn about common challenges and recommendations to overcome them.

- Craft the perfect resume! Master the Art of Resume Writing with ResumeGemini’s guide. Showcase your unique qualifications and achievements effectively.

- Great Savings With New Year Deals and Discounts! In 2025, boost your job search and build your dream resume with ResumeGemini’s ATS optimized templates.

Researching the company and tailoring your answers is essential. Once you have a clear understanding of the Certified Income Tax Preparer (CTP)‘s requirements, you can use ResumeGemini to adjust your resume to perfectly match the job description.

Key Job Responsibilities

Certified Income Tax Preparers (CTPs) are highly skilled professionals who assist individuals and businesses in preparing and filing their tax returns. They are responsible for ensuring that the returns are accurate and complete, and that all applicable deductions and credits are claimed. CTPs must stay up-to-date on the latest tax laws and regulations, and they must be able to clearly explain complex tax concepts to clients.

1. Preparing and filing tax returns

CTPs prepare and file individual, business, and estate tax returns. They gather the necessary information from clients, including financial documents and receipts. They then use this information to calculate the client’s tax liability and prepare the return. CTPs must be able to accurately interpret tax laws and regulations, and they must be able to identify potential deductions and credits. They must also be able to clearly and concisely explain the tax return to the client.

2. Advising clients on tax matters

CTPs advise clients on a variety of tax matters, including tax planning, tax audits, and tax appeals. They help clients understand their tax obligations and develop strategies to minimize their tax liability. CTPs must be able to communicate effectively with clients and clearly explain complex tax concepts. They must also be able to stay up-to-date on the latest tax laws and regulations.

3. Representing clients before the IRS

CTPs represent clients before the Internal Revenue Service (IRS) on a variety of matters, including audits, appeals, and collections. They advocate for their clients’ interests and help them resolve tax disputes.

4. Continuing education

CTPs must complete continuing education courses each year to stay up-to-date on the latest tax laws and regulations. This ensures that they are providing their clients with the most accurate and up-to-date tax advice.

Interview Tips

Preparing for an interview for a Certified Income Tax Preparer (CTP) position can be daunting, but with the right preparation, you can increase your chances of success. Here are a few tips to help you ace your interview:

1. Research the company and the position

Before you go on an interview, it is important to research the company and the position you are applying for. This will help you understand the company’s culture and values, and it will also help you tailor your answers to the specific requirements of the position.

2. Practice your answers to common interview questions

There are a few common interview questions that you are likely to be asked, such as “Why are you interested in this position?” and “What are your strengths and weaknesses?” It is helpful to practice your answers to these questions in advance so that you can deliver them confidently and clearly.

3. Be prepared to talk about your experience

The interviewer will want to know about your experience as a CTP. Be prepared to discuss your skills and knowledge, and be able to provide specific examples of your work. If you have any relevant certifications or training, be sure to mention them.

4. Be professional and enthusiastic

First impressions matter, so it is important to be professional and enthusiastic during your interview. Dress appropriately, arrive on time, and be polite and respectful to the interviewer. Show the interviewer that you are interested in the position and that you are eager to learn more about the company.

Next Step:

Now that you’re armed with the knowledge of Certified Income Tax Preparer (CTP) interview questions and responsibilities, it’s time to take the next step. Build or refine your resume to highlight your skills and experiences that align with this role. Don’t be afraid to tailor your resume to each specific job application. Finally, start applying for Certified Income Tax Preparer (CTP) positions with confidence. Remember, preparation is key, and with the right approach, you’ll be well on your way to landing your dream job. Build an amazing resume with ResumeGemini